Uncategorized

Closing Bell: ASX 200 reverses form slump with 0.55pc gain; sand stock Perpetual flies ahead of ‘potential acquisition’

The ASX had a much better day on the week’s hump, ending the bloodshed with a 0.5% gain, with the … Read More

The post Closing Bell: ASX 200 reverses…

- The ASX had a much better day, on the week’s hump, ending the bloodshed with a 0.55% gain

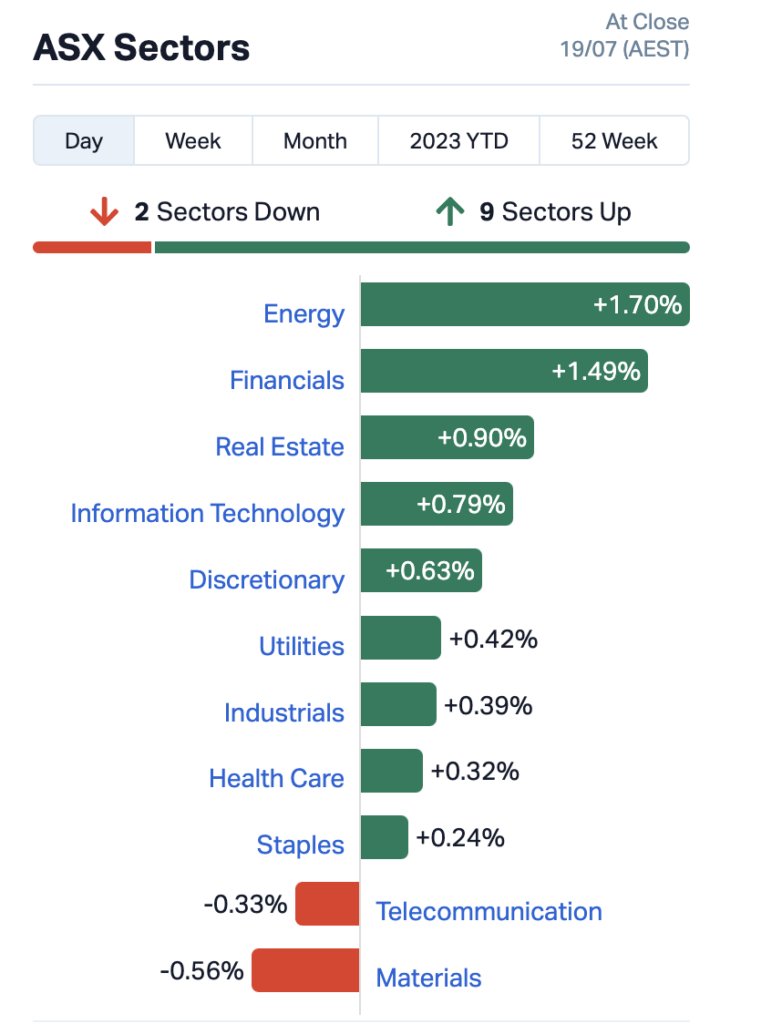

- Sectors-wise, Energy, Financials and Real Estate received gold stars, while Materials was sent to the naughty corner

- The day’s clear small-caps winner was Carnegie Clean Energy, up 50%

If we were lazy, we’d begin this piece with some sort of horrible cliché such as “what a difference a day makes”.

What a difference a day makes, eh? (Didn’t begin with it.) It’s a pleasantly US Tech-Rally shade of green on the ASX 200 today, which is a nice mood shift from the RBA Red palette covering the bourse over the preceding two days.

Our very own non-fungible Eddy Sunarto called it early doors with “Aussie shares are set to bounce back on Wednesday after another rally on Wall Street.” And, not quite like the $7.50 kebab we had for lunch yesterday, so it came to pass.

We’ll scratch around for some specifics on it all in a minute, but first…

MAKING HEADLINES

• Leading the Energy sector surge, well certainly in the large end of ASX town ($68.35b market cap) was Woodside Energy Group (ASX:WDS) with a 1.27% gain based on a positive Q2 report.

• Aussie banks have had a decent day, too, essentially copy-trading some of the bigger US banking entities (see “not the ASX”, below, and Eddy’s morning Market Highlights column.) CBA led the way, with a 1.82% gain with others in the Big Four rising around 1.3-1.7%.

“Based on a proprietary survey by UBS, analyst Jon Storey sees “rationality” returning to the sector, especially around deposit funding costs,” reported The Australian‘s David Rogers earlier.

• ASIC has violently ripped the band-aid off the local edition of disgraced crypto company FTX, and then quite deliberately, even more aggressively, stabbed it again, right in its festering wound.

In other words, what the Aussie financial regulator has done is cancel the financial services licence of local subsidiary of the once high-flying, now deep-frying exchange. Effective from July 14.

Did crypto prices care about this? Of course not – most crypto-investing folk have moved well past the FTX/SBF debacle – although there’s a Wolf of Wall Street-style film in the works, we hear. At the time of writing, Bitcoin (BTC) had regained US$30k again and the whole market was up 0.3%.

TO MARKETS

Local bourse first, of course. Where did the ASX 200 wind up, then? Right here, with a very decent 0.55% gain as the bell did its thing.

The ASX chart resembled a classic “Wind Sock” technical pattern, which may or may not be an actual TA term. If it isn’t, we’re claiming it.

As for sectors, we said it up t here in the bullet points, but here’s a closer visually aided bead for you, courtesy of the wonderfully reliable Market Index.

Onto gold for half a tick: The XGD All Ords Gold Index suffered a bit today, on the whole, down about -1% at the time of writing.

And just a couple of slightly larger-capped standouts for you, before we head down the ASX batting order, further below…

• Latin Resources Limited (ASX:LRS) : +7.5% on no fresh news for the Aussie minerals explorer with a Latin American lithium focus. Although it did engage Ernst and Young as an auditor the other day, which we’re guessing is some sort of validation for something important.

• Energy Resources of Australia (ASX:ERA) : +10% on no fresh news.

NOT THE ASX

As Eddy and Gregor reported this morning and at lunch, Wall Street types were in decent high-fiving form overnight, as, you guessed it, techie things staged another mini rally.

“The S&P 500 rose by +0.7% and tech heavy Nasdaq by +1.06% as bank stocks led US bourses higher,” wrote Eddy.

Banks you say? That’s right – Bank of America (which, incidentally is one of the most crypto-friendly banks around in the US of A, and in fact anywhere) notched roughly a 4.5% gain based on a decent Q2 earnings report, while Morgan Stanley fared even better with +6.5% and Charles Schwab (another Bitcoin/institutional crypto sniffer) flayed them both, with a 12.5% pump.

Oh, as for the tech stuff, Eddy noted: “Most AI (artificial intelligence) related stocks also rallied overnight, including Nvidia and Microsoft.”

Even my eldest son texted me from his high school with: “Dad, are you invested in AI?” To which I, disappointingly replied: “Yeah… but just a little bit in some of the crypto AI stuff such as FET and AGIX. Which had pumps a while back. Actually, I’ll just see how they’re going… Hmm, look, let’s just drop it and talk about basketball, okay?”

Onto Asian markets. How are those tracking? Not wonderfully over in China and Hong Kong, although Japan’s tracking decently:

• Shanghai Comp: -0.37%

• Hang Seng: -2.05%

• Nikkei: +0.32%

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 1,321,393 | $15,642,574 |

| PEC | Perpetual Res Ltd | 0.015 | 36% | 2,475,049 | $6,000,324 |

| 1ST | 1St Group Ltd | 0.008 | 33% | 4,067,277 | $8,501,947 |

| TAS | Tasman Resources Ltd | 0.008 | 33% | 656,973 | $4,276,016 |

| AYT | Austin Metals Ltd | 0.009 | 29% | 590,000 | $7,111,123 |

| CVR | Cavalierresources | 0.15 | 25% | 35,730 | $3,819,470 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | 35,800 | $6,605,136 |

| IEC | Intra Energy Corp | 0.005 | 25% | 6,940,428 | $6,483,126 |

| ME1 | Melodiol Glb Health | 0.01 | 25% | 8,613,990 | $21,508,430 |

| MTB | Mount Burgess Mining | 0.005 | 25% | 35,732,918 | $3,532,684 |

| OPN | Oppenneg | 0.01 | 25% | 4,051,861 | $1,940,240 |

| ROO | Roots Sustainable | 0.005 | 25% | 42,994 | $554,889 |

| DRO | Droneshield Limited | 0.375 | 23% | 12,288,749 | $179,005,601 |

| IPD | Impedimed Limited | 0.225 | 22% | 23,178,739 | $373,474,588 |

| YAR | Yari Minerals Ltd | 0.017 | 21% | 1,838,130 | $6,753,009 |

| 1CG | One Click Group Ltd | 0.018 | 20% | 3,572,520 | $9,211,063 |

| SLM | Solismineralsltd | 0.66 | 18% | 3,973,101 | $35,286,341 |

| AQX | Alice Queen Ltd | 0.02 | 18% | 512,632 | $2,150,752 |

| GBZ | GBM Rsources Ltd | 0.021 | 17% | 409,500 | $11,087,301 |

| IPT | Impact Minerals | 0.0175 | 17% | 22,058,039 | $42,670,558 |

| ATH | Alterity Therap Ltd | 0.007 | 17% | 460,151 | $14,639,386 |

| AUZ | Australian Mines Ltd | 0.028 | 17% | 1,357,554 | $15,691,737 |

| PRX | Prodigy Gold NL | 0.007 | 17% | 51,129 | $10,506,647 |

| SRZ | Stellar Resources | 0.014 | 17% | 2,763,742 | $12,071,571 |

| TGM | Theta Gold Mines Ltd | 0.1 | 16% | 726,384 | $60,206,451 |

Some standouts:

• Carnegie Clean Energy (ASX:CCE): +50% on no fresh news specifically today that we can see, other than catching a nice breaker on the rolling Energy sector waves today.

• Perpetual Resources (ASX:PEC): +36% > As we note further below in Trading Halts, there’s an announcement on its way from the company regarding a potential acquisition. Meanwhile, Reubs has noted the following:

“PEC is chipping away at its flagship 137Mt Beharra silica sands project 300km north of Perth.

“A painfully slow environmental approvals process – thanks to “extended Government processing delays” – is now in its final stages.”

Reuben also has some good intel on Theta Gold Mines (ASX:TGM), which is up 16.28% today at close.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AJQ | Armour Energy Ltd | 0.002 | -33% | 8,761,186 | $14,764,026 |

| VPR | Volt Power Group | 0.001 | -33% | 13,296,733 | $16,074,312 |

| PEN | Peninsula Energy Ltd | 0.1325 | -26% | 27,314,763 | $226,269,001 |

| AXP | AXP Energy Ltd | 0.0015 | -25% | 898,301 | $11,649,361 |

| DOU | Douugh Limited | 0.006 | -25% | 3,893,632 | $7,871,187 |

| KNM | Kneomedia Limited | 0.003 | -25% | 142,818 | $6,019,141 |

| MCT | Metalicity Limited | 0.0015 | -25% | 1,018,679 | $7,472,172 |

| YPB | YPB Group Ltd | 0.003 | -25% | 237,333 | $2,973,846 |

| DSE | Dropsuite Ltd | 0.28 | -24% | 27,043,734 | $256,313,341 |

| WSR | Westar Resources | 0.029 | -22% | 19,506,617 | $6,858,228 |

| FGL | Frugl Group Limited | 0.011 | -21% | 613,363 | $13,384,868 |

| ZEU | Zeus Resources Ltd | 0.017 | -19% | 10,181,044 | $9,644,901 |

| AHN | Athena Resources | 0.005 | -17% | 318,900 | $6,422,805 |

| BP8 | Bph Global Ltd | 0.0025 | -17% | 1,483,474 | $4,004,189 |

| CCO | The Calmer Co Int | 0.0025 | -17% | 1,300,000 | $1,692,233 |

| SFG | Seafarms Group Ltd | 0.005 | -17% | 59,271 | $29,019,595 |

| TMX | Terrain Minerals | 0.005 | -17% | 14,669,214 | $6,499,196 |

| WHK | Whitehawk Limited | 0.032 | -16% | 2,198,877 | $9,749,302 |

| LML | Lincoln Minerals | 0.011 | -15% | 8,790,426 | $18,469,254 |

| ARD | Argent Minerals | 0.012 | -14% | 2,893,481 | $16,505,737 |

| EXL | Elixinol Wellness | 0.012 | -14% | 170,238 | $6,397,879 |

| FFT | Future First Tech | 0.006 | -14% | 23,540,405 | $5,003,856 |

| MOH | Moho Resources | 0.012 | -14% | 542,733 | $3,634,089 |

| AUE | Aurumresources | 0.125 | -14% | 55,000 | $3,625,000 |

| SVG | Savannah Goldfields | 0.091 | -13% | 108,550 | $20,564,086 |

LAST ORDERS

Pursuit Minerals (ASX:PUR), a $36.49m market capped Aussie explorer focused on PGE-nickel-copper, lithium and gold projects, is having a good day on the bourse (+7.69%) at time of writing.

So let’s dig into that a little deeper here.

The company has made an announcement today regarding “firm commitments” it’s received from high-level investors for a $3 million placement of approximately 250m PUR shares at A$0.012 per unit. And that, is for the intention of raising funds for the company’s Rio Grande Sur lithium project.

And what’s the upshot of said firm commitments? Overwhelming interest it seems, with an oversubscription in the $3m placement which was quickly completed.

Essentially that means Pursuit is now locked and loaded to:

• pursue its initial drilling campaign at the Rio Grande Sur project (“which is expected to culminate in a maiden JORC resource), and

• finalise the acquisition of a lithium carbonate pilot plant located in Salta, Argentina, with initial brine processing anticipated over the course of H2 2023.

The ultimate objective is to produce technical and battery-grade lithium carbonate. And, with these factors in place, Pursuit expects to become the next big lithium carbonate producer on the ASX. Watch this space.

De Grey Mining (ASX:DEG), a gold explorer in WA’s Pilbara Craton, has made an executive announcement of note today. Or should we say, non-executive.

“Effective today, Executive Technical Director Andy Beckwith has transitioned from his executive role to Non-Executive Director where he will continue to be a leader in the company” said the company, which continues to ramp up its Pilbara gold ambitions.

Beckwith is noted for having led the geological team that discovered the Hemi gold mineralisation hot spot in the Pilbara, alongside two of his colleagues – General Manager Exploration Phil Tornatora and General Manager Business Development Allan Kneeshaw.

De Grey Chairman, Simon Lill, commented: “Without Andy’s leadership it’s unlikely De Grey would be in the fortunate position we are today, so we’re extremely grateful for his efforts and hard work.

“To be able to retain Andy’s knowledge and experience on the Board as a Non-Executive Director is tremendously valuable. He will continue to be a committed steward of De Grey and our Pilbara Gold Project.”

And lastly, Tasman Resources (ASX:TAS) is providing a loan to Eden Innovations (ASX:EDE) for a US-secured debt extension.

Tasman is a Perth-based Aussie explorer with a focus on gold, silver, copper, zinc, lead, nickel, uranium and probably more of the periodic table to boot, while Eden Innovations produces and sells a high-performance concrete admixture, EdenCrete and retrofits dual fuel technology, OptiBlend, for diesel generator sets.

Further details regarding the debt extension are scant, unreleased, at present. But we can tell you the market likes the look of TAS today, which had registered a 33.33% gain at the time of writing.

Anything else going on? Of course, but for more, we suggest you check out Em’s arvo column: In Case You Missed It.

Oh, and then there’s this, too…

TRADING HALTS

Tymlez (ASX:TYM) – Capital raising.

Black Canyon (ASX:BCA) – Capital raising.

Botanix Pharmaceuticals (ASX:BOT) – Capital raising and a pending announcement regarding a royalty acquisition.

PolarX (ASX:PXX) – Capital raising.

Energy Transition Minerals (ASX:ETM) – Pending an announcement on the lodgment of a Statement of Claim with an arbitration tribunal in Copenhagen.

Greenwing Resources (ASX:GW1) – Pending an announcement regarding the company’s funding arrangements. This halt could last as long as the commencement of trading on Friday, Greenwing advised.

Gold Mountain (ASX:GMN) – Capital raising.

Top Shelf International Holdings (ASX:TSI) – Capital raising.

Perpetual Resources (ASX:PEC) – Pending an announcement regarding a potential acquisition.

At Stockhead we tell it like it is. While Pursuit Minerals and De Grey Mining are Stockhead advertisers, they did not sponsor this article.

The post Closing Bell: ASX 200 reverses form slump with 0.55pc gain; sand stock Perpetual flies ahead of ‘potential acquisition’ appeared first on Stockhead.