Uncategorized

ASX Small Caps Lunch Wrap: Who wants to sign a petition to get Powell to stop saying stuff for a while?

It’s wrong to points fingers, but… Jerome Powell chose his words poorly, spooking the horses and making the cows give … Read More

The post ASX Small…

Australian markets have dropped sharply this morning – down more than 2.0% at open and causing some serious heartache all over town. It’s all Jerome Powell’s fault, probably.

What a mess.

So let’s lighten the mood, with a little story about a gross, dead elf.

Specifically, it’s a tale about the grave of a fictional character from the Harry Potter series, whose on-screen death made audiences around the world feel like their local markets had dropped more than 2.0% at open.

We’re talking, of course, about Dobby the House Elf – a manky little creature that was essentially a part-time cleaner, part-time BDSM sub and part-time gut-wrenching walking MacGuffin in the wizardy franchise.

SPOILER ALERT: At a pivotal moment in the film, the titular Potter guy tricks the elf’s evil owner into giving the horrid little beast a sock. Remember this, it’s important later, because giving a house elf a piece of clothing grants them their freedom from slavery. (You knew that, right?)

That could be a metaphor about land grants in post-civil war America, but it’s unlikely because that would make the author of the series seem a lot smarter than we suspect she is.

As an aside, Dobby later showed up to portray a bumbling Prime Minister of Britain for 44 days. Sterling effort.

Anyhoo… The elf dies in the movie, playing the part of the Noble Self-Sacrifice to save the hero and further the narrative.

It was hugely emotional for everyone involved, and the grotty squirt was buried on a beach in a shallow grave, for local dogs to dig up later or something.

The beach where it was filmed is located “IRL” Wales (small country, just near England, not Scotland) – and, Harry Potter fans being what they are, have been descending on the beach in real life to pay their respects to a computer generated thing that was never, ever real.

(But it’s all real to me, dammit! You just don’t understand! … I look forward to your angry emails)

The issue – they’ve been leaving socks at the site. Lots and lots of them, enough to the point where local authorities were faced with a decision on whether the shrine should be allowed to stay.

The good news is enough Harry Potter fanatics pressured them to allow the pile of rocks and socks to stay on the beach. But they are urging people to stop it. Please.

We’re certainly hoping the fans heed the local government’s request, because I’m not 100% certain on what the Rule of the Universe have to say about leaving dirty socks lying around, but we are pretty sure that if people don’t stop with the fanatical following of the films and books, the author is going to keep writing.

And that’s a final battle between reality and infantile fantasy films that no one will win.

TO MARKETS

So, yeah. The ASX 200 is having a shocker, down 2.0% at open but holding its ground at -2.1% as we trundle towards lunch.

Looking out across the sectors, and someone better call Moses because it’s a veritable Red Sea. The best of the sectors this morning is the Telcos, because they’re only down 0.98% – and it just keeps getting worse from there.

It’s Materials weighing heaviest, though – down a deeply unpleasant 3.19% at present, with Utilies, Consumer Discretionary, Energy and Real Estate all stuck around -2.5%.

In the nosebleed seats, there is one clear winner. A2 Milk (ASX:A2M) has jumped 8.5% on news that its been given FDA approval to sell its infant formula in the United States.

Some background: in May this year, the US experienced a severe supply shortage of infant formula, and as an emergency measure the FDA was given the power to apply discretionary approval for companies to supply formula to the market to plug the gap.

Showing just how amazingly nimble a US government agency can be in a time of national crisis, it took the FDA a mere – *checks calendar* – 171 days to go “Yep. You’re fine” and allow A2M to load up a boat with powdered baby stuff.

Blindingly rapid response.

Top of the Downers among the large caps today is Domino’s Pizza (ASX:DMP), down 8.0% so far today.

The company has reportedly (not really) been hit hard by a global shortage of qualified pizza slicers, following the (very real) demise of Kanye West’s ‘Donda Academy’ education centres, where children were to be taught essential basics such as reading, maths and (again, very real) parkour.

Let’s look at overseas markets before little ol’ Ye reads this and accuses me of being ‘the wrong kind of religious’.

NOT THE ASX

On Wall Street last night, it was awful. Just awful. The Dow closed 1.55% lower, and that was the best of the major indices.

The S&P shed 2.50% and the tech-heavy Nasdaq was left limping like it had been savaged by those weird dog-robots from Boston Dynamics, down 3.36% at close.

Normally, it’s wrong to point fingers at one particular person when something like this happens. The markets are a team effort, large and robust and it’s not like one man could make a huge difference.

Except this time, the market fell because by the looks of things, US Fed Chief Jerome Powell chose his words poorly, spooking the horses and making the cows give sour milk.

It came during Powell’s speech after announcing The Fed was hoisting rates by another 75bps, as he discussed a brief forecast of how, and by how much, the rate hikes are expected to slow down in the US.

As Eddy Suarto reported this morning: “Towards the end of his speech as investors hung on to his every word, Powell contradicted himself by saying it was ‘very premature’ to consider pausing rate increases.”

“Very premature” – let’s just sit with those two words for a moment, because pretty much the instant they popped out of Powell’s mouth, US markets plunged harder than a plumber in an old folks’ home – and now, here we are.

We’ll share a link to the global petition calling on Powell to keep his goddamn trap shut for six months, as soon as someone on the internet has enough spare cash to post it.

In Asia, Japan’s Nikkei seems to be immune to the pressures of a loose-lipped US Fed chief, with the market there down just 0.06% so far today.

Shanghai, likewise, is weathering the storm okay, down 0.25% while Hong Kong has dropped like the beat at an amateur rap battle, falling 1.25% this morning.

Over at the commodities desk, it’s all un-fun as well. Oil has dropped 1.17%, and gas has fallen 2.86% so far today.

Shiny things are also dull, with gold sinking 0.76%, copper down by 1.17% and silver plummeting 2.21%.

Dammit, Jerome.

In Crypto World, which theoretically should be immune to Powell’s mumblings and musings, and… yep. Same deal as the share markets.

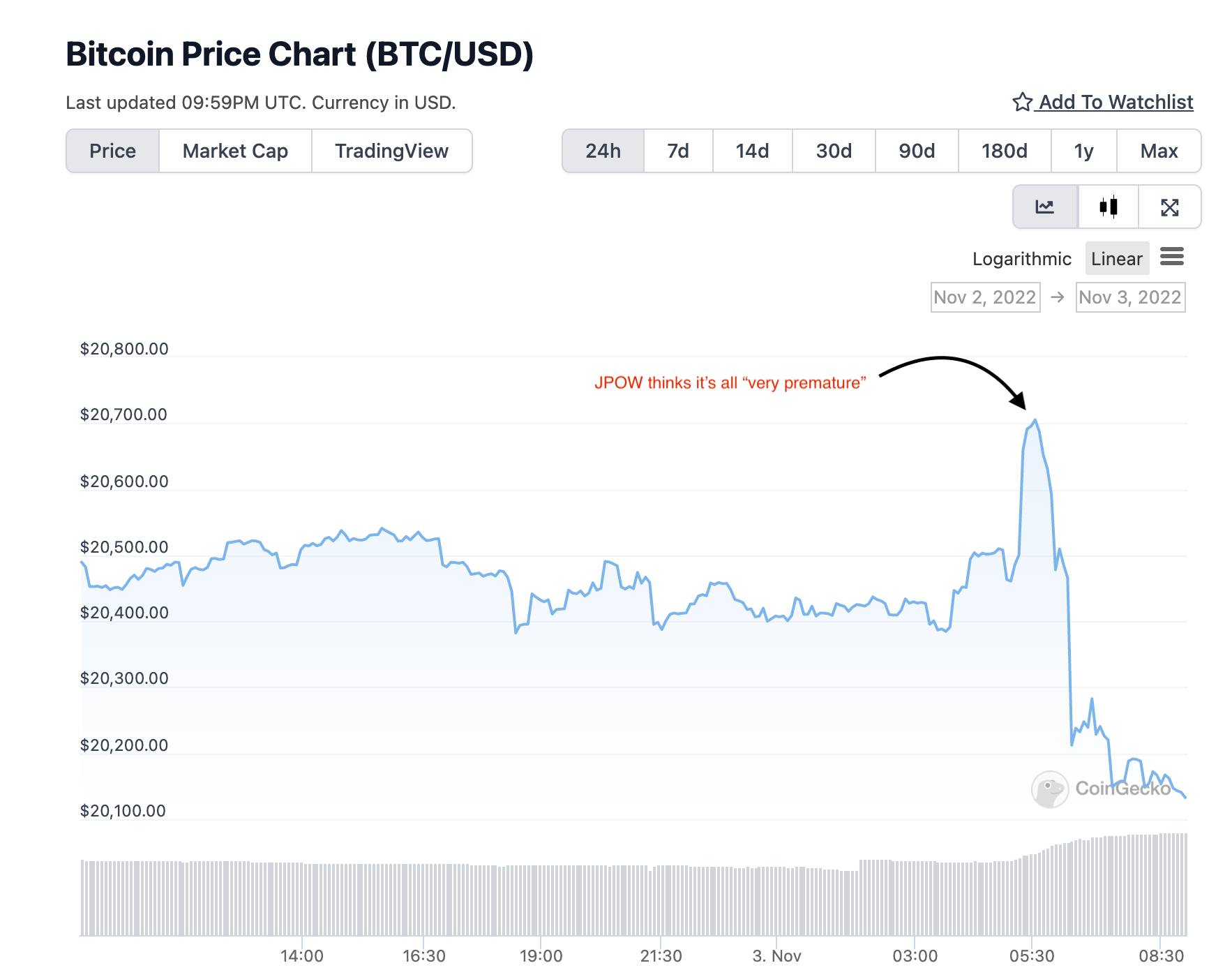

I’m pinching this graph from Rob “Too graphic for daytime TV” Badman’s epic Mooners and Shakers column, to illustrate how it all went down.

That says it all, really.

We need good news… so here come today’s gravity-defying Small Caps winners to help put a smile on everyone’s face.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 3 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NFL | Norfolk Metals | 0.26 | 93% | 22,297,150 | $4,026,374 |

| HIQ | Hitiq Limited | 0.045 | 50% | 340,779 | $3,394,685 |

| ADR | Adherium Ltd | 0.005 | 25% | 2,150,954 | $19,100,782 |

| EMT | Emetals Limited | 0.017 | 21% | 10,390,791 | $11,900,000 |

| ICG | Inca Minerals Ltd | 0.035 | 21% | 111,899 | $13,979,822 |

| BGE | Bridge SaaS | 0.15 | 20% | 202,469 | $3,629,501 |

| JTL | Jayex Technology Ltd | 0.006 | 20% | 308,892 | $1,246,143 |

| KGD | Kula Gold Limited | 0.037 | 19% | 681,998 | $10,422,570 |

| PUA | Peak Minerals Ltd | 0.007 | 17% | 56,998 | $6,248,225 |

| ARO | Astro Resources NL | 0.004 | 14% | 290,000 | $17,126,434 |

| OAU | Ora Gold Limited | 0.008 | 14% | 156,219 | $6,889,619 |

| PXX | Polarx Limited | 0.008 | 14% | 372,321 | $6,293,708 |

| ERG | Eneco Refresh Ltd | 0.024 | 14% | 59,000 | $5,719,525 |

| ASO | Aston Minerals Ltd | 0.075 | 14% | 100,000 | $73,493,042 |

| PVL | Powerhouse Ven Ltd | 0.059 | 13% | 3,389 | $6,278,645 |

| MOZ | Mosaic Brands Ltd | 0.38 | 13% | 83,829 | $36,522,109 |

| JAN | Janison Edu Group | 0.53 | 13% | 343,371 | $111,174,029 |

| LYK | Lykos Metals | 0.135 | 13% | 19,597 | $7,488,000 |

| MRD | Mount Ridley Mines | 0.0045 | 13% | 1,227,564 | $24,135,356 |

| PCL | Pancontinental Energy | 0.0045 | 13% | 11,994,258 | $30,216,891 |

| FND | Findi Limited | 0.56 | 12% | 54,560 | $15,441,806 |

| ALM | Alma Metals Ltd | 0.011 | 10% | 19,280 | $8,646,723 |

| CXZ | Connexion Telematics | 0.011 | 10% | 300,000 | $8,778,179 |

| GO2 | Go2 People | 0.011 | 10% | 50,000 | $4,066,383 |

| LSR | Lodestar Minerals | 0.0055 | 10% | 233,332 | $8,692,187 |

Is there an absolute bolter among the Small Caps today?

You bet your bloody boots there is – Norfolk Minerals (ASX:NFL) has soared 117% this morning after drilling a hole that has copper in it.

The company says that visual logging of core from hole 22RRD001 at EL20/2020 drilled to 318.0m depth identified the following:

- Native copper is observed in discrete zones from 58.5m to 145.40m downhole comprised of disseminated to blebby copper (1-3%) hosted in altered magnetic basalt and within silica-carbonate veins.

- Strong magnetite, potassium and hematite alteration zones associated with silica-carbonate veins (containing native copper) identified from 90.0m to 147.15m (main basalt/sediments contact).

- Chalcopyrite (copper-iron-sulphide) is also observed at 86.50m along a fracture surface.

- Intercalated basalt and sediments (brecciated with flattened clasts) containing dense potassium and epidote altered silica veins with disseminated sulphides (mainly pyrite) from 175.90m to 192.20m downhole.

- Dense pyrite veins within altered sediments from 233.70m-235.5m, 279.75m-284.60m and 302.80m-305.0m downhole.

Couple of things to note here:

First, “blebby” is a real word that real geologists use to describe definitely real things, and is absolutely not the name of Dobby the House Elf’s evil twin.

Second, Norfolk is very clear that it has “no estimate of potential gold, copper and/or any other base metal mineralisation, which can only be confidently determined through laboratory analysis” – but the results have encouraged investors to get on board nonetheless.

Elsewhere, HitIQ (ASX:HIQ) is on a +50% jag this morning, in the wake of two new agreements that will see its tech used to help with head injury and concussion assessment in senior levels of sport.

Yesterday, HIQ announced a two-year deal with England’s Premier League, which will see the company’s CSX Concussion Assessment Technology integrated into the League’s existing concussion management systems.

Then this morning, HIQ revealed another deal, this time with the Western Australian Football Commission, for its HITIQ Nexus instrumented mouthguards to be used to quantify and improve the understanding of the head impact forces sustained by players.

Good news for the players, excellent news for shareholders.

Outside of the penny stocks, Mosaic Brands (ASX:MOZ) is up nearly 15% this morning in the wake of a solid 64% uptick in sales for FY23, as consumers get back into the swing of going to the shops to buy stuff post-Covid.

And Intelligent Monitoring Group (ASX:IMB) is trading 9.5% higher this morning, after the security-focused firm revealed that it’s well-placed to further grow its business following its acquisition of Mammoth earlier this year.

We try to only mention poor performances when they are noteworthy – and today’s fall by Bravura Solutions (ASX:BVS) is definitely worth looking at.

After what looks like some serious soul-searching, new-ish CEO Libby Roy is faced with the task of restructuring the business in a very big way, which will require “enhancing the existing technology stack to unlock the existing microservices strategy, drive higher resale multiples on technology development and reduce single customer efforts.”

Translation: If this business was a car, we’re currently sitting in the back seat while trying to reverse park into the ocean.

It’s going to take time and money to get it to where the board thinks it needs to be – two things that investors are notoriously not keen on providing – and this morning, they’ve stormed the exits leaving Bravura trading 52% lower.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for November 3 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BVS | Bravura Solution Ltd | 0.655 | -50% | 29,850,930 | $326,585,512.63 |

| ANL | Amani Gold Ltd | 0.001 | -33% | 378,474 | $35,540,161.69 |

| AQX | Alice Queen Ltd | 0.002 | -33% | 400,000 | $6,600,750.28 |

| GGX | Gas2Grid Limited | 0.001 | -33% | 6,763,909 | $6,087,153.12 |

| RXH | Rewardle Holding Ltd | 0.01 | -29% | 524,585 | $7,368,500.83 |

| BRX | Belararox Limited | 0.31 | -25% | 952,350 | $15,906,958.30 |

| ARE | Argonaut Resources | 0.0015 | -25% | 67,037,704 | $10,857,075.89 |

| IVZ | Invictus Energy Ltd | 0.105 | -22% | 20,768,441 | $118,292,549.04 |

| SIH | Sihayo Gold Limited | 0.002 | -20% | 31,666 | $15,255,320.23 |

| NME | Nex Metals Explorat | 0.028 | -18% | 16,756 | $9,078,803.22 |

| NSM | Northstaw | 0.095 | -17% | 201,960 | $13,814,605.00 |

| AGH | Althea Group | 0.069 | -17% | 1,849,575 | $27,246,605.88 |

| G50 | Gold50 Limited | 0.1 | -17% | 40,610 | $6,833,160.12 |

| ROO | Roots Sustainable | 0.0025 | -17% | 101,400 | $2,746,298.06 |

| TOY | Toys R Us | 0.041 | -16% | 711,329 | $42,291,247.03 |

| AHK | Ark Mines Limited | 0.235 | -16% | 500 | $9,662,828.84 |

| BTR | Brightstar Resources | 0.017 | -15% | 40,035 | $13,529,951.92 |

| SMI | Santana Minerals Ltd | 0.54 | -15% | 21,706 | $93,380,584.66 |

| ATU | Atrum Coal Ltd | 0.006 | -14% | 148,427 | $9,679,156.70 |

| MCT | Metalicity Limited | 0.003 | -14% | 60,000 | $12,222,137.69 |

| MHC | Manhattan Corp Ltd | 0.006 | -14% | 1,622,692 | $10,683,950.85 |

| RAN | Range International | 0.006 | -14% | 130,731 | $6,575,032.24 |

| USQ | US Student Housing REIT | 0.95 | -14% | 106 | $61,095,339.80 |

| DM1 | Desert Metals | 0.35 | -13% | 472,352 | $19,196,727.20 |

The post ASX Small Caps Lunch Wrap: Who wants to sign a petition to get Powell to stop saying stuff for a while? appeared first on Stockhead.