Uncategorized

CLOSING BELL: The ASX needle has barely moved, AGL lost $1.2bn and AMP continues to suck

Local markets have risen from the dead again, closing at +0.26%. Also, Bowen Coking Coal shipped some boats on time. … Read More

The post CLOSING BELL:…

- Local markets have risen from the dead again, closing at +0.26% for the day.

- Bowen Coking Coal has leapt to the top of the ladder with a 26.3% gain.

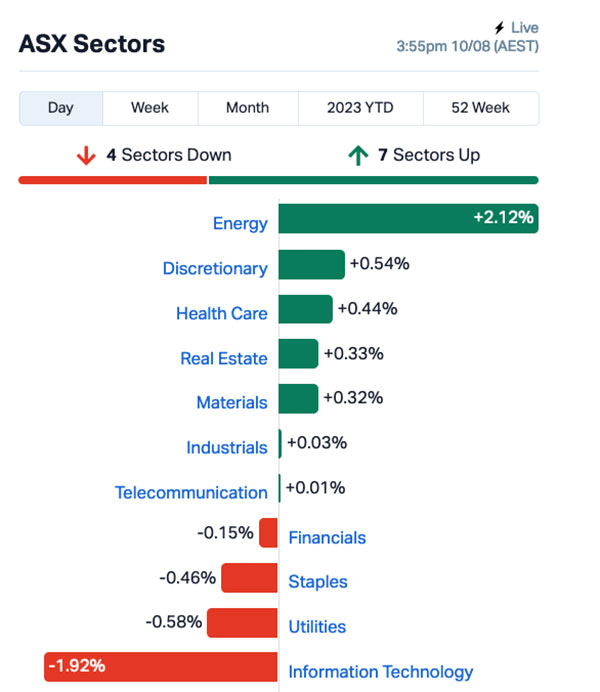

- Energy fought hard to hit 2.12%, but InfoTech’s -1.92% dead weight held the whole market back.

Today turned out to be something of a tug-of-war being fought on many different fronts, a phrase that makes absolutely no sense, but it’s the analogy I’m going with, so don’t even bother complaining.

The most obvious tugging took place between the leading and losing sectors today, with the big winner Energy yanking a 2.1% rise from the market, while InfoTech’s -1.92% spanking provided almost enough of an opposing force to keep the benchmark at zero by the end of the day.

It didn’t work, but. The benchmark basically death-marched to a respectably mediocre +0.26%, while investors did their best to wrap their heads around the rest of the day’s rope-based wargames.

For instance, there’s AGL’s performance today, after the company dropped its earnings report that spent more time pointing the finger of blame at everyone else in the room, than it did explaining away how it was able to have stuffed $1.2 billion worth of hand grenades into its own mouth this year.

AGL says it’s mostly due to it writing down $680 million in value of its coal-fired energy plants, and another $890 million was burnt like a pile of old coal when the company got caught holding a bunch of energy contracts that fell victim to Market Forces and a free market unfriendly Alborneezus Gungermint.

But if it weren’t for those Very Real and Very Tragic circumstances, AGL would have been $288 million better off for the year – and that’s why we’re all going to be slow-roasted by rising utility costs between now and Christmas Day.

Similarly, QBE blamed Climate Warming Global Change Weather for its need to push premiums in our local region higher by 11.2% over the past year, which resulted in a very handsome profit of $612 million for the previous 12 months, an increase of 733% over the prior period’s relatively grim $73.4 million.

However, AMP – the perennial brown stain on the ASX gusset – has no one but itself to blame for a 44% profit slump for the year.

The list of reasons why AMP is about as popular as an outbreak of ‘galloping knob-rot’ is longer than I have the time, inclination or attention span to cover – but the line of people queued up to take the company to court is much shorter than that list, if that’s any indication.

FROM THE HEADLINES

A lot has been happening around the place today, most of it horrifying (of course) but a couple of headlines have leapt off the page today, and deserve a very quick mention.

From the ABC we got this pearler: “There’s a floating ‘recipe for disaster’ off England’s coast”, which is a shocking way for the normally-sedate national broadcaster to talk about France.

And our stablemates’ decision at news.com.au to run the headlines “Nathan Tinkler’s home sale smashes records” adjacent to “Man’s terrifying ‘altercation with 300kg beast’” was as glorious as it was obviously a happy little accident.

And over at The Guardian today, we were treated to this gem: “Supermarket AI meal planner app suggests recipe that would create chlorine gas”, further proof that those “AI is coming to murder us all!!” fruitcakes may actually be on the money.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTH | Mithril Resources | 0.002 | 100% | 1,934,051 | $3,368,804 |

| THR | Thor Energy PLC | 0.0045 | 29% | 2,185,280 | $5,107,520 |

| LKE | Lake Resources | 0.21 | 27% | 35,176,265 | $234,703,377 |

| BCB | Bowen Coal Limited | 0.1175 | 26% | 21,297,170 | $198,646,687 |

| ADR | Adherium Ltd | 0.005 | 25% | 1,122,670 | $19,997,633 |

| OPN | Oppenneg | 0.01 | 25% | 2,431,874 | $8,933,437 |

| SHE | Stonehorse Energy Lt | 0.02 | 25% | 2,053,214 | $10,950,961 |

| UBI | Universal Biosensors | 0.31 | 24% | 236,143 | $53,092,359 |

| TEM | Tempest Minerals | 0.016 | 23% | 3,469,583 | $6,588,681 |

| TNC | True North Copper | 0.27 | 23% | 14,286,301 | $57,165,119 |

| TZL | TZ Limited | 0.028 | 22% | 803,028 | $5,905,437 |

| AGD | Austral Gold | 0.034 | 21% | 107,293 | $17,144,718 |

| NGY | Nuenergy Gas Ltd | 0.034 | 21% | 112,883 | $41,466,754 |

| KGD | Kula Gold Limited | 0.018 | 20% | 1,626,658 | $5,598,179 |

| SAU | Southern Gold | 0.018 | 20% | 20,000 | $7,294,279 |

| SCT | Scout Security Ltd | 0.018 | 20% | 100,055 | $3,460,020 |

| AUK | Aumake Limited | 0.006 | 20% | 5,000,000 | $7,436,297 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 2,367,784 | $1,737,583 |

| RML | Resolution Minerals | 0.006 | 20% | 450,000 | $6,286,459 |

| RDN | Raiden Resources Ltd | 0.013 | 18% | 22,086,874 | $22,607,958 |

| TTT | Titomic Limited | 0.02 | 18% | 2,910,898 | $14,713,986 |

| DCL | Domacom Limited | 0.027 | 17% | 100,000 | $10,016,541 |

| FTL | Firetail Resources | 0.14 | 17% | 1,163,449 | $11,550,000 |

| FAU | First Au Ltd | 0.0035 | 17% | 10,501,452 | $4,355,980 |

| CHW | Chilwaminerals | 0.18 | 16% | 47,156 | $7,110,625 |

Bowen Coking Coal (ASX:BCB), up 26.3% this afternoon on yesterday’s news that the company has achieved its four-boats-per-day shipping target last month. Hooray, Wheeee, etc etc.

Oh – there’s more to the announcement; the company says that it’s got a 45% upgrade in the resource estimate for its Hillalong South Project near Glenden, on the back of the 2022 exploration program.

The company says the total resource of the Hillalong Project now stands at a JORC-compliant 106 Mt, of which 56 Mt is classified in the Indicated category and 50 Mt as Inferred.

It also apologised for burying the lede so egregiously in its announcement to the ASX.

(It actually didn’t, but probably should…)

In second place, Lake Resources (ASX:LKE) has dropped from the top of the table since this morning, up 24.2% on (apparently) no fresh news, other than a general announcement that the company’s due to present at the XII International Seminar on Lithium in the South American Region later today.

The final tally for Lake is down from the 33.3% gain it was showing at lunchtime today.

True North Copper (ASX:TNC) has raced to a 22.7% rise this afternoon, after announcing a copper-plated hit from its very first drillhole at its Vero Resource, part of its 100% owned Mt Oxide Project, Queensland.

TNC says the maiden diamond drillhole has returned 66.50m @ 4.95% Cu, 32.7g/t Ag and 685ppm Co from 234.00m, inc. 20.60m (15.47m*) @ 10.51% Cu, 63g/t Ag and 1,149ppm Co from 234.60m and 8.55m (5.62m*) @ 6.03% Cu, 51.6g/t Ag and 98ppm Co from 290.15m

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DXN | DXN Limited | 0.001 | -50% | 296,000 | $3,442,630 |

| AMD | Arrow Minerals | 0.003 | -25% | 4,290,017 | $12,095,060 |

| AXP | AXP Energy Ltd | 0.0015 | -25% | 1,302,499 | $11,649,361 |

| EDE | Eden Inv Ltd | 0.003 | -25% | 561,387 | $11,987,881 |

| MSI | Multistack Internat. | 0.006 | -25% | 565,052 | $1,090,431 |

| SP3 | Specturltd | 0.022 | -24% | 860,206 | $6,547,761 |

| CLA | Celsius Resource Ltd | 0.012 | -20% | 48,843,188 | $33,690,775 |

| BFC | Beston Global Ltd | 0.008 | -20% | 2,725,324 | $19,970,469 |

| ERW | Errawarra Resources | 0.13 | -19% | 1,382,210 | $9,680,640 |

| MRZ | Mont Royal Resources | 0.175 | -19% | 245,970 | $14,723,774 |

| EPN | Epsilon Healthcare | 0.02 | -17% | 273,663 | $7,208,496 |

| GTG | Genetic Technologies | 0.0025 | -17% | 100,276 | $34,624,974 |

| IEC | Intra Energy Corp | 0.005 | -17% | 6,357,407 | $9,724,690 |

| LNU | Linius Tech Limited | 0.0025 | -17% | 35,000 | $11,366,372 |

| PIL | Peppermint Inv Ltd | 0.005 | -17% | 196,555 | $12,227,141 |

| SFG | Seafarms Group Ltd | 0.005 | -17% | 301,256 | $29,019,595 |

| BCA | Black Canyon Limited | 0.135 | -16% | 4,680 | $9,521,183 |

| FRX | Flexiroam Limited | 0.027 | -16% | 30,000 | $21,254,135 |

| PEC | Perpetual Res Ltd | 0.027 | -16% | 6,696,603 | $17,455,487 |

| CMX | Chemxmaterials | 0.09 | -14% | 109,700 | $5,319,418 |

| M2R | Miramar | 0.048 | -14% | 375,995 | $6,211,901 |

| TGH | Terragen | 0.024 | -14% | 60,037 | $6,791,085 |

| SIX | Sprintex Ltd | 0.032 | -14% | 141,000 | $10,780,555 |

| CUF | Cufe Ltd | 0.013 | -13% | 1,277,785 | $14,941,685 |

| FIN | FIN Resources Ltd | 0.013 | -13% | 533,500 | $9,315,530 |

LAST ORDERS

South Harz Potash (ASX:SHP) has revealed that it’s successfully completed a placement of 80,493,996 fully paid ordinary shares at an issue price of $0.03 per Share, bundled with 1 free attaching unlisted option to acquire 1 share exercisable at $0.08, expiring 10 August 2026.

Subsequently, SHP is offering a share purchase plan, under which eligible shareholders will have the opportunity to purchase up to $30,000 worth of Shares at the same issue price as the Placement ($0.03 per Share), irrespective of the size of their shareholding in the Company, without incurring brokerage or transaction costs.

Elsewhere, 360 Capital (ASX:TGP) has announced it’s launching a buy-back towards the end of the month, provided everything’s still looking rosy when it announces its results on 24 August.

If market conditions permit, the Group intends to undertake a buyback of up to 21,899,755 TGP securities (being approximately 9.0% of the Groups securities on issue, 15.6% of securities excluding Directors and KMPs).

And Toys“R”Us ANZ (ASX:TOY) has come to the ASX to ask that its securities remain in voluntary suspension while it continues to progress discussions in respect of its ongoing financial position and restructuring alternatives.

Toys”R”Us has been struggling along for quite some time, with heavy, serious questions surrounding the company’s performance and finances swirling around. So it makes absolutely perfect sense that the company remains in a voluntary suspension, while it waits to see if the release of that godawful Barbie movie is able to save the company from total annihilation, by kickstarting a sales boom on tiny, plastic women.

TRADING HALTS

Mayur Resources (ASX:MRL) – Announcement in relation to a proposed financing for its Central Lime project, Papua New Guinea.

Rumble Resources (ASX:RTR) – Capital raising.

Volt Resources (ASX:VRC) – Announcement regarding the revision of a feasibility study.

Phoslock (ASX:PET) – Announcement to ASX regarding material disclosures in the half year report.

Power Minerals (ASX:PNN) – Announcement relating to a joint venture and strategic investment for the Incahuasi salar. No, I don’t know what that means, either.

The post CLOSING BELL: The ASX needle has barely moved, AGL lost $1.2bn and AMP continues to suck appeared first on Stockhead.