Uncategorized

Guy on Rocks: All aboard the PMT train!

We are in a hot market for lithium and the PMT market capitalisation of around $1.5 billion certainly reflects this. … Read More

The post Guy on Rocks:…

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Precious metal sell off

Last week the US dollar hit a 10-week high of 104.9 which saw a sell-off in precious metals across the board. Gold was down US$22/oz for the week to US$1,842, platinum fell 3% to close at US$919/oz and palladium continued its downhill slide losing a further 2.5% to US$1,428/oz.

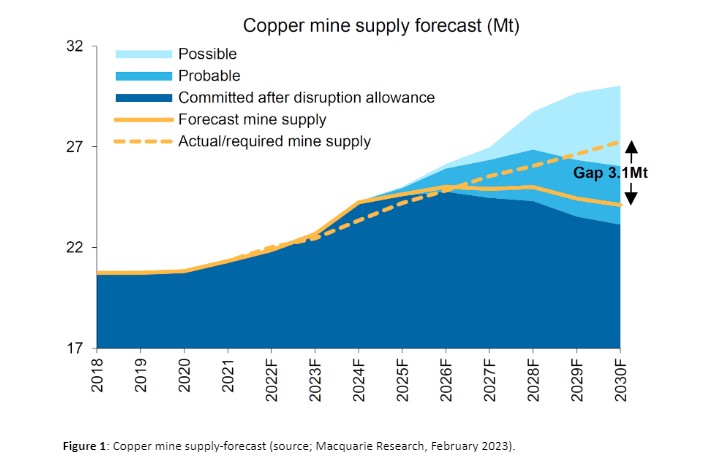

Copper remains relatively flat closing at US$4.05/lb with some extreme volatility in the front month futures which have been oscillating between backwardation and a contango of up to 6 cents.

As figure 1 demonstrates, the gap between mine supply and demand is significant and unlikely to be filled by scrap which currently accounts for around 1% (9Mt) of world supply. Clearly copper has room to move beyond its current pricing.

Not surprisingly the market has been nervous about worrying comments from the Federal Reserve as CPI and Producer Price Index (PPI) came in higher-than-expected last week. Market commentators are now making noises that the next rate rise may be closer to 50-basis point hike have been hurting energy with oil down just over 4.5% to close at US$76.41/bbl which coincided with a big surge in US oil inventories which were up a whopping 16MMBLS last week.

Oil imports also dropped from 7.1MBOPD to 6.2MBOPD. Gas prices have been the real surprise in the US, dropping to US$2.42MBTU.

Volumes and prices on the junior end of the market in both the TSX-V and ASX have remained a little subdued with overall market volatility as measured by the VIX pulling back to 19.9, not far off its long-term averages.

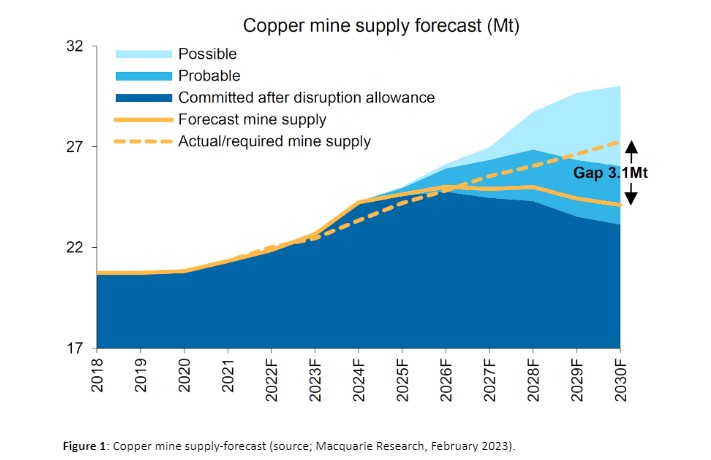

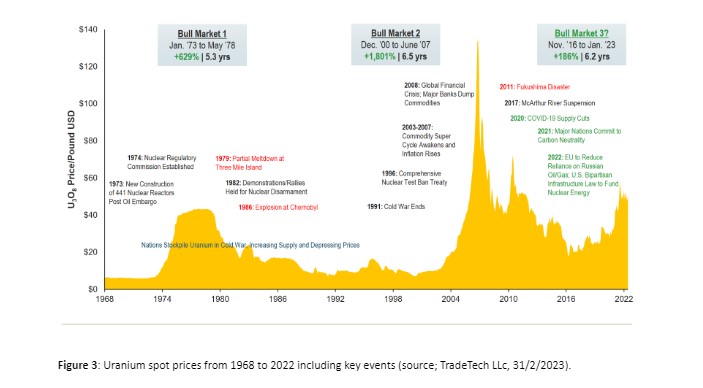

I am not a big fan of the specialty metals space from a junior exploration/development perspective however Andrew Radondjic, director of Venture Minerals Limited (ASX: VMS) pointed out at last week’s RIU Conference (here in Perth) that the Ukraine war had consumed the equivalent of one year’s production or 79,000 metric tonnes.

That is a lot of metal flying around! Good news for their Mount Lindsay tin-tungsten project in Tasmania which is currently the subject of an underground Feasibility Study leveraging off a previous open pit study.

The company needs a bit of luck – it was an iron ore producer at its Riley Iron Ore Mine in Tasmania for a few months before a sell-off in iron ore scuttled that dream!

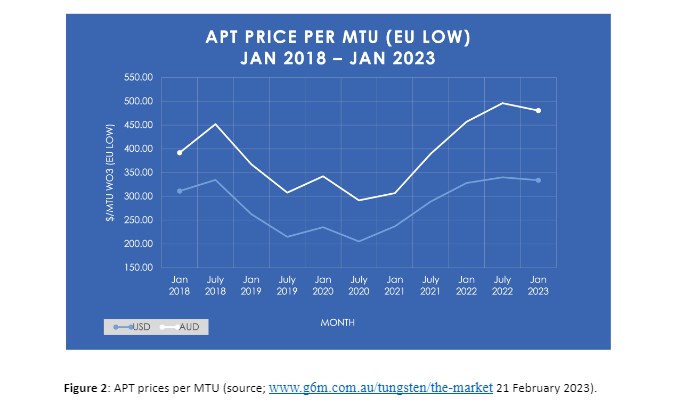

Finally, uranium seems to be holding up well, closing the week up 2.6% to close at US$51.15/lb despite no new news. Sprott (figure 3) remain as bullish as ever on uranium and maintain we are in the early phases of third bull market driven by shifting government policies, energy security issues and decarbonisation of the economy.

Stock of the Week: PMT keeps building

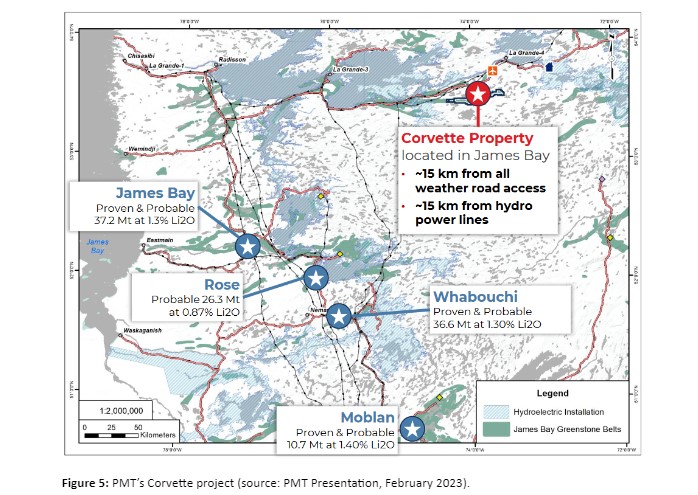

Dual listed lithium explorer Patriot Battery Metals Ltd (TSX-V: PMET; ASX: PMT) (figure 5), chaired by former Pilbara Mines Ltd (ASX: PLS) managing director Ken Brindsen, has been on a tear over the last year with excitement brewing over their 100% owned 214sqkm tenement package near James Bay in Quebec (figure 5).

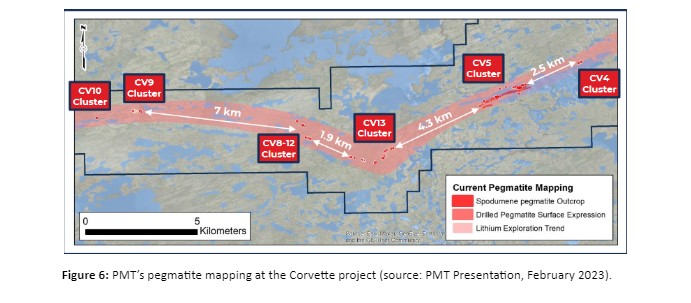

According to PMT, the tenements contains over 50km of prospective rocks containing over 70 pegmatite outcrops and 20km of strike potential remains to be investigated.

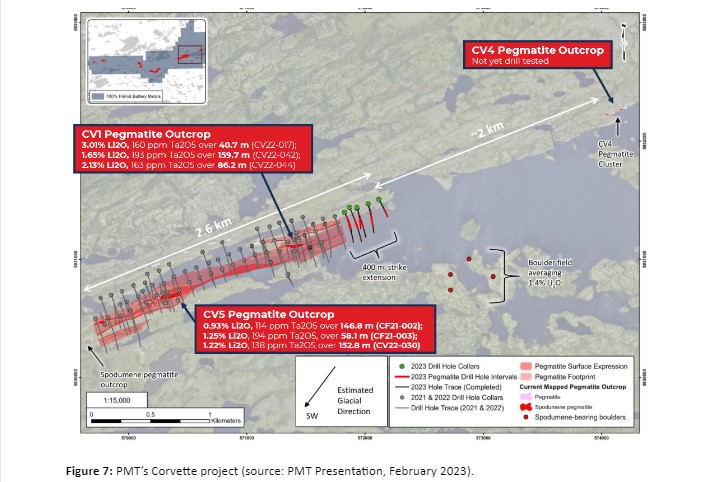

A 24,000-metre diamond drilling program delivered some excellent results last year with figure 6 suggesting that there is every possibility of extending the mineralised zone by a further two kilometres or so this field season. It is not hard to see a JORC Resource of +25Mt in the top 100m over the CV1 and CV5 pegmatites assuming average true widths of +50m at high grades (+1.5%). So this may be a little conservative.

The February 2023 outlines some eye-watering intersections including CF21-001 148.7 m @ 0.92% Li2O in the southwestern part of the mineralised trend and CV22-042

with 159.7 m @ 1.65% Li2O at the northeastern end.

Preliminary metallurgical testwork that a 5.5+% Li2O spodumene concentrate at high recovery (>75%) is expected using a simple process flowsheet including Dense Media Separation (DMS) and magnetic separation.

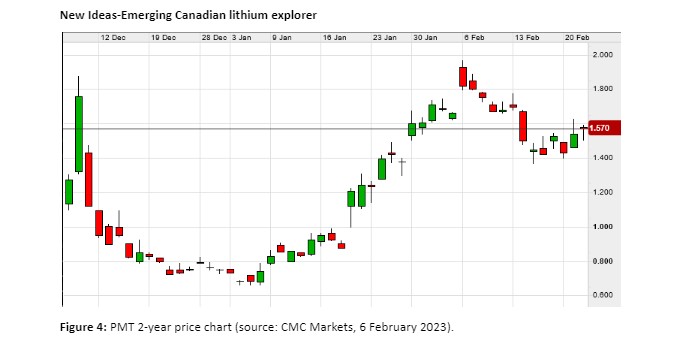

The three letters PMT are generally not linked to any pleasurable experiences (based on the experiences of 50% of the population at last count), however the share price is certainly showing signs of Patriot Battery Tension as far as I can see. The rumour is that one of the “old school” blokes (around my vintage) at ASX approved that ticker code while compliance was out at lunch.

We are in a hot market for lithium and the market capitalisation around $1.5 billion reflects this but with Congo developer AVZ Minerals (ASX: AVL) kicked into touch and Pilbara Mines (ASX: PLS) in a Low Earth Orbit, PMT looks like an unstoppable train with the potential to deliver a world class high-grade lithium deposit.

PMT, for the Stockhead faithful, also stands for Pre-Mining Technical (study) in case you were wondering where I was going with this…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: All aboard the PMT train! appeared first on Stockhead.