Uncategorized

Early cashflow and an 8Moz Granny Smith/Wallaby lookalike all part of the plan for Mt Malcolm Mines

Special Report: Mt Malcom will mine shallow, high-grade gold deposits to realise early cash flow while exploring the flagship Calypso discovery … Read…

- Desktop work has set the stage for coming field work

- Drilling and other exploration work to focus on shallow gold for rapid cashflow

- Exploration will also test REE and VHMS opportunities

Mt Malcom will mine shallow, high-grade gold deposits to realise early cash flow while exploring the flagship Calypso discovery – but it hasn’t forgotten about its rare earths, nickel and VMS prospectivity.

The 275km2 Malcolm project consists of several mostly contiguous tenements in the mineral-rich Leonora region that have, for the first time, been consolidated under one single owner.

The area is regarded as a Tier 1 gold province, with numerous multimillion ounce mines currently operating in the district.

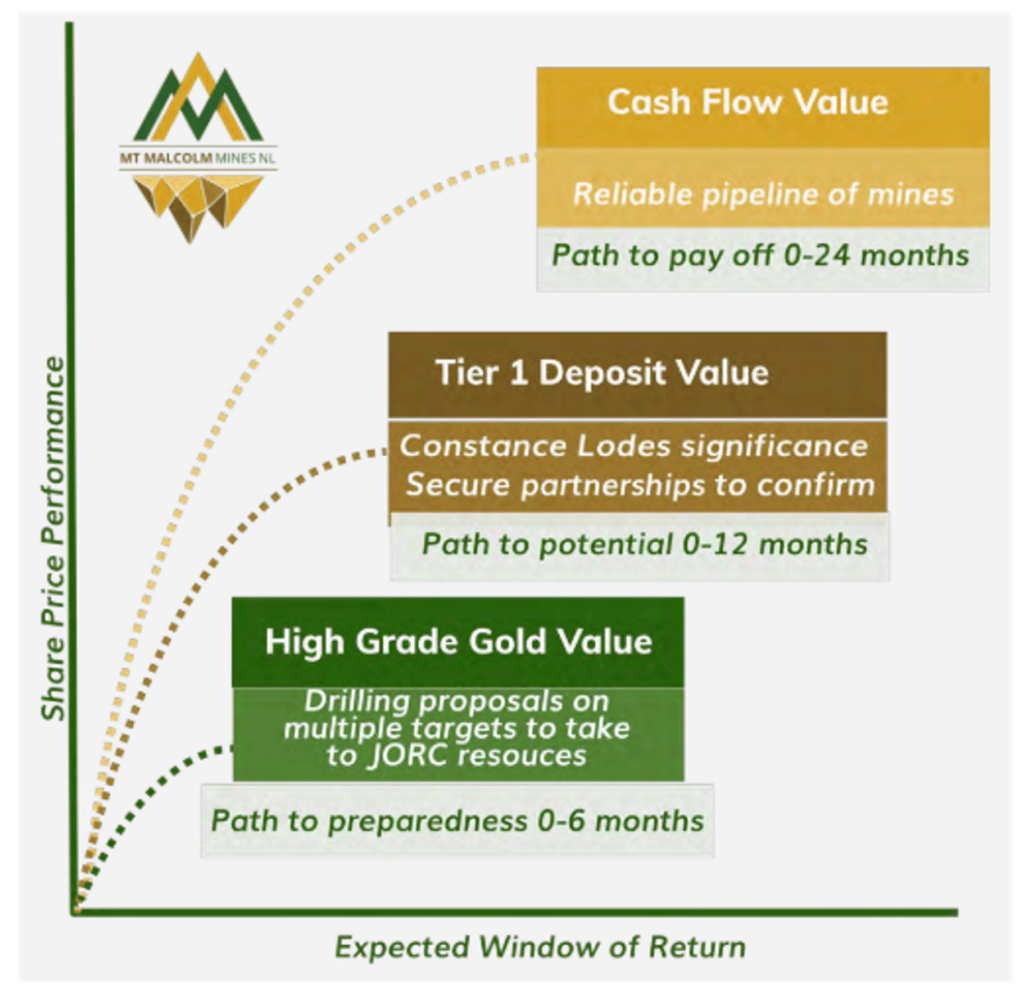

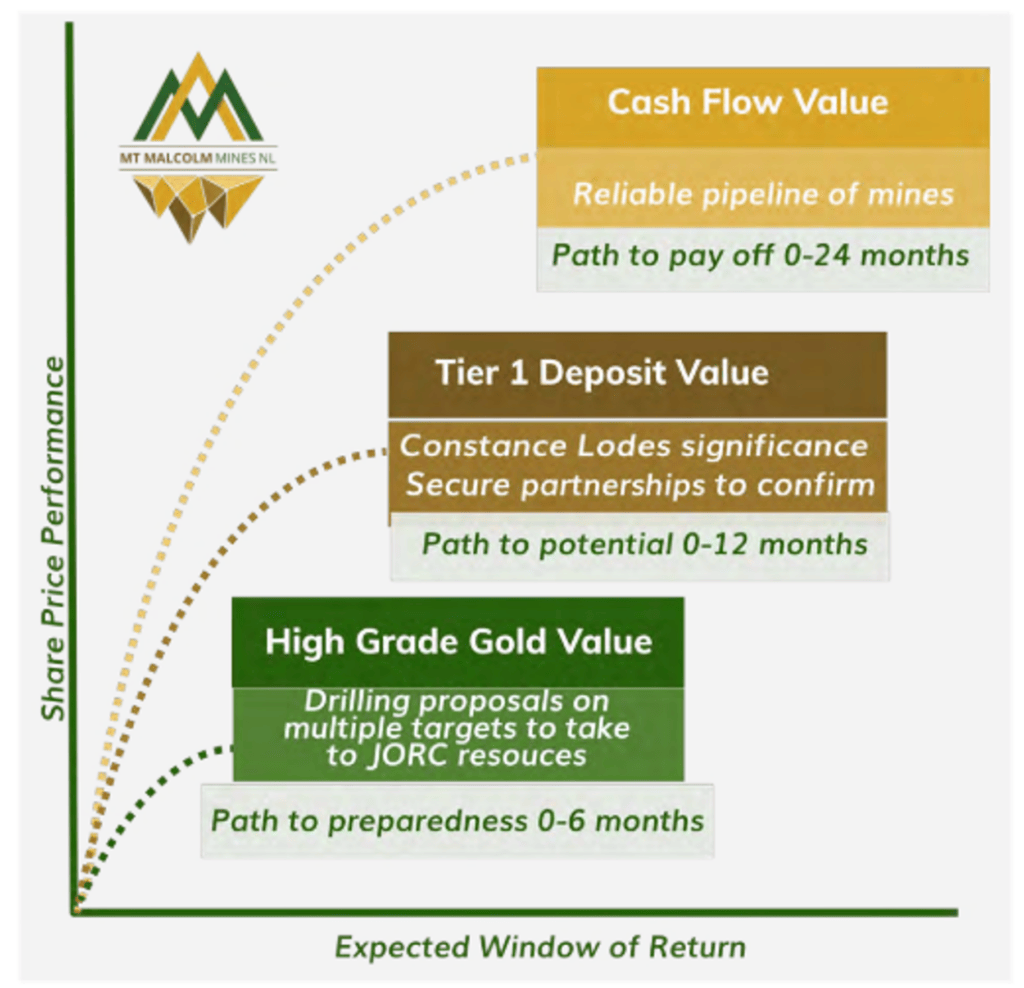

It is no surprise that after extensive internal planning, Mt Malcom Mines (ASX:M2M) is now progressing a two-fold strategy with a focus on shallow, high-grade gold deposits to realise early cash flow via shallow mining.

Meanwhile, the company will continue to advance the medium term development at the emerging flagship Calypso gold discovery.

While gold is the main game, the project’s potential to host nickel, rare earths and volcanic massive sulphides (VMS) is also being evaluated.

“The geological team engaged in a comprehensive science-based review during the first half of 2023, defining numerous opportunities across a range of mineral commodities throughout our portfolio of prospects,” MD Trevor Dixon says.

“Further releases with respect to detailed exploration and drill program planning on individual prospect opportunities are to follow.”

Near term mining potential

Malcolm covers several mineralised structures, the company says, that were explored “erratically” and “ineffectually” in the past.

It reckons the project area has the potential to host more than one economic gold deposit, based on previous exploration and geological interpretations.

The company’s current desktop work programs are focused on shallow, high-grade gold prospects, with Golden Crown now ready for resource definition drilling and Emu Egg not far behind.

Golden Crown is the first of several key prospects the company has earmarked for model review and drill planning to build a high-grade resource in line with its strategy and two-year goal to develop a sustainable production base from shallow mining opportunities.

Calypso: the flagship

The current focus is the Calypso prospect, where the company wants to build on the historic estimate of 2.9-3.9Mt at 1.6-2.2 g/t Au to establish a maiden resource of at least 300,000oz.

However, it could be much bigger. Recent drill results – including a highlight 16.21m @ 4.01 g/t Au from the Constance Lode – and geological modelling draw favourable comparisons between Calypso and Gold Fields’ 8Moz Granny Smith/Wallaby gold mine.

VHMS and REEs also on the cards

It is not all about gold though. Further evaluations of the Malcolm Mining Centre REE opportunity is progressing with portable XRF used to identify the best REE target zone.

The company expects to receive whole rock geochemistry results this quarter which will identify the minimum size and orientation of the WR REE target zone, improve its understanding of the play and test the current exploration model of a swarm of REE-fertile north-south trending porphyries extending from an underlying parent intrusion.

Work is also continuing on the VHMS opportunity at Malcolm Dam with the company noting that further geophysics are required to progress it to the drill target definition stage.

Drilling is also being contemplated to test below the encouraging nickel-copper intercepts at the Sunday-Picnic prospect to improve its understanding of the lithological and mineralisation architecture.

This article was developed in collaboration with Mt Malcolm Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Early cashflow and an 8Moz Granny Smith/Wallaby lookalike all part of the plan for Mt Malcolm Mines appeared first on Stockhead.