Uncategorized

Emission Control: Uh-oh, G20 member countries tipped almost $700bn in support for fossil-fuel power in 2021

BNEF says Australia has not only gone backwards on climate disclosure policies but fossil fuel subsidies increased by 4pc between … Read More

The post…

Emission Control is Stockhead’s fortnightly take on all the big news surrounding developments in renewable energy.

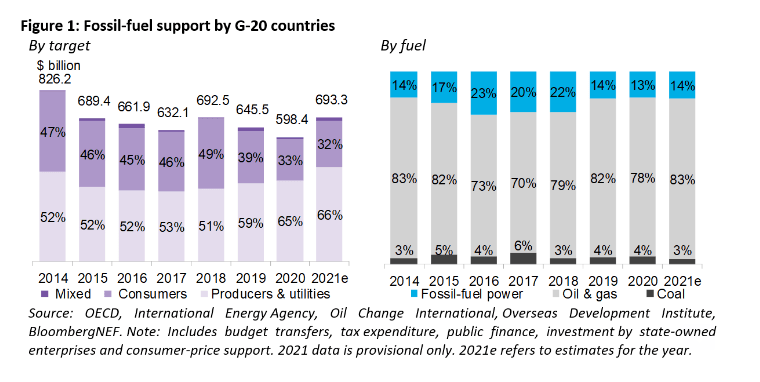

Bloomberg New Energy Finance (BNEF) is out with evidence showing support for fossil fuels by G20 nations in 2021 reached their highest level since 2014, and Australia is one of the worst offenders.

According to BNEF’s latest Climate Policy Factbook, Australia has not only gone backwards on climate risk disclosure policies but fossil fuel subsidies increased by 4pc between 2016 – 2020 to US$38bn ($59.2bn).

This was mainly in the form of tax breaks thanks to capex deductions for mining and petroleum operations, fuel tax credits and reduced fuel-excise rates.

In total, Australia lost out on nearly US$6bn in foregone taxes in 2020 alone, BNEF says.

Meanwhile, 19 individual country members of the G20 (including nations such as France, the United Kingdom, Japan, Canada, Germany, and the United States) provided $693bn in support for coal, oil, gas and fossil fuel power in 2021, an increase of 16pc from the year before.

That $700bn investment likely distorted prices, encouraged wasteful use and production of fossil fuels, and resulted in investment within long-lived, emission intensive equipment and infrastructure while slowing down progress on reaching the goals of the Paris Agreement.

The G20 is an intergovernmental forum comprising 19 countries and the European Union working to address major issues in the areas of financial stability, climate change mitigation, and sustainable development.

Although the share of G20 fossil fuel support allocated to coal is slowly shrinking – from 4.1pc in 2016 to 2.9pc in 2021 – BNEF states coal still managed to attract a total of $20bn of government support in 2021.

“This is surprising given that much of the effort to phase out fossil-fuel support has focused on coal, including pledges announced at recent G20 summits and COP26,” BNEF says.

“At the national level, China may have accounted for the largest share (26pc) of G20 fossil-fuel support in 2020 but it it is well below other G20 members on a per-capita basis – at $111 in 2020 compared with, for example, Saudi Arabia ($1,433), Argentina ($734) and Canada ($512).

“It also scaled back this support by 12pc over 2016-20, while Canada more than doubled fossil-fuel support over that period.

“The US has the lowest per-capita total out of the G-20 (at $34 in 2020) but provided 57pc more of such subsidies in 2020 relative to 2016,” BNEF added.

Here’s how ASX renewable stocks are tracking:

| CODE | COMPANY | PRICE | % TODAY | % WEEK | % MONTH | % YEAR | MARKET CAP |

|---|---|---|---|---|---|---|---|

| AST | AusNet Services Ltd | 0 | 0% | -100% | -100% | -100% | $9,919,608,019 |

| AVL | Aust Vanadium Ltd | 0.031 | 0% | -9% | -9% | 35% | $124,323,075 |

| BSX | Blackstone Ltd | 0.16 | 0% | -9% | -9% | -74% | $75,716,036 |

| DEL | Delorean Corporation | 0.075 | -6% | -21% | 19% | -65% | $17,257,673 |

| ECT | Env Clean Tech Ltd. | 0.014 | 0% | -7% | -13% | -39% | $24,027,523 |

| FMG | Fortescue Metals Grp | 15.32 | -3% | -5% | -9% | 10% | $48,432,118,160 |

| PV1 | Provaris Energy Ltd | 0.062 | 3% | 8% | 9% | -57% | $32,896,828 |

| GNX | Genex Power Ltd | 0.2 | -2% | 0% | -7% | 0% | $283,961,314 |

| HXG | Hexagon Energy | 0.014 | 0% | -7% | -18% | -86% | $7,180,823 |

| HZR | Hazer Group Limited | 0.59 | -3% | 7% | 3% | -61% | $103,970,683 |

| IFT | Infratil Limited | 7.79 | -3% | 6% | 3% | -1% | $5,801,395,000 |

| IRD | Iron Road Ltd | 0.135 | 0% | 0% | -13% | -37% | $107,981,276 |

| LIO | Lion Energy Limited | 0.036 | 0% | 3% | 13% | -58% | $15,339,968 |

| MEZ | Meridian Energy | 4.37 | 0% | 5% | -2% | -7% | $5,523,699,062 |

| MPR | Mpower Group Limited | 0.021 | 0% | 0% | -5% | -69% | $6,167,769 |

| NEW | NEW Energy Solar | 0.985 | -1% | 1% | 3% | 28% | $317,382,106 |

| PGY | Pilot Energy Ltd | 0.017 | 0% | -11% | -6% | -75% | $10,394,443 |

| PH2 | Pure Hydrogen Corp | 0.2475 | -1% | -1% | -8% | -48% | $87,047,514 |

| PRL | Province Resources | 0.08 | -2% | -8% | 0% | -48% | $96,882,438 |

| PRM | Prominence Energy | 0.0015 | 0% | 0% | -25% | -79% | $3,636,913 |

| QEM | QEM Limited | 0.19 | 0% | -5% | -16% | 6% | $25,159,096 |

| RFX | Redflow Limited | 0.033 | -3% | -8% | -15% | -43% | $60,615,991 |

| SKI | Spark Infrastructure | 0 | 0% | -100% | -100% | -100% | $5,036,718,784 |

| VUL | Vulcan Energy | 7.09 | -4% | -2% | -5% | -34% | $1,054,947,815 |

| CXL | Calix Limited | 4.28 | 0% | -25% | -26% | -23% | $747,564,234 |

| KPO | Kalina Power Limited | 0.021 | 5% | 17% | 24% | -19% | $30,303,916 |

| RNE | Renu Energy Ltd | 0.04 | 0% | -9% | -5% | -47% | $14,582,640 |

| NRZ | Neurizer Ltd | 0.11 | -4% | -4% | -19% | -4% | $125,336,596 |

| LIT | Lithium Australia | 0.049 | 0% | -2% | -13% | -61% | $59,837,902 |

| TNG | TNG Limited | 0.08 | 0% | 0% | 1% | -33% | $111,073,458 |

| SRJ | SRJ Technologies | 0.43 | 0% | 0% | 0% | 9% | $38,345,359 |

| NMT | Neometals Ltd | 1.14 | 2% | 5% | 1% | 12% | $618,628,089 |

| MR1 | Montem Resources | 0.04 | 0% | 0% | 0% | -55% | $12,766,020 |

| FGR | First Graphene Ltd | 0.125 | 0% | 14% | 14% | -39% | $72,010,642 |

| EGR | Ecograf Limited | 0.325 | -2% | -10% | 2% | -45% | $148,610,041 |

| EDE | Eden Inv Ltd | 0.006 | -8% | -8% | -37% | -73% | $17,622,988 |

| CWY | Cleanaway Waste Ltd | 2.745 | 0% | 4% | 1% | -1% | $6,121,500,330 |

| CPV | Clearvue Technologie | 0.195 | 3% | 3% | -15% | -33% | $40,481,657 |

| CNQ | Clean Teq Water | 0.375 | 1% | -21% | -23% | -49% | $16,526,484 |

| M8S | M8 Sustainable | 0.01 | 43% | 25% | 67% | -55% | $3,436,359 |

| EOL | Energy One Limited | 4.57 | 0% | -4% | -7% | -27% | $136,711,769 |

| LNR | Lanthanein Resources | 0.033 | 3% | -6% | -13% | 38% | $30,810,418 |

| FHE | Frontier Energy Ltd | 0.46 | -2% | -1% | 24% | 254% | $117,881,276 |

| LPE | Locality Planning | 0.054 | 0% | -4% | -10% | -67% | $9,486,112 |

Who’s got news out?

VULCAN ENERGY (ASX:VUL)

A number of initiatives have kicked off to expand the Zero Carbon Lithium business into France – in particular Alsace, which is a natural extension of the Upper Rhine Valley geothermal lithium brine field.

Vulcan has created a French entity, Vulcan Energie France SAS (VEF), registered in Strasbourg with offices in Haguenau, where Vulcan is growing an experienced French team.

VEF has applied for its first lithium exploration licence in the region, covering some 155km.

Vulcan says VEF is in discussions with local companies in Alsace to develop combined geothermal energy and lithium projects, and also to support industrials and municipalities to decarbonise their heating supply.

SPARC (ASX:SPN)

Sparc has received strong support from sophisticated and other professional investors for a $3.5m placement of shares priced at 65c each, which represents a 17.4% discount to the 10-day volume weighted average price.

The placement includes the issue of one free attaching unlisted option excisable at $1 and expiring on or before 30 November 2024 for every two shares subscribed.

Proceeds from the placement will be used by SPN to meet costs associated with scoping the acceleration of the pilot plant which will validate the commercial potential of its green hydrogen technology and production process.

It will also be used for R&D programs to support development of graphene products.

READ: Sparc raises $3.5m to accelerate hydrogen pilot, graphene research

The post Emission Control: Uh-oh, G20 member countries tipped almost $700bn in support for fossil-fuel power in 2021 appeared first on Stockhead.