Uncategorized

Don’t fret gold bulls — experts still reckon it will shine in 2023 amid ‘severe global economic reset’

Last week was volatile for gold, which rallied $50 mid-week, before plummeting to US$1,864/ounce for a 3% loss Bloomberg Intelligence … Read More

The…

- Last week was volatile for gold, which rallied $50 mid-week, before plummeting to US$1,864/ounce for a 3% loss

- Bloomberg Intelligence analyst Mick McGlone still sees gold shining this year amid “severe global reset”

- Stock Pick of the Week: lithium explorer Pursuit Minerals (ASX:PUR)

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Volatile week for precious metals

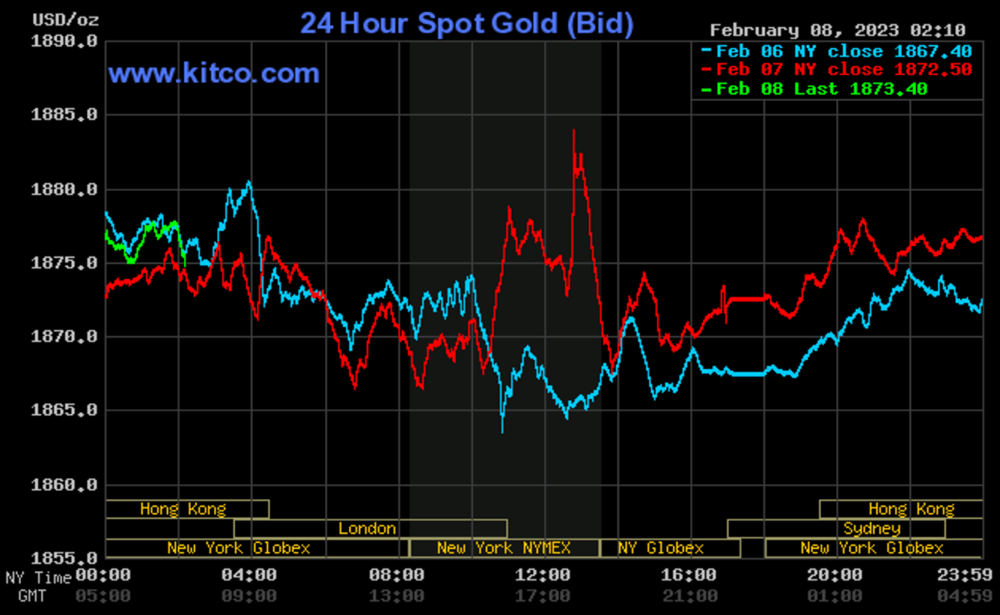

Last week was a volatile one for gold. It rallied $50 mid-week, before plummeting and settling back to US$1,864/ounce for a 3% loss for the week as the USD soared following some confusing comments by Powell at the Federal Reserve meeting last week.

He referred to stubborn inflation which is no longer “transitory” despite assurances to the contrary last year; ie more rate rises on the horizon.

Overall, the US economy looks somewhat anaemic with the Purchasing Managers Index (PMI) coming in last week at 47.4 (anything under 50 would indicate a contraction in activity) after reaching a recent high of over 63 back in July 2021.

Volatility remains very subdued with the VIX finishing the week at 18.46. Volumes on the Toronto Ventures Exchange also remain at low levels with the index finishing down 2 points to 620.

Other precious metals also remained volatile including platinum which lost 4% closing at US$973/ounce and palladium after hitting a multi-year low recently which finished the week up US$7 to US$1,557/ounce.

Fearful of Chinese weakness, copper was also off 3% to close at US$4.07/lb, staying briefly in contango then into backwardation for the front month contract.

Oil was also down 7.7% on the week, WTI closing at US$73.25/bbl with domestic drill rigs in the US down 7 weeks in a row. US oil inventories are up on the back of refinery problems and seasonal maintenance.

Despite fears of energy shortages, it appears the opposite has taken place with natural gas crashing to US$2.45MBTU late last week.

While not necessary reflected in the oil price it seems that the oil market has adjusted to the embargo by the EU and G7 and the price cap on imports of Russian seaborne oil. This has seen an increase in oil exports east of the Suez from 20-80% of total exports, resulting in Atlantic Basin crude being bid up, with Russian long-distance flows sold at a discount as the additional costs of long-distance hauls requiring more tankers and more market risks for FOB sales.

Bloomberg Intelligence analyst Mick McGlone believes we are heading for a “a severe global economic reset” and sees gold as potentially “shining” this year with the “enduring gold bull and crude-oil bear markets may be energising.”

He points to extreme fiscal and monetary stimulus during the pandemic, followed by Russia’s invasion of Ukraine, and then unprecedented synchronised aggressive tightening by central banks as the biggest drivers for commodities.

He also goes to point out that since 2007, gold has gained about 130%, while WTI saw a decline of about 20%. And if WTI crude falls to $40, it would pave the way for gold to hit $3,000 an ounce.

He, and many other gold bulls believe gold is “on the cusp” of taking out the $2,000 an ounce level and hitting a new record high. This will happen once the market “sniffs out an inevitable Fed pivot.”

It appears McGlone is not the only one projecting a golden year with central banks getting in on the action.

As Croatia moves to become part of the eurozone and adopt the euro as its national currency, World Gold Council analyst Krishan Gopaul reported that Croatia bought nearly 2 tonnes of gold in December, the central bank’s first gold purchase since 2001. The purchase was, according to Croatia’s public news agency Hrvatska radiotelevizija – HRT, related to the country’s entry into the eurozone.

The 56,256 ounce purchase for around $101 million, accounted for 15% of the payment to the ECB.

The World Gold Council also recently reported that 2022 marked the highest recorded level of central bank gold purchases (figure 2). The banks purchased 1,136 tonnes of gold last year of which 800 tonnes were purchased in the second half of the year and 417 tonnes in the last three months of 2022.

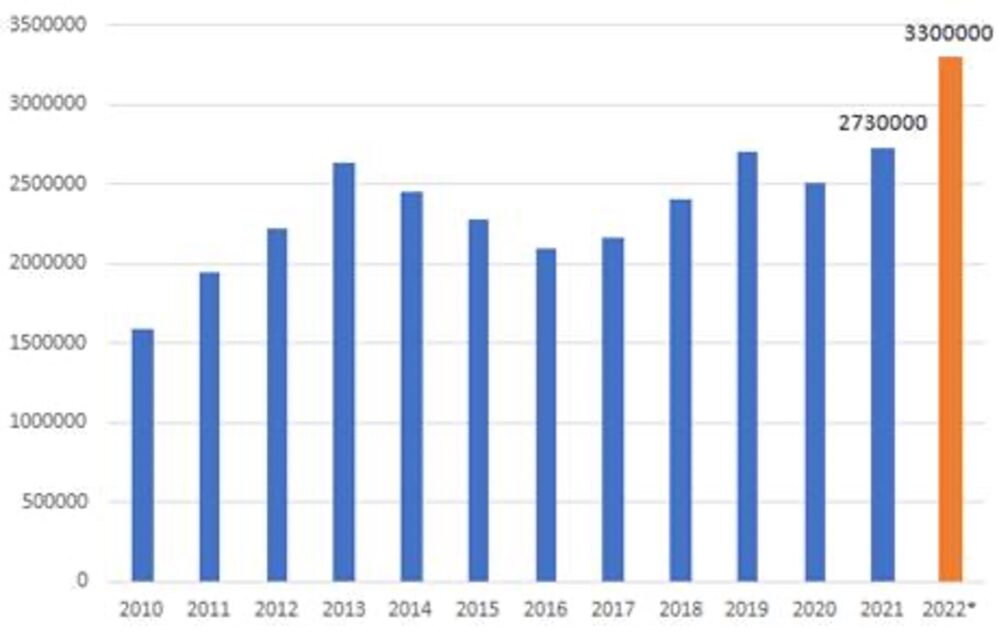

Despite a big lift in nickel production nickel has remained firm at US$12.49/lb (figure 3) despite the US Geological Survey (USGS), reporting that global mine nickel production reached 3,300 thousand tonnes in 2022 and was 21% higher than 2,730 thousand tonnes produced in 2021 (figure 4).

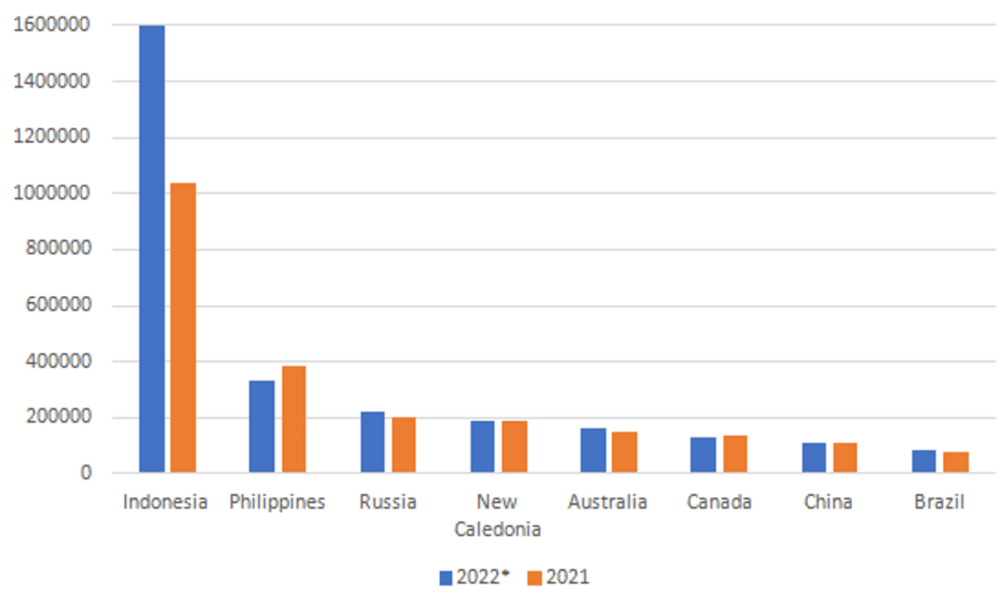

Despite negative sentiment towards high-pressure acid leach (“HPAL”) plants in Australia, with well documented cost overruns at nickel laterite producers including Murrin Murrin and Ravensthorpe, it appears HPAL plants are performing extremely well with Indonesia producing 1,600,000 tonnes of nickel per annum (figure 5), well ahead of the Philippines with 330,000 tonnes and Russia with 220,000 tonnes.

Nickel production is estimated by the USGS to be up over 54% which included integrated nickel pig iron and stainless-steel projects. A number of companies also produced nickel matte or mixed nickel-cobalt hydroxide.

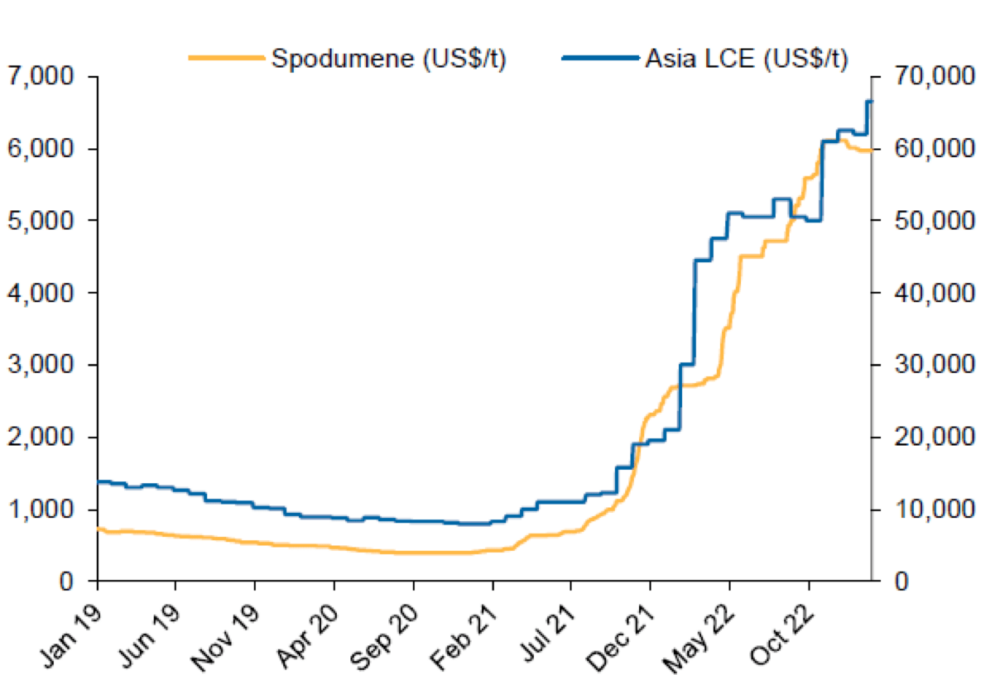

Finally, lithium prices have remained high in 2023 despite a slowdown in momentum with spot spodumene prices remaining flat (figure 6) while LCE and LiOH prices are off 8-10%. On the rare earth front, NdPr prices (figure 7), after a soft 2022 have also begun to rebound, good news for the emerging rare earth explorers in Australia.

New Ideas: An Argentine lithium developer

Pursuit Minerals Ltd (ASX:PUR) (figure 8) recently approved the acquisition of Trilogy Minerals for 362.5m Shares and 710 million performance shares (worth just over A$8m based on a stock price of 2.3 cents) whose main asset are four tenements comprising the Rio Grande Sur project, a salar that covers approximately 27,500ha.

The project has a 2018 43-101 inferred resource of 2.1 million tonnes LCE at 370mg/Li to a depth of 100m below surface. It looks like settlement of the acquisition will take place in late February/early March.

The Trilogy project has good access to the Chilean port of Antofagasta located 336km from the border crossing of Socompa and the company has planned an aggressive exploration program to convert the current resource to JORC status.

This will include geophysical surveys as well as a 4,000 metre diamond drilling program in addition to a pumping well and a long-term (approximately 30 days) hydraulic test to assess the sustainability of brine quality for future production.

The company is headed by experienced lithium explorer Aaron Revelle who was a founder of an Argentinian Lithium focused exploration company Centaur Resources which was sold to Arena Minerals (CVE:AN–market cap C$214.3m) for A$23m. He has also worked on the exploration and development of the Hombre Muerto and Rincon Salars in Argentina.

The project has been drilled before in 2011 by ADY Resources for sodium sulphate resources and returned Li results ranging from 350- 400mg/Li.

Eight production wells, 2 exploration wells and 2 piezometer monitoring holes were also completed (Figure 9).

Together with previous geophysical surveys and twin holes drilled by LSC Lithium in 2017/2018 and ADY Resources near the lease, the company remains optimistic of the prospectivity of the Rio Grande Salar.

At a market capitalisation of around $50 million, put this on the watch list as I believe the news flow from what looks to be a fairly aggressive program could surprise on the upside as it looks to move into the development phase later in CY 2023.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: Don’t fret gold bulls — experts still reckon it will shine in 2023 amid ‘severe global economic reset’ appeared first on Stockhead.