Uncategorized

Closing Bell: Bleak benchmark goes back to the beginning as Wall Street worries widen; RBA holds at 4.1pc

The ASX200 has erased all exciting gains made in 2023, as the Aussie dollar nears an 11-month low and the … Read More

The post Closing Bell: Bleak benchmark…

- ASX200 drops sharply on Wall Street worry

- Healthcare only sector to rise

- Small caps led by Noxopharm, Nimy Resources, Alderan and ECS Botanics

The ASX200 has inched below where it was at the start of 2023, while the Australian dollar nears an 11-month low and the RBA keeps a firm hold on the official cash rate.

Surging US 10-year Treasury yields clocked new highs overnight, with further positive US economic data reinforcing Wall Street fears that the Federal Reserve will sustain US interest rates “higher for longer”.

The benchmark ASX200 was back at January 2023 around 2pm, under 7,000 points, before closing down 1.2 per cent to 6948.30 points, before ending the session 83 points lower, or -1.28% short at 6,943.

Year to date, the ASX200 is down -1.35%, but hangs on to some +7.5% of gains over the last year.

The Healthcare Sector at least rose on the orbital pull of a happy performance from snoozing blood plasma giant CSL (ASX:CSL), which has found more than 1%, adding a lot to its $120 billion market cap.

Mining and Energy names are driving the worst-performing sectors on Tuesday. The uranium miners, which had such a stonking September, are giving up some of their gains, while the drop in oil and gold prices has hit names like Perseus Mining (ASX:PRU) and Beach Energy (ASX:BPT) losing over -4.5% each.

Across the bourse, heavyweight financial, IT and consumer-related stocks had a tanty as well.

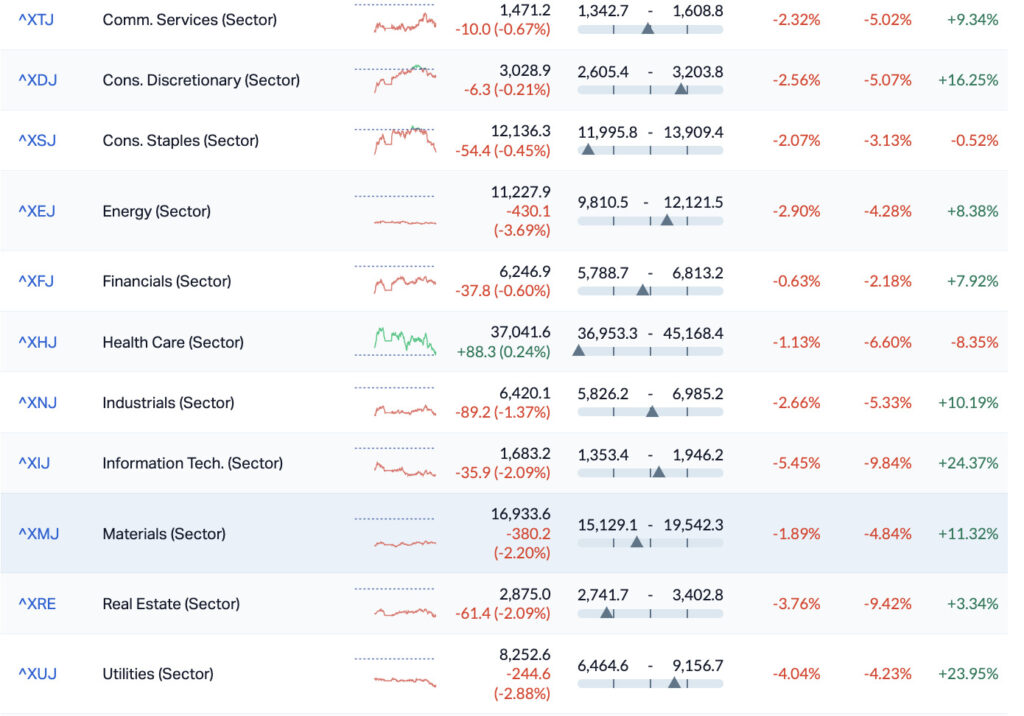

ASX by Sectors on Tuesday — Intraday — 52 Week Range — Week – Month – Year

Random small cap news

Aussie wound and burns specialist Avita Medical (ASX:AVH) has crashed and… anyway – the stock is down heavily after announcing a forced delay of its flagship US product launch after the US Food and Drug Administration’s request for more information.

Avita’s made a lot of its Recell system and put investors on notice earlier this year, promising the post-FDA launch into the states for Recell would be a 5x market expansion opportunity.

Rox Resources (ASX:RXL) says it’s hit “spectacular high-grade gold results” at Link, its “fast-developing strike extension to the historically mined lodes at Youanmi”.

The recent assay batch received from Youanmi resource development drilling at Link include:

- RXDD088: 24.43m @ 12.79g/t Au from 369.00m, incl:

6.03m @ 25.01g/t Au from 372.97m, and:

1.87m @ 28.65g/t Au from 383.13m, and:

2.68m @ 36.51g/t Au from 390.75m - RXDD092: 7.73m @ 3.12g/t Au from 366.90m, incl:

4.10m @ 4.65g/t Au from 366.90m - RXDD093: 3.89m @ 5.75g/t Au from 408.00m, incl:

1.93m @ 9.21g/t Au from 409.96m, and:

1.02m @ 29.88g/t Au from 425.45m - RXDD096: 3.84m @ 9.13g/t Au from 412.51m, incl:

2.15m @ 13.50g/t Au from 412.51m

“These results strongly support Rox’s agenda of moving resources at Link to a higher confidence category to support feasibility studies and to also demonstrate significant resource upside.”

The company says further phase of RC drilling currently underway testing advanced near-mine targets and greenfield regional targets.

Shares are up about 2.1%.

Ripped from the headlines

The Reserve Bank of Australia (RBA) has kept the cash rate unchanged at 4,1% following its October meeting earlier today in Martin Place – the first with Michele Bullock at the wheel.

This is its fourth straight meet where the policy rate remains unchanged, giving Aussie mortgage holders another slight reprieve.

Harvey Bradley, Portfolio Manager at Insight Investment said it’s becoming increasingly apparent the RBA board believes they have tightened enough through this cycle.

“The economic data coming in line with expectations during September has likely reinforced this belief,” Mr Bradley told Stockhead.

“Australian government bonds were little changed after the meeting given the no change and associated commentary was in line with expectations. It is clear every meeting will remain live from here and the market will remain very sensitive to the incoming data given the uncertainty which remains around the macro outlook.”

According to Insight, the risks for growth remain to the downside… but the risks for inflation remain to the upside.

“We expect that the RBA will be on hold for an extended period, until they can be confident inflation has returned to their target on a sustainable basis.”

Over at Mozo.com Rachel Wastell says the pain is not over for borrowers.

“Monetary policy works at a lag, and in fact most financial datasets are ‘backward looking’ – so we have to remember that the impacts of the 12 rate rises since last May are still flowing through the economy.

“This may be difficult in a world where we are so used to instant gratification it can be easy to expect change to occur quite quickly, but the RBA’s pause today shows that despite the August uptick in inflation, the board understands that the full effect of those rate rises (including the forecast rise in unemployment) is yet to be realised, as the RBA made a point to mention in their statement.

Around the traps

Asian Pacific equity markets fell all over the place on Tuesday, reacting with an adolescent displeasure as the strong US dollar got a re-boost and US Treasury yields creeping toward 5% ruined an otherwise bright beginning to October trade on Wall Street.

The USD’s at 10-month highs, leaving the Aussie in peril of slipping back under 63.5 US cents, while in Japan the Yen can go back to one-year lows without many complaints.

Sharemarkets in Japan and Hong Kong have fallen, while markets in South Korea and mainland China remain shuttered for the Mid-Autumn Festival.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.002 | 100% | 3,944,886 | $15,642,574 |

| NOX | Noxopharm Limited | 0.062 | 48% | 3,849,822 | $12,273,994 |

| HVY | Heavymineralslimited | 0.13 | 37% | 1,166,954 | $5,474,239 |

| PUA | Peak Minerals Ltd | 0.004 | 33% | 222,139 | $3,124,130 |

| AL8 | Alderan Resource Ltd | 0.0145 | 32% | 23,565,870 | $6,783,641 |

| ASO | Aston Minerals Ltd | 0.035 | 30% | 1,564,878 | $34,437,985 |

| AHK | Ark Mines Limited | 0.225 | 25% | 410,872 | $8,126,056 |

| BPP | Babylon Pump & Power | 0.005 | 25% | 2,000,000 | $9,848,308 |

| GTG | Genetic Technologies | 0.0025 | 25% | 173,083 | $23,083,316 |

| TOY | Toys R Us | 0.011 | 22% | 31,947,890 | $8,306,262 |

| BCK | Brockman Mining Ltd | 0.03 | 20% | 313,866 | $232,005,803 |

| SCN | Scorpion Minerals | 0.069 | 19% | 1,559,515 | $20,050,959 |

| ECS | ECS Botanics Holding | 0.026 | 18% | 24,112,971 | $24,348,075 |

| HTG | Harvest Tech Grp Ltd | 0.033 | 18% | 116,674 | $19,477,230 |

| JXT | Jaxstaltd | 0.066 | 18% | 1,276,310 | $28,742,817 |

| DEL | Delorean Corporation | 0.027 | 17% | 92,592 | $4,961,581 |

| EXL | Elixinol Wellness | 0.007 | 17% | 464,650 | $3,758,896 |

| FGL | Frugl Group Limited | 0.014 | 17% | 244,894 | $11,472,744 |

| RIM | Rimfire Pacific | 0.007 | 17% | 500,000 | $12,631,468 |

| PTR | Petratherm Ltd | 0.064 | 16% | 212,572 | $12,361,313 |

| NIM | Nimyresourceslimited | 0.22 | 16% | 1,719,712 | $14,718,854 |

| BLU | Blue Energy Limited | 0.015 | 15% | 4,403,113 | $24,062,657 |

| NMR | Native Mineral Res | 0.047 | 15% | 432,443 | $8,262,961 |

| MOH | Moho Resources | 0.008 | 14% | 1,319,500 | $1,904,249 |

| RMX | Red Mount Min Ltd | 0.004 | 14% | 3,120,433 | $9,357,516 |

Nimy Resources (ASX:NIM) says it’s onto massive nickel-copper sulphides from the first hole of RC drilling at Mons, intersecting 13m of massive sulphide mineralisation in total, containing pyrrhotite, pentlandite, chalcopyrite and pyrite.

Some bullies FYC:

• Mineralised intersection is continuous and commencing from 102m depth.

• The massive sulphide intersections are coincident with the modelled MLEM plate locations.

• Samples have been delivered to Perth for expedited assaying.

• Holes have been cased in preparation for downhole electromagnetic (DHEM) survey to enhance

understanding of the plates’ dimensions.

• Drill Rig has been moved to Block 3 to test modelled conductive plates at that location.

• Nimy has an additional 31 VTEM anomalies with similar characteristics undergoing investigation.

Nimy executive director Luke Hampson says it’s a big win for their strategy of extensive VTEM and follow up MLEM.

“The intersections represent proof of concept in our search for massive sulphide mineralisation in an enormous holding covering an 80km strike of greenstone in over 2000km² that has already delivered very deep intersections of low-grade nickel from previous drilling.”

Samples have been delivered to Perth for’ urgent turnaround’.

Toys R Us (ASX:TOY) was up 50% at lunchtime on news from the overseas branch of the toy-seller is that it’s in new hands, and has plans to build 24 new retails spaces in some unconventional places – inside other major stores like Macy’s, and on cruise ships (the ultimate in captive audiences). As Grgeor noted this morning, the last missive to the market from TOY was a fairly ‘morose letter about how dismal things have been’.

Next up is Noxopharm (ASX:NOX), which earned itself a speeding ticket from the ASX success police – up 35% at lunchtime, and near 50% at 3.30pm NOX is in a halt.

Does it relate to news concerning its Chroma platform, as presented at the American Association of Cancer Research (AACR) Special Conference on Pancreatic Cancer? Honestly, I ‘ave NFI.

No. wait, I have this:

NOX is in a halt “pending an announcement by the Company to the market regarding the determination of the designation by FDA for pancreatic cancer drug candidate CRO-67.” Hope that helps.

ECS Botanics (ASX:ECS) is loving Tuesday after revealing this morning that it’s signed a fab new $24 million offtake agreement to supply medicinal cannabis dried flower over the next five years to MediCann Health.

The deal builds on the existing two-year contract and expects to deliver over four tonnes of dried cannabis flower over five years:

Supply starts in January 2024 with over four tonnes of dried cannabis flower to be delivered over five years. Under the agreement, ECS will supply two ECS strains of GMP medicinal cannabis dried flower exclusively to MediCann.

“The agreement underscores the Company’s strong presence in the B2B sector and highlighting the positive outcomes stemming from its recent capacity and production enhancements,” ECS told the exchange on Tuesday morning.

And Alderan Resources (ASX:AL8) has spiked on an update regarding its recent acquisition of seven lithium exploration projects in the mineral resource rich state of Minas Gerais, Brazil.

The company notes that project site visits are currently underway, with geologist-led field inspections looking to provide some expert confirmation of potential lithium mineralisation from pegmatite fields.

Legal due diligence is also reportedly on track, following the appointment by Alderan of Brazilian legal firm FFA Legal.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TI1 | Tombador Iron | 0.012 | -33% | 9,579,587 | $38,852,683 |

| EXT | Excite Technology | 0.005 | -29% | 408,333 | $8,464,692 |

| NZS | New Zealand Coastal | 0.0015 | -25% | 2,652,670 | $3,334,020 |

| A3D | Aurora Labs Limited | 0.017 | -23% | 2,066,177 | $5,407,777 |

| CPN | Caspin Resources | 0.12 | -23% | 45,112 | $14,611,178 |

| WBEDC | Whitebark Energy | 0.02 | -20% | 354,956 | $3,669,830 |

| ADS | Adslot Ltd. | 0.004 | -20% | 630,000 | $16,122,478 |

| AVH | Avita Medical | 3.61 | -19% | 1,626,975 | $269,342,398 |

| E33 | East 33 Limited. | 0.025 | -17% | 106,517 | $15,572,661 |

| NWF | Newfield Resources | 0.125 | -17% | 18,731 | $132,307,086 |

| AMD | Arrow Minerals | 0.0025 | -17% | 2,487,566 | $9,071,295 |

| AVM | Advance Metals Ltd | 0.005 | -17% | 2,797,790 | $3,531,352 |

| CNJ | Conico Ltd | 0.005 | -17% | 984,418 | $9,420,570 |

| NES | Nelson Resources. | 0.005 | -17% | 1,000,000 | $3,681,566 |

| TIG | Tigers Realm Coal | 0.005 | -17% | 1,500,000 | $78,400,214 |

| DMM | Dmcmininglimited | 0.056 | -16% | 34,250 | $2,006,650 |

| ZGL | Zicom Group Limited | 0.048 | -16% | 66,539 | $12,229,920 |

| CBR | Carbon Revolution | 0.135 | -16% | 1,133,443 | $33,944,401 |

| MEL | Metgasco Ltd | 0.011 | -15% | 1,249,403 | $13,830,528 |

| TMK | TMK Energy Limited | 0.011 | -15% | 243,300 | $65,397,531 |

| BUS | Bubalusresources | 0.17 | -15% | 109,951 | $5,694,235 |

| ATS | Australis Oil & Gas | 0.023 | -15% | 1,153,415 | $34,205,370 |

| KNO | Knosys Limited | 0.035 | -15% | 186,717 | $8,861,687 |

| 1MC | Morella Corporation | 0.006 | -14% | 3,076,961 | $42,970,590 |

| AYT | Austin Metals Ltd | 0.006 | -14% | 209,857 | $7,111,123 |

TRADING HALTS

Noxopharm (ASX:NOX) – Pending an announcement by the Company to the market regarding the determination of the designation by FDA for pancreatic cancer drug candidate CRO-67

The post Closing Bell: Bleak benchmark goes back to the beginning as Wall Street worries widen; RBA holds at 4.1pc appeared first on Stockhead.