Uncategorized

Futures, World Markets Tumble After China Surprise Rate Cut Sparks Growth Fears

Futures, World Markets Tumble After China Surprise Rate Cut Sparks Growth Fears

US futures and global markets are weaker and bond yields resume…

Futures, World Markets Tumble After China Surprise Rate Cut Sparks Growth Fears

US futures and global markets are weaker and bond yields resume their ascent, amid growing concerns that China’s economic slowdown and debt problems – which prompted Beijing to unexpectedly cut rates the most since 2020 amid mounting economic gloom …

… will spread to the global economy. As of 7:45am ET, S&P futures were at session lows, down 0.7% while Nasdaq futures dropped 0.6%, with Tech outperforming on the move lower.

Global bonds fell. Treasury yields extended their climb, with the 10-year rate trading at 4.23%, the highest since October. UK gilts slid and the pound climbed after wage growth accelerated to the strongest pace on record. Commodities are weaker: oil fell and gold held near its lowest close since March as traders pared expectations for Fed rate cuts next year and beyond; the USD erased earlier losses after the latest NY Fed consumer survey showed 1Y inflation expectations dropped to 3.5%, down from 3.8%, and the lowest since Apr 2021. On today’s calendar, Retail Sales is today’s key macro data where BofA card data suggests the July print will come well ahead of consensus estimates.

Away from the US, major markets are all lower ex-Italy; UK the biggest laggard as macro data shows increased wage growth despite increased unemployment. Regional bond yields are higher on the data as the market prices in more rate hikes. Japan GDP surprised to the upside as China macro data disappoints leading to surprise rate cut. In factors, Momentum is leading, Vol is lagging; Growth over Value; Defensives over Cyclicals. UKX -1.2%, SX5E -0.8%, SXXP -0.8%, DAX -0.8%. In the tail end of earnings season, consumer-sector earnings remain in focus.

In premarket trading, NVDA is up 1.6% following an FT reports that China, Saudi Arabia, and UAE are ramping purchases from NVDA to fuel growth in AI, while UBS raised its price target on the semiconductor company’s stock, and follows Morgan Stanley boosting its PT ahead of the technology giant’s earnings report next week. The big banks are all lower premarket as CNBC reports that Fitch may be forced to downgrade multiple banks including JPM. Here are the other notable premarket movers:

- The Arena Group jumps 12% as the publisher of media brands including Sports Illustrated signed a letter of intent with 5-hour Energy drink founder Manoj Bhargava and his firm Simplify Inventions.

- Navitas Semiconductor gains about 7% after projecting revenue for the third quarter that topped the average analyst estimate.

- CareDx Inc. gains 4.4% as Raymond James analyst Andrew Cooper upgraded the firm to outperform from market perform, citing a risk-reward “that skews positive.”

- F45 Training tumbles 65% in premarket trading, after the fitness company backed by actor Mark Wahlberg said it plans to voluntarily delist from the New York Stock Exchange and deregister its common stock.

- Freedom Holding fell 7.1% after Hindenburg disclosed a short position on the financial services holding company’s stock.

- Getty Images shares drop 16% after the photo-services company cut its full-year revenue outlook. Analysts highlighted the impact of the writers’ and actors’ strike in Hollywood, with Citigroup noting that Getty’s guidance assumes these will last through the second half of the year.

- Navitas Semiconductor shares are up 6.7% after the semiconductor device company reported second-quarter results that beat expectations and gave an outlook.

- Redfin Corp. shares are up 0.6% after Oppenheimer upgraded the online real estate company to market perform from underperform.

Attention is increasingly turning to China whose emergence from pandemic lockdowns has been disappointing, fanning concern the world’s economic engine is sputtering. The nation is struggling to contain a potential default at developer Country Garden Holdings Co. after it missed payments on its debt. In a striking development, Beijing announced that it would stop reporting Chinese youth unemployment data after it hit a record high above 21% last month.

“China property worries and today China unexpectedly cutting two key rates are sending a clear signal that growth may not reach its GDP guidance of 5% by year-end,” said Stephane Ekolo, a strategist at TFS Derivatives. “Hence global growth is likely to suffer and the probability of a real slowdown or recession is growing.”

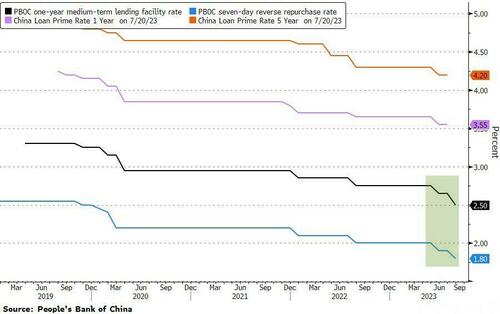

China’s yuan slipped as much as 0.5% after policymakers lowered the rate on one-year loans — known as the medium-term lending facility — by 15 basis points to 2.5%. Data for July underscored the economic slide, showing growth in consumer spending, industrial output and investment dropping across the board and unemployment picking up.

Instead of reassuring investors, China’s surprise rate cut only deepened anxiety about policy steps to revive growth, driving Europe’s Stoxx 600 index down as much as 1.2% to the lowest in a month. China’s rate cut came amid a raft of news depressing risk appetite, from a devaluation in Argentina to an attempt by Russia on Tuesday to stem the ruble’s slide with an emergency rate hike.

As reported earlier, the ruble erased earlier gains and resumed its drop after Russia unexpectedly raised its key rate to 12% from 8.5% and said another increase is possible.

Meanwhile, Argentina’s already-distressed debt slumped after a populist who vowed to burn down the central bank won surprisingly strong support in a primary vote. Its under-siege government submitted to a 18% currency devaluation.

European stocks extended a drop to a session low as investors worried about higher-for-longer interest rates as well as the impact from a gloomy economic outlook in China. The Stoxx 600 dropped 1.1% as US bond yields jump, driven by a slide in real estate and mining stocks lead while energy outperformed. Here are the biggest European movers:

- Tecan rallies as much as 11%, the most in a year, after the Swiss laboratory equipment maker reported first-half earnings and reiterated its guidance, which analysts said was a key positive

- Marks & Spencer jumps as much as 9.7%, to the highest since January 2022, after the UK retailer provided an unscheduled sales update and increased its profit outlook for the year

- Pandora gains as much as 3.8% after the Danish jewelry chain reported 2Q Ebit that beat estimates and boosted its full-year organic revenue outlook. Analysts said the results were better than expected

- Embracer falls as much as 11% after Axios reported that Saudi-funded Savvy Games was the partner behind a $2 billion deal which fell through in May, sending shares plunging as much as 45%

- Straumann shares drop as much as 6.1%, the most since December, after the Swiss dental equipment company’s decision to keep guidance unchanged overshadowed better-than-expected 1H earnings

- 888 shares drop as much as 8.7%, before paring the decline, after the online betting firm toned down expectations for full-year sales amid suspension of VIP accounts in the Middle East

- Alfen plunges as much as 11% after cutting its revenue forecast for the full year citing destocking challenges in its EV charging sales channels. The guidance missed the average analyst estimate

- Hexatronic declines as much as 16% after the Swedish fiber-optic cable manufacturer reported a weak growth outlook in several key markets in its latest earnings report, Redeye notes

- TKH falls as much as 11% after the telecommunications firm warned that challenging market conditions might dampen growth for its Smart Visions unit in the second half of the year

Earlier in the session, Asian stocks traded mixed amid gains in Japan after its economy expanded more than expected, while Chinese stocks extended recent declines on disappointing economic data. The MSCI Asia Pacific dropped 0.2%. Japan’s Toyota and Sony were among the biggest boosts while Chinese tech stocks including Alibaba dragged on the benchmark. Key indexes in Australia and Taiwan also advanced, while markets in South Korea and India were closed for holidays. Japan’s gross domestic product increased 6% in the second quarter, more than double economists’ forecasts, showing resilience in the face of global recession fears. That stands in marked contrast to China, where the latest retail sales and factory output data missed estimates. An unexpected rate cut by the People’s Bank of China provided little market cheer Tuesday. Pressure is building across Chinese financial markets amid spiraling crises in the non-bank lending industry as well as ongoing real estate woes. The CSI 300 Index is on track to erase all of its gains since a key political meeting in July provided some hope for efforts to boost the economy.

“Investors are now worried about credit events, not just from the ailing property sector, but also on the shadow banking system which the authorities are unlikely to bail out,” said Redmond Wong, market strategist at Saxo Capital Markets. Cutting rates can help margins, but it may not be “very effective in boosting loan demand when confidence is still weak in the corporate and household sectors.”

- Nikkei 225 benefitted from a strong GDP report which showed Japan’s economy expanded by the fastest annualised pace since Q4 2020 but was led by exports as private consumption contracted for the first time in 3 quarters.

- ASX 200 was firmer with most sectors in the green including the top-weighted financials after earnings from big 4 bank NAB which also announced a share buyback, while the RBA minutes provided little in the way of new information and kept the door open for further rate hikes although the latest Wage Price Index printed softer-than-expected.

In FX, the Bloomberg Dollar Spot Index steadied after three days of gains. The pound rallied as much as 0.3% against the dollar to $1.2721 before paring some of those gains, while gilts fell, led by the front end of the curve after data showed April to June wages excluding bonuses rose 7.8% from the prior year, beating analyst estimates of 7.4%. The market has now fully priced in a 25-basis-point hike in September, as well as an additional 50 basis points of tightening through March. Focus turns to the UK’s July CPI data due Wednesday. The Swiss franc tops the intraday G-10 rankings, rising 0.3% versus the greenback.

“The US dollar and US yields are still the pre-eminent driver of global financial conditions, and volatility could pick up as US rates inch higher,” Michael Wan, senior currency analyst at MUFG Bank, wrote in a note

In rates, treasuries remain under pressure after declining during Asia session and European morning, led by core euro-zone bonds. Yields across the curve reached highest levels in at least several weeks, with 10- to 30-year yields attaining new YTD highs: the 10-year yield 3 basis points higher at 4.23%. Treasury yields cheaper by 3bp-4bp across intermediate and long-end sectors, steepening 2s10s by ~3bp, 5s30s by less than 1bp; 10-year yields around 4.23%, with bunds and gilts cheaper by additional 4bp and 2bp in the sector. French 10-year yields reached highest level since 2011 as money markets price in the European Central Bank raising interest rates as high as 4%. Gilts have led a sell off in the bond markets after record wage growth in the UK prompted traders to raise bets on the BOE terminal rate to around 6%. UK two-year yields are up 9bps while the German equivalent add 6bps. During Asia session, Treasury futures traded heavy also, following losses in Aussie bonds even as RBA minutes signaled a greater bar to further rate hikes and China data disappointed. The US session has packed economic data slate including retail sales.

In commodities, crude futures decline with WTI falling 0.2% to around $82.40. Spot gold drops 0.2%

Looking at the day ahead now, and US data releases include retail sales for July, the Empire State manufacturing survey for August, and the NAHB’s housing market index for August. Elsewhere, we’ll get UK employment for June, the German ZEW survey for August, and Canada’s CPI for July. Otherwise, central bank speakers include the Fed’s Kashkari, and earnings releases include Home Depot.

Market Snapshot

- S&P 500 futures down 0.5% to 4,482.75

- MXAP down 0.2% to 161.15

- MXAPJ down 0.5% to 507.38

- Nikkei up 0.6% to 32,238.89

- Topix up 0.4% to 2,290.31

- Hang Seng Index down 1.0% to 18,581.11

- Shanghai Composite little changed at 3,176.18

- Sensex up 0.1% to 65,401.92

- Australia S&P/ASX 200 up 0.4% to 7,304.96

- Kospi down 0.8% to 2,570.87

- STOXX Europe 600 down 0.8% to 456.05

- German 10Y yield little changed at 2.69%

- Euro up 0.1% to $1.0920

- Brent Futures little changed at $86.20/bbl

- Gold spot down 0.1% to $1,904.43

- U.S. Dollar Index little changed at 103.12

Top Overnight News from Bloomberg

- UK wage growth accelerated at the strongest pace on record, underscoring the Bank of England’s concerns that it hasn’t yet broken the wage-price spiral feeding inflation across the economy.

- China’s central bank unexpectedly reduced a key interest rate by the most since 2020 to bolster an economy that’s facing fresh risks from a worsening property slump and weak consumer spending.

- China suspended publishing data on its soaring youth unemployment rate to iron out complexities in the numbers, fanning investor fears about data transparency in the world’s second-largest economy.

- Japan’s economy expanded at a much faster clip than forecast, as a surge in exports more than offset weaker-than-expected results for both business investment and private consumption.

- Russia’s central bank raised interest rates to the highest in over a year, increasing the pace of monetary tightening at an emergency meeting called after one of the steepest depreciations in emerging markets cast a pall over the economy.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed in an event-packed session as participants digested key releases including disappointing Chinese activity data and the PBoC’s surprise cuts to its 7-day Reverse Repo and 1-year MLF rates. ASX 200 was firmer with most sectors in the green including the top-weighted financials after earnings from big 4 bank NAB which also announced a share buyback, while the RBA minutes provided little in the way of new information and kept the door open for further rate hikes although the latest Wage Price Index printed softer-than-expected. Nikkei 225 benefitted from a strong GDP report which showed Japan’s economy expanded by the fastest annualised pace since Q4 2020 but was led by exports as private consumption contracted for the first time in 3 quarters. Hang Seng and Shanghai Comp were subdued as the miss on Chinese Industrial Production and Retail Sales

Top Asian News

- PBoC conducted CNY 401bln in MLF and unexpectedly cut the 1-year MLF rate by 15bps to 2.50% from 2.65%, while it injected CNY 204bln via 7-day reverse repos with the rate cut to 1.80% from 1.90%.

- PBoC cut the standing lending facilities rates; 10bps reduction for overnight (now 2.65%), 7-day (now 2.8%) and 1–month maturities (now 3.15%).

- PBoC adviser called for the urgent need to boost residential consumption.

- China NBS said the economy continued to recover in July and the foundation for economic recovery needs to be cemented, while it reiterated to boost domestic demand and noted that domestic demand is not sufficient. China’s stats bureau also stated that China’s economic recovery faces challenges but expects exports to be basically steady in H2 and said risks for property developers could be gradually resolved due to policy optimisation. Furthermore, the NBS said PPI declines are expected to moderate further and the decline in CPI could be temporary, while it anticipates China’s economy to improve as policies gain traction.

- China reportedly mulls cutting its stamp duty to revive slumping stock market, according to Bloomberg sources; details on timing and size are yet to be determined, and there is no guarantee the proposal will be approved.

- Japanese Finance Minister Suzuki said rapid FX moves are undesirable and they are to respond appropriately to excessive moves; not targeting absolute FX levels when intervening. Suzuki added FX should move stably reflecting fundamentals, and offered no comment on FX levels, but said they are watching markets with a strong sense of urgency.

- Japan’s top FX diplomat Kanda says will take appropriate steps against excessive moves, according to Jiji; adds that excess volatility is undesirable and monitoring with a high sense of urgency, according to Reuters.

- RBA Minutes from the August meeting stated that the Board considered raising rates by 25bps or holding steady and agreed that the case for holding steady was the stronger one, while the Board saw a credible path back to the inflation target with Cash Rates at the current 4.10% level but agreed it was possible some further tightening may be needed which would depend on data and evolving assessment of risks. Furthermore, it stated that inflation is heading in the right direction although service inflation is too high and the Board saw plausible scenarios where inflation took longer than acceptable to return to the target.

European bourses have been unable to hold onto modest opening gains. There wasn’t a clear reason behind the pullback in global equities and summer trading conditions can often cause an unexplained drift within the market. Sectors in Europe are now lower across the board with the exception of Retail just about managing to hold in positive territory with Marks & Spencer. On the downside, Real Estate names are the standout laggard with the sector struggling in the face of firmer yields, whilst Basic Material names are suffering in the wake of Chinese-induced softness in underlying metals prices. Stateside, equity futures are trading on the back foot, with ES and NQ giving back some of yesterday’s gains after overnight data out of China disappointed

Top European News

- ZEW said respondents by and large do not expect further rate hikes in the EZ and US. ZEW said the economic outlook for the US has seen a significant increase; this contributes to improved expectations for Germany, according to Reuters.

FX

- DXY trades on a more mixed footing amidst a myriad of factors ranging from data to Central Bank policy action and further intervention. The Dollar index holds a tight line around 103.000, with downside pressure emanating from the Sterling, the Euro and Franc, whilst support comes via the Loonie, Yen and Swedish Crown.

- GBP derived traction from the hotter-than-expected UK wages.

- The Chinese Yuan relied on state bank buying to stem losses overnight following disappointing activity data and rate cuts by the PBoC.

- PBoC set USD/CNY mid-point at 7.1768 vs exp. 7.2648 (prev. 7.1686)

- Chinese state banks were seen selling dollars vs yuan at the 7.2800 level.

- CBR hiked by 350bps from 8.5% to 12% at its emergency rate decision.

Fixed Income

- Debt futures have recouped some losses after plunging further into negative territory, and arguably in relief that supply has not prompted any additional pressure from a demand perspective

- Bunds are holding above worst levels within a 130.57-131.26 range, Gilts midway between 92.51-99 confines and the T-note just over their 109-22 overnight base.

- UK sells GBP 2.5bln 1.125% 2039 Gilt: b/c 2.51x (prev. 2.58x), average yield 4.786% (prev. 3.780%) & tail 0.8bps (prev. 0.2bps).

- Germany sells EUR 4.234bln vs. Exp. EUR 5.5bln 3.10% 2025 Schatz: b/c 1.3x (prev. 1.5x), average yield 3.12% (prev. 3.7%) & retention 21.38% (prev. 17.28%)

Commodities

- WTI and Brent futures are experiencing another morning of choppiness in summer markets, the losses seen since the European cash open seemingly a function of the broader risk aversion and downbeat Chinese data.

- Spot gold is subdued this morning as the Dollar clawed back some earlier losses in early European trade, with the yellow metal dipping under its 200 DMA around USD 1,905/oz.

- Base metals have also seen a choppy session thus far with the initial mild support from the aforementioned Bloomberg sources dissipating amid this morning’s risk aversion. 3M LME copper briefly dipped under USD 8,200/t.

Geopolitics

- Russian Ambassador to the US said the US denied some Russian officials visas to travel to the APEC conference in Seattle, according to Reuters.

US Event Calendar

- 08:30: July Retail Sales Advance MoM, est. 0.4%, prior 0.2%

- Retail Sales Control Group, est. 0.5%, prior 0.6%

- Retail Sales Ex Auto and Gas, est. 0.4%, prior 0.3%

- Retail Sales Ex Auto MoM, est. 0.4%, prior 0.2%

- 08:30: July Import Price Index MoM, est. 0.2%, prior -0.2%

- July Import Price Index YoY, est. -4.6%, prior -6.1%

- July Export Price Index MoM, est. 0.2%, prior -0.9%

- July Export Price Index YoY, prior -12.0%

- 08:30: Aug. Empire Manufacturing, est. -1.0, prior 1.1

- 10:00: June Business Inventories, est. 0.1%, prior 0.2%

- 10:00: Aug. NAHB Housing Market Index, est. 56, prior 56

- 16:00: June Total Net TIC Flows, prior -$167.6b

DB’s Jim Reid concludes the overnight wrap

The last 24 hours have been pretty mixed for markets, as growing concerns about Chinese property and the prospect of higher US rates have dampened risk appetite among investors. We mentioned yesterday that the developer Country Garden were suspending trading of 11 onshore bonds, and this morning we’ve had another round of economic data that’s fallen short of expectations once again. For instance, Chinese industrial production in July only grew by +3.7% year-on-year (vs. +4.3% expected), whilst retail sales fell to a +2.5% (vs. +4.0% expected). In the meantime, YTD property investment fell to -8.5% year-on-year (vs. -81% expected), and the urban unemployment rate rose to 5.3% (vs. 5.2% expected).

That backdrop has seen the People’s Bank of China cut the rate on the medium-term lending facility overnight, with a 15bp cut down to 2.5%. And in turn, the offshore Yuan has weakened against the US Dollar for a 4th consecutive session, meaning it’s currently trading at its weakest level since November, at 7.30 per US Dollar. Yields on the country’s 10yr government debt are also down -4.9bps to 2.57%, marking their lowest level since 2020.

With economic data weakening further, Chinese equities have lost further ground this morning, and the CSI 300 (-0.49%) is down for a 3rd consecutive session. In Hong Kong, the Hang Seng is also down -0.80%, whilst the Hang Seng Property Index is down -1.53% to a 9-month low as well. But it hasn’t been entirely bad news overnight, since Japanese GDP grew twice as fast as expected in Q2, with annualised growth coming in at +6.0% (vs. +2.9% expected), and the Nikkei is up +0.84%. That said, the GDP beat was driven by a much stronger-than-expected net exports figure, with business investment and private consumption actually coming in beneath consensus.

Those concerns around Chinese property haven’t been helped by rising US interest rates, and yesterday saw the 10yr Treasury yield (+3.9bps) reach its highest level so far in 2023, closing at 4.19%. Alongside that, there was an even bigger milestone for the 10yr real yield (+5.7bps), which closed at a post-2009 high of 1.84% yesterday. So that’s a fresh sign that borrowing costs are still getting more restrictive in real terms. At the front-end, those increases were even more pronounced, and the 2yr yield (+7.4bps) closed at a one-month high of 4.97% as well. Those trends have continued overnight as well, with the 10yr yield up another +0.8bps to 4.20%.

The main factor driving yields higher was the prospect that the Fed would keep policy in restrictive territory for longer than previously anticipated. In fact, fed funds futures for the December 2024 meeting hit a new high for this cycle yesterday, closing at 4.29%, so we’re continuing to see markets reappraise the policy path in a more hawkish direction. Now admittedly, that’s still beneath the 4.6% rate signalled in the Fed’s dot plot from June. But market pricing was at just 3.73% on July 13, so now we’ve seen more than 50bps worth of rate hikes being priced back in for next year in the space of just over a month.

In the US and Europe, the major equity indices were impressively resilient given the backdrop yesterday, and the S&P 500 (+0.57%) started the week on the front foot, with futures up another +0.18% this morning. However, the rally yesterday was on the narrower side, and less than 50% of the S&P 500’s constituents rose on the day. Megacap tech stocks were among the outperformers, with the NASDAQ (+1.05%) and FANG+ (+1.73%) indices posting their strongest performance of August so far. At the same time, there were several points of weakness, and the small-cap Russell 2000 (-0.24%) hit a one-month low, as did the MSCI EM index (-0.48%).

Over in Europe, the most interesting macro story of the day came out of Russia, with the dollar exchange rate moving above 100 rubles on Monday morning, the highest since March 2022 (in the early weeks after Russia’s invasion of Ukraine). The ruble did recover from 102 to around 98 during the day after the Bank of Russia said an emergency rates decision will be made this morning (which should deliver a chunky hike). The ruble is among the weakest currencies this year (-26% ytd versus the dollar) despite the rise in oil prices in recent months. In a report last month (link here), our EM economists described how a slowing of exports, a strong recovery in imports and an inability to attract capital left the exchange rate as a release valve for rising imbalances in the Russian economy. They also note that Moscow’s move to increase trade in non-Western currencies exacerbated the ruble’s vulnerability – so an event study arguing against any imminent demise of the dollar’s dominance in global trade.

Elsewhere in Europe, markets were fairly calm yesterday, with the STOXX 600 up +0.15%. Bonds saw more of a struggle however, with yields on 10yr bunds (+1.3bps), OATs (+2.0bps) and BTPs (+2.6bps) all moving higher. Gilts were the biggest underperformer, with the 10yr yield up +3.9bps, whilst the 30yr yield (+2.4bps) hit its highest level since the mini-budget at 4.75%. It was the same story for the 30yr real yield (+1.2bps), which also hit its highest since the mini-budget at 1.27%. The focus should remain on the UK this morning, as we’ve got labour market data shortly after we go to press, as well as the July CPI release tomorrow morning.

There wasn’t much data of note yesterday, although we did get the New York Fed’s latest Survey of Consumer Expectations. That showed that 1yr inflation expectations hit their lowest since April 2021, at just 3.5%. And there was also a modest decline in 3yr and 5yr expectations, which both came down a tenth to 2.9%.

To the day ahead now, and US data releases include retail sales for July, the Empire State manufacturing survey for August, and the NAHB’s housing market index for August. Elsewhere, we’ll get UK employment for June, the German ZEW survey for August, and Canada’s CPI for July. Otherwise, central bank speakers include the Fed’s Kashkari, and earnings releases include Home Depot.

Tyler Durden

Tue, 08/15/2023 – 08:18

new york stock exchange

nasdaq

asx

ax

gold

iron