Uncategorized

Guy on Rocks: Gold soars, lithium softens, and this ASX base metals explorer could go either way

Gold which has been inversely tracking the USD in recent years, finally broke the trend closing at US$1,868/oz up 7-10% … Read More

The post Guy on Rocks:…

- Gold which has been inversely tracking the USD in recent years, finally broke the trend closing at US$1,868/oz up 7-10% on safe haven demand

- Lithium developers/ miners still looking like cash machines despite softening spot prices

- Stock of the Week: American West Resources

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Gold responds in volatile week

A rough week here in Toronto to mark the end of the Prospectors and Developers Association of Canada (“PDAC”) conference with the bear market in full swing. Probably a good thing I got lost in a bottle of 14-year-old Glenmorangie at Hy’s Restaurant mid-week to ease the pain.

The USD index closed off 8 basis points to 104.62 after a week of extreme volatility. The Toronto Ventures Exchange (TSX-V) was hit by falling commodity prices and pulled down with the rest of the market closing at 612 down 4.8% for the week.

The DOW Lost 4.5% last week to 31,910 and the VIX (volatility index) surged to 25.7 before settling at 24.7. Federal reserve comments on further tightening (now thought to be closer to 0.5% in April) resulted in some extreme volatility in 2 and 10 year bonds crashing to 4.80% and 3.70% respectively.

The volatility is almost certain to continue into next week with plenty of US economic data out including CPI, retail sales, European Central Bank meeting on rates, housing starts, industrial production and consumer sentiment.

All this came after commodities had come under pressure earlier in the week after China set a fairly modest economic growth outlook of 5% for CY 2023. This announcement according to John Meyer from SP Angel amounts to more of a stabilisation measure than anything else. Furthermore, there were no further stimulus measures announced.

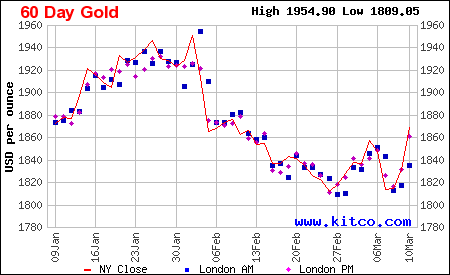

Gold (Figure 1), which has been inversely tracking the USD in recent years finally broke the trend closing at US$1,868/oz up 7/10% on safe haven demand.

Figure 1: 60-day gold price (source www.kitcometals.com).

Central bank activity (figure 2) has continued unabated in January with central banks buying 31 tonnes of gold, a monthly increase of 16%, said WGC in a note Thursday.

Figure 2: Central bank purchases. (source, World Gold Council, February 2023).

Figure 2: Central bank purchases. (source, World Gold Council, February 2023).

In line with a rising gold price the Kitco gold survey last week (figure 3) was overwhelmingly bullish on both Main and Wall Street.

Figure 3: Kitco gold survey (source; www.kitco.com, 11 March 2023).

The rest of precious metals didn’t do so well with Platinum closing down 1.6% to finish at US$960/oz while silver closed down 3.5% to US$20.50/oz and Palladium (figure 4) closed at US$1,314/oz down 3.7% for the week after cracking US$3,000/oz back in March 2022.

Uranium remained flat at US$50.63/lb up 25 cents for the week. Uranium has been range bound for the past 7 weeks or so.

Its next stop is likely to be +US$70/lb, the price needed to satisfy the hurdle rates for many existing uranium resources based on 2010 cost profiles. This may now be closer to US$80/lb.

Figure 4: 60-day palladium price (source www.kitcometals.com).

Oil briefly traded above US$80/bbl but closed at US$76.56/bbl for a 4% drop. US production was at 12.2MBBLS off 100,000 bls for the week while inventories were down 1.7 MBLS.

Refinery production was 15MBLS down 100,000 BOPD as the maintenance season is due to end.

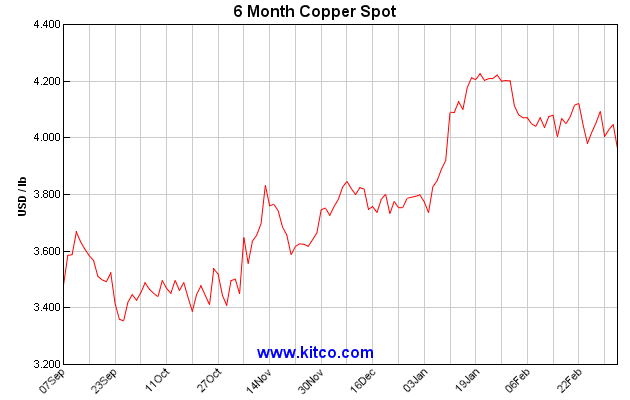

Copper (figure 5) was volatile and traded down to US$3.97/lb but has recovered to US$4.01/lb with the May 23 contract basically flat. Nickel (figure 6) fell under US$11.00/lb and is now trading at US$10.22/lb after reaching US$13.78/lb back in December last year.

Figure 5: 60-day copper price (source www.kitcometals.com).

Figure 6: 60-day nickel price (source www.kitcometals.com).

Getting (back) down to earth on lithium

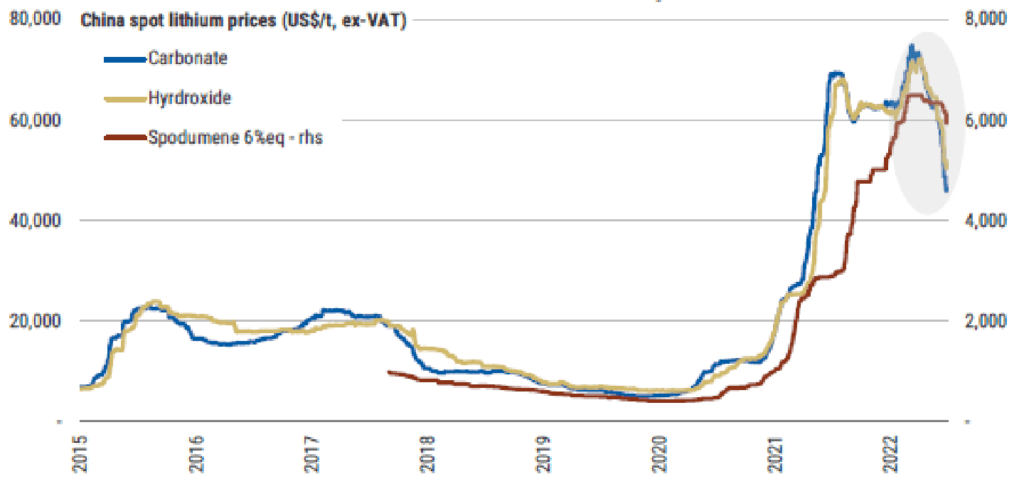

There has been a lot of chatter about lithium prices in recent weeks with some eye watering valuations on the junior end coming back to earth in the wake of lithium prices having retreated around 40% this year (figure 7).

Weaker than expected EV sales, particularly in China over January 2023, and de-stocking by battery and downstream participants have been a major contributor.

Figure 7: China spot lithium prices 2015-2016 (source; Bloomberg, March 2022).

It appears that some feasibility numbers are nothing short of spectacular if we take Galan Lithium (ASX:GLN) as an example with their 2021 Pre-Feasibility Study showing a US$2.2 billion NPV’s based on lithium carbonate prices of US$18,594 with spot prices now hovering around US$50,000/tonne.

I can’t wait for the Definitive Feasibility Study numbers to come out! Talking to a number of developers here at PDAC there are quite a few projects with 3–12-month paybacks on mines using a range of lithium prices (even heavily discounted to spot).

Consensus is currently that lithium prices will remain under pressure until the end of 1Q’23 with a likely stabilisation around 2Q 2023 on the back of a ramp up in production of EV’s. I think this is a once in a lifetime event to see such enormous margins on forecast lithium production…at least on paper.

Question is what will the longer-term price of lithium carbonate and spodumene concentrates be?

Lithium is a very abundant element in the earth’s crust (33rd most abundant element) and exploration will very quickly build up resources.

Have a look at Patriot Battery Metals (ASX:PMT; CVE:PMET) as one example of a company which could outline JORC resources in the short-medium term in the 50-100Mt range.

I think longer term production will look more like an operating cost plus 20-30% gross operating margin.

Spodumene producer Pilbara Minerals (ASX:PLS) whose unit operating costs are around US$860/tonne (CIF China) could still make acceptable margins at Spodumene Concentrate prices around US$2,000/tonne compared to their net realised price around US$7,500 for 1H 2023. So based on these financial metrics there is still plenty of downside in lithium prices.

The other negative for lithium was the announcement last week that Tesla’s next generation of permanent magnets would no longer use rare earths.

Stock prices of rare earth producers were down around 10% across the board.

Mind you Tesla only represents 15% of rare earths used in electric vehicles which equates to around 12% of global permanent magnet consumption according to Adamas Intelligence (February 2023) -this equates to 1.8% of world demand so not the end of the world.

I have heard lots of statements about substitution (e.g., cobalt) but I have my doubts about whether this will eventuate, and whether battery performance will be compromised given rare earth permanent magnets offer superior size and energy efficiency that are yet to be matched.

Stock idea of the Week: American West Resources

Figure 8: AW1 1-year price chart (source: CMC Markets, 11 March 2023).

Not long after writing the words that American West Metals (ASX:AW1) “won’t disappoint” in September 2022, the stock appeared to go into a downward spiral after a somewhat underwhelming announcement of a JORC Resource upgrade at its West Desert at 33.7Mt @ 3.83% Zn, 0.15% Cu and 9.1 g/t Ag.

I went back and checked the draft and there appears to be a spelling error on behalf of the Stockhead editorial team and it was supposed to read “will” not “won’t” disappoint.

So, I was right. Again. Naturally.

Figure 9: Polaris and Seal Projects (source: AW1 Presentation, March 2023).

Good news is that exploration at its Storm and Seal projects (figure 9) in the Nunavut region of Canada is fast approaching with a recently completed $2.6 million placement and 2.6 million Rights Issue (closing 11 April 2023) for those on the register on 23 March 2023.

Not a bad opportunity to pick up stock at 5 cents with a one for two free attaching three-year option exercisable at 10 cents.

Full disclosure: RM Corporate Finance acted as the Lead Manager for the placement and Underwriter for the Rights Issue and will receive fees in the form of cash and options.

This year’s work program will be a lot more aggressive with plenty of drilling focussed on the high-grade DSO copper resources.

This will/won’t disappoint. What could possibly go wrong…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: Gold soars, lithium softens, and this ASX base metals explorer could go either way appeared first on Stockhead.