Uncategorized

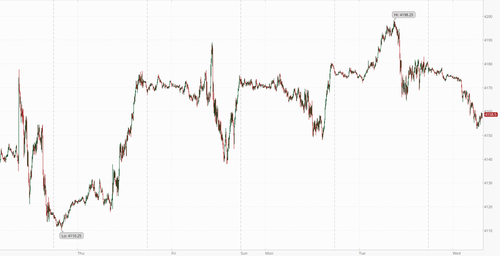

Futures Slide After Hawkish Bullard Comments, Red Hot UK Inflation

Futures Slide After Hawkish Bullard Comments, Red Hot UK Inflation

US equity futures fell following hawkish comments from FOMC non-voter Jim…

Futures Slide After Hawkish Bullard Comments, Red Hot UK Inflation

US equity futures fell following hawkish comments from FOMC non-voter Jim Bullard and another double digit CPI print out of the UK; China was weak with property names dropping -2% led by Hong Kong developers which dropped after city leader John Lee dismissed calls by the industry to scrap property cooling measures. Sentiment was also dented by news Tesla cut prices again – just hours before it reports Q1 earnings -which is likely to not be well received by auto sector. Netflix tumbled as much as 12% on Tuesday before recouping almost all losses after a miss on subscribers but after boosting cash flow. Regional banks within a hair of new lows but WAL numbers overnight should give some support to the sector.

Contracts on the S&P 500 fell 0.5% at 7:15 a.m. ET Nasdaq 100 futures slipped 0.8% as the yield on the 10-year Treasury rose to nearly 3.62%, mirroring larger moves in UK gilts following the abovementioned CPI print. The Bloomberg Dollar Spot Index traded near the day’s highs, pressuring most Group-of-10 currencies. Oil, gold and Bitcoin all fall in tandem.

In premarket trading, Tesla dropped 2% after further cutting prices on some models in what is an increasingly bitter price war to capture EV market share ahead of first-quarter results due later Wednesday. Netflix dipped after the video-streaming firm added fewer subscribers than anticipated in the first quarter. Here are some other notable premarket movers:

- Western Alliance rises as much as 18%, boosting shares in fellow regional lenders, as analysts viewed the bank’s balance-sheet repositioning positively, highlighting measures to improve liquidity. The company said deposits rose $2 billion this month through April 14, an encouraging signal given March’s turmoil in the industry following the collapse of SVB.

- Netflix falls 1.3% after the video-streaming company added fewer subscribers than had been anticipated in the first quarter. However, analysts remain positive on the stock’s long-term prospects as the company raised its full-year free cash flow forecast. UBS upgraded to buy from neutral. Shares of video streaming companies were lower after Netflix added fewer subscribers than had been anticipated in the first quarter. FuboTV -3.2%, Roku -1.3%.

- Intuitive Surgical jumps 7.1% after the maker of surgical tools reported procedure growth for the first quarter that beat the average analyst estimate, sending analyst price targets higher. Brokers said Intuitive’s results bode well for peers, and show the environment is improving for such companies as they recover from pandemic-related disruptions to medical procedures.

- United Airlines climbs as much as 0.8% after the carrier reported a narrower-than-estimated loss for the first quarter. Analysts said the company’s outlook was strong and showed that demand for travel is holding up.

- Riot Platforms and Marathon Digital lead fellow cryptocurrency- exposed stocks lower as Bitcoin records its biggest drop in over a month, falling back below the $30,000 mark.

With tax receipts filtering in expect to see a broad based liquidity drain over the next few weeks. CTA positioning is approaching fully long, macro buying has persisted for 6 weeks (nets have crept higher ) and the Goldman trading desk has already seen quite substantial vol control demand with vix back to a 16 handle.

Investors are monitoring earnings to assess how companies have grappled with headwinds including slowing demand and higher interest rates. At the same time, they’re looking for clues if and when the Federal Reserve will end its tightening policy amid fears of a recession and more bank failures.

“Central banks, for now, will keep hiking until they see more evidence of lower inflation down the road,” Barclays Plc strategist Emmanuel Cau said on Bloomberg Television. “Inflation is still high and to some extent growth is resilient at the same time, so I think the resolve of central banks to hike and to see more evidence of inflation coming down is still here.” Separately, Cau said in a note that there’s scope for first-quarter earnings to beat estimates given that growth momentum has rebounded in China, and held up better than expected in the US and Europe.

Globally, volatility has remained at low levels leading many bearish strategists to warn of complacency. Bank of Atlanta President Raphael Bostic said he favors raising rates one more time and then holding them above 5% for some time to curb inflation, while his St. Louis counterpart James Bullard said he prefers getting rates into a 5.5% to 5.75% range. Global markets appear to be overbought and “people should not be too complacent” about the reduced volatility, JPMorgan Asset Management’s Head of Investment Specialists for Asia excluding Japan Jonathan Liang said in a Bloomberg Television interview. He added that a US recession has not yet been priced in.

DAX and CAC lose 0.1%, while UK stocks underperformed their regional peers following another month of hotter than expected double-digit CPI, pushing the FTSE 100 down 0.3%. Here are the biggest European movers:

- Worldline shares jump as much as 9.4%, most since July, after the French payments company launched a joint-venture in merchant payments with Credit Agricole

- Heineken shares rise as much as 3.9% after 1Q update, with analysts saying the Dutch brewer’s pricing power helped offset some expected but unwelcome volume weakness in key markets

- Kuehne + Nagel climbs as much as 2.2% after the Swiss logistics giant was upgraded to buy from hold at Deutsche Bank, which cited better freight data

- National Express shares rise as much as 5.8%, with analysts saying the transport operator delivered a strong first-quarter revenue performance that will underpin its guidance

- ASML shares fall as much as 3.5% in Amsterdam after the semiconductor-equipment maker reported its lowest quarterly order intake since 2020 amid an industry downturn

- Renault falls as much as 4.4% was downgraded to neutral from buy at BofA amid higher EV competition and price pressures. Renault is also set to release 1Q sales figures tomorrow

- Just Eat Takeaway shares dip as much as 6.1% in Amsterdam, paring gains of as much as 5.1%, after the food-delivery company reported first-quarter orders that were below expectations

Earlier in the session, Asian stocks fell as Chinese shares struggled to find footing after mixed economic data released Tuesday, while investors parsed the latest comments from Federal Reserve officials on interest-rate hikes. The MSCI Asia Pacific Index dropped as much as 0.9%, led by consumer discretionary and technology shares. Hong Kong and Chinese benchmarks led losses around the region, while South Korea edged closer to a bull market. Australia also advanced. The latest set of Chinese economic data showed an uneven recovery picture, while hopes for further stimulus have been dampened. That has kept a lid on investor enthusiasm as it signals China’s recovery will likely be gradual, even though the worst may be over after its reopening from Covid Zero.

Japanese stocks declined, halting an eight-day rally, as investors remained concerned about the risk of higher US interest rates and Chinese equities were hit by shareholders’ plans to trim their stakes. The Topix was virtually unchanged at 2,040.38 as of the market close in Tokyo, while the Nikkei 225 declined 0.2% to 28,606.76. Out of 2,158 stocks in the index, 753 rose and 1,251 fell, while 154 were unchanged. “With the stock indexes at a high level, profit-taking selling is prevailing,” said Hideyuki Suzuki, a general manager at SBI Securities.

Australian stocks edged higher, with the S&P/ASX 200 index rising just 0.1% to close at 7,365.50, buoyed by miners as most sectors dropped. Asian shares fell with US stock futures as traders weighed earnings from Wall Street and as Chinese equities were hit by shareholders’ plans to trim their stakes.

In FX, the Bloomberg Dollar Spot Index is up 0.3% having risen versus the rest of its G-10 rivals amid some modest risk-off. US and German short-end yields have followed their UK counterparts higher, rising by 7bps and 5bps respectively.

“The picture being painted by the data released so far this week will likely be raising concerns inside the BOE,” said Stuart Cole, chief macro economist at Equiti Capital in London. “This likely means a continuation of its hiking cycle, a lengthening that will come at a time when peers such as the Federal Reserve will likely have paused with their own cycle of interest-rate rises.”

In rates, treasuries fell, lifting the 10-year yield 6bps higher to 3.63%, the highest since March 22, as BOE and Fed rate hike bets mount following higher-than-forecast UK inflation figures. US yields cheaper by 2bp-7bp across the curve at highest levels this month, with front-end-led losses flattening 2s10s, 5s30s spreads by ~2bp and ~3bp on the day. Money markets price 23bps of Fed hikes next month and 31bps by June; 46bps of easing is priced by year-end. Gilts are sharply lower and the pound has outperformed as traders ramp up bets on additional rate hikes from the Bank of England after UK inflation surprised to the upside. UK two-year yields have jumped 14bps to a six-week high of 3.83% while the pound gains 0.2% versus the greenback. BOE rate hike wagers surge even more, pricing a 5.03% peak rate by November — the highest since October — compared to 4.86% on Monday. Treasury auctions resume with $12b 20-year bond reopening at 1pm; $21b 5-year TIPS new-issue is ahead Thursday

In commodities, crude futures decline with WTI falling 1.9% to trade near $79.30. Spot gold is down 1.4% around $1,978.

Bitcoin has come under marked pressure this morning, with BTC dropping from USD 30k to a test of USD 29k in minutes. At the time, there was no clear fundamental catalyst with the likes of Coindesk subsequently suggesting it may have been spurred by long-liquidations. US House Financial Services Committee will hold a hearing on stablecoin regulation on Wednesday, according to Cointelegraph.

To the day ahead now, and data releases include the UK CPI reading for March. From central banks, the Fed will be releasing their Beige Book, and we’ll hear from the Fed’s Goolsbee, the ECB’s Lane, Knot, de Cos, and Schnabel, as well as the BoE’s Mann. Finally, earnings releases include Tesla, Morgan Stanley and IBM.

Market Snapshot

- S&P 500 futures down 0.4% to 4,162.75

- STOXX Europe 600 down 0.3% to 467.44

- MXAP down 0.8% to 162.36

- MXAPJ down 0.9% to 523.41

- Nikkei down 0.2% to 28,606.76

- Topix little changed at 2,040.38

- Hang Seng Index down 1.4% to 20,367.76

- Shanghai Composite down 0.7% to 3,370.13

- Sensex down 0.4% to 59,470.47

- Australia S&P/ASX 200 little changed at 7,365.54

- Kospi up 0.2% to 2,575.08

- German 10Y yield little changed at 2.52%

- Euro down 0.1% to $1.0960

- Brent Futures down 1.7% to $83.37/bbl

- Gold spot down 1.0% to $1,985.90

- U.S. Dollar Index up 0.14% to 101.89

Top Overnight News

- Washington and Beijing tensions continue to creep higher, w/the White House set to unveil stringent new rules limiting American investments on the mainland. Politico

- South Korea’s CPI for Mar overshoots the St, coming in at +7.1% (vs. the consensus forecast of +6.9% and up from +7% in Feb). BBG

- India has surpassed China as the world’s most populous country, according to UN data released on Wednesday, marking a historic crossover moment for the two Asian neighbors and geopolitical rivals. According to the UN’s Population Dashboard, India’s population has surpassed 1.428bn, just overtaking China’s more than 1.425bn people. FT

- Russian officials quietly raised concerns last year about the risks of becoming too reliant on Chinese technologies after sanctions shut off access to other suppliers. The memo suggests some are worried Chinese firms such as Huawei may come to dominate the Russian market and threaten information security and networks, people familiar said. BBG

- UK inflation for Mar overshoots the St, coming in at +10.1% on the headline (vs. the St consensus of +9.8% and down only modest from +10.4% in Feb). RTRS

- Passenger-car registrations across the EU rose in March on the year as each of the bloc’s largest markets saw double-digit growth, the European Automobile Manufacturers Association, or ACEA, said Wednesday. New car registrations, which reflect sales, rose to 1,087,939 units, a 29% increase compared with March 2022, while registrations in the first quarter rose 18% to almost 2.7 million units, the ACEA said. WSJ

- The EU is storing record levels of natural gas after a milder than anticipated winter, bolstering hopes that the bloc can wean itself off imports from Russia. The bloc’s storage totaled 55.7 per cent of capacity at the start of the month according to the industry body Gas Infrastructure Europe — the highest level for early April since at least 2011. FT

- US crude inventories fell by 2.7 million barrels last week, the API is said to report. That would take total holdings to the lowest in two months if confirmed by the EIA. Gasoline supplies declined by 1 million, dropping for a ninth week ahead of the summer driving season. Distillate stocks also dropped. Elsewhere in oil, a rush in Asia to secure supplies after OPEC+’s output-cut surprise is fading. BBG

- CDW a large distributor of IT products, announced a negative preannouncement (they see Q1 revenue of $5.1B vs. the Street consensus of $5.57B and full-year EPS is now seen falling Y/Y vs. the St consensus of +6%). RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were lacklustre in the absence of any major positive macro drivers and following the flat handover from Wall St where risk sentiment was clouded amid mixed data releases and earnings results. ASX 200 was kept afloat amid outperformance in the mining and materials sectors although gains were limited by weakness in energy and consumer stocks, as well as uninspiring data with Westpac Leading Index flat. Nikkei 225 declined after the latest Reuters Tankan survey for April showed Japanese manufacturers remained glum with the Large Manufacturing Index stuck in negative territory. Hang Seng and Shanghai Comp were subdued with underperformance in Hong Kong amid losses in autos, property and tech, while the mainland was also cautious ahead of US Treasury Secretary Yellen’s major speech on Thursday regarding US-China Economic ties where she will outline US economic priorities on China.

Top Asian News

- BoJ is reportedly wary of tweaking yield control in April, via Bloomberg; BoJ is reportedly likely to mull of guidance change can wait or not; smoother yield curve is said to suggest no need for a move now; seeing elevated uncertainties after the banking crisis.

- China’s NDRC said it is studying and drafting documents to recover and expand consumption, while it added that it will work hard to stabilise auto consumption, according to Reuters.

- UBS raises it FY23 Chinese GDP forecast to 5.7% Y/Y from 5.4%.

European bourses are in the red, Euro Stoxx 50 -0.4%, after the index’s largest weighted component ASML drops post-earnings despite beating estimates as it highlights caution among customers. Elsewhere, the macro backdrop has been influenced by hotter-than-expected UK CPI data with a hawkish move seen in Europe/UK at the time, FTSE 100 -0.4%. Given the above, sectors have a negative skew with Real Estate lagging as yields increase while Tech names slip given ASML, at the other end of the spectrum Food, Beverage and Tobacco outperforms after Heineken’s update. Stateside, futures are in the red with the Nasdaq lagging as yields increase while banking names are deriving support from WAL’s after-hours update. Netflix Inc (NFLX): Top- and bottom-lines were broadly in line with expectations, although net subscriber additions were short in the quarter, and guidance for the next quarter was soft relative to analyst expectations; some analysts suggested that the soft subscriber guidance was a result of pushing back the launch of its paid-sharing service into Q2. Western Alliance Bancorp (WAL): The regional bank reported that deposits stabilised in Q1, and profits topped expectations.

Top European News

- Morgan Stanley now expects the BoE to hike rates by 25bps in May vs. prev. view of unchanged.

- Central London property prices fell nearly 5% in the 12 months to March which is the largest annual decline since 2019, according to FT

FX

- Overall, the session is characterised by broad USD strength which is seemingly being fuelled by yield action and associated JPY underperformance alongside dovish-sounding BoJ commentary.

- Thus far, the DXY has eclipsed the 102.00 handle to a 102.18 peak from a 101.65 base, with upside initially capped by GBP outperformance after hotter-than-expected CPI data; Cable peaked at 1.2472, but has since been drawn back to 1.2400.

- Returning to the JPY, USD/JPY has most recently pulled-back from the 135.00 mark to circa. 134.75 after source reports suggest the BoJ is wary of tweaking yield control in April, via Bloomberg.

- Elsewhere, peers are broadly-speaking softer against the USD with EUR unreactive to final HICP as marked OpEx draws interest while the CHF experienced only a fleeting upside from SNB’s Maechler.

- Note, given the marked crude move petro-FX has been coming under slightly more pressure as the session progressed, with USD/CAD below the 200-DMA and towards its 10-DMA.

- SNB’s Maechler says inflation is back with a vengeance and monetary policy is back to the traditional tools. Ready to sell foreign currencies..

- PBoC set USD/CNY mid-point at 6.8731 vs exp. 6.8728 (prev. 6.8814)

Fixed Income

- Gilts once again underperform after hawkish UK data ahead of the May BoE, with 25bp now fully priced compared to circa. 80% before-hand.

- As such, Gilts have been down to 99.85 with the associated 10yr yield above 3.85%

- Action which has been seen, though to a lesser extent, in EGBs and USTs and has served as another bout of concession before the well-received Bund outing and the upcoming US 20yr; albeit, limited upside from the German sale.

- Stateside, USTs remain pressured pre-supply/Goolsbee with the curve elevated and action again most pronounced at the short-end.

Commodities

- WTI and Brent are under marked pressure that has seen the benchmarks move below the last two week’s lows amid broad USD strength; note, the move occurred despite a lack of timely drivers and the initial bout did not coincide with Dollar action.

- Specifically, the benchmarks have moved below USD 79/bbl and USD 83/bbl respectively, from initial USD 81.24/bbl and USD 85/15/bbl peaks.

- China’s NDRC said it will speed up the construction of iron ore projects and will firmly curb an irrational rise in iron ore prices, according to Reuters.

- China’s Huayou Cobalt is looking to build a nickel ore processing plant in the Philippines, according to an industry source cited by Reuters.

- Spot gold has succumbed to the firmer USD and has surrendered the USD 2k/oz handle to a USD 1972/oz trough, with base metals under similar pressure though ranges are somewhat more contained in the likes of LME Copper.

- Ukraine’s Deputy PM says ship inspections are recommencing under the Black Sea grain initiative and grain transit through Poland is to open overnight Thursday/Friday.

Geopolitics

- US did not issue visas to all members of the Russian delegation going to the UN, according to RIA.

- UK government cyber defence agency warned of a threat to Western infrastructure from hackers sympathetic to Russia and its war on Ukraine, according to Reuters.

- South Korean President Yoon said South Korea may consider providing military aid for Ukraine if a large attack on civilians occurs and it will take the most appropriate measures considering battlefield developments in Ukraine. Yoon also commented that he won’t hold a summit with North Korean leader Kim for show but the door for dialogue to promote peace remains open, while South Korea is developing ultra-high performance and high-power weapons to respond to North Korea’s emerging threats and is discussing extended deterrence plans with the US including information sharing, joint planning and joint execution, according to Reuters.

- North Korean leader Kim ordered the preparation to launch a military spy satellite as planned and ordered the deployment of a series of spy satellites to boost reconnaissance capabilities, according to KCNA.

- US House China Select Committee will be war-gaming a scenario of China invading Taiwan, according to Axios

- A leaked US military assessment stated that China’s military could soon deploy a high-altitude supersonic spy drone unit, according to Washington Post.

US event calendar

- 07:00: April MBA Mortgage Applications, prior 5.3%

- 14:00: Federal Reserve Releases Beige Book

Central Banks

- 14:00: Federal Reserve Releases Beige Book

- 17:30: Fed’s Goolsbee Interviewed on Marketplace

- 19:00: Fed’s Williams Speaks in New York

DB’s Jim Reid concludes the overnight wrap

I’m in the US showing off my panda eye ski tan for the rest of the week. Before I left I had the weirdest, nostalgic dollop of deja-vu. Unbeknown to me my wife had bought our five-year-old twins their first Panini football card album. To say they were immediately obsessed was an understatement. It brought back memories of me desperate to swap my excess cards for one Ian Rush sticker over 40 years ago. From my brief interactions before I left it seems they’ll do anything for a pack of new cards now to expand their set. So we have a list of chores that completing will gain a set. I’ve written to Panini to see if they’ll do an Investment Bank edition. Imagine the excitement of getting the full house of DB Research professionals’ stickers in your book before one of our rivals!

The market has been collecting a few duller days of late but it probably wouldn’t want to swap for those seen a month or so ago. The last 24 hours fitted into that narrative with most major assets closing either side of unchanged. We did get several earnings releases to chew over, but they were pretty mixed overall and didn’t point to an obvious conclusion for investors, and it was much the same from yesterday’s limited round of data. So with all said and done, the S&P 500 ultimately ended the day just +0.08% higher, remaining in its narrow band over April that’s left it within a range of little more than 1% either side of its level at the start of the month.

With little volatility to speak of, that’s enabled a continued easing in financial conditions, with Bloomberg’s index hitting a post-SVB high yesterday. In fact, it’s now unwound around 90% of the tightening related to last month’s market turmoil, so it’s increasingly feeling like a bad dream with little lasting impact on market based financial conditions. We’ll see from the SLOOS report in a couple of weeks whether there has been scars from bank-based financial conditions. For now the looser market-based financial conditions have helped cement investors’ conviction that the Fed are set to deliver another hike in just two weeks’ from now, which was supported by the latest round of FOMC speakers. For instance, St Louis Fed President Bullard struck a bullish tone on the economy, saying that “Wall Street’s very engaged in the idea there’s going to be a recession in six months or something, but that isn’t really the way you would read an expansion like this.” Later on, Atlanta Fed President Bostic then said that his baseline was for one further hike and then a pause that left them there for “quite some time”. But even as officials offered more signals about another rate hike, 10yr Treasuries reversed a touch to end the day -2.5bps lower at 3.576%. Fed futures ticked slightly lower with the probability of a rate hike next month dropping 2 percentage points to 85.8% but this comes after increasing 64pp since the Monday after SVB failed.

When it came to equities, there was a reasonable amount of dispersion given the subdued movements for the broader indices. In fact, there was exactly 50% of constituents higher and lower on the day, with cyclicals outperforming defensives as industrials (+0.46%) and energy (+0.45%) stocks outpaced healthcare (-0.66%), communications (-0.65%) and utilities (-0.51%). In terms of the various earnings reports, the main highlights included Goldman Sachs (-1.70%), whose share price fell back after their FICC sales and trading revenue came in beneath expectations thanks to a -17% decline. Elsewhere, Bank of America’s (+0.63%) trading revenue beat expectations and overall revenue was up 9%. And away from the financials, Johnson & Johnson (-2.81%) was another that struggled, even as they raised their earnings forecast for this year. After the close, NFLX (initially down -12.5% before recovering to unchanged in after-market trading) missed on new subscriber growth (+1.75mn vs +2.41mn estimated) and lowered sales and profit guidance further than analysts expected. United Airlines was up +1.30% in after-market trading after reporting increased international travel that will see stronger 2Q results than analysts expected after posting a first-quarter adjusted loss of $0.63 EPS.

Over in Europe, the performance was a bit stronger yesterday, although in part that reflected a catchup to the US rally after Europe went home the previous day. That enabled the STOXX 600 (+0.38%) to hit a 14-month high, and the Euro STOXX 50 (+0.60%) is now just shy of its closing peak from November 2021, which if surpassed would leave the index at its highest level since late 2007. For bonds there was also a bit more of a risk-on tone, and yields on 10yr bunds ended the day up +0.4bps. That followed comments from ECB chief economist Lane that “I think the baseline is that we should indeed increase interest rates in May”.

Whilst most sovereign bonds in Europe were fairly steady yesterday, back in the UK, gilts were an underperformer thanks to data that showed stronger-than-expected wage growth, and the 10yr yield climbed +5.6bps on the day. The release showed that growth in average total pay was up +5.9% (vs. +5.1% expected) over the three months to February compared to the previous year. And with upward revisions to the previous month as well, the data added to fears that inflation would prove more persistent than expected, and that the Bank of England would need to hike rates yet further. Indeed, the chances of another 25bp rate hike at the May meeting moved up to 90.1% according to overnight index swaps, the highest level since SVB’s collapse. On that front, the next crucial component will be the CPI release this morning, which should be coming out around the time this email hits your inboxes.

Asian equity markets are mostly trading lower this morning following the lacklustre performance on Wall Street overnight. As I type, the Hang Seng (-0.60%) is leading losses across the region, pulled down by technology and real estate stocks, while the CSI (-0.50%), the Shanghai Composite (-0.21%) and the Nikkei (-0.24%) are also in the red amid the prospect of interest rate hikes from the Fed. Otherwise, the KOSPI (+0.23%) is bucking the regional market trend in early trading, albeit only just.

Outside of Asia, US stock futures are retreating with those on the S&P 500 (-0.12%) and NASDAQ 100 (-0.16%) inching downward following the latest round of earnings.

Running through yesterday’s other data, the German ZEW survey’s expectations component fell back for a second month running in April, with a decline to 4.1 (vs. 15.6 expected). In Canada, CPI inflation declined as expected in March, falling back to 4.3%. And finally in the US, housing starts decelerated in March, falling to an annualised rate of 1.42m (vs. 1.40m expected), with building permits also falling back to 1.413m (vs. 1.45m expected).

To the day ahead now, and data releases include the UK CPI reading for March. From central banks, the Fed will be releasing their Beige Book, and we’ll hear from the Fed’s Goolsbee, the ECB’s Lane, Knot, de Cos, and Schnabel, as well as the BoE’s Mann. Finally, earnings releases include Tesla, Morgan Stanley and IBM.

Tyler Durden

Wed, 04/19/2023 – 07:45

nasdaq

asx

ax

gold

iron