Uncategorized

Guy on Rocks: A gold stock for less than the value of the gold it holds? Praise the Lord!

If someone can show Guy Le Page a better value equation in a listed gold stock he promises he will … Read More

The post Guy on Rocks: A gold stock for…

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Gold momentum builds

It seems the market will look at any excuse to see the world as glass half-full and last week was a good example.

US inflation came in 0.2% lower than consensus at 7.7% annualised which saw the US Dollar Index at 106.38, off a whopping 4.8% for the week (figure 1).

10-year US Treasuries dropped 36-basis points with the US 2- and 10-year Treasuries inverted to a massive 50 basis points.

The market is now hoping for a 50-basis point (as opposed to 75-basis point) lift in December.

The markets seemed to like the news with the DOW closing up just under 4% for the week at 33,747 and the NASDAQ up 8% to 11,323. I am not sure if the punters are getting a little ahead of themselves as one month’s data doesn’t mean a great deal.

Metals soured on the news with gold closing at US$1,767 for a 5.1% gain and US$122 per ounce over the last few weeks. December gold futures last traded at $1,768 an ounce. Silver finished the week at US$21.64/oz up 3.6%. Platinum was also a big mover up 6.4% for the week to close at US$1,025/oz and palladium surged 9% to close at US$1,968/oz.

According to Gary Wagner from FX Empire (12 November 2022), US dollar weakness accounted for around 78.2% of gains in gold, with the balance of 21.3% attributable to market participants buying physical gold.

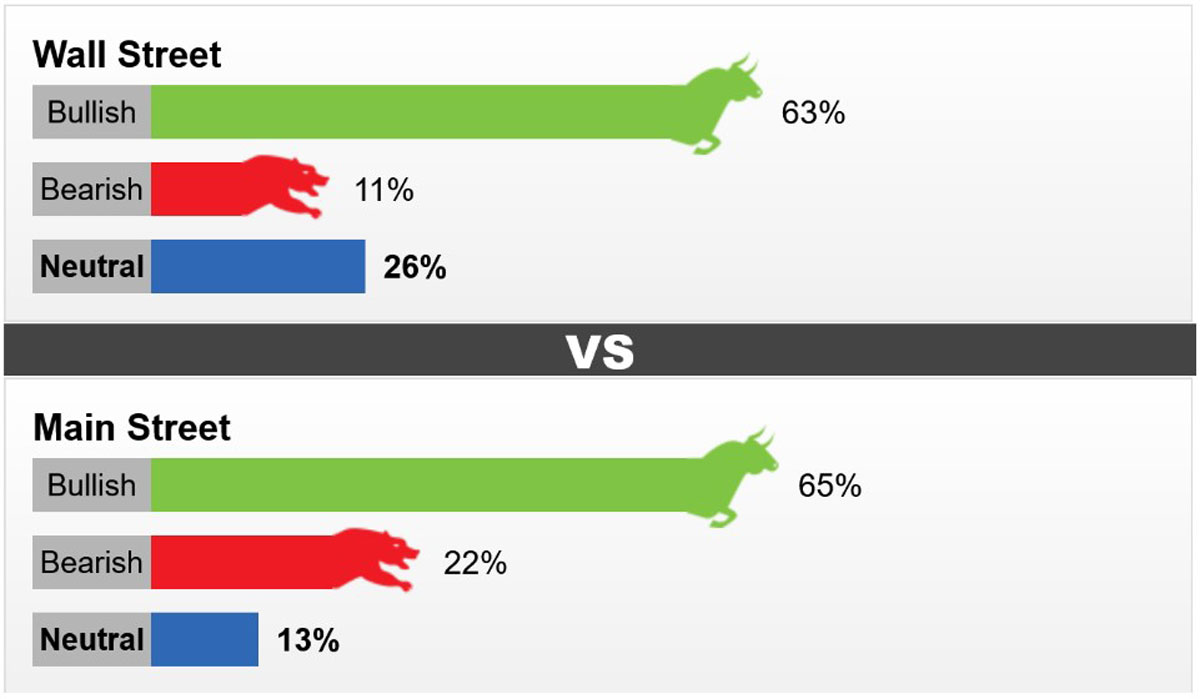

It appears sentiment has also turned more positive if the recent Kitco gold survey of 19 Wall Street professionals and 905 retail punters is anything to go by (figure 2).

Copper had its best week in a while with a big spike to US$3.78/lb on the back of low inventories and a weak US dollar. The forward curve is undulating and is up 5 cents on the front month.

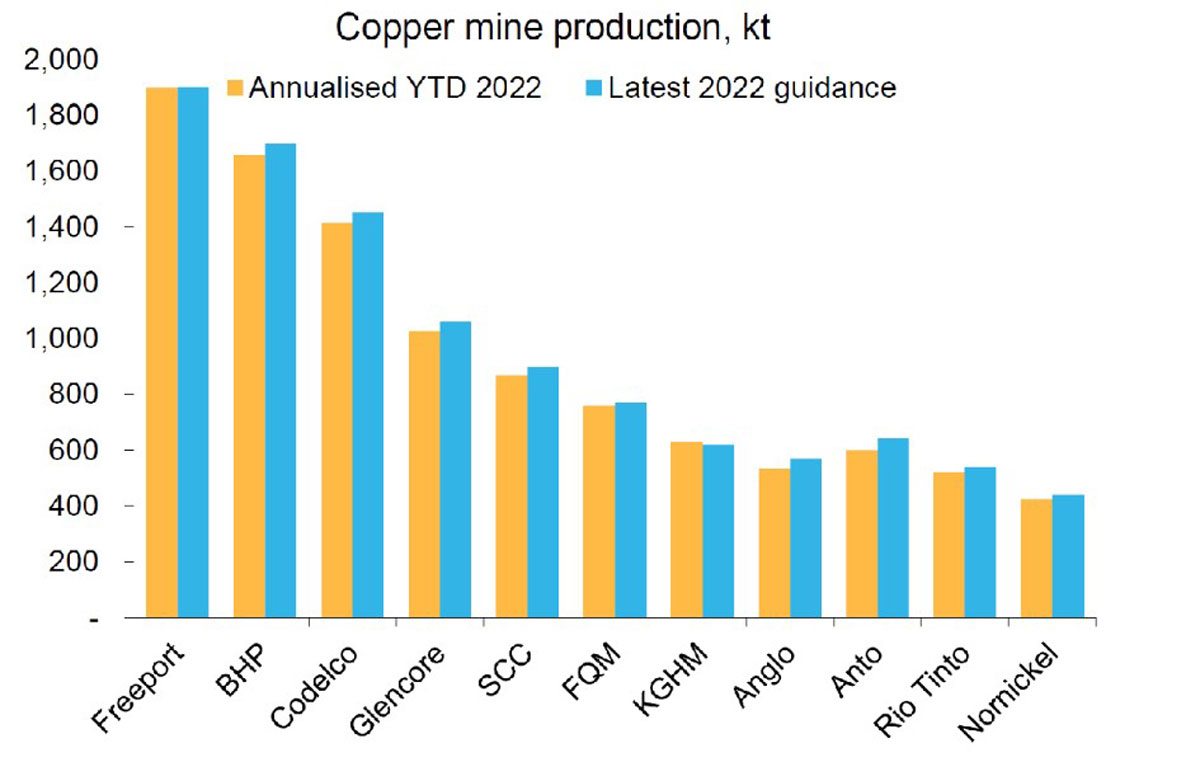

Global copper production (figure 3) was down 3.4% year on year however Freeport, BHP and Rio Tinto did report increases. At the end of Q3, according to Macquarie Research (11 November 2022), 15 companies were around 2.5% off their 2022 copper production guidance.

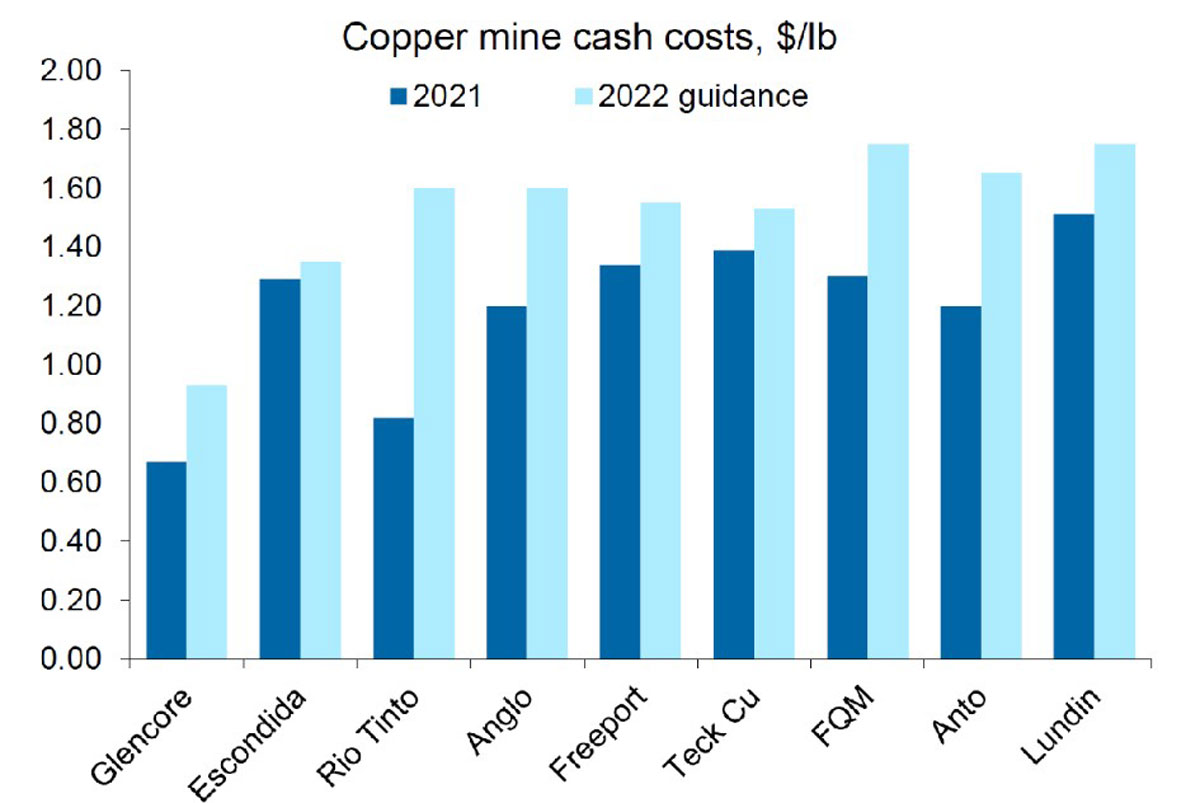

Costs however (figure 4) remained inflated. Globally, mine production is still expected to rise ~1.7% (~350kt, after allowing for disruptions) in 2022 due to increases from other producers, with Kamoa-Kakula’s ~230kt the largest single increment.

Going into LME week and the Q3 reporting season, Macquarie is projecting a 2022 concentrate deficit of 378kt and a refined deficit of 145kt.

For 2023 however, Macquarie is anticipating a significant increase in mine supply, up 7.5% as new projects continue ramping up, such as Quellaveco. Whether these production increases materialise is another thing.

The only loser last week was oil with WTI closing off 3% for the week at US$89.89/bbl. Gasoline prices in the US appear to have retreated from around US$3.50 gallon to US$3.18/gallon shortages.

Micky Fulp (Mercenary Geologist, 12 November 2022) pointed out that new methane rules come into effect next year which are bound to put a big dent in US domestic production with many small operators, particularly those producing in the 60-100 BOPD range in states such as Texas and Oklahoma likely to shut down.

New ideas… Free on option on gold

The path of the righteous mining company, according to Ezekiel 25:17, is beset on all sides by the selfish and the inequities of the financial markets. However, Ezekiel goes on to suggest that if we get behind the stock with “great vengeance and furious anger” things could turn around fairly quickly.

So, I am hoping for some divine intervention with Tribune Resources (ASX: TBR) which has fallen victim to declining sentiment towards gold stocks as well as a slowdown in gold production at its 50:50 Joint Venture with Evolution Mining (ASX: EVN) at East Kundana (EKJV). I’ll declare an interest here in TBR Shares.

The EKJV was contributing around 40-70Koz of gold per annum attributable to TBR, however this has fallen to around 20Koz as EVN are undertaking a mining study to optimise production from the JV. While some of the underground areas (e.g. Raleigh) are somewhat “seismic” and need additional ground support, there remains significant potential both along strike and down plunge at Rubicon, Pegasus, and Hornet.

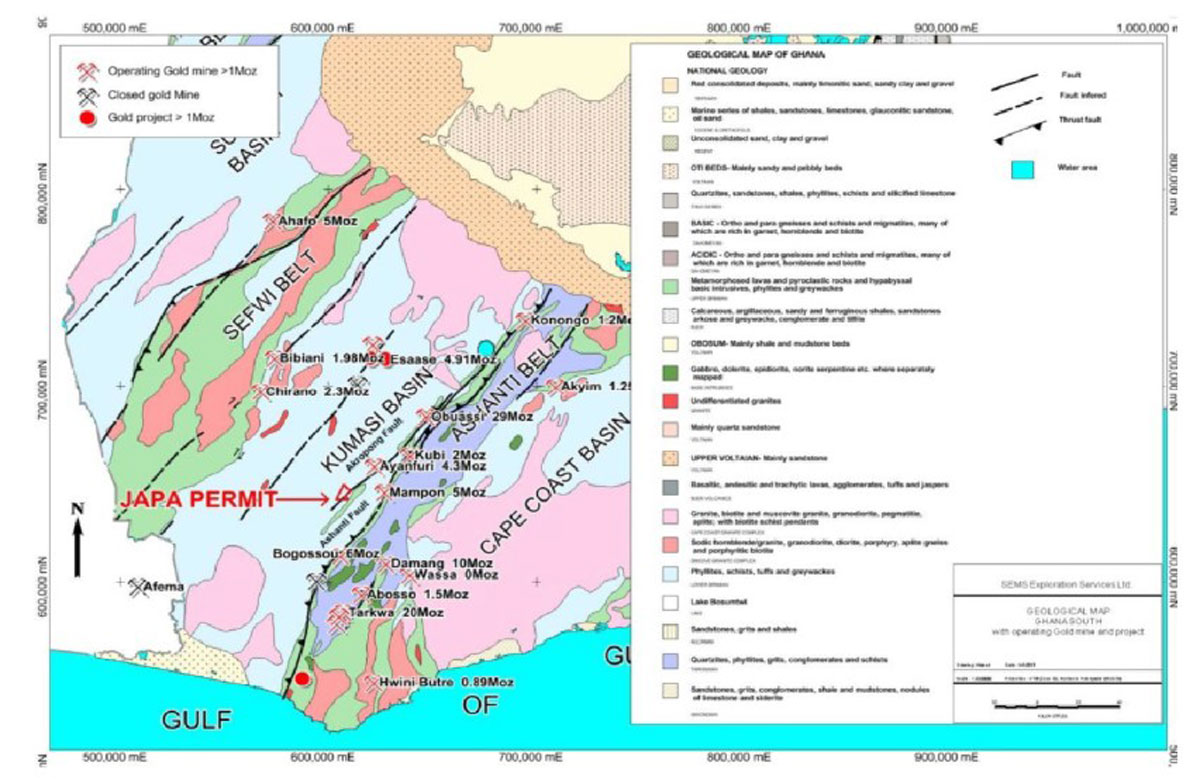

The company also has a gold exploration project in the Philippines (Diwalwal-1Moz gold, Non-JORC) that has slowed down, however the Japa Project (Adiembra Deposit) in Ghana (Inferred and Indicated Resources of 21Mt @ 2.7g/t for 1.81Moz of gold) may be looking to move forward into the development phase late next year (figure 7, 8). As figure 8 demonstrates, there is plenty of resource upside at Adiembra.

An infill diamond core and reverse circulation drilling program has been planned to upgrade the indicated resource to a measured category for future reserve estimation. Metallurgical, sterilisation and hydrological drill holes for plant, infrastructure, water, and tailings dam

are likely to follow this drill out.

From a value perspective, the company is holding around 110,000 ounces of gold bullion (based on the 2022 Annual Report) worth around $5.00 per share (before tax) based assuming a $2,450/oz gold price. So, you can buy stock today at $3.13 which is less than the value of the gold holdings and pick up the EKJV, Adiembra (1.8Moz) and Diwalwal (1Moz Non JORC gold resources) for nothing.

If Adiembra comes online (100Koz gold per annum?) and production ramps back up at the EKJV (+40Koz of gold per annum?) then I believe a significant re-rating is in order. That might turn out to be an understatement!

If someone can show me a better value equation in a listed gold stock I will walk to China (subject of course to fitness, appropriate footwear, visas, the political situation, and availability) …

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: A gold stock for less than the value of the gold it holds? Praise the Lord! appeared first on Stockhead.