Uncategorized

ASX Small Caps News Wrap: Who got canned for their love of monkeys this week?

Local markets are up, OzAurum is flying and someone at the ACCC really has it in for Qantas, apparently. It’s … Read More

The post ASX Small Caps News…

Local markets are up this morning, climbing 1.6% by lunchtime today after Wall Street staged a rally overnight, and OzAurum (ASX:OZM) went 2.5x Ballistic in the wee hours of the trading day.

There’s plenty of local news to get through, but first there’s news out of the US which caught my eye this morning – largely because it’s got all the ingredients of precisely the kind of news story I love:

- Monkeys

- Florida

It’s a short list, but it hits deep.

The intro to this story from The Miami Herald, on its own, is amazing and in need of dissection: “A Hindu man who promotes kindness and compassion toward animals went to work for Miami’s most controversial monkey supplier.”

I’ll note this and move on, but the phrase “Miami’s most controversial monkey supplier” is a banger.

It clearly implies the baffling fact that there is more than one “monkey supplier” operating in Miami.

Secondly, the fact that the company – identified in the story as Worldwide Primates – is only the most controversial monkey supplier “in Miami” means that somewhere in Florida, there is an even more controversial monkey supplier.

Which is hard to believe, since Worldwide Primates founder and owner, Matthew Block, was sentenced to 13 months in federal prison and fined $30,000 for his role in the notorious “Bangkok Six” orangutan smuggling case that rocked the monkey world in 1990.

Anyhoo – the baffling ‘hero’ of the story is an Indian fella Sudeep Garg, who completely uprooted his entire family and moved them to Florida, specifically to take a gig supplying monkeys.

But – horror of horrors – ol’ mate Garg got canned from the gig when the company went back through his social media accounts, and found a bunch of Pro-Monkey posts… along with some pretty strident views around the slaughter of animals.

Garg, because “Florida”, has taken the company to court, after deciding that his firing is against that state’s remarkably lax worker protection laws. He says that he’s been fired for being a Hindu (which would breach the law, if it were true).

“Mr. Garg is extremely upset that, after uprooting his family from India to come to Miami for this job, he was terminated due to his beliefs on animal rights. Laws are in place to ensure that an employee can practise his religious beliefs without fear of termination,” Garg’s lawyer, the improbably-named Chad Levy, says.

Levy points out that the Bhagavata – an ancient Hindu text – clearly sets out the religion’s position on animals.

“Deer, camel, donkey, monkey, rats, creeping animals, birds, and flies – one should consider them like one’s own children, and not differentiate between one’s children and these creatures.”

That – like every religious text ever – is open to some interpretation, as it’s not clear whether it means we’re supposed to love all animals, or hate our kids… but there’s no doubt Garg is hoping that the judge will accept it’s the first of those two options.

It’s destined for court, and if I remember to, I’ll update if there’s any major developments.

But now, it’s off to a relatively monkey-free ASX to see what’s on the boil.

TO MARKETS

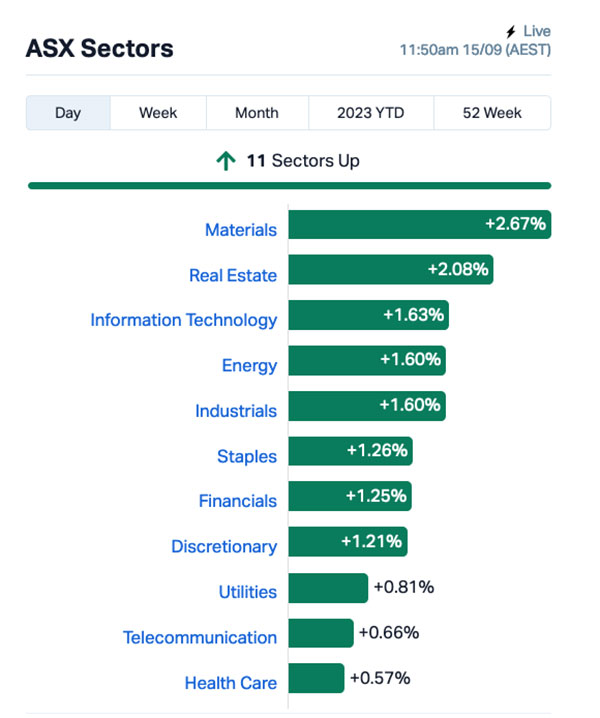

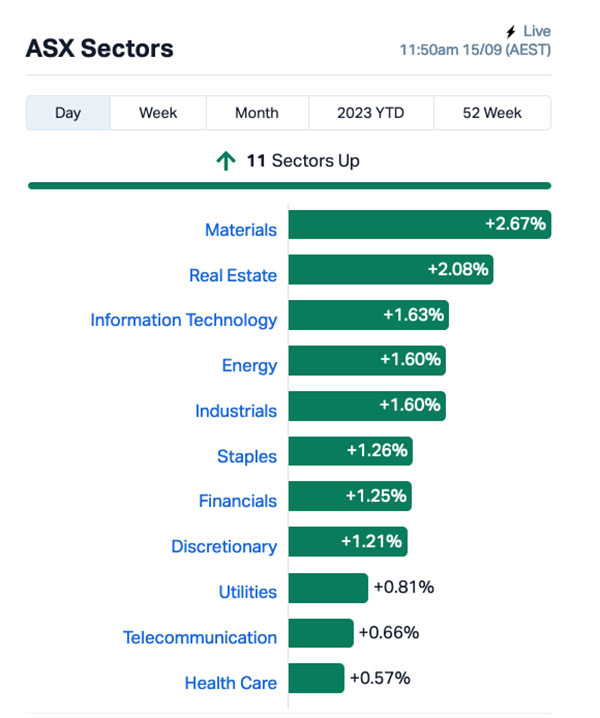

It’s a happy day on the ASX at lunchtime, with the market up 1.6% as a whole, led to greener pastures by a significant bump from Materials and Energy today.

Even the worst performer, Health Care, is doing better than a few of the winners we’ve seen this week.

Leading the Large Caps are Liberty Financial (ASX:LFG), up 8.8% since everyone’s forgotten how shoddy the company’s IT security was for years, and Centuria Capital (ASX:CNI) has added 7.4% because that’s what capital companies are supposed to do.

In the headlines today, it’s become very clear that someone at the ACCC’s holiday plans were ruined by a cancelled flight, after the watchdog gave Qantas another kicking this morning, refusing to allow the company to collude – sorry, co-ordinate – with Chinese carrier China Eastern on passenger and cargo transport operations between two countries.

And it would seem that founder and CEO of Gurner Group, Tim Gurner, has seen the error of his ways, after showing the world just how much of an arsehole people can be when they’ve got money.

In case you missed it, here’s what Gurner said the other day.

Gurner Group founder Tim Gurner tells the Financial Review Property Summit workers have become “arrogant” since COVID and “We’ve got to kill that attitude.” https://t.co/lcX3CCxGuj pic.twitter.com/f9HK2YZRRE

— Financial Review (@FinancialReview) September 12, 2023

He’s since issued an apology. Sort of.

“There are clearly important conversations to have in this environment of high inflation, pricing pressures on housing and rentals due to a lack of supply, and other cost-of-living issues,” he said in a statement.

“My comments were deeply insensitive to employees, tradies and families across Australia who are affected by these cost-of-living pressures and job losses.

“I want to be clear: I do appreciate that when someone loses their job it has a profound impact on them and their families and I sincerely regret that my words did not convey empathy for those in that situation.”

Now, the last thing I want is to end up on the unemployment queue, despite how much joy it would obviously bring to Gurner’s coal-black swine heart – so, I’ve chosen my words very carefully here.

[redacted]

NOT THE ASX

Earlybird Eddy Sunarto has reported that Wall Street’s had a decent day for a change, which left the S&P 500 up by +0.84%, blue chips Dow Jones up by +0.96%, and tech heavy Nasdaq by +0.81%.

That’s off the back of news that US retail sales increased more than expected by 0.6% in August, which points to the resilience of US consumers despite rising interest rates, but the US Producer Price Index meanwhile increased 0.7% in August, indicating stubborn inflation.

Arm Holdings’ highly-anticipated trading debut on Nasdaq got off to a good start, with the chip design company soaring by 25% to close at US$63.59.

At a US$60 billion valuation, Arm’s PE (price to earnings) multiple is trading around 110x, which is comparable to Nvidia’s valuation at 108x.

Other chipmakers like Micron Technology and Broadcom also added between 1-2% last night.

EV maker Nikola surged more than 32% after the company announced plans to sell its hydrogen fuel-cell trucks later in September.

Online used car retailer Carvana also surged 13.5% as investors turned bullish on used cars in anticipation of the the looming UAW workers’ strike which analysts say could be the ‘biggest auto strike in generations’.

In Asia, Japan’s Nikkei is up 1.34%, Shanghai is 0.5% higher and Hong Kong’s Hang Seng has climbed 1.53% as well.

The mood is buoyant in the region despite news that Russian leader Vladimir Putin has reportedly accepted an invitation from Kim Jong-Un to visit North Korea.

“I would love to visit your beautiful country and will be there with 250,000 troops as soon as I have finished my visit to Ukraine,” Putin didn’t say, but we all know he was thinking it.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 15 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| OZM | Ozaurum Resources | 0.098 | 206% | 15,594,825 | $4,064,000 |

| AVW | Avira Resources | 0.002 | 100% | 1,000,000 | $2,133,790 |

| PNX | PNX Metals | 0.003 | 50% | 101,309 | $10,761,249 |

| ADS | Adslot | 0.004 | 33% | 2,308,645 | $9,799,853 |

| BNR | Bulletin Res Ltd | 0.08 | 33% | 802,720 | $17,615,466 |

| EVR | Ev Resources Ltd | 0.015 | 25% | 810,957 | $11,231,809 |

| AUG | Augustus Minerals | 0.25 | 25% | 531,815 | $16,324,000 |

| GTG | Genetic Technologies | 0.0025 | 25% | 261,039 | $23,083,316 |

| GTR | Gti Energy Ltd | 0.01 | 25% | 19,750,267 | $16,359,577 |

| PIL | Peppermint Inv Ltd | 0.01 | 25% | 7,294,522 | $16,302,855 |

| SI6 | SI6 Metals Limited | 0.01 | 25% | 11,833,243 | $15,950,875 |

| TKL | Traka Resources | 0.005 | 25% | 3,450,000 | $3,485,317 |

| OKR | Okapi Resources | 0.13 | 24% | 3,753,851 | $22,059,032 |

| LBT | LBT Innovations | 0.017 | 21% | 267,077 | $4,982,605 |

| IEC | Intra Energy Corp | 0.006 | 20% | 8,710,080 | $8,103,908 |

| SIS | Simble Solutions | 0.006 | 20% | 1,684,945 | $3,014,754 |

| FBM | Future Battery | 0.135 | 17% | 9,795,592 | $52,365,315 |

| SZL | Sezzle Inc. | 21.21 | 17% | 31,806 | $49,637,929 |

| BSN | Basin Energy | 0.14 | 17% | 698,558 | $7,203,600 |

| KGL | KGL Resources Ltd | 0.14 | 17% | 12,186 | $68,075,024 |

| CRB | Carbine Resources | 0.007 | 17% | 470,000 | $3,310,427 |

| NES | Nelson Resources | 0.007 | 17% | 72,857 | $3,681,566 |

| TAS | Tasman Resources Ltd | 0.007 | 17% | 100,000 | $4,276,016 |

| 5EA | 5E Advanced | 0.405 | 16% | 966,591 | $106,398,873 |

| TON | Triton Min Ltd | 0.023 | 15% | 448,649 | $31,227,112 |

Topping the small caps chart today is Ozaurum Resources (ASX:OZM), which is so far out in front of the rest of the market, everyone’s starting to miss it.

OZM was flying hard right from open this morning, on news that the company has snapped up the Linopolis Jaime Project – a strategically held area of over 20 Lithium-Cesium-Tantalum (LCT) bearing pegmatites that have been mined intermittently for tantalite, beryl, tourmaline, brazilianite and feldspar intermittently by the Pacheco family and other artisanal miners for over 50 years.

OZM wants the spot for its lithium, as it boasts spodumene grades of up to 7.36% LiO2 with an average spodumene grade of 6.94% LiO2 confirmed within a +7m wide spodumene zone.

Them’s big grades.

Future Battery Minerals (ASX:FBM) is rising nicely this morning, up nearly 22% on news that the company has received firm commitments for a heavily oversubscribed $7.6 million placement, including dollars coming in from some Big Names like Hancock Prospecting.

FBM says it’s going to spend the money on speeding up exploration drilling at the Kangaroo Hills Lithium Project (KHLP) in WA, in which the recent Phase 3 drilling has confirmed a significant spodumene bearing pegmatite swarm at the Big Red and Rocky prospects.

Also moving, but in a weird way, is Element 25 (ASX:E25), which is up 25% this morning on no local news, the morning after its OTCQX-listed arm ELMTF dropped a similar amount overnight.

That one’s a little above my pay-grade to understand – if anyone’s got a theory, I’m all ears.

(Ed: Or maybe you need a pay cut.)

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 15 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.002 | -33% | 500,000 | $4,413,601 |

| BGE | Bridgesaaslimited | 0.025 | -22% | 67,787 | $929,152 |

| AVM | Advance Metals Ltd | 0.005 | -17% | 2,051,924 | $3,531,352 |

| EDE | Eden Inv Ltd | 0.0025 | -17% | 2,668,130 | $10,090,911 |

| FFG | Fatfish Group | 0.01 | -17% | 295,631 | $14,282,876 |

| RLC | Reedy Lagoon Corp. | 0.005 | -17% | 79,944 | $3,700,102 |

| AMN | Agrimin Ltd | 0.185 | -16% | 34,790 | $63,437,547 |

| NAG | Nagambie Resources | 0.022 | -15% | 304,142 | $15,124,884 |

| 1AG | Alterra Limited | 0.006 | -14% | 1,646,769 | $4,875,868 |

| AJL | AJ Lucas Group | 0.012 | -14% | 250,000 | $19,260,215 |

| EMP | Emperor Energy Ltd | 0.012 | -14% | 1,495,700 | $3,764,075 |

| 14D | 1414 Degrees Limited | 0.033 | -13% | 508,939 | $9,050,404 |

| MGU | Magnum Mining & Exp | 0.034 | -13% | 3,548,498 | $28,218,777 |

| BMO | Bastion Minerals | 0.021 | -13% | 522,023 | $4,159,781 |

| MOZ | Mosaic Brands Ltd | 0.13 | -12% | 276,931 | $26,329,700 |

| ZNC | Zenith Minerals Ltd | 0.093 | -11% | 416,791 | $36,999,993 |

| XF1 | Xref Limited | 0.16 | -11% | 20,590 | $33,511,732 |

| CCZ | Castillo Copper Ltd | 0.008 | -11% | 93,121 | $11,695,548 |

| JTL | Jayex Technology Ltd | 0.008 | -11% | 955,053 | $2,531,507 |

| NAE | New Age Exploration | 0.008 | -11% | 3,397,497 | $12,923,090 |

| SHO | Sportshero Ltd | 0.016 | -11% | 3,284,255 | $10,350,020 |

| MTC | Metalstech Ltd | 0.175 | -10% | 18,923 | $36,777,895 |

| AHK | Ark Mines Limited | 0.22 | -10% | 62,767 | $11,060,466 |

| RDM | Red Metal Limited | 0.09 | -10% | 612,719 | $24,559,174 |

The post ASX Small Caps News Wrap: Who got canned for their love of monkeys this week? appeared first on Stockhead.