Uncategorized

Closing Bell: Local markets shed 0.6pc as we brace for tonight’s US Fed call

The ASX 200 benchmark falls 0.6% as we brace for news from The Fed Sector losses led by Resources, while … Read More

The post Closing Bell: Local markets…

- The ASX 200 benchmark falls 0.6% as we brace for news from The Fed

- Sector losses led by Resources, while Consumers make gains

- Small caps led by Alderan, and BNPL Sezzle returns

Local markets made it a hat trick of losses, with the resources stocks taking on the most water.

The ASX200 benchmark index lost -0.6%, while the Small Ords (XSO) and the Emerging Companies (XEC) measurements closed -0.5% and -1.25%

At home it was the blue chip names like Woodside and BHP among materials and energy stocks which led broad-based losses after a terribly, terribly flat lead from Wall Street.

Ahead of The Federal Reserve decision in a few hours, the Dow Jones Industrial Average came away with a +0.02% blip into the positive, the Tech Heavy Nasdaq Composite was even less emphatic, up +0.01% and the S&P 500 comparatively roared ahead up +0.07%.

Global markets are almost in stasis while staring down a central bank reckoning this week, which begins soon as London, Tokyo and New York brace for critical rate decisions.

The US Fed’s expected to hold America’s target range for federal funds at 5.25%-5.5%, following the last 25bps boost in July. Like ours, America’s central bankers want to better assess the impact of their hiks which has the cost of borrowing at 22 year highs.

This meet is particularly revealing with traders getting a look at the bank’s governor’s so-called dot plot – where evryone drwas where they think rates might end up in the future. Fed fun!

Qantas flew low again shedding almost 2.4% in arvo trade as outrage filtered through media outlets around the idea of public enemy No. #121 ex-CEO Alan Joyce officially pocketing a $21.4 million take home paypack (although QAN is reportedly keeping some while its fighting the ACCC).

But in some rare BNPL good news, Sezzle (ASX:SZL) shares jumped 20% after the buy now pay later player reports a rise in income in August.

Sezzle’s total income increased to $US14m ($21.6m) in August, up 11.7 per cent month-on-month and by 44.3% year-on-year.

“August has proven to be yet another testament to the efficacy and success of our latest product offerings,” Sezzle chairman and chief executive Charlie Youakim said..

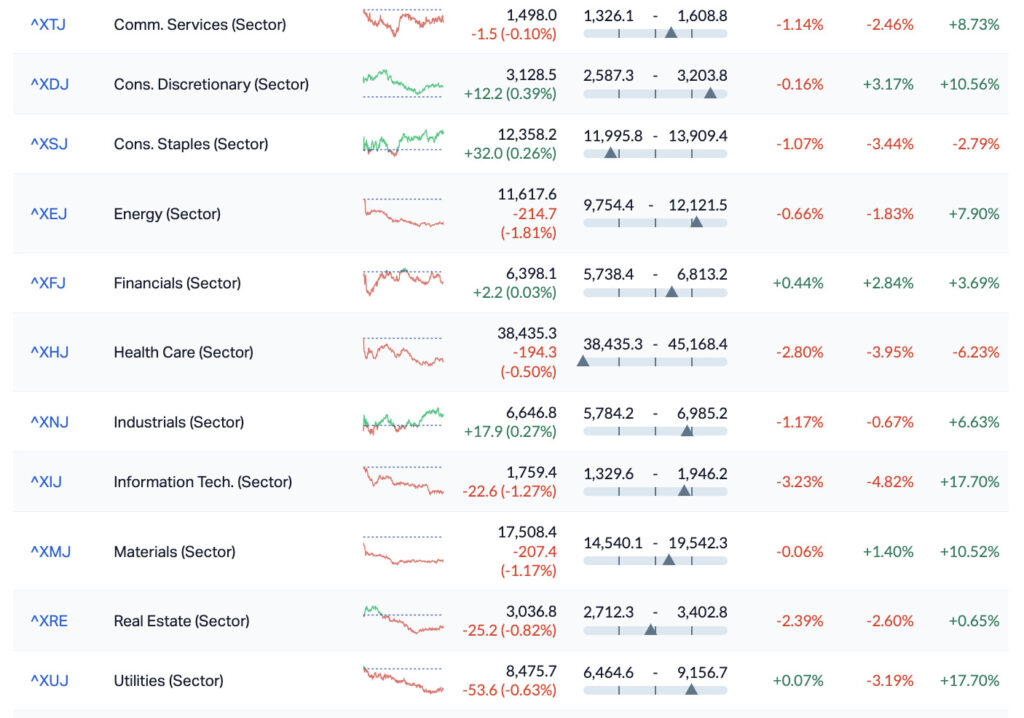

ASX Sectors on Wednesday Sept. 20 DAY — WEEK — MONTH — YEAR

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.002 | 100% | 252,454 | $1,471,200 |

| AL8 | Alderan Resource Ltd | 0.012 | 50% | 44,984,502 | $4,933,557 |

| KEY | KEY Petroleum | 0.002 | 33% | 1,388,889 | $2,951,892 |

| MKL | Mighty Kingdom Ltd | 0.013 | 30% | 946,120 | $3,262,196 |

| OSM | Osmondresources | 0.125 | 25% | 69,141 | $4,689,604 |

| RBX | Resource B | 0.175 | 25% | 246,251 | $11,575,828 |

| BP8 | BPH Global Ltd | 0.0025 | 25% | 2,180,000 | $2,669,460 |

| CCO | The Calmer Co Int | 0.005 | 25% | 4,456,593 | $3,268,477 |

| LNU | Linius Tech Limited | 0.0025 | 25% | 6,683,333 | $8,459,581 |

| TMX | Terrain Minerals | 0.005 | 25% | 1,857,392 | $4,332,797 |

| OZM | Ozaurum Resources | 0.11 | 22% | 10,566,308 | $11,430,000 |

| SZL | Sezzle Inc. | 24.25 | 20% | 69,428 | $55,259,904 |

| MBH | Maggie Beer Holdings | 0.12 | 20% | 251,235 | $35,243,992 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 262,926 | $5,079,373 |

| EDE | Eden Inv Ltd | 0.003 | 20% | 5,980,880 | $8,409,092 |

| LML | Lincoln Minerals | 0.006 | 20% | 44,000 | $7,103,559 |

| MDR | Medadvisor Limited | 0.24 | 17% | 109,196 | $111,954,351 |

| NTD | National Tyre & Wheel | 0.83 | 17% | 903,688 | $94,622,636 |

| CMP | Compumedics Limited | 0.21 | 17% | 82,422 | $31,889,331 |

| FRM | Farm Pride Foods | 0.14 | 17% | 82,393 | $17,262,943 |

| TNY | Tinybeans Group Ltd | 0.14 | 17% | 28,575 | $10,060,631 |

| ATH | Alterity Therap Ltd | 0.007 | 17% | 1,050,000 | $14,639,386 |

| CHK | Cohiba Min Ltd | 0.0035 | 17% | 574,899 | $6,639,733 |

| LBT | LBT Innovations | 0.014 | 17% | 496,075 | $4,270,804 |

| MOB | Mobilicom Ltd | 0.007 | 17% | 2,321,431 | $7,960,060 |

Gaming minnow, Mighty Kingdom (ASX:MKL) which hired lawyers on Monday to chase down their ex-CEO for a cool $2 million has jumped this arvo, on news they won’t be going bust as they hunt their man.

Circa $2.1 million which it says are owed to it by the gaming company’s largest shareholder Gamestar Studios founded by ex MKL CEO Shane Yeend.

Gamestar’s outstanding contribution to a $7mn placement last year was circa $2.3mn. Mighty Kingdom says only $200k of that has been handed over.

Mighty Kingdom chaired by former ABC boss Michelle Guthrie. says the funds “have not been forthcoming despite efforts to resolve the delays”, with the announcement released just 18 days after the Gamestar Studios founder quit MKL.

MKL says it however in a position to finance its ongoing business operations without immediate recourse to the Gamestar+ settlement monies.

Alderan Resources (ASX:AL8) jumped up 50% before lunch on happy news that the company has acquired 100% ownership of seven lithium exploration projects consisting of 24 granted exploration licences covering 472km2 in Brazil’s Eastern Lithium Belt.

The licences cover project areas all located in and immediately south of the area known as ‘Lithium Valley’ in the Eastern Lithium Belt of Eastern Brazil.

For reference, Latin Resources’ (ASX:LRS) Salinas Project is just up the road, which boasts a JORC compliant Measured, Indicated & Inferred Mineral Resource estimate of 45.2Mt grading 1.34% Li2O.

OzAurum Resources (ASX:OZM) is back in the winner’s circle again this morning, on news that the company has raised $2.4 million (before costs) via a share placement through the issue of 31,750,000 new shares.

Interest in OZM went through the roof last week on news that OzAurum has also been out project shopping in Brazil, buying up the Linopolis Jaime Project that has been mined intermittently for tantalite, beryl, tourmaline, brazilianite and feldspar intermittently by the Pacheco family and other artisanal miners for over 50 years.

Besra Gold (ASX:BEZ) spiked early on news the company has agreed to sell to Quantum a quantity of refined gold from the Bau Gold Project, up to 3,000,000oz or a value of US$300,000,000, whichever comes first – but has sinced settled back to a 12% gain for the morning.

Resource Base (ASX:RBX) and Megado Minerals (ASX:MEG) are up on thin volume, climbing more than 21% each.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ERG | Eneco Refresh Ltd | 0.014 | -26% | 201,524 | $5,174,809 |

| WEC | White Energy Company | 0.06 | -25% | 8,567 | $5,472,495 |

| BBX | BBX Minerals Ltd | 0.031 | -23% | 662,496 | $20,709,384 |

| AGE | Alligator Energy | 0.053 | -22% | 81,196,751 | $224,952,956 |

| BLU | Blue Energy Limited | 0.015 | -21% | 7,891,858 | $35,168,498 |

| BSN | Basin Energy | 0.12 | -20% | 2,815,110 | $9,004,501 |

| GTG | Genetic Technologies | 0.002 | -20% | 500,000 | $28,854,145 |

| JNO | Juno | 0.095 | -17% | 831,500 | $15,600,670 |

| NMR | Native Mineral Res | 0.043 | -17% | 328,231 | $10,479,853 |

| HFY | Hubify Ltd | 0.015 | -17% | 20,000 | $8,930,453 |

| ICG | Inca Minerals Ltd | 0.015 | -17% | 1,366,296 | $8,748,180 |

| PNX | PNX Metals Limited | 0.0025 | -17% | 4,100,000 | $16,141,874 |

| YOJ | Yojee Limited | 0.008 | -16% | 3,221,816 | $10,784,443 |

| NIS | Nickelsearch | 0.049 | -16% | 4,249,952 | $5,546,562 |

| MYE | Metarock Group Ltd | 0.11 | -15% | 64,482 | $39,128,859 |

| OKR | Okapi Resources | 0.14 | -15% | 1,811,243 | $34,664,193 |

| BRN | Brainchip Ltd | 0.2125 | -15% | 19,178,562 | $443,764,536 |

| BUR | Burley Minerals | 0.17 | -15% | 432,512 | $20,259,351 |

| NSB | Neuroscientific | 0.081 | -15% | 232,114 | $13,737,463 |

| BTN | Butn Limited | 0.12 | -14% | 68,680 | $25,622,604 |

| CNJ | Conico Ltd | 0.006 | -14% | 25,174 | $10,990,665 |

| ELE | Elmore Ltd | 0.006 | -14% | 2,281,895 | $9,795,687 |

| FAU | First Au Ltd | 0.003 | -14% | 1,222,498 | $5,081,976 |

| IEC | Intra Energy Corp | 0.006 | -14% | 6,884,829 | $11,345,471 |

| MTB | Mount Burgess Mining | 0.003 | -14% | 20,835 | $3,554,764 |

TRADING HALTS

Netlinkz Limited (ASX:NET) – Pending finalising terms for a debt funding / capital raising.

National Tyre & Wheel (ASX:NTD) – Pending an announcement in relation to the entry into a material supply agreement

Adelong Gold (ASX:ADG) – Pending the release of an announcement concerning an acquisition.

Codrus Minerals (ASX:CDR) – Pending the release of an announcement regarding a potential capital raising.

DXN (ASX:DXN) – Pending an announcement to the market in relation to the completion of a material modular data centre contract.

Pachold (ASX:PGO) – Pending an announcement in connection with a capital raising.

The post Closing Bell: Local markets shed 0.6pc as we brace for tonight’s US Fed call appeared first on Stockhead.