Uncategorized

Brightstar swaps tenure with Ardea, expands Menzies gold and lithium landholding

Special Report: Brightstar Resources has added 12km2 of highly prospective gold tenure adjacent to its Menzies Gold Project (MGP) and … Read More

The…

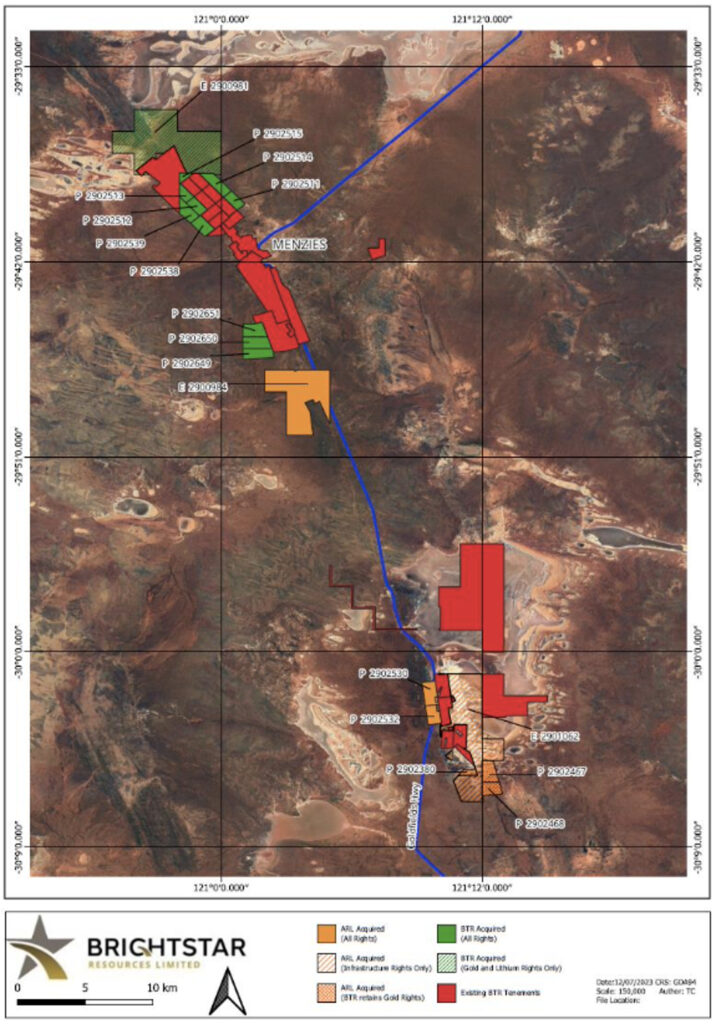

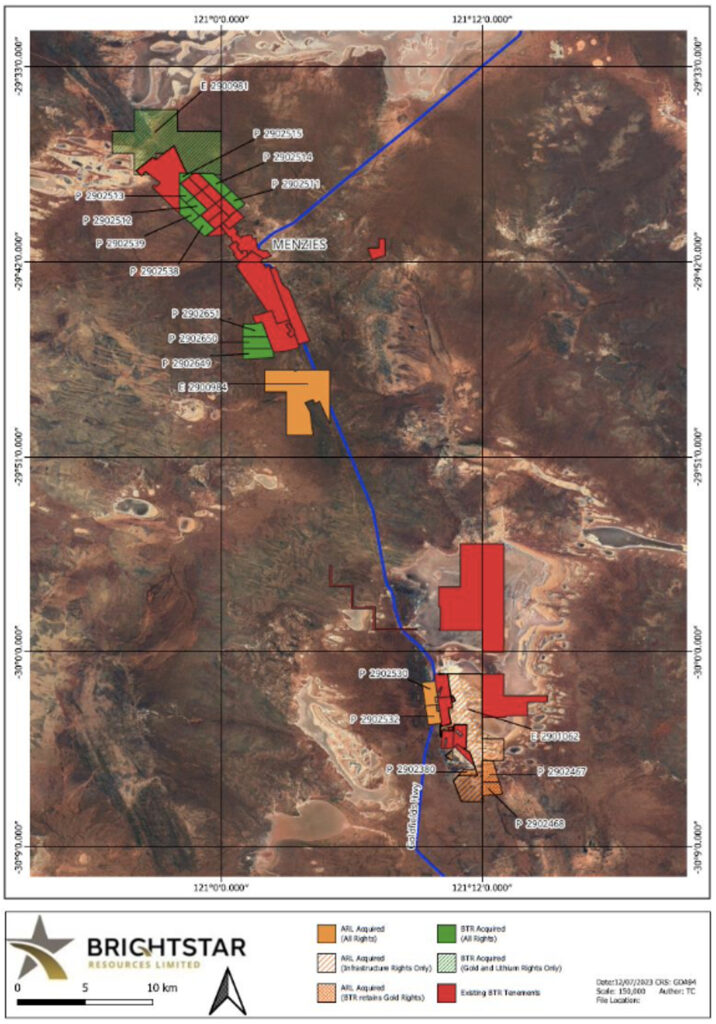

Brightstar Resources has added 12km2 of highly prospective gold tenure adjacent to its Menzies Gold Project (MGP) and divested non-core assets in a tidy tenure swap with Ardea Resources (ASX:ARL).

The company will swap several non-core tenements south of the Menzies Gold Project and at the Goongarrie Project to Ardea, in order for Ardea to advance the Kalgoorlie Nickel Project – Goongarrie Hub which has recently been the focus of a Pre-Feasibility Study.

Importantly, Brightstar Resources (ASX:BTR) will still retain all the gold rights to the exploration licences at the Goongarrie Project and is only transacting on the non- gold rights and ability for Ardea to develop infrastructure on the southern half of E29/1062.

In return, Brightstar will acquire 10 prospecting licenses immediately adjacent or along strike to existing Brightstar tenements in the Menzies Gold Project, in addition to the gold and lithium rights to exploration licence E29/981.

The only consideration payable in the transaction is the grant of a 2.0% net smelter return royalty payable on any Lithium extracted and sold from E29/981.

Ground could host more gold mineralisation

The tenement swap is in line with Brightstar’s objective of rationalising its portfolio across both Menzies and Laverton to maintain its streamlined pathway towards a low capex restart for gold production.

“We are pleased to have entered into an agreement with Ardea to secure highly prospective exploration ground for nil cash consideration immediately along strike of known mineralisation to the north of our Menzies Gold Project,” Brightstar MD Alex Rovira said.

“The acquired ground has significant exploration potential to host further gold mineralisation given the combination of known Menzies ‘mine corridor geology’ within and adjacent to the Menzies Shear Zone and has seen limited historical exploration for gold due to shallow cover.

Exploring the potential for lithium

Whilst Brightstar rapidly advances towards development of its gold resources, Rovira says it’s also prudent to assess the potential for lithium mineralisation at Menzies given the geological setting and known pegmatite occurrences observed in the field and in historical records.

“The acquisition of lithium and gold rights in Ardea’s E29/981, northwest of Lady Irene, is important as this is directly along strike from a +1km long, stacked pegmatite system recently identified by Brightstar with comprehensive mapping and sampling programs underway at present,” he said.

“The structural and geological setting is ideal to host lithium-bearing LCT Pegmatites, given the greenstone terrane that wraps around a granitic intrusion to the north is a similar geological setting to Delta Lithium’s (ASX:DLI) Mt Ida Lithium Project located approximately 70km to the northwest.

“A hyperspectral survey is being planned and commissioned to aid exploration efforts and fast track the identification of appropriate drilling targets.”

Future mining infrastructure a bonus

Not only is the tenure acquired by Brightstar from Ardea prospective for gold and lithium mineralisation, it has the added utility of providing additional ground and access for potential future mining infrastructure.

It presents opportunities in the way of unimpeded access to the sealed Menzies-Sandstone Road in the event that economic gold or lithium resources are exploited and hauled from the combined tenement group.

Going forwards, Brightstar is aiming to complete a scoping study which is progressing to outline underground and open pit mining scenarios at Menzies and Laverton, plant refurbishment costs and conceptual production profiles in August.

Along with planned resource definition and brownfields exploration activities at Menzies and Laverton, the company also plans to conduct ‘early-stage’ greenfields exploration across the newly acquired tenements at the MGP, which will encompass regional aircore drilling, mapping and sampling programs to delineate further targets for reverse circulation drill testing of gold mineralisation.

Once assays are received from recent sampling activities, an exploration program will be delineated that will involve the comprehensive testing of pegmatite occurrences at Menzies for lithium mineralisation.

A ‘win win’ for both parties

Ardea says transaction allows it to divest non-core gold exploration tenements within the northern sector of the Goongarrie Hub and acquire key tenements for both strategic infrastructure and potential resource growth for the Goongarrie Hub nickel-cobalt project development.

The acquisition of tenement E29/984 at Highway is especially important as the current optimised open pit mine design currently extends to the mining lease boundary, and Ardea believes that there is an opportunity to increase the size of the nickel-cobalt laterite resource and ore reserve, through potentially extending the existing Highway deposit northwards.

Acquiring this tenement will also allow the company to design more cost effective staged open pits that maximise resource utilisation.

“The key benefits of this transaction for Ardea are the extra land area around key Goongarrie and Highway production mining leases,” ARL MD and CEO Andrew Penkethman said.

“This will enable the optimum detailed mine design for the upcoming Definitive Feasibility Study and will include increased direct access to the Goldfields Highway and rail line, and shorter haul road distances from satellite pits to the Goongarrie plant site.

“Of particular importance, the extra land area allows the extension of the width and depth of open pit mine designs to facilitate safer and more productive ore movement.

“Also, waste rock landforms can be better designed with final site rehabilitation optimised.”

This article was developed in collaboration with Brightstar Resources Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Brightstar swaps tenure with Ardea, expands Menzies gold and lithium landholding appeared first on Stockhead.