Uncategorized

Golden Mile is riding the development wave for Quicksilver

Special Report: Golden Mile has a diverse portfolio of projects across Western Australia but there’s little doubt that it is … Read More

The post Golden…

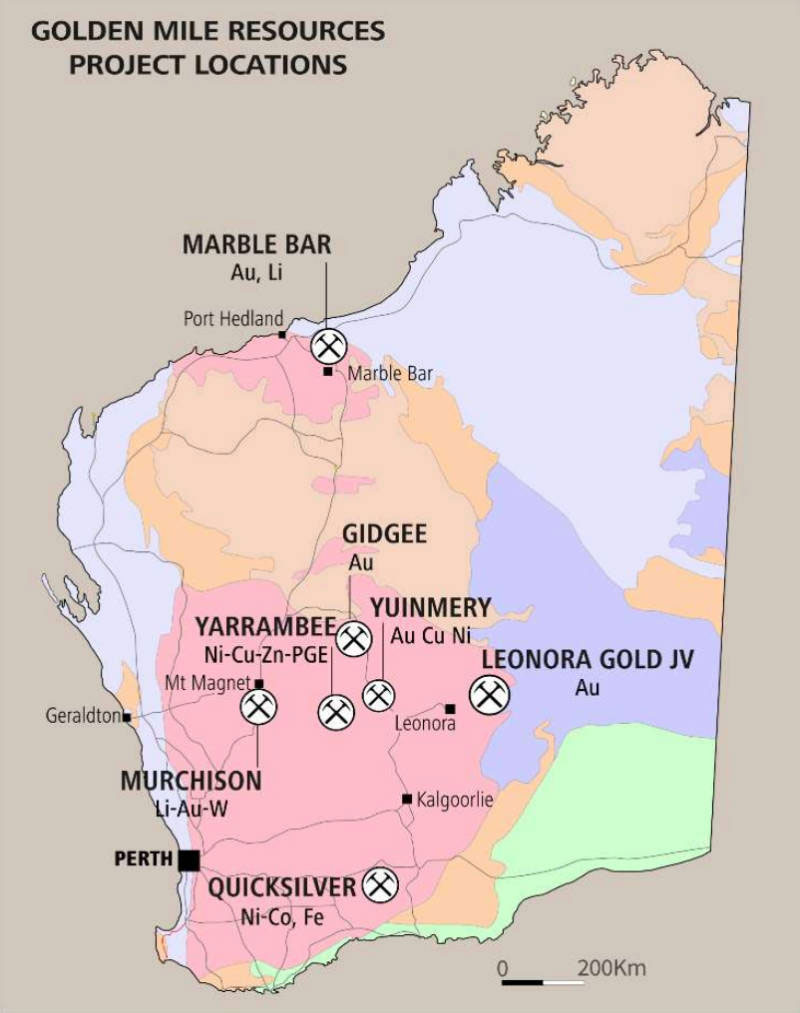

Golden Mile has a diverse portfolio of projects across Western Australia but there’s little doubt that it is focused on advancing its Quicksilver nickel-cobalt project near Lake Grace.

This focus is well deserved due to the strong demand for the basket of critical minerals contained within the project and the relatively simple and low-cost mechanical development plan.

But to really understand the latter, it is important to consider that despite extensive work carried out on Quicksilver, which defined a resource of 26Mt grading 0.64% nickel and 0.04% cobalt, the project was overlooked and unloved for some time by the market.

This was due to it being originally thought of as a nickel laterite project that would require expensive high pressure acid leach (HPAL) to develop.

What led to the step change in how the project was viewed came about after Golden Mile Resources (ASX:G88) really investigated the fundamentals of Quicksilver, according to recently appointed chief executive officer Damon Dormer.

“Too often in mining, people make assumptions and just replicate what the last person did, which leads to a lot of poor engineering work and ill-thought out work,” he told Stockhead.

Golden Mile examined the project’s fundamentals through its metallurgy and proved that HPAL was not the right fit for Quicksilver.

“We did extensive metallurgical testwork looking into the mechanical properties of the orebody, which is a clay hosted nickel-cobalt deposit in essence, and this initial phase of testwork studied how it responded to screenings, scrubbing, separation methodologies, and the benefits of regrind,” Dormer added.

“This demonstrated that beneficiation using mechanical methods could not only improve the ore into a nickel-cobalt concentrate but also form an iron-chromium-nickel concentrate as a separate revenue stream.

“In addition to that, we could form industrial aggregates because part of the process was looking at how these things worked with screening off some of the silicates, which is a viable product for selling locally.”

The project also benefits from what Dormer says is an “enviable” position due to its proximity to Lake Grace, which is a well facilitated town with sport facilities, motels, shops and an industrial area.

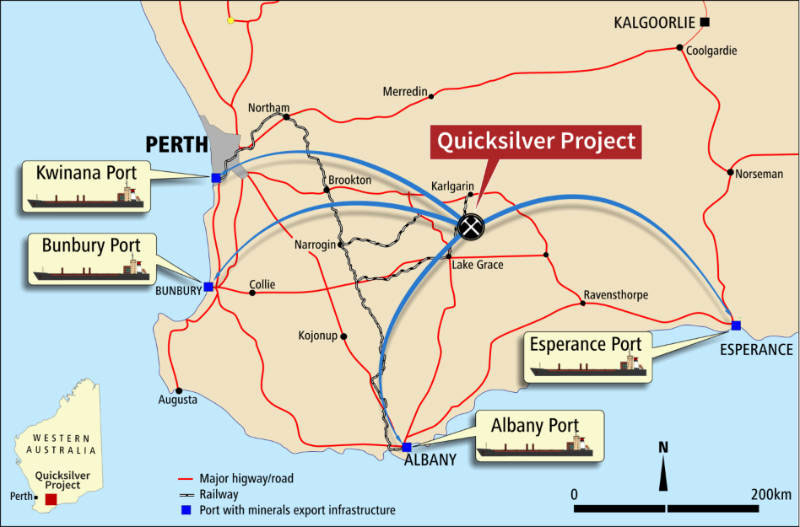

Infrastructure is also excellent with sealed roads and access to rail and ports.

“We are central to four ports, which helps with shipping product out and logistics coming in, and that provides a level of risk mitigation because we are not totally tied into one supply line,” Dormer said.

“We are not governed by a single route, we have multiple sealed roads and access to different ports in all directions. And when you have options, that drives the cost profile.”

Mining is also straightforward given the deposit’s geometry – long with significant width and shallow – and free dig nature of the orebody, which eliminates the need for drill and blasting.

The removal of heave and throw from blasting also grants the company the ability to tightly manage where it mines and therefore mine ore grade on a block to block basis.

Besides reducing mining costs, this also allows Golden Mile to optimise its grade profile to payback capital as quickly as possible and deliver early and significant profits.

More than just nickel and cobalt

While the prospect of recovering its nickel and cobalt content is reason enough to develop Quicksilver, recent work has also proved up the potential for the project to host rare earth elements (REE) and scandium.

Re-assaying of drill pulp samples held in storage returned clay-hosted REE intercepts such as 4m grading 3,295 parts per million (ppm) total rare earth oxides (TREO) including 1m at 7,915ppm TREO and 10m at 2,548ppm TREO including 1m at 3,949ppm TREO.

While these are good, results, they are made all the better in Dormer’s view by being located within the same mineralised envelope as the nickel-cobalt mineralisation.

“What moves the REE mineralisation from good to great is the surrounding economics,” he explained.

“Our view is to get the nickel and cobalt to pay for how we want to do things. If the rare earths are easy to process, then our advantage is massive as we don’t have to pay for the cost of mining because it will get a full carry from the nickel-cobalt that we are already planning to dig up.”

He also noted that while there are no drilling costs associated with defining the REE mineralisation as the company had a substantial library of existing samples from its nickel-cobalt drilling to re-sample, it was being pragmatic by testing only a portion of its pulps for now.

This was done to avoid wasting money if the initial benchtop testing to determine if the REEs can be extracted using a weak solvent, which makes it the much sought-after ionic adsorption mineralisation, did not succeed.

Should the testing be successful, Dormer noted that the company will then send more pulps for processing to grow the REE mineralised area in a staged way.

On the scandium, he added that Golden Mile already knew what is present as it was assayed at the same time as the nickel and cobalt was.

However, it typically requires HPAL to extract and the company needs to carry out more research on different processing techniques

Dormer also raised the possibility that some of the potential customers for nickel and cobalt already had HPAL circuits and could potentially extract the scandium under the right business arrangement.

He noted that First Quantum had a HPAL plant just a couple of hundred kilometres down the road, while Indonesia is investing a lot into nickel processing and is also looking to build HPAL processing facilities.

“There will be ways to derive value from scandium through the product itself or credits from what we sell.”

Quicksilver plans

Over the next four months, Golden Mile expects to receive drill results from the PQ diamond drilling, which was completed to recover samples for the Stage 3 metallurgical testwork.

Results from the testwork will also de-risk the process flowsheet which demonstrates a pathway to nickel, cobalt, iron, chromium and industrial mineral products using low energy, low cost mining and low cost processing, as well as providing the confidence to proceed to a Scoping Study.

The company will also complete testwork to confirm that the REE mineralisation is indeed ionic in nature, which will substantially reduce the costs of processing.

Dormer adds that the company is completing pre-work required to set up the Scoping Study.

“We know what the work processes are like and how we get there, which quite often can be lacking when a company transitions from exploration to project development,” he noted.

“For a formal Scoping Study, you need to get at least 80% Indicated resources. So if the business plan covers the entire 26Mt resource, we need to drill out the 80% of that to the Indicated level, which is a significant amount of money.

“But if you dial that business case down, show that you can get a profitable business case on a much smaller footprint, then your drilling and study costs go down.”

Other projects on the boil

Golden Mile also has a number of other projects, chief of which is the Yuinmery gold project about 80km southwest of Sandstone in the Youanmi gold mining district and 10km east of Rox Resources and Venus Minerals’ Youanmi gold mine.

Aircore drilling carried out to test the Elephant Reef, Ladies Patch and Hammerhead gold geochemical targets returned assays of up to 6m at 1.49 grams per tonne (g/t) gold from 12m and 5m at 1.35g/t gold from 6m.

Notably, the best results occurred at the end of the drill line and the mineralisation remains open.

“We are currently in the process of reviewing our targets there and looking at the best way to monetise Yuinmery.” Dormer explained.“We certainly want to be doing work up there, and we are still working through what that exactly looks like.”

Others include the 816km2 Yarrambee nickel-copper-zinc-gold-PGE project, the Marble Bar and Murchison greenfield lithium projects as well as the Leonora joint venture project where Kin Mining is earning up to 80% and the Gidgee joint venture project with Gateway Mining.

“We need to make sure we consolidate what we have got and make sure we have a critical focus on what we want to run and what we want to JV because we are transitioning from exploration into project development,” Dormer said.

Management team

While Golden Mile has an advanced development project along with an extensive exploration portfolio, it has also assembled a small but experienced and successful team, which reduces overheads.

Dormer, a mining engineer with over 26 years of experience, noted that success was important. A lot of companies will talk to their experience however a lot fewer talk to their success.

“This is fundamental to me, because success shows a mindset of problem solving and how to keep working at something to achieve a great result,” he added.

Dormer is himself no stranger to leveraging his experience in operations, projects and innovation towards making transformational changes.

He detailed an example early in his career where he was involved in an operation that was going to be shut down early because it was too problematic and costly.

Due to being ‘outspoken’ about how to run things, Dormer was granted the opportunity to give the operation its last hurrah and worked on all angles of the problem.

“We developed innovative mining techniques particularly around slotting and orebody management, and we took this operation, which was probably in the worst position of all the operations on the lease and made it deliver,” he explained.

“Then we extended the mine life by a year because we created such a transformation to our production profile and therefore our cost base.”

Former managing director Jordan Luckett has 27 years of experience in both exploration and mining geology and has transitioned to be an executive director within the company.

“Jordan’s a very accomplished geologist and mining executive, so it’s great that we retain his expertise within Golden Mile,” Dormer noted.

Non-executive chairman Grant Button is a seasoned mining executive with over 30 years of experience and a track record of successfully bringing projects along.

Francesco Cannavo rounds out the board with his business and investment experience working with companies operating across various industries, and particularly mining exploration companies.

This article was developed in collaboration with Golden Mile Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Golden Mile is riding the development wave for Quicksilver appeared first on Stockhead.

asx

gold

cobalt

rare earths

ree

scandium

rare earth oxides

nickel

zinc

iron

diamond