“On the risks around that view we continue to see rate cuts as being a very long way off. If the Bank does move in the near term – or even in the first half of 2024 – higher interest rates are much more likely than cuts.”

Uncategorized

Closing Bell: RBA pauses, lithium leaps and ASX 200 finishes 0.54pc to the good

The ASX 200 had a positive finish to the day on the whole, on the back of the rates pause … Read More

The post Closing Bell: RBA pauses, lithium leaps…

- The ASX 200 had a positive finish to the day on the whole, on the back of the rates pause from the RBA

- Sectors were a green scene, with IT and Staples leading the way

- Standout small caps: Viridis, Imricor and Baby Bunting, among several others

That’s right – the RBA today hit pause on its interest-rate hiking for the second month running. We NEVER DOUBTED IT. Honest.

All the handles that predicted a pause at the last 6 RBA meetings are now telling us I told you so.

— Assad Tannous (@AsennaWealth) August 1, 2023

And the market digged it, naturally, with proceedings closing a pleasant, soothing shade of green at closing time (see further below).

It turns out Philip Lowe has a couple of things in common with English fast-ish bowler Stuart Broad. Both are huge thorns in the sides of Australians everywhere and are, at last, making significant departures from their respective legacy-pursuing organisations.

As Eddy noted in his Large Caps column just now: “This was Philip Lowe’s final meeting, and Michele Bullock will be taking over in September.”

We can’t confirm if Lowe is a weekend headband wearer, bail switcher and doesn’t walk when he’s edged one to third slip*. But it’s possible.

(*Yep, wasn’t even in this series, but never letting it go.)

Well then, an RBA hold and an Ashes hold. There’s something poetic yet deeply unsatisfying in that. And so ends (finally) this columnist’s relentless share markets and tenuous crypto analogising with cricket. For at least a couple of months.

But wait, there’s more… or is there?

One thing, though, before we take a closer look at the markets…

• Just to put a dampener on things, Treasurer Jim Chalmers reminded us all to not get carried away with a few green candles on the charts, and that the inflation fight is not over, despite this RBA decision being “a welcome reprieve for Australians already doing it tough”.

Maybe one more rate rise to come before the end of this year? Prrrr…obably?

“Australians are still under the pump, even as inflation moderates and even after this decision today,” Chalmers, who might not be very fun down the pub, was at pains to remind us, adding:

“We know inflation in our economy is coming off but still too high, we understand and we acknowledge that.”

• But… but… here’s a hot take from ANZ chief economist, Adam Boyton, who reckons (per a report in The Australian) an “extended pause” in RBA rate hikes is likely after it held the cash rate unchanged at 4.1 per cent for a second month in a row.

“Our expectation remains that the Bank is on an extended pause,” noted Boyton, who unfortunately also felt the need to add:

TO MARKETS

The ASX 200 jumped to a three-day high on the back of the day’s biggest news, with a solid 0.6% gain.

Regarding advanced technical analysis of the situation, the chart formed a classic “US Coast Guard Rescue of the Pendleton Oil Tanker Crew” formation, neatly breaching an initial troublesome sand bar and then, heroically, another, mightier one.

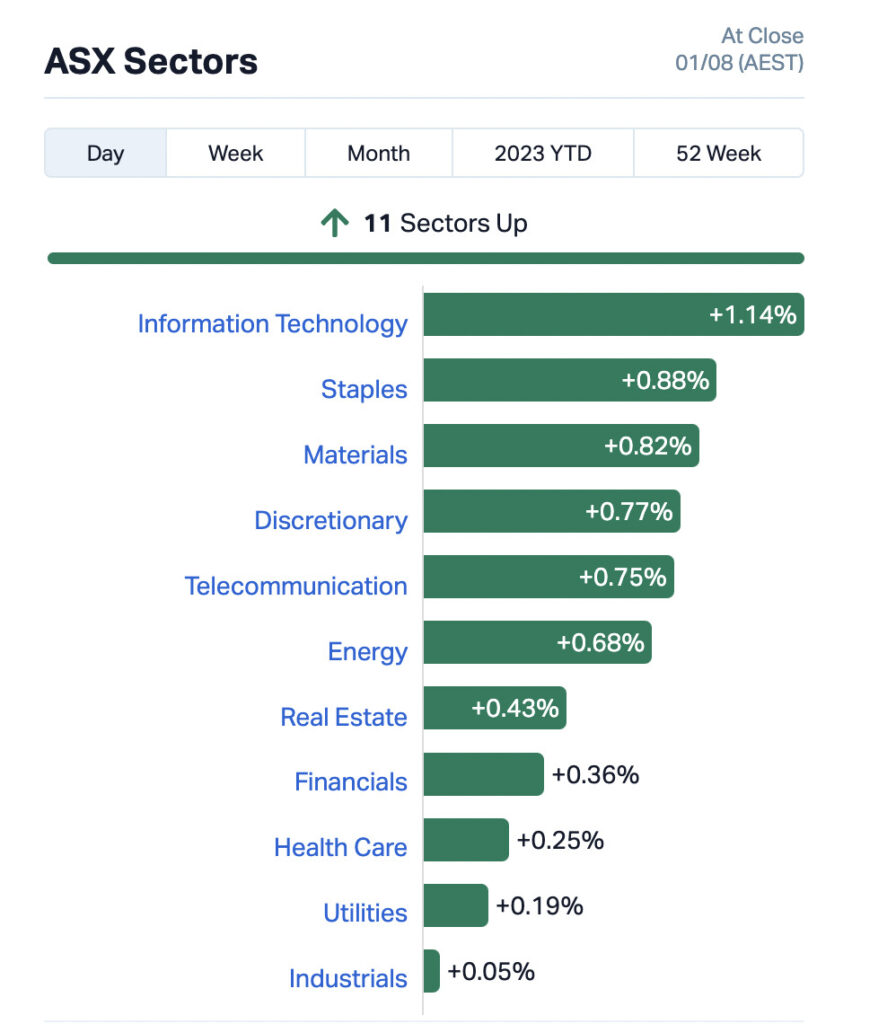

Zooming in a little tighter, we have the sectors, and the Market Index graphic below neatly encapsulates the winning feeling across the bourse this afternoon.

InfoTech had a belter in the arvo sesh, with Materials and Staples also looking solid. Industrials must be a cricket fan, because it finished a little flat, but otherwise, it’s handshakes and slaps on backs all round.

Now for a few specific standouts in the larger end of Bourse City, before we take you to ASX Funky Town, further below…

• Sayona Mining (ASX:SYA): +6.9% > As reported by Josh earlier, and lovingly cut and pasted here:

“The whole battery metals sector rose on the ASX today, including fellow Canadian miner Sayona, which revealed it had lifted concentrate production by 744% QoQ to 29,610t at its North American Lithium operations in Quebec in the June quarter. Its first shipment is due this quarter.”

• TPG Telecom (ASX:TPM): +6.77% > The $9.97bn telco has confirmed today that Vocus Group is interested in buying up the company’s non-mobile fibre assets.

“Vocus Group made an indicative, highly conditional, non-binding offer to acquire certain of TPG’s Enterprise, Government and Wholesale assets and associated fixed infrastructure assets, including Vision Network, for approximately $6.3 billion”, revealed TPG.

• Mid-tier gold producer Gold Road Resources (ASX:GOR) meanwhile managed an 8.9% climb. There was nothing specifically newsy regarding it today, although it released positive quarterly results into the world yesterday.

• Latin Resources (ASX:LRS) finished +11.6%, breaking through the $1 billion market cap market for the second time.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| VMM | Viridismining | 0.46 | 84% | 3,670,367 | $7,802,250 |

| ECG | Ecargo Hldg | 0.03 | 71% | 373,281 | $10,766,875 |

| GFN | Gefen Int | 0.006 | 50% | 517,899 | $513,119 |

| MTL | Mantle Minerals Ltd | 0.002 | 33% | 1,075,000 | $9,221,169 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 109,814 | $11,494,636 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | 33,333 | $6,605,136 |

| W2V | Way2Vatltd | 0.016 | 23% | 9,264,324 | $8,162,346 |

| OXT | Orexploretechnologie | 0.05 | 22% | 70,061 | $4,250,232 |

| IMR | Imricor Med Sys | 0.58 | 21% | 455,816 | $74,271,771 |

| BBN | Baby Bunting Grp Ltd | 2 | 20% | 2,615,182 | $224,619,304 |

| KGD | Kula Gold Limited | 0.018 | 20% | 173,421 | $5,598,179 |

| MXC | Mgc Pharmaceuticals | 0.003 | 20% | 4,151,244 | $9,730,899 |

| PUA | Peak Minerals Ltd | 0.003 | 20% | 358,722 | $2,603,442 |

| KZA | Kazia Therapeutics | 0.155 | 19% | 41,186 | $30,723,469 |

| HMY | Harmoney Corp Ltd | 0.445 | 19% | 303,564 | $38,083,345 |

| OLL | Openlearning | 0.035 | 17% | 160,119 | $8,036,072 |

| AJL | AJ Lucas Group | 0.014 | 17% | 4,796,607 | $16,508,756 |

| ATH | Alterity Therap Ltd | 0.007 | 17% | 85,609 | $14,639,386 |

| OAU | Ora Gold Limited | 0.007 | 17% | 1,385,285 | $26,621,551 |

| EQX | Equatorial Res Ltd | 0.18 | 16% | 254,884 | $20,296,530 |

| BNZ | Benzmining | 0.405 | 16% | 252,306 | $38,473,741 |

| MXR | Maximus Resources | 0.038 | 15% | 554,354 | $10,528,840 |

| NWC | New World Resources | 0.038 | 15% | 10,697,488 | $69,481,237 |

| GRE | Greentechmetals | 0.345 | 15% | 1,345,096 | $16,978,667 |

| CCX | City Chic Collective | 0.51 | 15% | 1,204,069 | $103,204,438 |

Some standouts:

Viridis Mining and Minerals (ASX:VMM) : We told you about this one in Top Resources 4, so we suggest you head there for the info in brief. But even more briefly…

Viridis started well, and ended well today, registering all time highs after announcing the acquisition a significant ionic clay (IAC) rare earths deposit.

Imricor Medical Systems (ASX:IMR): The health-tech stock (focused on MRI-compatible devices to, for example aid cardiac-ablation procedures) is up today on a medical ethics committee approval to trial VISABL-VT, a cardiac arrest study. More here, from Eddy.

Baby Bunting (ASX:BBN): Up on no major news. There’s “a change of interests of a substantial holder” notice, but no other announcements.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -50% | 4,971,108 | $20,529,010 |

| ABPDA | Abacus Property Grp. | 1.375 | -48% | 648,372 | $2,377,129,304 |

| NYR | Nyrada Inc. | 0.033 | -34% | 472,770 | $7,800,435 |

| ACS | Accent Resources NL | 0.008 | -27% | 46,796 | $5,204,400 |

| ID8 | Identitii Limited | 0.017 | -26% | 8,680,918 | $4,894,365 |

| MTH | Mithril Resources | 0.0015 | -25% | 153,005 | $6,737,609 |

| PIL | Peppermint Inv Ltd | 0.006 | -25% | 3,155,690 | $16,302,855 |

| SCL | Schrole Group Ltd | 0.225 | -25% | 1,297 | $10,700,276 |

| STA | Strandline Res Ltd | 0.17 | -23% | 17,896,309 | $275,635,506 |

| MOB | Mobilicom Ltd | 0.012 | -20% | 1,946,145 | $19,900,150 |

| JTL | Jayex Technology Ltd | 0.008 | -20% | 384,177 | $2,812,785 |

| NWM | Norwest Minerals | 0.042 | -19% | 2,820,044 | $14,436,995 |

| SKF | Skyfii Ltd | 0.047 | -19% | 626,887 | $24,341,913 |

| TPD | Talon Energy Ltd | 0.155 | -18% | 26,225,460 | $119,215,100 |

| AAP | Australian Agri Ltd | 0.014 | -18% | 169,574 | $5,186,691 |

| NNG | Nexion Group | 0.014 | -18% | 100,005 | $3,439,234 |

| SVG | Savannah Goldfields | 0.075 | -18% | 226,494 | $17,822,208 |

| R3D | R3D Resources Ltd | 0.043 | -17% | 472,844 | $7,573,882 |

| DTZ | Dotz Nano Ltd | 0.2 | -17% | 240,190 | $111,893,428 |

| BNO | Bionomics Limited | 0.01 | -17% | 8,518,704 | $17,624,825 |

| EEL | Enrg Elements Ltd | 0.005 | -17% | 4,646,582 | $6,055,405 |

| EFE | Eastern Resources | 0.01 | -17% | 819,054 | $14,903,358 |

| NES | Nelson Resources. | 0.005 | -17% | 1,100,004 | $3,681,566 |

| PRX | Prodigy Gold NL | 0.005 | -17% | 142,180 | $10,506,647 |

| EOF | Ecofibre Limited | 0.18 | -16% | 557,500 | $75,081,128 |

LAST ORDERS

Biopharma pushes for cannabinoid breakthroughs

Neurotech (ASX:NTI), a biopharmaceutical development firm focused on paediatric neurological disorders, has revealed the first patient has been enrolled and treated in the Phase I/II clinical trial investigating the use of NTI164 in female Rett Syndrome patients.

The trial seeks to provide initial evidence on the safety and efficacy of NTI164, which is derived from a unique genetic strain of medicinal cannabis.

Dr Thomas Duthy, Executive Director of Neurotech International said: “There is a need for safer and more effective therapies that target the persistent neuroinflammation associated with this rare neurological disorder.

“Recent corporate activity in the Rett Syndrome therapeutic space highlights to us the significant opportunity ahead for the company in developing NTI164 for this patient population.”

The Phase II clinical trial will examine the effects of daily oral treatment of NTI164 and is targeting the recruitment of 14 Rett Syndrome patients initially.

As the company’s report explains, Rett Syndrome occurs almost exclusively in girls, “with incidence of one in 10,000 female live births”. Some 350,000 girls and women are directly affected globally.

And, notes Neurotech, the market is estimated at over US$2 billion annually.

Not the ASX

• Just quickly, regarding world markets, and this seems as good a place to squeeze it in as any other, as Gregor told you at lunch, Wall Street had a high-fiving close:

“Overnight, the major indices enjoyed a day in positive territory that left the S&P 500 up by 0.15%, the Dow Jones by +0.28% and tech-heavy Nasdaq by 0.21%.”

Meanwhile, in Asia, here how things were shaping up at the time of writing:

Shanghai Comp: +0.46%

Hang Seng: +0.82%

Nikkei: +1.26%

TRADING HALTS

State Gas (ASX:GAS) – Capital raising.

BOD Science (ASX:BOD) – Capital raising.

Cooper Metals (ASX:CPM) – Capital raising.

Future Battery Minerals (ASX:FBM) – Pending an announcement regarding exploration results.

Rex Minerals (ASX:RXM) – Capital raising.

Genmin (ASX:GEN) – An announcement is coming relating to the approval of an environmental permit for the company’s 100% owned Baniaka iron ore project in Gabon.

Pan Asia Metals (ASX:PAM) – A placement equity raise is in the works.

Aeris Environmental (ASX:AEI) – Some info is pending regarding debt financing and an operational update.

Codan (ASX:CDA) – Pending a material announcement regarding a proposed acquisition, which is awaiting a final regulatory approval in the UK.

Besra Gold (ASX:BEZ) – The goldie has some board changes it’s planning on announcing to the market.

WA Kaolin (ASX:WAK) – Pending an announcement regarding a significant corporate transaction with the company’s offtake partner.

The post Closing Bell: RBA pauses, lithium leaps and ASX 200 finishes 0.54pc to the good appeared first on Stockhead.