Uncategorized

CLOSING BELL: Another red day on the ASX as Fed eyes ‘mild recession’ and big miners dip

S&P/ASX 200 closes well in the red today: -1.24% after US stocks dipped on the back of Fed FOMC minutes … Read More

The post CLOSING BELL: Another…

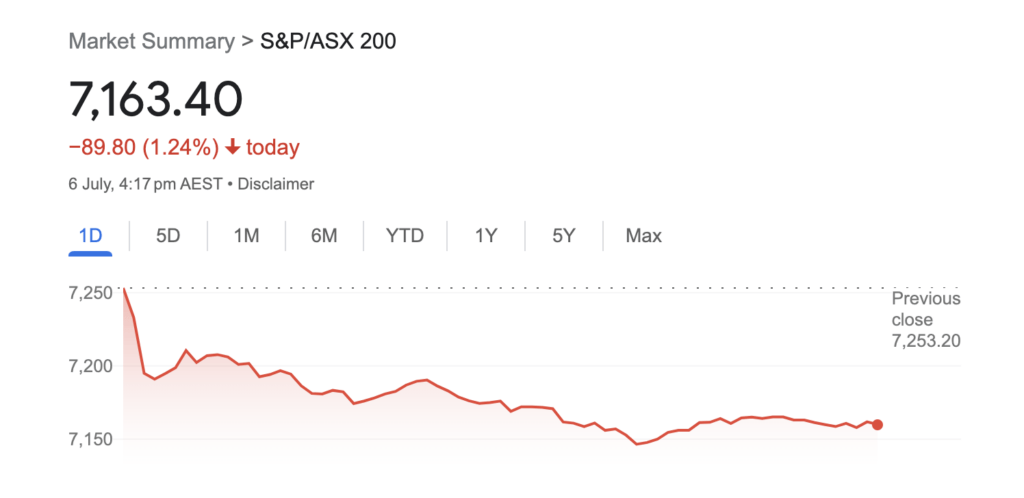

- S&P/ASX 200 closes well in the red today: -1.24% after US stocks dipped on the back of Fed hawkishness

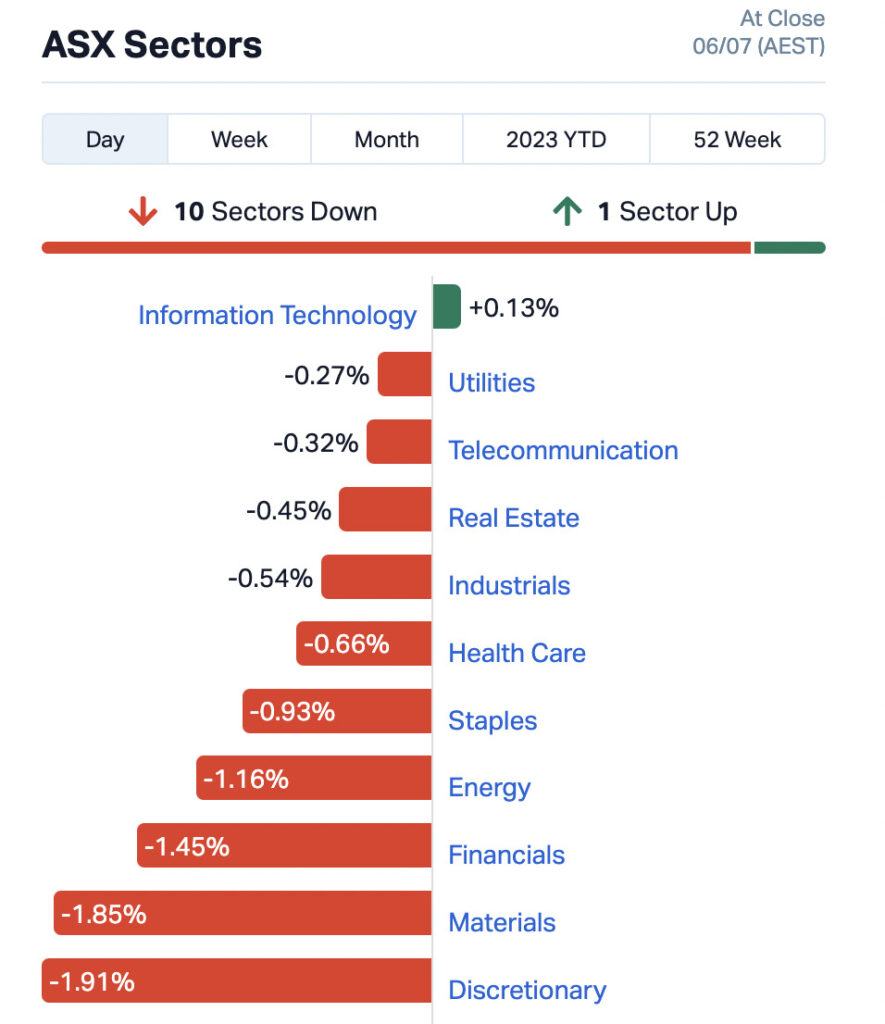

- Sectors-wise, IT was the only group finishing vaguely in the green, with Materials Discretionary and Financials stocks largely hammered

- Standout stocks in the lower caps, at least: PEB, XTC, RGS

Yesterday, about this time, we suggested the ASX 200 seemed aimless with no US stock markets to copy on July 4. Well, it turns out we were better off with a temporarily closed Wall Street.

Was it only about a week ago when the US Federal Reserve boss Jerome Powell said the following regarding recession this year? “Not the most likely case, though it is possible.” Yes, he did, is the answer.

Translation: Recession Confirmed

A recession “is not the most likely case,” though it is possible, Fed Chair Powell said at the ECB Forum.

— Wall Street Silver (@WallStreetSilv) June 28, 2023

Although the Fed did also indicate in April that a “mild recession” in H2 is probable.

Well, after a rates pause in June that supposedly not all members agreed with, the Fed is back on its April line of thinking again, pivoting mid-innings like a Ben Stokes special. [Ed: Wait, you’re praising an English cricketer now? Cease that immediately.]

Here, straight from the Fed horse’s mouth: “(Internal economists at the bank are) continued to assume that the effects of the expected further tightening in bank credit conditions, amid already tight financial conditions, would lead to a mild recession starting later this year, followed by a moderately paced recovery.”

Hmm, insert Dumb and Dumber Jim Carrey gif here. You know the one: “So… you’re telling me there’s a chance? Yeeeahhhhh!”

FOMC Minutes: Staff Still See Mild Recession Later This Year.

*keep expanding those multiples

— Sven Henrich (@NorthmanTrader) July 5, 2023

As Eddy “Market Highlights” Sunarto noted earlier in the day:

“Overnight, both the S&P 500 and Nasdaq closed -0.2% lower following the release of the June Fed Reserve meeting minutes. The minutes indicated that FOMC members wanted to hike the Fed Funds rate in June before deciding to keep it at 5%-5.25%.

“Analysts believe the upcoming CPI report on July 12 will determine whether or not the Fed will hike in July.”

Interest rates to remain higher for longer, then, apparently. And it didn’t need a soothsayer, Paul the Octopus or even Eddy (although he’s brilliant) to tell you that the ASX 200 was always likely to have a very ordinary day on the back of Fed hawkishness – and so it played out for the day’s entirety on the local bourse (see a bit further below).

Okay. A coupla newsy bits, before we dig slightly deeper:

• Magellan Financial Group, the Aussie-based funds managing big gun, has suffered another large outflow of funds under management, reports David Rogers of The Australian. Its total net reduction is now $21.6bn over the past year.

• Major mining stocks are down today. Sentiment has apparently soured for iron ore futures, according to another report from The Aus – falling as China’s property debt crisis rears its ugly head again. BHP – down 2.5% at time of writing, while Fortescue (-1.5%) and Rio Tinto (-1.9%) also had a less-than-passable day on the bourse.

TO MARKETS

Redder than Jonny Bairstow’s face after that dozy stumping dismissal – that’s how the ASX 200, and every single sector bar one – wound up again today.

[Ed: That’s better, although you made that crack yesterday. But I’ll allow it as it’s still topical.]

The local bourse, for the same reasons already explained further above, by Eddy this morning, and by Gregor at lunch, has closed like this: a very disappointing -1.24%.

Here’s the worm that slid deeper and deeper into a hole:

Sectors-wise, InfoTech is the only thing holding today’s innings together. Let’s hope the others can put together a few decent partnerships tomorrow.

Materials (see big miners above) really brought the bourse down today, but Discretionary, Financials, Energy and Staples stocks hardly covered themselves in glory, either.

Here’s how it looks.

Before we move on to the BIG winners of the day in small caps, in the slightly larger end of market cap town, we’re seeing…

… not bloody much in terms of gains at all. But here, this is the best we can muster:

• A2 Milk (ASX:A2M): +0.3% on no news at all. Other than the fact A2 milk is a decent source of protein. Which is good for you.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PEB | Pacific Edge | 0.175 | 101% | 4,183,878 | $70,501,774 |

| XTC | Xantippe Res Ltd | 0.002 | 100% | 20,834,829 | $11,480,100 |

| RGS | Regeneus Ltd | 0.015 | 67% | 1,379,355 | $2,757,932 |

| CCO | The Calmer Co Int | 0.003 | 50% | 2,850,062 | $889,555 |

| KEY | KEY Petroleum | 0.0015 | 50% | 104 | $1,967,928 |

| ALM | Alma Metals Ltd | 0.014 | 40% | 10,009,960 | $11,040,008 |

| AYT | Austin Metals Ltd | 0.007 | 40% | 2,166,985 | $5,079,373 |

| DDT | DataDot Technology | 0.004 | 33% | 1,070,080 | $3,632,858 |

| ELE | Elmore Ltd | 0.008 | 33% | 3,737,000 | $8,396,303 |

| TYM | Tymlez Group | 0.004 | 33% | 5,528,600 | $3,276,586 |

| TTM | Titan Minerals | 0.07 | 32% | 7,086,199 | $74,797,479 |

| R8R | Regener8Resourcesnl | 0.21 | 31% | 320,479 | $4,105,000 |

| EPM | Eclipse Metals | 0.018 | 29% | 5,572,080 | $28,392,837 |

| JPR | Jupiter Energy | 0.023 | 28% | 16,390 | $22,137,302 |

| CVR | Cavalierresources | 0.14 | 27% | 41,840 | $3,501,181 |

| TMB | Tambourahmetals | 0.14 | 27% | 2,034,133 | $4,531,186 |

| CRR | Critical Resources | 0.053 | 26% | 135,291,504 | $66,979,705 |

| OAK | Oakridge | 0.1 | 25% | 20,033 | $1,375,654 |

| ROO | Roots Sustainable | 0.005 | 25% | 121,066 | $554,889 |

| WFL | Wellfully Limited | 0.005 | 25% | 100,000 | $1,971,777 |

| SBM | St Barbara Limited | 0.3025 | 24% | 49,024,692 | $199,363,622 |

| TRU | Truscreen | 0.026 | 24% | 150,000 | $8,749,482 |

| NRX | Noronex Limited | 0.016 | 23% | 201,746 | $3,281,739 |

| SGQ | St George Min Ltd | 0.049 | 23% | 5,373,149 | $33,620,422 |

| CYP | Cynata Therapeutics | 0.14 | 22% | 803,344 | $20,657,655 |

Some standouts:

• Pacific Edge (ASX:PEB): +101% > As reported at lunch by Gregor, this local cancer diagnostics company is on a comeback-trail tear today partly thanks to two other companies, Novitas and First Coast granting a stay of execution on US Medicare’s local Coverage Determination – a policy that would have had a terminal effect on an important PEB product – the genomic biomarker Cxbladder test for bladder cancer. What happens next? Not exactly sure, but it’s good news today, at least.

• Xantippe Resources (ASX:XTC): +100% on no apparent fresh news for the WA precious metals explorer that’s readily noticeable at the time of writing.

• Regeneus (ASX:RGS): +67% > This local health tech stock is up for absolutely no reason that we could figure out earlier in the day, or now. And, as it turns out, the company has no clue why, either, stating:

“The Company has no explanation as to why there has been a price and volume change in the trading of the Company’s securities.”

• The Calmer Co International (ASX:CCO): +50%… also on no news of note. But at least we’re seeing some success stories today, no matter how dubiously informed some of those narratives might appear to be at a first or second glance.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MHI | Merchant House | 0.032 | -36% | 127,258 | $4,713,325 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 1,060,933 | $8,737,021 |

| CLE | Cyclone Metals | 0.001 | -33% | 1,934,096 | $15,396,757 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 1,288,456 | $9,221,169 |

| TD1 | Tali Digital Limited | 0.001 | -33% | 3,810 | $4,942,733 |

| OPN | Oppenneg | 0.007 | -22% | 2,640,392 | $2,182,770 |

| TEE | Topendenergylimited | 0.165 | -21% | 56,671 | $9,352,875 |

| BP8 | Bph Global Ltd | 0.002 | -20% | 962,981 | $3,211,824 |

| EMU | EMU NL | 0.002 | -20% | 207 | $3,625,053 |

| GTG | Genetic Technologies | 0.002 | -20% | 151,721 | $28,854,145 |

| RMX | Red Mount Min Ltd | 0.004 | -20% | 161,188 | $11,359,255 |

| TAL | Talius Group Limited | 0.009 | -18% | 273,111 | $25,065,033 |

| FG1 | Flynngold | 0.053 | -17% | 435,630 | $8,697,327 |

| LER | Leaf Res Ltd | 0.015 | -17% | 764,412 | $37,116,700 |

| CHK | Cohiba Min Ltd | 0.0025 | -17% | 965,913 | $6,339,733 |

| GFN | Gefen Int | 0.005 | -17% | 110,106 | $408,601 |

| MTB | Mount Burgess Mining | 0.005 | -17% | 46,454,107 | $5,299,027 |

| ATV | Activeportgroupltd | 0.096 | -17% | 354,171 | $20,304,104 |

| AJQ | Armour Energy Ltd | 0.003 | -14% | 5,875,033 | $17,224,697 |

| IVX | Invion Ltd | 0.006 | -14% | 1,461,438 | $44,951,425 |

| MOM | Moab Minerals Ltd | 0.012 | -14% | 1,059,829 | $9,547,489 |

| GTE | Great Western Exp. | 0.031 | -14% | 114,875 | $9,097,132 |

| IMI | Infinitymining | 0.13 | -13% | 132,996 | $11,471,748 |

| HYD | Hydrix Limited | 0.028 | -13% | 10,041 | $8,135,003 |

| LSA | Lachlan Star Ltd | 0.007 | -13% | 700,529 | $10,552,102 |

LAST ORDERS

“Hey Gregor, how’s it go…”

“Yes, yes, Robert. I’ll help out with Last Orders. Again. Sigh…”

“ Zeus Resources (ASX:ZEU) has issued a mea culpa to the ASX on behalf of one of its directors, Colin Mackay, after an Appendices 3Y transaction disclosure lodged by the company on 10 March showed that Mackay bought a bunch of Zeus stock when he wasn’t allowed to.

Mackay bought the securities in two bundles – one each on 03 and 09 March – just days before Zues dropped its half-year results on 15 March, in breach of the market’s Blackout Period rule, which states in-part:

“In addition to the prohibitions on insider trading set out in the Corporations Act, the Company requires that directors, officers, employees and contractors, must not trade in the Company’s securities during the period:

(i) in the 2 weeks prior to the release of the Company’s Quarterly Results or Half Year Results;”

So, yeah… that’s a clear breach.

But it appears that this is likely to have a happier ending than you’d be forgiven for expecting, as Zeus has written to the ASX to claim that the transactions took place due to a misunderstanding on Mackay’s part around the timing of the company’s HY results.

Additionally, it was a small “rounding up” level quantity of stock, and that Mackay was “not in possession of any inside information at the time of the transactions”.

For what it’s worth, Zeus notes that the company was trading lower for about 2 months in the wake of the HY results announcement and transactions, and that Mackay “did not sell any securities under the Transactions and has not sold any securities in the Company since the Transactions”.

In short: Mackay got his dates mixed up, bought a small number of securities to round up his holdings, and in any case, the price dropped and he didn’t sell anything, so it’s not like he made any money from it”.

No word from the ASX just yet on whether the explanation is going to fly, but it does look like (from Zeus’ explanation) that it’s an honest mistake. If anything changes, we’ll let you know. “

“Thanks Gregor. And now for a couple of other topline bits and pieces…”

• Hammer Metals (ASX:HMX) has announced it’s acquired the Mt Dorothy copper-REE and Cobalt Ridge projects, or at least an 80% stake in them. They’re two critical minerals operations in the Mt Isa region.

Mount Dorothy, in particular, is a copper-heavy, rare-earth element and yttrium prospect.

• Opyl (ASX:OPL), a biopharma and health development firm, has announced some senior management changes. Dr Hugo Stephenson joins to lead the Opin (clinical trial recruitment platform) division, Michelle Gallaher moves to General Manager of TrialKey and Mark Ziirsen steps in as the Executive Chairman.

TRADING HALTS

Lumos Diagnostics (ASX:LDX) – Capital raising.

Krakatoa Resources (ASX:KTA) – Capital raising.

Note: regarding the following two, their trading halts from yesterday have been lifted after the resolution of a “technical issue with the dissemination of the iNAV” tech. Alphinity Global Equity Fund (ASX:XAL); Alphinity Global Sustainable Equity Fund (ASX:XAS).

The post CLOSING BELL: Another red day on the ASX as Fed eyes ‘mild recession’ and big miners dip appeared first on Stockhead.