Uncategorized

Golden Mile says Quicksilver has simple and economic mining potential

Special Report: Golden Mile Resources recently found scandium and rare earths at its Quicksilver nickel-cobalt deposit located near Lake Grace … Read…

Golden Mile Resources recently found scandium and rare earths at its Quicksilver nickel-cobalt deposit located near Lake Grace in WA, which could be a potential value enhancer for the ore body.

The company confirmed scandium intersections including 32m at 124ppm from 3m (including 20m at 154ppm from 5m), along with rare earth element mineralisation of 4m at 3,295 ppm TREO (including 1m at 7,915ppm TREO).

While the primary focus remains on a scoping study for extraction of the nickel and cobalt resources, the economics of the project could see a nice boost.

“Because the scandium and rare earth are contained within the same tonnes which would be mined, they provide potential additional revenue streams into the economics and/or by-product credits,” Golden Mile Resources (ASX:G88) CEO Damon Dormer said.

“Obviously, it’s still early stages, but certainly any additional stream that comes into this ore body is another value enhancer.”

Quicksilver is an oxide clay hosted Nickel-Cobalt (+ Scandium) deposit with an Indicated and Inferred Resource of 26.3Mt @ 0.64% Nickel (“Ni”) & 0.04% Cobalt (“Co”) (cut-off grade >0.5% Ni or >0.05% Co) containing approximately 168,500 tonnes of nickel metal and 11,300 tonnes of cobalt metal.

The Company is interpreting the deposit as clay hosted secondary nickel-cobalt-scandium mineralisation overprinted by secondary REE mineralisation.

Rare earth metallurgical testwork planned

Dormer said the company has only tested about 5% of its samples for rare earths so far, with the next step to do some metallurgical testwork.

“The challenge with rare earths is not about having them, it’s about whether you can extract them – so we want to do some initial metallurgical testwork to build the case and we think we’ve got good potential to extract these, because there are some early indications that at least part of the rare earths could be ionic,” he said.

For context, Ionic clay hosted (IAC) deposits often contain a higher proportion of magnet rare earths, and crucially the heavy rare earths; the type critical for use in wind turbines and electric vehicles – and they’re easier to explore, drill and mine.

The company is aiming to confirm extraction via the testwork before spending more money to expand its sampling program for rare earths from drilling already completed.

Simple, low risk mining potential

Dormer says what makes Quicksilver exciting – beyond the scandium and REE bonus finds – is that it could be a very simple, free dig, low cost and low complexity mining and processing operation.

And with that simplicity comes risk reduction and low CapEx and OpEx.

“We don’t have to worry about blasting and dealing with explosives, with mechanical processing we don’t have to deal with harsh chemicals for processing,” he said.

“That simplicity comes down to the high potential for a very low cost, low capital and efficient operation which is all about getting the best product to maximize the saleable price and maximize margin.”

The Company has commenced Stage 3 Metallurgical diamond drilling to further de-risk the proposed multi-product flowsheet (Nickel, Cobalt, Iron, Chromium and industrial) and provide confidence to proceed to a Scoping Study.

Maintaining exposure through Joint Ventures

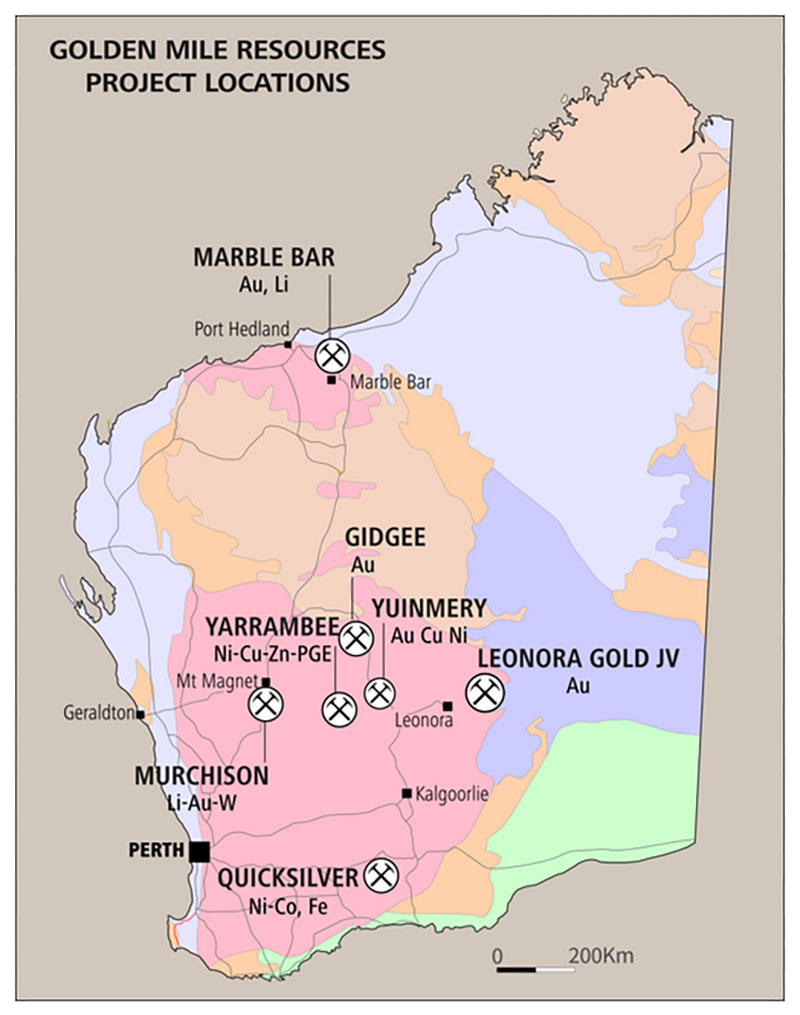

While the focus is on Quicksilver, Golden Mile also holds the Yarrambee copper-zinc-nickel project, the Yuinmery gold-copper-nickel project, the Murchison lithium-gold project and the Marble Bar lithium-gold project.

Joint ventured assets include the Leonora gold and Gidgee gold projects with Kin Mining (ASX:KIN) and Gateway Mining (ASX:GML) respectively.

“We have joint ventured out some of our assets to keep us with an exposure to them without having the expenditure requirement,” Dormer said.

“It’s about looking at our portfolio and going ‘where’s the best bang for buck on the money we need to spend?’”

Dormer believes there’s a huge opportunity, particularly with the company’s market valuation of under $4 million.

“There’s a huge amount of upside as we progress Quicksilver but still keep our eye on our other assets as well,” he said.

This article was developed in collaboration with Golden Mile Resources Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Golden Mile says Quicksilver has simple and economic mining potential appeared first on Stockhead.

asx

gold

lithium

cobalt

rare earths

ree

scandium

nickel

copper

zinc

iron

diamond