Uncategorized

Easy mining 1.5Moz resource underpins next ‘gold mine of significance’ in West Africa

Special Report: Toubani Resources has updated the Mineral Resource Estimate (MRE) for the Kobada gold project in southern Mali to … Read More

The post…

- The updated MRE is now 87Mt at 0.86g/t for 2.4Moz of gold

- Update includes 1.5Moz shallow free dig oxides which improves project economics

- Toubani says Mali is a proven gold production jurisdiction

- The new MRE will feed into a DFS update due 1Q24

Toubani Resources has updated the Mineral Resource Estimate (MRE) for the Kobada gold project in southern Mali to 87Mt at 0.86g/t for 2.4 million ounces of gold.

This includes 1.5 million ounces of Indicated (higher confidence) resources, including 1.0 million ounces of shallow, free-dig oxide material which can be easily mined and processed – a considerable boon for the project’s economics.

Notably, 77% of the MRE is near surface — within the first 150m — and 85% of the first 100m is free dig, oxide material.

Toubani Resources’ (ASX:TRE) says the MRE will underpin its Definitive Feasibility Study (DFS) update activities, optimising the oxide project phase as part of a bulk tonnage, low-cost oxide dominant project.

The 2021 DFS outlined a +100,000oz per annum operation at US$972/oz AISC over the first 10 years, delivering a pre-tax NPV of $US506m and an IRR of 45%.

It’s expected this MRE update will aid detailed mine planning and scheduling planned as part of the DFS update, with the company confident Kobada is on track to become the next open pit gold development asset of significance in West Africa.

Targeting higher throughput and lower costs

The company is confident that Kobada has all the hallmarks of a high production, low-cost oxide gold development project with an extended mine life.

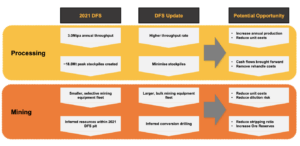

The overarching goal of the DFS update is to deliver a project with a more optimal alignment between mining and milling rate, targeting an initial oxide plant that supports a relatively lean and competitive capex profile for a larger throughput project.

“Today’s MRE update marks a significant step forward for the company,” Toubani CEO Phil Russo said.

“We have now delivered the critical review and re-estimation of the 2021 MRE (given the new team now steering Kobada) mentioned in our decision to optimise the 2021 DFS last month.

“The company’s vision is to reposition Kobada as a reduced technical risk, low strip, bulk-tonnage, oxide-dominant open pit development project of scale.

“Today’s MRE update confirms we are well on our way in delivering on this goal.

“We now have a strong baseline of validated Indicated oxide and fresh material to underpin the DFS update targeting a higher throughput and lower cost development project.”

The company anticipates that a low strip, bulk tonnage oxide mining and processing operation represents a lower overall technical risk profile for the initial phase of the Kobada project.

The company says economies of scale are the focus areas of the DFS update. Image: via Toubani Resources.

Mature mining industry in Mali

While some African countries have a reputation of being rather risky jurisdictions, Toubani says Mali has a mature, and long-established mining industry – particularly in gold production – with a transparent operating system.

Significant capital reinvestment is being made elsewhere in the country, highlighting Mali’s attractiveness for mine builds, with Leo Lithium (ASX:LLL) constructing the US$318m Goulamina mine, Resolute Mining (ASX:RSG) undertaking development plans at Syama North, B2Gold (TSE:BTO) in the study phase to build a standalone oxide mill at Fekola and Allied Gold undertaking US$300m IPO with the Sadiola mine its key asset.

“West Africa, and Africa generally, continues to be a destination for mine builds and M&A activity with Toubani continuing to advance Kobada down the path towards being an asset of significance in the region,” Russo said.

‘Significant’ potential for further growth

Last month the company demonstrated the scale of the project, reporting Phase 1 drilling had more than doubled the strike of gold mineralisation from 5km up to 11km with shallow, open-pittable mineralisation intersected at all tested targets.

Resource definition drilling will now focus on the conversion of the near surface Inferred ounces from the updated MRE, ~0.5Moz of which are oxides, which are likely to be mined in the first 5 – 10 years of the project.

“We see significant opportunity for drilling to drive continued growth in the confidence and size of our mineral resource base,” Russo said.

“We will be targeting conversion of a significant amount of shallow Inferred free dig oxide resources at Kobada Main and Foroko (which was not part of the 2021 DFS).

“We have resource drilling planned for recent discoveries that were not included in this MRE update (Kobada West and Gosso).

“There is also significant exploration potential outside of all the known mineralisation with approximately 40km of the 50km+ regional-scale shear zones yet to be drill tested – gold developers with this level of district style potential are a rarity in the gold universe.”

“Our dual track strategy will see DFS Update activities rapidly progressing with a lead engineer set to be announced shortly, while a drilling contractor will be mobilised to site early next month to begin drill programs targeting both resource growth as well as conversion of inferred material to feed into the DFS update,” Russo added.

Results of this drilling will be fed directly into the DFS Update, anticipated early in 2024.

This article was developed in collaboration with Toubani Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Easy mining 1.5Moz resource underpins next ‘gold mine of significance’ in West Africa appeared first on Stockhead.