Uncategorized

Closing Bell: ASX 200 drooped on retail sales volume dip; but at least Loyal Lithium pumped

The ASX 200 extended its losses from yesterday. Thanks, ABS data, thanks Wall Street. … Read More

The post Closing Bell: ASX 200 drooped on retail…

- The ASX 200 extended its losses from yesterday. Thanks, ABS data, thanks Wall Street

- Generalising, it was a bloodbath across the sectors, apart from a valiant effort from Telcos

- Standout small caps: Loyal Lithium, Advance Metals, Stellar Resources

Things continued to go a bit pear-shaped for the ASX 200 today, after a brief hit of hopium and RBA-pausing positivity the other day.

There’s a fresh reason for that, as well as not-so-fresh reasoning, the latter namely an extension of yesterday’s reaction to Wall Street’s sell-off after the US credit rating was downgraded an ‘A’ by Fitch Ratings.

As the old saying goes, when Wall Street sneezes, the rest of the world catches a cold, after wiping away a mixture of sprayed snot and cocaine.

The US markets have done it again. As Eddy and Gregor reported earlier today, sharp US falls on interest rate jitters have roiled the day once again.

The Fitch downgrade also pummelled sentiment in equities, wrote Eddy’n’Gregor, pushing the VIX (also called the fear index) higher by more than 15%, and sparking a selloff in Treasuries that sent 10-year yields to the highest levels since November.

And the fresh ingredient added to the mix? Retail sales volume. The ABS released data today on the volume of retail sales for the June quarter. Measured by GDP, it’s an important metric for determining economic growth.

Here’s a tweet from the ABS that goes into it in detail…

In case you missed it, here’s one of our top posts from July!! Which movie was your favourite? #ABSICMYI pic.twitter.com/UabRSEx3Gv

— Australian Bureau of Statistics (@ABSStats) August 3, 2023

Hang on, wrong tweet. Here it is…

For the first time since 2008, retail sales volumes have recorded three consecutive quarterly volumes falls.

For more, visit https://t.co/asHaG1Z17M pic.twitter.com/7GXyTi7xPc

— Australian Bureau of Statistics (@ABSStats) August 3, 2023

A 0.5% decline in the figure in the June quarter has some today calling the situation a “deep retail recession”.

The precedent for that frank assessment was a 0.8% dump in the March quarter of 2023 and a 0.4% dip in the December quarter of 2022.

Per a report in The Australian, “It’s the first time since 2008 that retail sales volumes have recorded three consecutive quarterly falls. Retail sales volumes fell 1.4 per cent on-year”.

“The widespread fall in sales volumes reflects what retailers have been telling us about consumers focusing on essentials, buying less or switching to cheaper brands,” said ABS head of retail statistics, Ben Dorber.

Analysts had largely predicted something like this, but the market still didn’t dig it. What wasn’t perhaps anticipated, was Australia’s June trade surplus falling to $11.32bn versus $10.75bn expected.

TO MARKETS

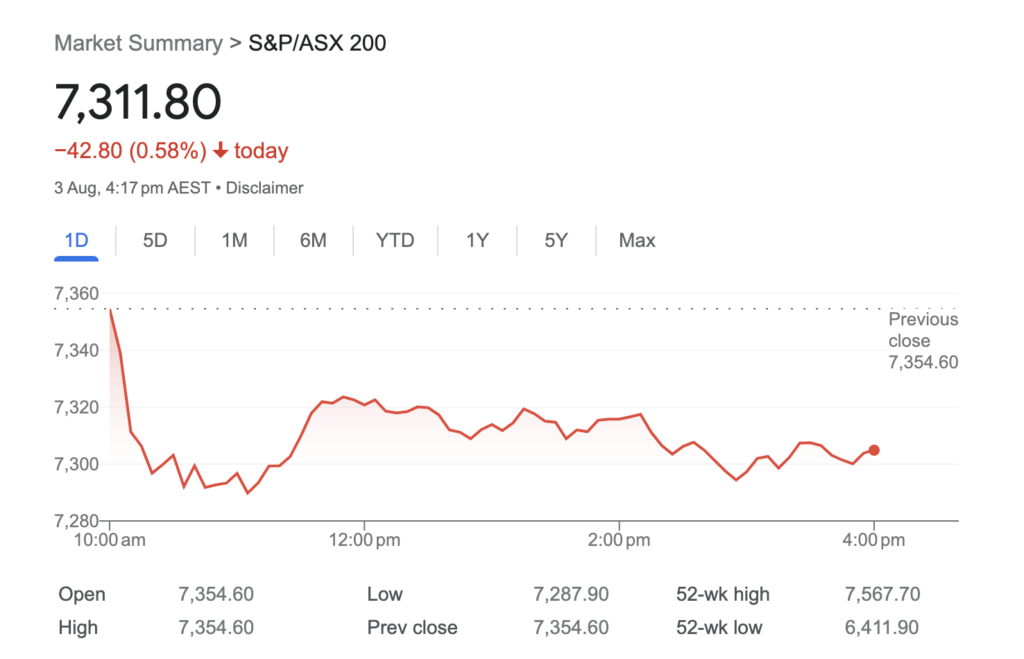

The ASX 200 formed a perfect “Deeply Hungover Person Attempts to Write Signature But Predictably Falls Over Instead” formation on the charts today.

And that comes, too, after the market felt particularly dusty yesterday after partying hard on RBA pause day on Tuesday.

Zooming in a little tighter to the sectors, and it’s another step-laddered tale of woe. After a valiant attempt to hold up the bourse yesterday, IT wilted in a big way, leading today’s losses, with Materials and Financials sheepishly pulling in just behind.

Telcos? Well done – an early mark for you.

A couple of specific standouts having a half-decent day at least in the mid-larger end of Bourse City, before we take you to ASX Small Caps Funky Town, further below…

Winning:

• Calix (ASX:CXL): +5.6% > The environmental tech company has made a final investment decision to progress the construction and operation of a Mid-Stream Demonstration Plant at the joint venture Pilgangoora Operation between Pilbara Minerals Limited and Calix Limited.

The project aims to demonstrate the benefits of producing a mid-stream lithium-enriched product using Calix’s patented electric kiln technology.

• Winton Land (ASX:WTN): +8.9% on no fresh news today for the residential land developer.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LLI | Loyal Lithium Ltd | 0.55 | 72% | 11,117,395 | $21,596,800 |

| EEL | Enrg Elements Ltd | 0.005 | 67% | 24,700,054 | $3,027,703 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 1,829,995 | $15,642,574 |

| CLE | Cyclone Metals | 0.0015 | 50% | 1,743,472 | $10,264,505 |

| FGL | Frugl Group Limited | 0.016 | 45% | 1,106,889 | $10,516,682 |

| W2V | Way2Vatltd | 0.022 | 38% | 3,767,573 | $10,045,964 |

| BNZ | Benzmining | 0.55 | 38% | 1,139,880 | $43,969,990 |

| OKJ | Oakajee Corp Ltd | 0.02 | 33% | 25,000 | $1,371,690 |

| ECG | Ecargo Hldg | 0.05 | 28% | 270,665 | $23,994,750 |

| EQN | Equinoxresources | 0.15 | 25% | 382,507 | $5,400,000 |

| HYD | Hydrix Limited | 0.037 | 23% | 585,451 | $7,626,565 |

| TMB | Tambourahmetals | 0.32 | 22% | 1,575,593 | $11,095,666 |

| PAM | Pan Asia Metals | 0.28 | 22% | 227,568 | $35,825,130 |

| BXN | Bioxyne Ltd | 0.018 | 20% | 5,000 | $28,524,681 |

| S3N | Sensore Ltd | 0.3 | 20% | 29,850 | $7,989,433 |

| LML | Lincoln Minerals | 0.006 | 20% | 1,073,196 | $7,103,559 |

| CUS | Coppersearchlimited | 0.31 | 19% | 141,520 | $13,726,673 |

| DC2 | Dctwo | 0.027 | 17% | 85,563 | $3,006,470 |

| MZZ | Matador Mining Ltd | 0.07 | 17% | 313,686 | $18,921,542 |

| AJL | AJ Lucas Group | 0.014 | 17% | 270,879 | $16,508,756 |

| AVM | Advance Metals Ltd | 0.007 | 17% | 40,204,184 | $3,531,352 |

| HLX | Helix Resources | 0.007 | 17% | 9,567,778 | $13,938,875 |

| MEL | Metgasco Ltd | 0.014 | 17% | 121,783 | $12,766,641 |

| SRZ | Stellar Resources | 0.014 | 17% | 1,090,215 | $12,071,571 |

| ASQ | Australian Silica | 0.072 | 16% | 347,446 | $17,462,943 |

• We noted it before (twice) and we’re highlighting it here again in Closing Bell. Loyal Lithium is the small caps leader today. Here’s a reprise from earlier in the day:

Freshly relisted Loyal Lithium (after a four-month trading halt) is leading the resources pack this morning, with news it’s initiated a comprehensive exploration program at its recently acquired Hidden Lake project in lithium-rich Canada.

The Hidden Lake project is in the emerging Yellowknife Lithium Belt in the glacial, northwest part of the country.

Some 315 untested individual pegmatite outcrops have been by the company identified via high-resolution satellite imagery.

These, Loyal Lithium notes, are in addition to four other main spodumene-rich dykes, which have a drill and channel tested cumulative strike length of 2,250m and remain open along strike and depth.

• Advance Metals (ASX:AVM) is up on the confirmation of high-grade copper potential at the Augustus project in Arizona. the company reports that XRF sample results demonstrated copper grades as high as 20.47% Cu.

A large area for potential copper ore has been identified through drone-supported ground surveys, geological field reconnaissance, satellite analysis, and geochemical surveys.

• Meanwhile, Stellar Resources (ASX:SRZ) has some copper-based news of its own, intersecting a broad copper-bearing stockwork zone at the North Scamander prospect in north-east Tasmania.

The discovery confirms the presence of a significant hydrothermal system at depth under the site’s historic drilling locations.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SVR | Solvar Limited | 1.12 | -36% | 10,960,652 | $362,952,249 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 10,968,261 | $8,737,021 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 323,750 | $9,221,169 |

| AYM | Australia United Min | 0.003 | -25% | 547,872 | $7,370,310 |

| KPO | Kalina Power Limited | 0.007 | -22% | 5,281 | $13,636,762 |

| ERW | Errawarra Resources | 0.081 | -18% | 1,401,839 | $5,989,896 |

| BOD | BOD Science Ltd | 0.09 | -18% | 476,711 | $16,843,364 |

| CTQ | Careteq Limited | 0.025 | -17% | 602,583 | $3,604,246 |

| KGD | Kula Gold Limited | 0.015 | -17% | 253,614 | $6,717,815 |

| ZMM | Zimi Ltd | 0.025 | -17% | 1,215,458 | $3,344,847 |

| MXC | Mgc Pharmaceuticals | 0.0025 | -17% | 2,289,998 | $11,677,079 |

| SGC | Sacgasco Ltd | 0.005 | -17% | 302,454 | $4,641,496 |

| TMX | Terrain Minerals | 0.005 | -17% | 327,372 | $6,499,196 |

| VMM | Viridismining | 0.455 | -16% | 912,040 | $16,852,859 |

| BSN | Basinenergylimited | 0.11 | -15% | 3,140 | $7,803,901 |

| AIS | Aeris Resources Ltd | 0.23 | -15% | 23,390,318 | $186,555,311 |

| ADY | Admiralty Resources. | 0.006 | -14% | 55,165 | $9,125,054 |

| RIM | Rimfire Pacific | 0.006 | -14% | 500,000 | $14,036,713 |

| BCT | Bluechiip Limited | 0.019 | -14% | 605,970 | $15,700,750 |

| VAR | Variscan Mines Ltd | 0.013 | -13% | 27,705 | $5,070,054 |

| RXM | Rex Minerals Limited | 0.2175 | -13% | 6,073,046 | $148,196,897 |

| BIR | BIR Financial Ltd | 0.068 | -13% | 357 | $22,353,699 |

| CAZ | Cazaly Resources | 0.034 | -13% | 481,800 | $14,661,561 |

| ELE | Elmore Ltd | 0.007 | -13% | 1,728,166 | $11,195,071 |

| KTA | Krakatoa Resources | 0.028 | -13% | 3,718,801 | $13,644,051 |

LAST ORDERS

I’d like to pretend I wrote this section. So I will. But you should probably know that Gregor “I Wrote this Section” Stronach kindly did so instead…

First cab off the rank for Last Orders today is some happy ATO news for Venture Minerals Limited (ASX:VMS), after the tax office’s leg-breakers took some time away from harassing law-abiding citizens to deliver a $0.45 million cheque under the R&D Tax Incentive Program for the financial year ended 30 June 2022.

Venture says that company has incurred “significant R&D expenditure on metallurgical testwork and studies” at the Mount Lindsay tin-tungsten project in Tasmania during the subsequent financial year, so it’ll be lodging a claim for a follow-up rebate later in the year, while it spends its windfall on upcoming metallurgical test work on the tin-rich borates over the next 12 months.

Meanwhile, Shine Lawyers (ASX:SHJ) has announced an update from the end of a very lengthy legal road, after a class action lawsuit against Johnson & Johnson Medical Ethicon Sàrl and Ethicon, Inc was settled for $300 million.

The lawsuit, which has been playing out in court for more than 10 years, was brought over claims that the companies concealed the risks to patients of Ethicon’s pelvic mesh products, until a final judgement was handed down on concealing the risks of Ethicon’s pelvic mesh products.

The result was announced on 16 March of this year, following which Shine sought to have the court determine orders with respect to the distribution of the settlement fund.

Shine says that for the duration of the legal action, which it conducted on a “no win, no fee” basis, the company bore all costs involved, “including the disbursements payable to third parties”.

The longer that dragged on, and the larger the disbursements became, those costs necessitated a loan in order to keep the entire process funded. Those loans, in turn, attracted sizable quantities of interest, which Shine sought to have included in its slice of the settlement pie.

That application was dismissed today by the court, “without dismissing the opportunity to make another application in relation to the same subject matter”, leaving Shine to have another bite at the cherry sometime down the track.

Meanwhile, a determination in relation to the amount which can be deducted from the Settlement Fund for Shine Lawyers’ professional fees for the Class Actions is expected in the first half of FY24.

TRADING HALTS

Felix Group (ASX:FLX) – Capital raising.

Titan Minerals (ASX:TTM) – Capital raising.

Orange Minerals (ASX:OMX) – Pending news of an acquisition.

Cosol (ASX:COS) – Capital raising.

Alicanto Minerals (ASX:AQI) – Capital raising.

Mont Royal Resources (ASX:MRZ) – Capital Raising.

Poseidon Nickel (ASX:POS) – Capital raising.

Advent Health (ASX:AH1) – An announcement is coming regarding a material licence transaction.

The post Closing Bell: ASX 200 drooped on retail sales volume dip; but at least Loyal Lithium pumped appeared first on Stockhead.