Uncategorized

Burley’s bulking up in Quebec, acquiring Chubb lithium play near Sayona’s NAL operation

Special Report: Burley’s move to make a strategic acquisition in Quebec, a world-class lithium province which hosts major projects operated … Read…

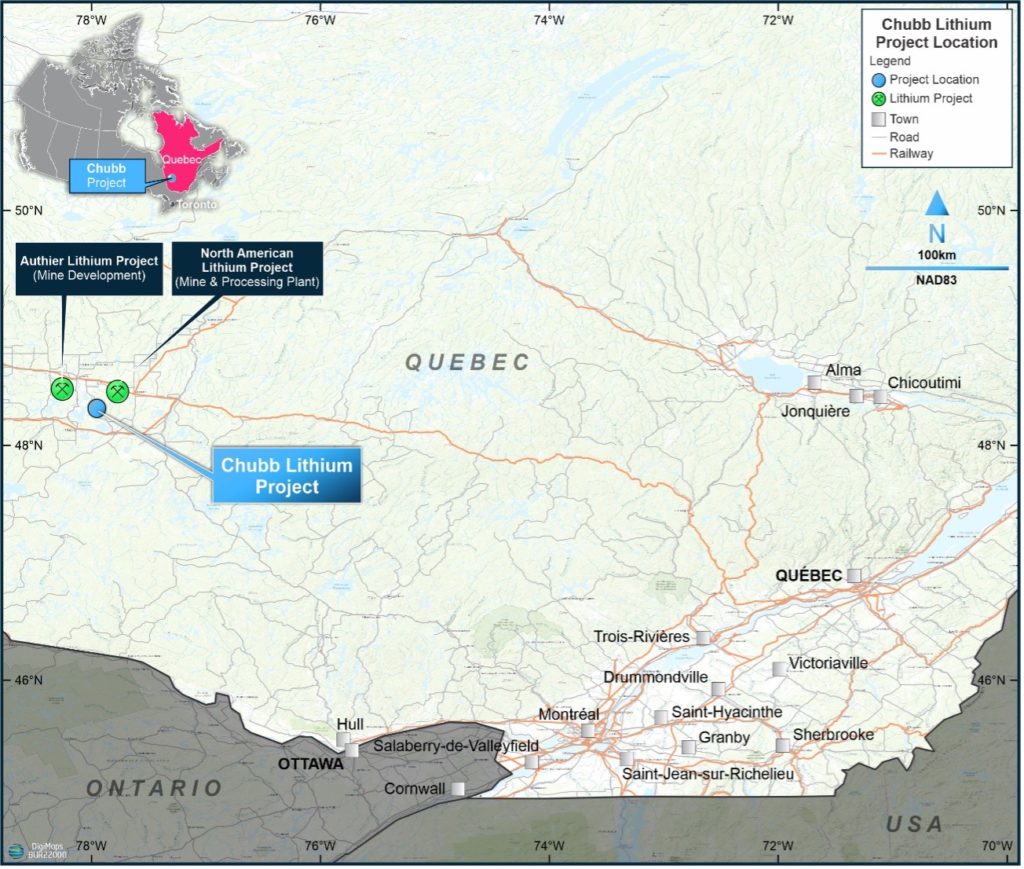

Burley’s move to make a strategic acquisition in Quebec, a world-class lithium province which hosts major projects operated by the likes of Sayona Mining and Piedmont Lithium, is intriguing to say the least.

After all, it is not hard to see the growing interest in Quebec with Sayona Mining (ASX:SYA) and Piedmont Lithium (ASX:PLL) through their 75%/25% Lithium Joint Venture expanding its land position around the near-term North American Lithium (NAL) operation, with the acquisition and earn-in of the Valle Lithium project.

The growing interest in lithium projects in the Quebec Province certainly highlights both its prospectivity and proximity to the burgeoning electric vehicle battery sector in North America.

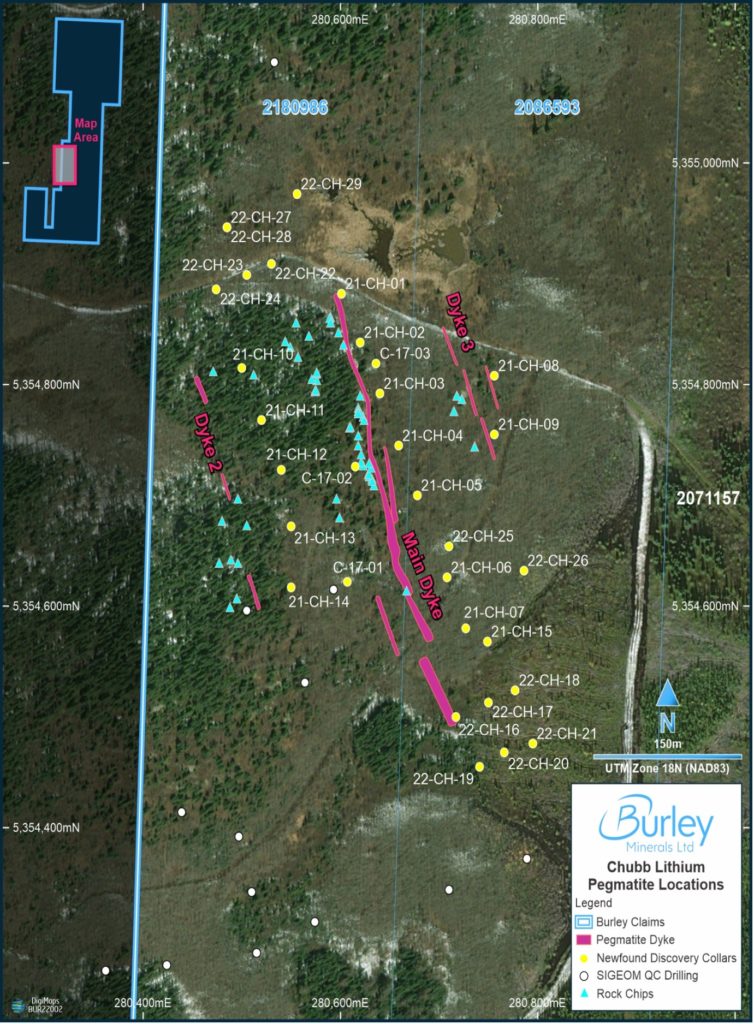

As such, Burley Minerals’ (ASX:BUR) move to acquire the Chubb Lithium project just 10km to the southwest of the NAL Processing Plant and Mine, where previous drilling has confirmed the presence of spodumene-bearing lithium pegmatites in shallow, multiple parallel dykes along a 560m strike with a corridor width of 240m, certainly seems well-timed.

This drilling returned some notable intersections including 12m grading 1.57% Li2O from a downhole depth of 108m (21-CH-15), 11.8m at 1.28% Li2O from 83.2m (22-CH-17) and 9m at 1.26% Li2O from 69m (21-CH-07).

Further outlining the company’s lithium ambitions, it has also picked up the Mt James and Dragon lithium projects in Western Australia’s central Gascoyne region.

Proud as Punch

“We are very pleased to announce the signing of this agreement to acquire such high-potential lithium projects in jurisdictions complemented by other major lithium explorers and developers,” managing director Wayne Richards said.

“The strategic and geographic location of all three potential Projects are located in world class mining provinces and in Tier 1 jurisdictions of Australia and Canada.”

He noted that Chubb’s proximity to established infrastructure, services, and transport corridors greatly supported its development potential. This is further backed by the presence of neighbouring mines, concentrate plants and proposed refineries.

“Whilst the acquisition is progressing the company intends on modelling the existing drilling, permitting infill and extensional drilling and tendering for diamond drilling which will commence at Chubb upon completion,” Richards added.

“Concurrently all data available in relation to the Gascoyne Projects is being evaluated and a suitable geochemical and mapping program is being devised to rank and prioritise targets warranting further investigation.”

Chubb project

The 15km2 Chubb project in the Val-d’Or Quebec region is close to supporting infrastructure including excellent sealed road access (route 111) just 3 kms east of the tenement, operating rail networks within the district, multiple port export options and established towns, mines, and hydro-generated power network systems.

Besides the drilling which returned lithium intercepts in the Main Dyke, which remains open along strike and at depth, the company has also uncovered historical drilling by Lithium Americas Corp which defined mineralisation 100-310m along strike to the south.

Multiple substantial widths of spodumene were logged but were not assayed for lithium and warrant priority drill testing.

Significant outcropping mineralisation has also been identified as spodumene bearing lithium pegmatites across multiple targets.

The orientation of the outcropping pegmatites and geological mapping suggests the contiguous nature of the pegmatite is similar to that of the NAL deposit

Gascoyne projects

The Mt James gold, copper and lithium project (ELA 52/4185) and the Dragon lithium project (ELA09/2747) are located within the same corridor as the Yinnetharra project which was recently acquired by Red Dirt Metals.

Outcropping pegmatites have been mapped on these projects while previous copper and gold anomalism have also been identified.

This article was developed in collaboration with Burley Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Burley’s bulking up in Quebec, acquiring Chubb lithium play near Sayona’s NAL operation appeared first on Stockhead.