Uncategorized

Brightstar increases its gold focus with another strategic partnership for non-core assets

Special Report: Brightstar Resources is increasingly laser-focused on its Laverton and Menzies gold projects after executing a farm-out deal of … Read…

Brightstar Resources is increasingly laser-focused on its Laverton and Menzies gold projects after executing a farm-out deal of its non-gold assets of the Lake Goongarrie project to fellow miner DevEx Resources.

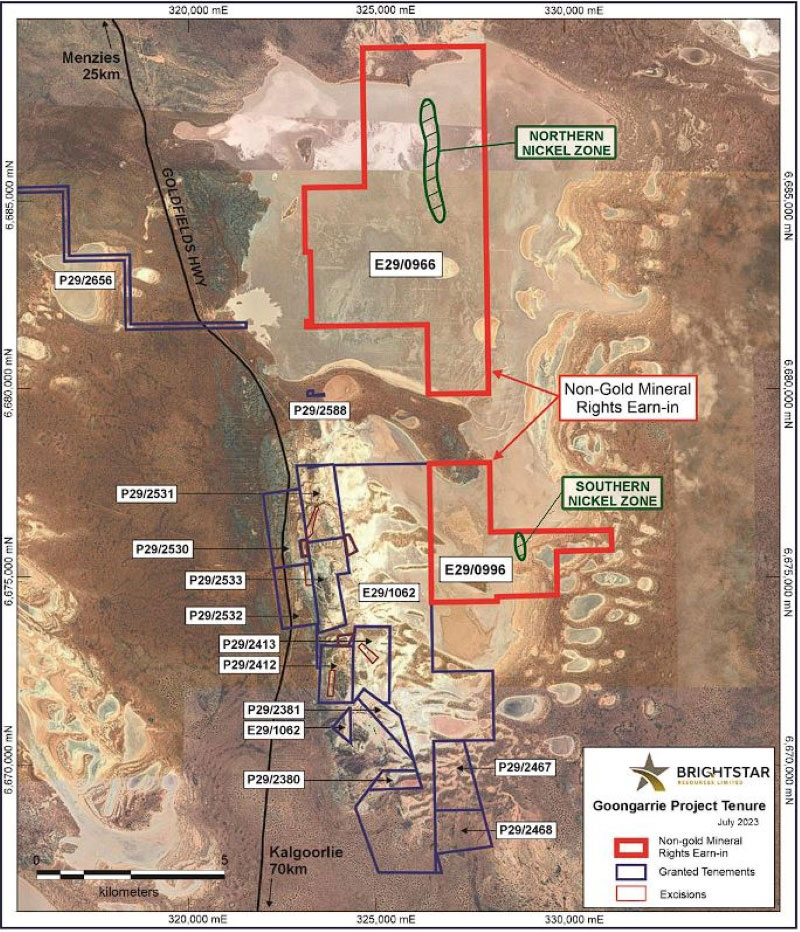

The strategic deal will see DevEx Resources (ASX:DEV) – a company chaired by prominent exploration executive and Liontown Resources Chairman Tim Goyder – enter an earn-in agreement for up to 75% of non-gold mineral rights associated with Lake Goongarrie’s exploration licences, with Brightstar Resources (ASX:BTR) keeping all gold rights across the E29/0966 and E29/0996 tenements and retain a 25% exposure to other minerals.

The move comes on the back of a recent tenement swap with Ardea Resources (ASX:ARL) where Brightstar negotiated to increase its gold tenure in exchange for non-core assets.

This current deal is again in line with Brightstar’s strategic pathway to gold production across Menzies and Laverton, where its Selkirk deposit is about to churn out ingots.

As part of the agreed terms DevEx is required to undertake a SQUID electromagnetic (EM) survey within 12 months, after which it can elect to spend not less than $1 million within the next two years, in order to earn a 51% interest in the non-gold mineral rights.

DevEx can also earn a further 24% interest in the non-gold mineral rights by spending at least an additional $2m within a further 2 years of earning its 51%.

Brightstar MD Alex Rovira said the earn-in agreement provides an exciting opportunity to partner with DevEx.

“Brightstar will retain a meaningful stake in these tenements and exposure to any potential nickel discovery, as well as retaining the gold rights,” Rovira said.

“This transaction is part of Brightstar’s focused strategy of transitioning towards becoming a gold developer and producer.

“As the Company advances towards gold production from the Selkirk deposit at Menzies, Brightstar continues to look for opportunities to prioritise and progress exploration across our broader tenement portfolio.”

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Brightstar increases its gold focus with another strategic partnership for non-core assets appeared first on Stockhead.