Uncategorized

Closing Bell: Small caps gain 1.2pc, and say farewell to cheap holidays everyone

The ASX 200 rose up 0.90% and ASX XEC was also up 1.24% A solid 10 out of 11 sectors … Read More

The post Closing Bell: Small caps gain 1.2pc, and say…

- The ASX 200 rose up 0.90% and ASX XEC was also up 1.24%

- A solid 10 out of 11 sectors were higher, with Real Estate leading the way

- ABS releases a bunch of data and travel and accommodation prices are rising

The ASX 200 gained 0.90% today and the ASX XEC was up 1.24%, with 10 out of 11 sectors higher, led by Real Estate which rallied by 1.89%.

Commercial and industrial property player Goodman Group (ASX:GMG) led the way, up 2.86% along with real estate investment trust Vicinity Centres (ASX:VCX) up 2.53% followed by shopping centre owners Scentre Group (ASX:SCG) up 2.08%.

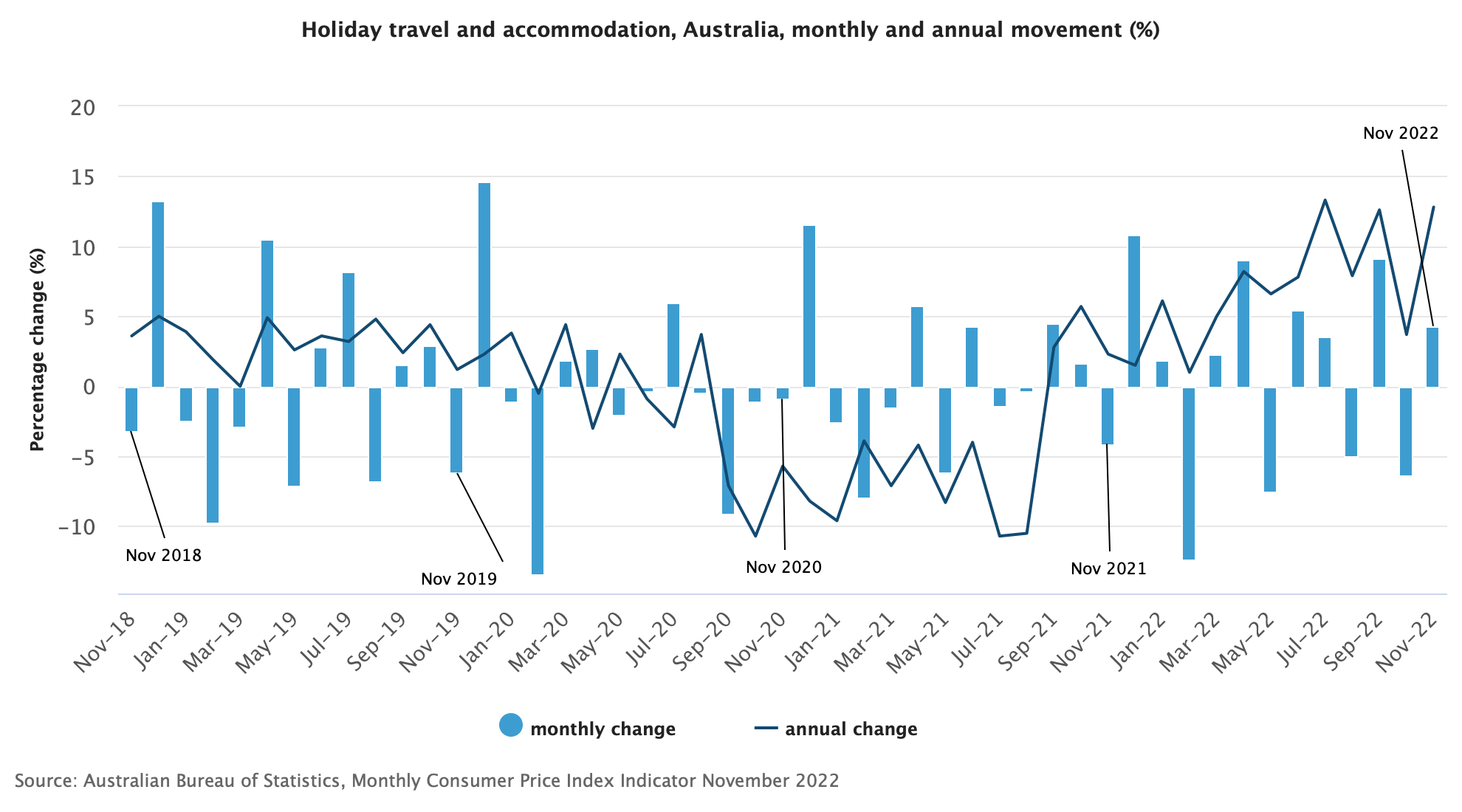

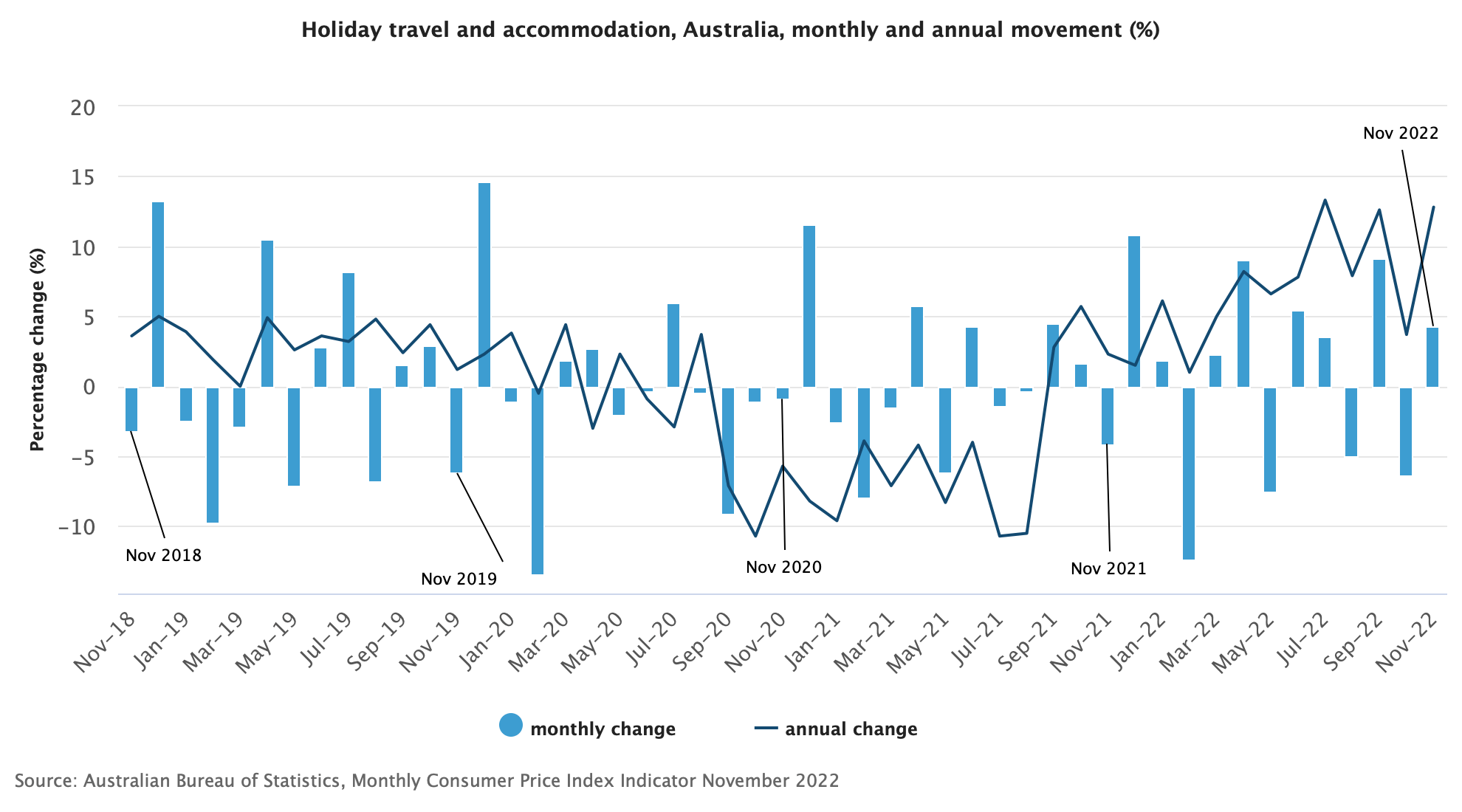

The Australian Bureau of Statistics has released a swathe of data today, and it looks like we’ve seen the last of cheap holidays for a while with travel and accommodation prices recovering from Covid-19 related lows.

Good news for travel stocks, but not so much for anyone planning on taking the kids to Disney Land this year.

“November’s monthly increase of 4.3 per cent for holiday travel and accommodation departs from the falls usually seen in November following the September and October school holiday period,” ABS head of prices statistics Michelle Marquardt said.

“High jet fuel prices combined with strong consumer demand in November pushed airfare prices up, with accommodation prices also rising.”

Also rising is retail turnover, which jumped 1.4% in November thanks to Black Friday sales because Australia has for some reason adopted the American Turkey Day tradition of stuffing your face and then queueing up at the crack of dawn for those sweet deals at the outlet stores.

The November jump followed a 0.4 per cent rise in October 2022, the smallest rise of the year to date.

ABS head of retail statistics Ben Dorber said Black Friday sales boosted spending on clothing, footwear, furniture, and electronic goods.

“While we typically see a rise in spending around Black Friday sales, the strong seasonally adjusted rise in November 2022 shows that the effect is increasing over time, as the event has become more common across retailers and sales periods become longer,” he said.

“Given the increasing popularity of Black Friday sales, the smaller increase in October may reflect consumers waiting to take advantage of discounting in November, particularly in light of cost-of-living pressures.”

Dorber says it’s clear that Black Friday sales are becoming increasingly popular across the country.

“The last time we saw a general increase of this magnitude across states and territories was during the COVID-19 induced spending in May 2020,” he added.

NOT THE ASX

In the USA, US Federal Reserve Chair Jerome Powell managed to avoid commenting on US interest rate policy in a speech delivered to Sweden’s Riksbank on Tuesday – but he did say that “restoring price stability when inflation is high can require measures that are not popular in the short term as we raise interest rates to slow the economy.”

Investors are hoping that the upcoming December Consumer Price Index (CPI) could show further deceleration, potentially giving the US central bank room to slow the pace of its interest rate hikes.

Often considered laggards on the global markets stage, stock indices across the European region in recent months have outperformed major US indices.

Germany’s DAX index and France’s CAC 40 have each risen 18% or more in the past three months through Tuesday, more than double the roughly 8% gain for the S&P 500.

The UK’s benchmark FTSE 100 has also surged, putting it a little more than 2% away from reaching a record.

Morningstar says the turnabout underscores how drastically economic expectations have shifted regarding Europe, which only months ago was engulfed by anxieties over the war in Ukraine, a possible energy crisis, and record-high inflation.

While those issues haven’t gone away completely, investors have felt more comfortable continuing to wade back into investing on the continent.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ANL | Amani Gold Ltd | 0.0015 | 50% | 1,704,648 | $24,693,441 |

| T3D | 333D Limited | 0.0015 | 50% | 49,570 | $3,189,317 |

| ARE | Argonaut Resources | 0.002 | 33% | 1,500,000 | $9,542,807 |

| XST | Xstate Resources | 0.002 | 33% | 100,000 | $4,822,772 |

| AZS | Azure Minerals | 0.3 | 33% | 5,245,387 | $70,251,273 |

| PKO | Peako Limited | 0.015 | 25% | 192,000 | $4,550,583 |

| PLG | Pearlgullironlimited | 0.03 | 25% | 965,887 | $1,688,455 |

| ALM | Alma Metals Ltd | 0.01 | 25% | 434,069 | $7,312,006 |

| AAJ | Aruma Resources Ltd | 0.065 | 23% | 20,199,054 | $8,318,960 |

| BLZ | Blaze Minerals Ltd | 0.011 | 22% | 23,367 | $3,307,574 |

| BRK | Brookside Energy Ltd | 0.014 | 22% | 27,850,078 | $57,641,138 |

| SER | Strategic Energy | 0.017 | 21% | 350,000 | $4,154,412 |

| VAR | Variscan Mines Ltd | 0.018 | 20% | 334,495 | $4,000,980 |

| AHN | Athena Resources | 0.012 | 20% | 21,143,632 | $8,704,676 |

| TOE | Toro Energy Limited | 0.012 | 20% | 12,947,660 | $43,588,876 |

| CMX | Chemxmaterials | 0.19 | 19% | 230,183 | $8,105,780 |

| HYT | Hyterra Ltd | 0.019 | 19% | 105,263 | $7,705,579 |

| PUR | Pursuit Minerals | 0.019 | 19% | 11,578,538 | $18,280,798 |

| CDR | Codrus Minerals Ltd | 0.165 | 18% | 808,639 | $5,660,200 |

| OXT | Orexploretechnologie | 0.105 | 17% | 81,333 | $9,329,778 |

| ATU | Atrum Coal Ltd | 0.007 | 17% | 138,237 | $8,350,195 |

| CHK | Cohiba Min Ltd | 0.007 | 17% | 3,197,354 | $10,639,465 |

| MTH | Mithril Resources | 0.0035 | 17% | 300,000 | $9,789,271 |

| SLM | Solismineralsltd | 0.093 | 16% | 144,108 | $3,714,436 |

| BLG | Bluglass Limited | 0.029 | 16% | 2,573,417 | $33,488,792 |

The biggest winner was WA explorer Azure Minerals (ASX:AZS) who secured a $20m cornerstone investment from global lithium producer Sociedad Química y Minera de Chile subsidiary SQM for a 19.99% stake in the company.

“This is a significant milestone event and is a strong endorsement of Azure and our projects by one of the world’s leading lithium producers,” MD Tony Rovira said.

“The new relationship will allow Azure to draw upon SQM’s technical expertise in pegmatite-hosted lithium exploration, project development, production and marketing, providing Azure with strong support as we look to develop the Andover lithium assets.

“Azure is now in a very strong financial position and, following completion of both tranches of the transaction with SQM, Azure will have a cash balance of more than $25 million which will be used to accelerate lithium exploration through a program of intensive drilling across the Andover Project.”

SQM is investing at a price of $0.2564 per share — a 13.9% premium to Azure’s last traded price of $0.225 per share on 6 January 2023.

Aruma Resources (ASX:AAJ) flagged further high-grade lithium-rubidium intersections from its final batches of assays from the recently completed drilling program at the Mt Deans Lithium-Rubidium Project in WA.

A total of 12 intersections graded >1.5% lithium-rubidium, with best results including 8m at 1.89% Li2O+Rb2O from 26m and 5m at 1.51% Li2O+Rb2O from 55m.

Assays also returned high potassium values, of up to 3.6%, with cesium (up to 0.6%) and tin-tantalum (600ppm and 700ppm).

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EVE | EVE Health Group Ltd | 0.001 | -33% | 300,000 | $7,911,724 |

| MGG | Mogul Games Grp Ltd | 0.001 | -33% | 148,750 | $4,895,162 |

| WBE | Whitebark Energy | 0.001 | -33% | 1,813,565 | $9,697,329 |

| EFE | Eastern Resources | 0.019 | -30% | 76,290,852 | $31,205,293 |

| GLV | Global Oil & Gas | 0.0015 | -25% | 2,012,598 | $6,857,595 |

| AUK | Aumake Limited | 0.004 | -20% | 5,798,333 | $4,372,235 |

| ATH | Alterity Therap Ltd | 0.009 | -18% | 4,753,986 | $26,580,603 |

| GMN | Gold Mountain Ltd | 0.005 | -17% | 4,075,252 | $11,068,895 |

| MHC | Manhattan Corp Ltd | 0.005 | -17% | 1,901,271 | $9,157,672 |

| DDT | DataDot Technology | 0.006 | -14% | 79,936 | $8,707,086 |

| NGS | NGS Ltd | 0.049 | -14% | 492,536 | $8,453,525 |

| CVR | Cavalierresources | 0.13 | -13% | 25,000 | $4,560,608 |

| HVY | Heavymineralslimited | 0.13 | -13% | 56,422 | $5,787,788 |

| FXG | Felix Gold Limited | 0.1 | -13% | 19,701 | $9,564,136 |

| ADY | Admiralty Resources. | 0.007 | -13% | 176,106 | $10,428,633 |

| IPT | Impact Minerals | 0.007 | -13% | 959,236 | $19,850,964 |

| CBR | Carbon Revolution | 0.145 | -12% | 1,725,946 | $34,703,722 |

| KAU | Kaiser Reef | 0.19 | -12% | 319,145 | $28,005,289 |

| DEM | De.Mem Ltd | 0.115 | -12% | 87,054 | $31,772,824 |

| BDG | Black Dragon Gold | 0.039 | -11% | 200,007 | $8,829,482 |

| TSN | The Sust Nutri Grp | 0.024 | -11% | 158,561 | $3,256,372 |

| BPP | Babylon Pump & Power | 0.004 | -11% | 317,559 | $11,059,971 |

| FGL | Frugl Group Limited | 0.008 | -11% | 7,223,334 | $2,383,646 |

| GTI | Gratifii | 0.016 | -11% | 53,486 | $18,137,648 |

| PCL | Pancontinental Energ | 0.008 | -11% | 2,310,433 | $67,988,005 |

LAST ORDERS

Daniel O’Halloran is back in the hot seat as acting CEO for green tech stock Tymlez (ASX:TYM), after only recently stepping down from the position last year.

O’Halloran will “help secure important deals for the business and execute on the Board’s strategy” while TYM searches for a permanent CEO to replace Maciek Kiernikowski.

Gold Hydrogen (ASX:GHY) has been admitted to the Official List of ASX and will commence quotation at 11am AEDT on Friday, 13 January.

GHY raised $20m at 50c per share to progress the flagship Ramsey gold hydrogen project in South Australia.

‘Gold hydrogen’ is hydrogen that is generated naturally by geological processes, which offers significant cost and emissions advantages compared to other means of hydrogen production.

And the Supreme Court has approved the proposed acquisition of Pendal (ASX:PDL) by fund manager Perpetual (ASX:PPT) via Scheme of Arrangement.

Pendal will also request that the quotation of its shares on the ASX be suspended from close of trading tomorrow.

The post Closing Bell: Small caps gain 1.2pc, and say farewell to cheap holidays everyone appeared first on Stockhead.