Uncategorized

Ground Breakers: One of the best gold miners on the ASX is en route to the mid-tier

Gold miner CMM plots expansion as A11 fends off takeover amidst lithium rally. Oh, and heavily shorted PLS is now … Read More

The post Ground Breakers:…

- WA based Capricorn Metals is one of the lowest cost gold producers on the ASX

- Production from 120,000ozpa Karlawinda operation to be bolstered by 3.24Moz Mt Gibson development

- Development of Mt Gibson puts CMM on path to +270,000 low cost ounces per year

- Lithium stocks continue to rally, with heavily shorted Pilbara Minerals up 14% since Wednesday close

WA miner Capricorn Metals (ASX:CMM) has been one of the gold sector’s most consistent performers over its short life as a miner.

Look at this chart.

That’s a nice chart. The five-year equivalents of many of its ~$1bn capped peers is chaos:

(The above doesn’t include the magnificent Emerald Resources (ASX:EMR).)

Consistent share price performance doesn’t tell the whole story, but it does indicate that CMM has continued to execute, regardless of cost inflation and fluctuating precious metals sentiment.

CMM shareholders initially rode out repeated management shuffles, failed takeover bids and a major financial restructuring exercise before construction of the flagship Karlawinda mine, which has performed beautifully since the first gold bar was poured mid 2021.

It produced a record 120,000oz at a low $1208/oz in FY23, which is not far off the feasibility numbers (100,000ozpa @ $1025/oz) released way back in 2017. Incredible.

CMM has similar guidance for FY24, but after partially closing its hedge book the company now enjoys increased exposure to high gold prices.

CMM’s next growth project is the historic Mt Gibson mine in the Murchison, which was mothballed +30 years ago when the gold price fell below US$450/oz.

All going well, development of Mt Gibson puts CMM on a path to >270,000 ounces gold production per annum at lowest Australian industry quartile operating costs, it says.

A series of big drilling programs has now upgraded the initial 2.1Moz resource to 3.24Moz, mostly indicated, which will underpin an update to the 1.45Moz ore reserve estimate later in FY24.

There’s also new underground potential, with deeper holes pulling up a series of hits like 14m @ 12.85g/t from 208m, incl 5m @ 30.38g/t.

“The increase in the Mt Gibson gold resource to 3.2 million ounces is a fantastic validation of the quality of the project we acquired just over two years ago,” CMM boss Mark Clark says.

“The shallow average depth of the resource and the emergence of strong underground potential gives us confidence that the project will continue to grow.”

The $1.75bn capped stock is now up 1400% over the past five years.

CMM share price chart

Atlantic bolsters cash pile as lithium predators circle

Atlantic Lithium’s (ASX:A11) 350,000tpa Ewoyaa lithium project in Ghana is pencilled in for a 2025 production start, backed by Piedmont Lithium (ASX:PLL) (which will take a 50% stake in the project) and the Minerals Income Investment Fund (MIIF) of Ghana.

Like many of its peers, A11 has become a takeover target.

The company has now outright rejected two recent offers from private South African miner and major shareholder Assore (+25% stake) to purchase the remaining shares in A11 at an offer price of £0.33 per share (A$0.63).

A11 says this offer was not in the best interests of shareholders, “having regard to the near-term producer status of the project, the status of the pending investment from the Minerals Income Investment Fund and the positive near-term outlook for lithium project developers”.

A11 is now raising $7m via placement at 44c/sh (11.9% discount to the 5-day VWAP) to strength the balance sheet “notably in light of recent takeover offers from the company’s largest shareholder, Assore, and to ensure the advancement of project in line with the current development schedule”.

This will keep it flush with cash while it awaits funds from MIIF’s US$32.9m investment, expected in Q1 2024, and the completion of the offtake process in late Q1 2024.

Ewoyaa will cost an estimated US$185 million to build. Piedmont will sole fund the initial US$70 million, and 50% thereafter.

Following MIIF’s investment, A11’s development expenditure requirement for Ewoyaa will be US$38 million.

A11 share price chart

Lithium stocks continue to rally

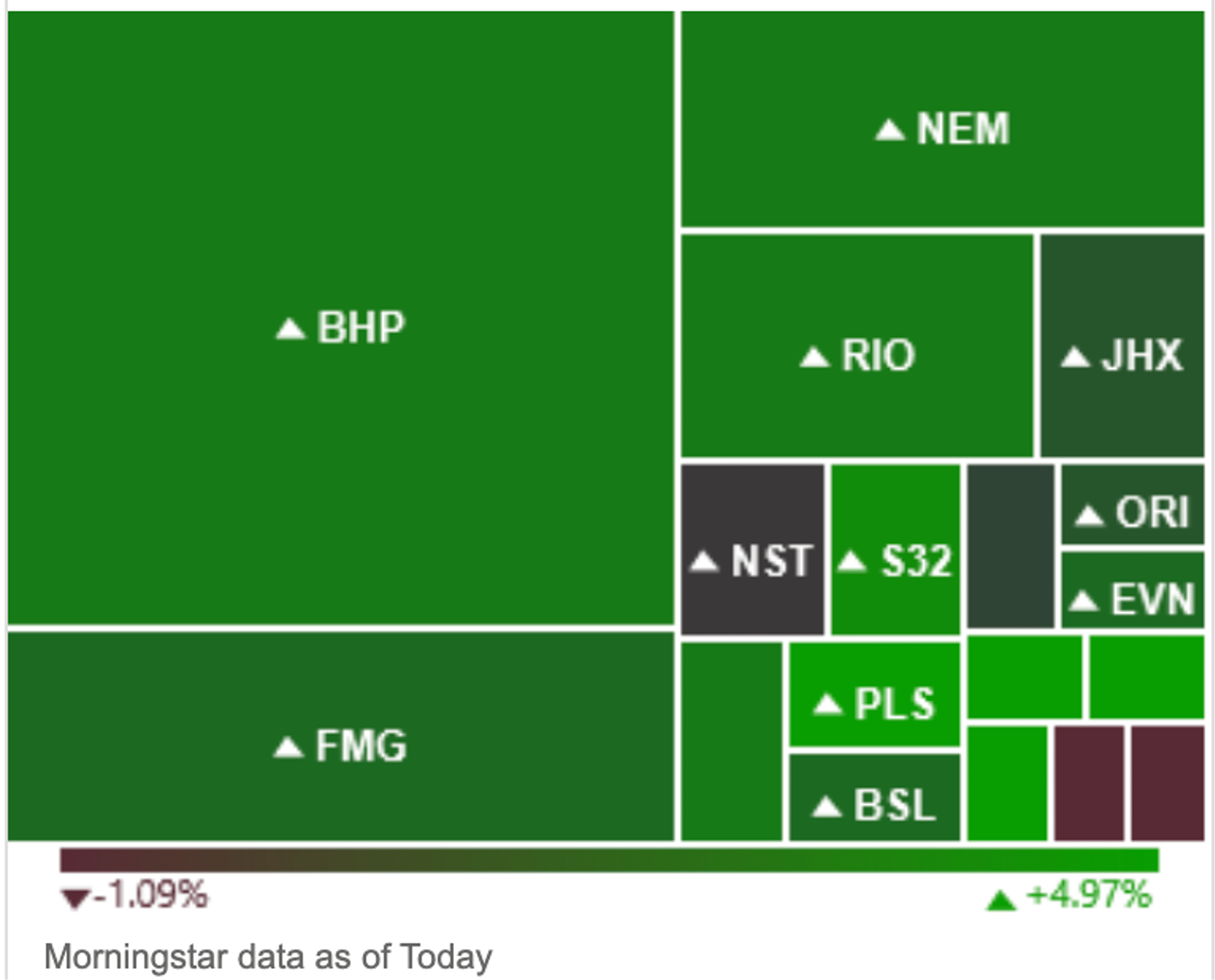

It is a sea of green at the big end, with the Materials index gaining 2.18% to lunchtime Friday.

Iron ore is near its highest point since February, after sharply rallying on moves by China to boost steel output and infrastructure spending.

The volatile gold price is back above US$2000/oz, dragging precious metals stocks with it.

Lithium stocks continue to bounce, with Allkem (ASX:AKE) +5%, Pilbara Minerals (ASX:PLS) +4%, Core Lithium (ASX:CXO) +14%, and Piedmont +16% leading the charge.

Heavily shorted PLS is now up ~14% since COB Wednesday.

$PLS 20% shorts pic.twitter.com/4RPVxNIAaq

— Dave O’D (@Supratrade1) December 6, 2023

PLS, AKE, CXO, PLL share price charts

The post Ground Breakers: One of the best gold miners on the ASX is en route to the mid-tier appeared first on Stockhead.