Uncategorized

Early Cash Flow: Up to 40.3pc surface copper paves way for Horseshoe’s direct shipping ore strategy

Special Report: Horseshoe is pursuing significant early cash flow opportunities from direct shipping ore (DSO) sales of existing high-grade copper ……

- Surface stockpiles at Horseshoe Lights could provide early cash flow for Horseshoe Metals via low-cost direct shipping ore (DSO) sales

- Surface materials assayed up to 40.3% copper

- These samples have been provided to potential customers for DSO offtake

Horseshoe is pursuing significant early cash flow opportunities from direct shipping ore (DSO) sales of existing high-grade copper stockpiles at the Horseshoe Lights project in WA.

Horseshoe Metals’ (ASX:HOR) flagship copper-gold project, 60km west of Sandfire’s (ASX:SFR) Degrussa copper discovery, is home to a 138,000t copper, 52,000oz gold resource in WA’s Bryah Basin.

Past production from Horseshoe Lights includes around 316,000oz gold and 55,000t copper metal in two phases of mining.

The copper phase of mining included early DSO copper production which left ‘subgrade’ and rehandled DSO material around the site.

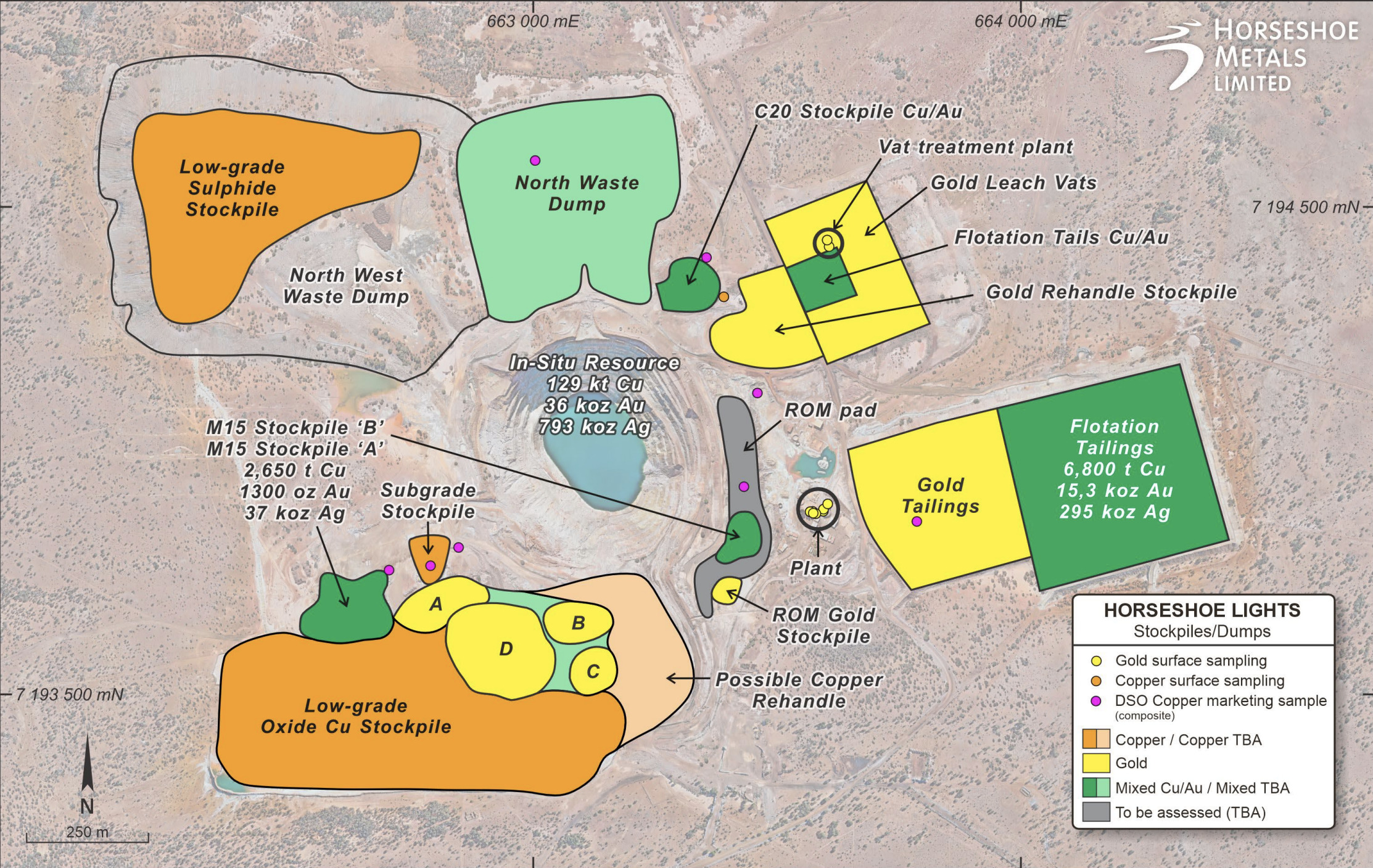

Areas identified and assessed as having future DSO potential include M15, Subgrade and C20 stockpiles along with rehandle and surface pimple dumps on the north waste dump, gold tailings and southern low-grade stockpiles.

Material identical to historically produced and sold DSO material

Surface grab samples have been collected to confirm grade as well as a 27kg composite sample source from various stockpiles around the site with grab samples assaying up to 40.3% copper and stockpile composites assaying up to 39% copper.

That’s very high grade.

HOR management says the composite sample has been delivered to Nagrom for compositing, crushing and analysis.

Sub-samples of this composite, which is identical to the historically produced and sold DSO material, have also been provided to potential customers for assessment who have expressed strong interest in purchasing the material.

What’s next?

An array of exploration activities are planned to further investigate the surface materials including additional RC and/or auger drilling of the North Dump, gold stockpiles, copper low-grade oxide and low-grade sulphide stockpiles.

Other activities such as auger drilling of gold-copper rehandle areas, acid leaching test work on oxide copper stockpiles and targets, as well as gravity recovery test work on copper flotation and CIP tailings will also be carried out.

This article was developed in collaboration with Horseshoe Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Early Cash Flow: Up to 40.3pc surface copper paves way for Horseshoe’s direct shipping ore strategy appeared first on Stockhead.