Uncategorized

ASX Small Caps Lunch Wrap: Who tried (and failed) to ‘take the money and run’ this week?

Local markets have opened lower, tracking moderate losses on Wall Street overnight as US investors gear up for the results … Read More

The post ASX Small…

Local markets have opened lower, tracking moderate losses on Wall Street overnight as US investors gear up for the results of this week’s US Fed meeting, which should arrive sometime this evening, local time.

That’s translated into an early 0.4% dip for the benchmark, as yesterday’s leading sector – Energy – takes a bit of a hammering this morning.

I’ll get into the deets on that shortly, but before I do, it’s time to delve into the wild and wacky world of Art once more, after a Danish artist found himself on the wrong end of a lawsuit which has, once and for all, settled the argument over how acceptably dumb art in general is allowed to be.

The artist is Jens Haaning, who a few years ago took out a hefty personal loan to create two works of conceptual art, called An average Austrian annual income (2007) and An average Danish annual income (2010).

It’s worth checking out those links, if only for the astounding mental and linguistic gymnastics it takes to justify gluing a bunch of money onto a framed sheet of gyprock in order to “make a statement”.

Anyway – for some unfathomable reason, the works generated a buzz of interest among whoever’s behind putting daft things into the Kunsten Museum of Modern Art, the name of which I am forbidden to make fun of, so I won’t, because Being Rude is Wrong.

The Kunsten people asked Haaning to recreate the two works to hang in their museum, and – recognising that it’s unlikely that Haaning, being an artist and all, had that kind of money just lying around, the museum itself ponied up the cash.

Haaning, being the super-intelligent artistic type and seeing an opportunity to create something even bolder, agreed – and then turned up at the museum to deliver a brand new, totally audacious work in place of the one that the museum had asked for.

Instead of two framed pieces containing the 500,000 Danish kroner (roughly AUD$110,000) the museum got two large, blank canvasses – a work that Haaning called Take the Money and Run.

Granted, that is objectively hilarious, but the Museum People were understandably very unhappy that they didn’t get what they’d asked for, and – as the title of the work suggests – Haaning had decided to basically steal their cool half-mil.

When the news broke, Haaning told Danish media that the artwork he delivered in place of the commissioned pieces was “meant to highlight how people were underpaid for their work” and took the opportunity to encourage people who worked in supermarkets at the checkout to steal from their employers, because “Art”.

That went down about as well as you’d expect, the whole thing ended up in a court battle that came to a fairly obvious conclusion, especially considering that Haaning told Danish media straight up that he’d thieved the cash.

“The work is that I have taken their money,” Haaning said – the only reasonable response to which being “Your Honour, the prosecution rests”.

The court action was won by the museum, even though it made a tidy sum of money from the foot traffic Haaning’s work created at the time, leaving the artist with an enormous debt to pay off.

TO MARKETS

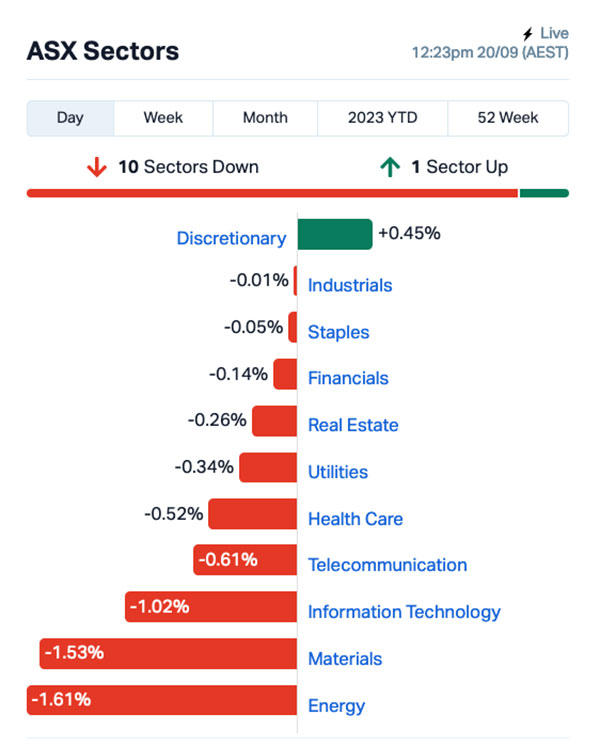

The benchmark has fallen this morning, following a wan performance on Wall Street overnight, despite the best of intentions and efforts of our local Consumer Discretionary sector which has managed to lift by +0.5%.

Languishing at the bottom of the pile, however, are the Gruesome Twosome – Materials and Energy – both down more than 1.5% this morning, leading many avid ASX-watchers to exclaim “Wait… it’s Wednesday already?”

InfoTech is also suffering a little this morning, down more than 1.0% while the ASX’s own thinly-sliced indices are almost unanimously in the red this morning as well.

Even the goldies are down today, with the XGD All Ords Gold index posting a 0.82% fall, with the XSO Small Ords down 0.63% by lunchtime.

Up the Big Money end of the bourse, there’s a solitary stand-out – the $27.7 billion market cap Aristocrat Leisure (ASX:ALL) is up 4.2% on no particular news, so we can only assume that the company managed to hit a max-bet Five Dragon free spin re-trigger at least 5 or 6 times in a row at Penrith Panthers during last night’s meat raffle.

NOT THE ASX

In the US overnight, all eyes were on the closed doors of the US Fed meeting, a two-day affair that usually ends with all involved in agreement that the time is right for US Fed Chair Jerome Powell to emerge, open his mouth, and tank the economy.

In New York, the S&P 500 fell by -0.22%, the blue chips Dow Jones index was up by -0.31%, and the tech-heavy Nasdaq fell by -0.23%.

Earlybird Eddy reported this morning that debutante IPO stock Instacart stole the limelight as it rose over 40% at one point before pulling back to just 12% higher at the close.

The online grocery delivery company closed at US$34.23, valuing the company at about US$11bn which is still a steep plunge from the US$39 billion valuation it received in a 2021 funding round.

Automakers GM and Ford gained despite threats from the United Auto Workers union of more strikes if no deal is struck by Friday.

Starbucks lost -1.5% after broker TD Cowen downgraded the coffee chain to “underperform”.

Walt Disney lost -3.6% after doubling its capital expenditure for its parks business to about US$60 billion over the next 10 years.

In Japan, the Nikkei is down 0.36%, as the nation deals with the bitter disappointment that only 75 people were able to witness a high-speed pro-wrestling bout in person, aboard Nozomi Shinkansen bullet train running between Tokyo and Nagoya at a blistering 290kph.

The Main Event between Minoru Suzuki against Sanshiro Takagi was won by Suzuki, after Takagi was done by transit cops for putting his feet on the seat.

And… if you’ve ever had the desire to watch two grown men in their undies beating each other up on a train, but too busy to catch Sydney’s 4:29pm all stops from Blacktown to Emu Plains, boy-oh-boy am I about to make your day.

You are welcome.

In China, Shanghai markets are down 0.36% because wrestling in Chinese trains is considered uncouth – perhaps even, dare I say it, quite gauche – while in Hong Kong the Hang Seng is down 0.46% because even though it’s okay to wrestle on the trains there, no one really seemed up for it each time I’ve tried to get a match going.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 20 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.002 | 100% | 252,454 | $1,471,200 |

| AL8 | Alderan Resource Ltd | 0.012 | 50% | 37,343,416 | $4,933,557 |

| OSM | Osmond Resources | 0.125 | 25% | 39,179 | $4,689,604 |

| BP8 | BPH Global Ltd | 0.0025 | 25% | 2,180,000 | $2,669,460 |

| CCO | The Calmer Co Int | 0.005 | 25% | 4,456,593 | $3,268,477 |

| LNU | Linius Tech Limited | 0.0025 | 25% | 6,683,333 | $8,459,581 |

| TMX | Terrain Minerals | 0.005 | 25% | 396,800 | $4,332,797 |

| OZM | Ozaurum Resources | 0.11 | 22% | 8,477,004 | $11,430,000 |

| MEG | Megado Minerals Ltd | 0.046 | 21% | 1,318,293 | $9,669,311 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 262,926 | $5,079,373 |

| EDE | Eden Inv Ltd | 0.003 | 20% | 4,264,214 | $8,409,092 |

| LML | Lincoln Minerals | 0.006 | 20% | 44,000 | $7,103,559 |

| SZL | Sezzle Inc. | 23.91 | 19% | 46,996 | $55,259,904 |

| ATH | Alterity Therap Ltd | 0.007 | 17% | 500,000 | $14,639,386 |

| DOU | Douugh Limited | 0.007 | 17% | 713,857 | $6,341,852 |

| MOB | Mobilicom Ltd | 0.007 | 17% | 2,321,431 | $7,960,060 |

| RIE | Riedel Resources Ltd | 0.007 | 17% | 104,860 | $12,356,442 |

| SGC | Sacgasco Ltd | 0.007 | 17% | 5,025,800 | $4,641,496 |

| TAS | Tasman Resources Ltd | 0.007 | 17% | 14,600 | $4,276,016 |

| MDI | Middle Island Res | 0.022 | 16% | 280,900 | $2,672,506 |

| OLI | Oliver’S Real Food | 0.022 | 16% | 700,290 | $8,373,906 |

| GLV | Global Oil & Gas | 0.015 | 15% | 3,306,258 | $6,071,004 |

| APS | Allup Silica Ltd | 0.055 | 15% | 26,102 | $1,846,901 |

| GCM | Green Critical Min | 0.008 | 14% | 100,000 | $7,956,095 |

| BEZ | Besra Gold | 0.16 | 14% | 4,681,468 | $51,096,220 |

Alderan Resources (ASX:AL8) is leading the small caps race this morning, up 50% on happy news that the company has acquired 100% ownership of seven lithium exploration projects consisting of 24 granted exploration licences covering 472km2 in Brazil’s Eastern Lithium Belt.

The licences cover 7 project areas – Curral de Dentro, Minas Novas, Carai, Catuji, Itaipe, Itambacuri and Governador Valadares, which are all located in and immediately to the south of the area known as ‘Lithium Valley’ in the Eastern Lithium Belt of Eastern Brazil.

For reference, Latin Resources Limited (ASX:LRS) Salinas Project is just up the road, which boasts a JORC compliant Measured, Indicated & Inferred Mineral Resource estimate of 45.2Mt grading 1.34% Li2O.

OzAurum Resources (ASX:OZM) is back in the winner’s circle again this morning, on news that the company has raised $2.4 million (before costs) via a share placement through the issue of 31,750,000 new shares.

Interest in OZM went through the roof last week on news that OzAurum has also been out project shopping in Brazil, buying up the Linopolis Jaime Project that has been mined intermittently for tantalite, beryl, tourmaline, brazilianite and feldspar intermittently by the Pacheco family and other artisanal miners for over 50 years.

Besra Gold (ASX:BEZ) spiked early on news the company has agreed to sell to Quantum a quantity of refined gold from the Bau Gold Project, up to 3,000,000oz or a value of US$300,000,000, whichever comes first – but has sinced settled back to a 12% gain for the morning.

Resource Base (ASX:RBX) and Megado Minerals (ASX:MEG) are up on thin volume, climbing more than 21% each.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 20 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BSN | Basin Energy | 0.12 | -20% | 2,567,200 | $9,004,501 |

| AGE | Alligator Energy | 0.055 | -19% | 50,957,779 | $224,952,956 |

| T92 | Terra Uranium | 0.11 | -19% | 274,549 | $6,966,697 |

| HFY | Hubify Ltd | 0.015 | -17% | 20,000 | $8,930,453 |

| ADV | Ardiden Ltd | 0.005 | -17% | 124,875 | $16,130,012 |

| PNX | PNX Metals Limited | 0.0025 | -17% | 4,100,000 | $16,141,874 |

| RBR | RBR Group Ltd | 0.0025 | -17% | 1,000,062 | $4,855,214 |

| BLU | Blue Energy Limited | 0.016 | -16% | 2,734,986 | $35,168,498 |

| NIS | Nickel Search | 0.049 | -16% | 3,715,826 | $5,546,562 |

| MYE | Metarock Group Ltd | 0.11 | -15% | 64,482 | $39,128,859 |

| JATDD | Jatcorp Limited | 0.28 | -15% | 18,667 | $27,477,470 |

| CNJ | Conico Ltd | 0.006 | -14% | 174 | $10,990,665 |

| ELE | Elmore Ltd | 0.006 | -14% | 116,666 | $9,795,687 |

| EXL | Elixinol Wellness | 0.006 | -14% | 1,296,181 | $4,385,379 |

| FAU | First Au Ltd | 0.003 | -14% | 1,222,498 | $5,081,976 |

| BCT | Bluechiip Limited | 0.026 | -13% | 200,000 | $21,410,114 |

| EMT | Emetals Limited | 0.007 | -13% | 47,956 | $6,800,000 |

| ID8 | Identitii Limited | 0.014 | -13% | 61,716 | $5,545,832 |

| NAE | New Age Exploration | 0.007 | -13% | 22,059,215 | $11,487,191 |

| SER | Strategic Energy | 0.014 | -13% | 1,357,356 | $7,773,042 |

| YPB | YPB Group Ltd | 0.0035 | -13% | 495,035 | $2,973,846 |

| OKR | Okapi Resources | 0.145 | -12% | 1,384,435 | $34,664,193 |

| PSL | Paterson Resources NL | 0.029 | -12% | 33,334 | $13,110,712 |

| R8R | Regener8 Resources | 0.15 | -12% | 49,702 | $4,361,563 |

| SRT | Strata Investment | 0.16 | -11% | 37,836 | $30,496,244 |

The post ASX Small Caps Lunch Wrap: Who tried (and failed) to ‘take the money and run’ this week? appeared first on Stockhead.