Uncategorized

Emission Control: Australia’s storage capacity needs to grow 14-fold to meet rising energy demand by 2050

A report released by CSIRO pinpoints fit-for-purpose solutions for energy storage to keep pace with rapidly rising electricity demand. … Read More

The…

Emission Control is Stockhead’s fortnightly take on all the big news surrounding developments in renewable energy.

A 200-page report released by Australia’s national science agency, CSIRO, indicates the national electricity market (NEM) could require a 10 to 14-fold increase in its electricity storage capacity between 2025-2050 to meet the country’s growing electricity demand across multiple sectors.

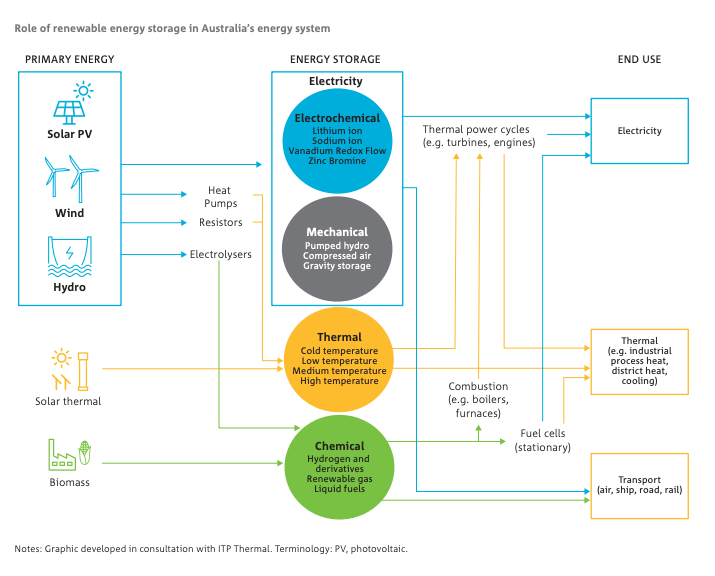

Although traditional storage technologies (such as batteries and pumped hydro) will continue to play a key role, the Renewable Energy Storage Roadmap highlights all forms of energy storage will be needed for Australia to meet its net zero emission targets.

These include electrochemical storage such as lithium ion batteries, mechanical storage processes like pumped hydro, chemical storage in the form of hydrogen in tanks and pipelines, and thermal storage that converts and stores an energy input in the form of thermal energy in a thermal medium like molten salts to be used at a later period.

CSIRO chief executive Larry Marshall noted new technologies would be needed to increase penetration of renewables and stabilise the grid while we start to build utility scale storage capacity.

“There is no silver bullet for energy storage because it’s hard to beat the unique energy characteristics of fuels, so we need multiple shots on goal from batteries, hydrogen, pumped hydro, and a host of new science-driven technologies,” he said.

“To ensure sustained progress towards net zero, we need a robust pipeline of projects that use diverse technologies supported by industry, government, research, and community stakeholders.”

Using a scenario-based approach and building on pathways developed in the Australian Energy Market Operator’s 2022 Integrated System Plan, the report marks a major step towards pinpointing fit-for-purpose solutions for energy storage.

“For example, batteries may be the best option for local and short duration storage of electricity while thermal or heat energy (like steam) might be technology better suited for heat intensive industries,” CSIRO energy director Dietmar Tourbier said.

“Government and industry have recognised energy storage as a priority. However, significant knowledge gaps remain, requiring further investigation to support informed action.

“Co-investment is required across the system to accelerate technology commercialisation and scale up across a diverse portfolio of energy storage technologies,” he said.

While the report examines energy storage needs to 2050, it makes it clear that the technology recommendations require urgent action and attention prior to 2030 to account for scale up and the availability of commercially competitive, widely deployed and easy-to-finance technology options.

Here’s how ASX renewable energy companies are tracking:

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| AVL | Aust Vanadium Ltd | 0.039 | 11% | 22% | 0% | -57% | $170,181,383 |

| BSX | Blackstone Ltd | 0.175 | 9% | 21% | -3% | -55% | $82,895,559 |

| DEL | Delorean Corporation | 0.043 | -12% | -28% | -35% | -77% | $9,275,999 |

| ECT | Env Clean Tech Ltd. | 0.01 | 11% | 11% | -46% | -72% | $24,766,106 |

| FMG | Fortescue Metals Grp | 21.57 | 0% | -3% | 23% | 0% | $66,413,273,281 |

| PV1 | Provaris Energy Ltd | 0.045 | 2% | -6% | -17% | -57% | $24,717,621 |

| GNX | Genex Power Ltd | 0.16 | 0% | 3% | -26% | 7% | $221,628,342 |

| HXG | Hexagon Energy | 0.012 | 9% | -14% | -29% | -72% | $6,154,991 |

| HZR | Hazer Group Limited | 0.55 | 12% | 6% | -4% | -46% | $93,744,059 |

| IFT | Infratil Limited | 8.79 | 2% | 7% | 16% | 17% | $6,363,815,686 |

| IRD | Iron Road Ltd | 0.1075 | 2% | -2% | -33% | -46% | $86,369,409 |

| LIO | Lion Energy Limited | 0.039 | 3% | 8% | 15% | -29% | $16,618,299 |

| MEZ | Meridian Energy | 4.89 | -2% | -1% | 15% | 3% | $6,183,377,949 |

| MPR | Mpower Group Limited | 0.02 | -13% | 11% | -9% | -44% | $5,874,066 |

| PGY | Pilot Energy Ltd | 0.013 | -7% | 0% | -28% | -65% | $10,477,059 |

| PH2 | Pure Hydrogen Corp | 0.155 | -6% | -6% | -44% | -68% | $55,048,840 |

| PRL | Province Resources | 0.041 | 0% | -23% | -52% | -58% | $48,441,219 |

| PRM | Prominence Energy | 0.002 | 33% | 33% | 33% | -85% | $4,849,218 |

| QEM | QEM Limited | 0.19 | 12% | -3% | -10% | -27% | $25,677,278 |

| RFX | Redflow Limited | 0.215 | -30% | 13% | -42% | -46% | $38,639,663 |

| VUL | Vulcan Energy | 5.73 | 2% | -9% | -25% | -43% | $821,884,275 |

| CXL | Calix Limited | 4.57 | -1% | -17% | -24% | -42% | $827,564,025 |

| KPO | Kalina Power Limited | 0.011 | -8% | -15% | -39% | -59% | $16,667,154 |

| RNE | Renu Energy Ltd | 0.047 | -4% | -10% | 24% | -13% | $20,703,600 |

| NRZ | Neurizer Ltd | 0.08 | -15% | 11% | -33% | -59% | $92,353,202 |

| LIT | Lithium Australia | 0.033 | -3% | -15% | -42% | -70% | $40,299,325 |

| TVN | Tivan Limited | 0.084 | 12% | -1% | 5% | -3% | $116,627,131 |

| SRJ | SRJ Technologies | 0.064 | 3% | -42% | -85% | -85% | $6,068,227 |

| NMT | Neometals Ltd | 0.62 | 3% | -17% | -44% | -65% | $342,699,529 |

| MR1 | Montem Resources | 0.04 | 0% | 0% | 0% | 25% | $12,913,190 |

| FGR | First Graphene Ltd | 0.08 | -11% | -16% | -27% | -54% | $46,683,089 |

| EGR | Ecograf Limited | 0.175 | 0% | -19% | -49% | -70% | $78,808,355 |

| EDE | Eden Inv Ltd | 0.005 | -9% | 0% | -17% | -71% | $14,657,222 |

| CWY | Cleanaway Waste Ltd | 2.46 | 3% | -5% | -13% | -19% | $5,475,960,295 |

| CPV | Clearvue Technologie | 0.165 | -3% | -4% | -20% | -59% | $35,815,123 |

| CNQ | Clean Teq Water | 0.355 | -7% | -3% | -30% | -42% | $20,487,156 |

| M8S | M8 Sustainable | 0.009 | 0% | 0% | 29% | -44% | $4,418,176 |

| EOL | Energy One Limited | 3.78 | -3% | 0% | -21% | -40% | $113,199,736 |

| FHE | Frontier Energy Ltd | 0.44 | -4% | 0% | 16% | 76% | $110,382,727 |

| LPE | Locality Planning | 0.052 | 4% | 8% | -12% | -32% | $9,264,126 |

| GHY | Gold Hydrogen | 0.4 | 19% | 0% | 0% | 0% | $20,400,000 |

Who’s got news out?

TIVAN (ASX:TVN)

Critical minerals company, Tivan, has signed a one year non-binding letter of intent with Sun Cable to support its planned processing facility in Darwin.

Sun Cable is developing of one of the largest solar generation, storage and transmission projects in the world in the Northern Territory, known as the Australia-Asia Powerlink project (AAPowerlink).

The project includes a 17-20GW solar array, the world’s biggest battery at a scale of 36-42GWh and the world’s longest subsea cable that will transfer solar power 4200km from Darwin to Singapore.

Under the agreement, the companies will progress commercial and technical discussions around potential offtake of up to 300MW of renewable electricity from Sun Cable’s planned Australia Asia Powerlink project to supply TVN’s Tivan processing facility (TPF).

Tivan and Sun Cable will work together to develop an indicative renewable energy supply and commercial strategy for the TPF.

The parties will collaborate in order to optimise the design, delivery and utilisation of the proposed electricity supply/purchase from AAPowerLink for the TPF.

The supply of energy is subject to the parties subsequently agreeing and executing a formal power purchase agreement.

The post Emission Control: Australia’s storage capacity needs to grow 14-fold to meet rising energy demand by 2050 appeared first on Stockhead.