Uncategorized

ASX Small Caps Lunch Wrap: Who else reckons we should have just finished the working week yesterday?

Local markets are stumbling at the end of a decent week, while local SaaS techie Pointerra’s looking 68.5% higher on … Read More

The post ASX Small Caps…

Local markets are down this morning, following a disappointing session on Wall Street that saw the Dow’s stab at a record-setting 14-session winning streak scuppered when the index refused to play ball.

If we’d all agreed to just pull the pin on the week yesterday, we could have avoided this mess entirely… but, no. Which means that by lunchtime today, the local benchmark was down 0.7%.

That was a slight improvement on the morning’s low-point, which – I’m sure we can all agree – was the substandard cup of coffee I purchased from tha cafe across the street.

I think it had oat milk in it. Oats don’t have milk, or children to feed it to.

Anyway – it’s Friday, which is the one day of the week most people will agree is a good one, if only for the fact that for most of us, it marks the end of the working week.

However, that might be about to change, after the results of a lengthy experiment landed during the week, which show that people who only work four days a week prefer that to working five days a week.

In other shocking news, water is wet, and dumb experiments produce predictable results.

The experiment was overseen by 4 Day Week Global, a New Zealand-based nonprofit that would probably be able to describe itself as a “profit” if they bothered to put in a full week’s work.

The group recruited a number of companies from a range of countries, including the UK, US and Australia, and – somehow – talked management into giving their employees the option of only rocking into work for four days, giving them a perennial long weekend.

Which, on the surface of it, does sound rather pleasant – until you remember that you’re just dudding yourself out of a bunch of public holidays and making a mockery of the sanctity of the four-day Easter Bunny’s Birthday festival along the way.

That said, there were some surface-level surprises in the results of the experiment, which have (naturally) been breathlessly reported in certain sections of the media – including the aforementioned oh-so-startling discovery that human beings would much rather do something other than be exploited as grist to the capitalist mill.

One of the actually surprising findings was that revenue among the companies undertaking the 12-month trial grew by 15%, despite the 20% drop in time spent doing stuff to make the businesses run.

That could be because a happier workforce is far less likely to indulge in workplace misappropriation – or it could be a direct result of every company on the planet jacking up the cost of everything because inflation’s been running out-of-control for the past 12 months.

Or it could just be a total coincidence – no one really knows, but if some rock-solid “correlation does equal causation, ackshewally” confirmation bias is going to help your argument for a 32-hour work week along, then who am I to argue?

It’s not a new idea at all, even in the US of A where Bernie “I’ve dressed to the left all my life” Sanders has been rattling his dentures about the idea for centuries.

With exploding technology and increased worker productivity, it’s time to move toward a four-day work week with no loss of pay. Workers must benefit from technology, not just corporate CEOs.https://t.co/mIm1EpcZLu

— Bernie Sanders (@SenSanders) February 21, 2023

I’m not sure what technology has been exploding, or how those explosions have been increasing worker productivity, but… it’s Bernie, man – American politics’ answer to the question “What would happen if you smooshed Stadtler and Waldorf from The Muppet Show together and magicked them into being A Real Boy?”

My plan for today was to jump on the ‘short working week’ bandwagon, and simply end Lunch Wrap right here so I could knock off and go back to bed for three days.

However, I’ve been gently reminded that hundreds, if not thousands, of workers over the years paid the ultimate price to bring about the introduction of the 40-hour working week, and to undo their hard work and sacrifice would be an international travesty.

So – in solidarity – here’s the rest of today’s Lunch Wrap…

TO MARKETS

The ASX 200 benchmark has dropped 0.7% before lunch today, recovering from a mid-morning low of -1.0% after local markets were once again led into a dark alley by Wall Street, so we could all get mugged in time for the weekend.

Adding to uncertainty this morning was the release of the nation’s June retail trade figures, showing a 0.8% drop after Australians turned their backs on EOFY sales and went back to stealing much-needed stationary items from work instead.

The June figures are the inverse of the previous month’s 0.8% rise, and add weight to the arguments for the RBA to keep rates on hold next week, because – let’s be honest – it really is beginning to look like no one got the foggiest what’s happening with the economy at the moment.

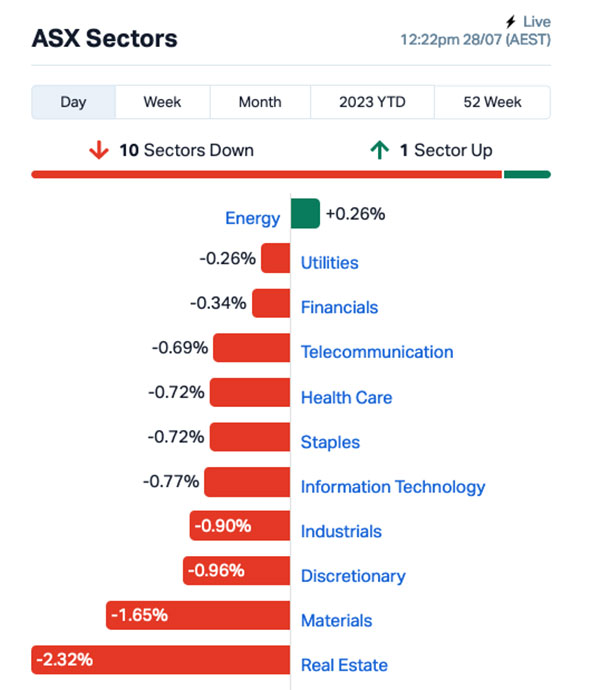

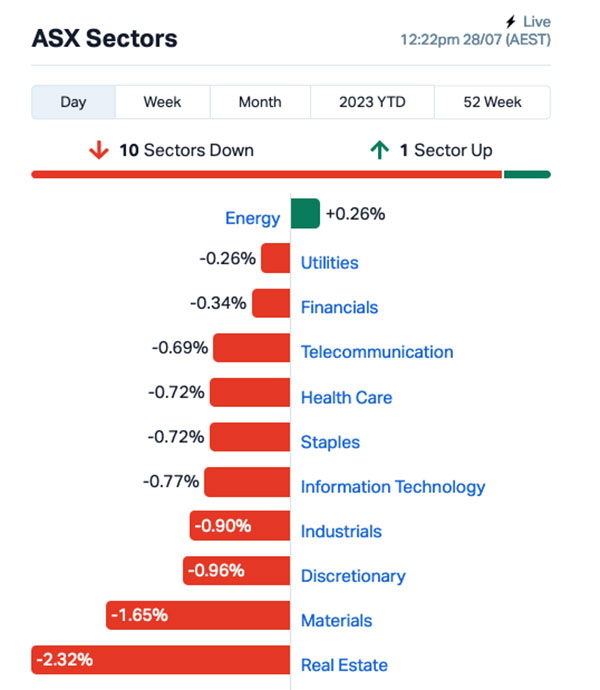

The Real Estate and Materials sectors are leading the losses this morning, with the former shedding 2.32% as yet-another-builder is in the headlines for all the wrong reasons.

Metricon, the country’s biggest home builder, has reportedly been tearing up fixed-price contracts left, right and centre – allegedly shaking down its customers for hefty extra payments with threats of cancelling their home-building contracts altogether if they don’t cough up the dough.

The rest of the market is similarly in the red, with the exception of the Energy sector, which is only just keeping its friendly little oil fire burning merrily atop the market’s sea of red.

NOT THE ASX

On Wall Street overnight, the Dow fell by 0.67%, the S&P 500 was down 0.64%, while Nasdaq slipped 0.55% – the result bringing an end to the Dow’s record-equalling 13-day winning streak.

In US stock news, it was a mixed bag of fortunes for travel shares after Southwest Airlines was forced to turn on the Seatbelt Sign as its share price tumbled 9% after a dip in Q2 profit.

On the high seas, however, those pirates of the Royal Caribbean were breaking open the rum and yo-ho-hoing all over the place, after its price surged 9% on a healthy boost to the company’s profit forecast.

Elsewhere, chipmakers including Nvidia, Micron and Marvell Technology all rose after analysts predicted upbeat quarterly sales.

Earlybird Eddy reported this morning that Wedbush Securities’ Dan Ives believes the “AI Gold Rush” has begun. It remains unclear which rock Ives has been hiding under for the past month or so, but it’s good to know that he’s finally all caught up with the rest of the US market, which has been buying up anything that even hint at “A” and “I” like vowels on Wheel of Fortune.

In Japan, the Nikkei is down 1.32% on the ‘devastating’ news that Mongolia’s dominance of the sport of Sumo is set to continue, after back-to-back ozeki promotions for Mongolian natives Kirishima and Hoshoryu brought that country’s total at the rank to seven.

Hoshoryu was the latest to achieve the rank, and – if you’re looking for something to do while quietly stressing about your lunchtime decision to eat something not-quite-healthy, here’s the big man in action during a recent Super Slappy Hands Beanbag Man Competition, where morbid obesity was declared the eventual winner.

In China, ousted Foreign Minister is still missing, and Shanghai markets are up 0.17%, while in Hong Kong the Hang Seng is down 0.21%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 28 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTL | Mantle Minerals Ltd | 0.002 | 100% | 2,766,803 | 6,147,446 |

| 3DP | Pointerra Limited | 0.165 | 74% | 15,871,386 | 64,391,589 |

| CLE | Cyclone Metals | 0.0015 | 50% | 37,000 | 10,264,505 |

| CT1 | Constellation Tech | 0.003 | 50% | 293,428 | 2,942,401 |

| MEB | Medibio Limited | 0.0015 | 50% | 806,481 | 5,150,594 |

| BFC | Beston Global Ltd | 0.0095 | 36% | 2,866,875 | 13,979,328 |

| GLA | Gladiator Resources | 0.016 | 33% | 136,696 | 6,554,039 |

| MCT | Metalicity Limited | 0.002 | 33% | 2,000 | 5,604,129 |

| TMB | Tambourah Metals | 0.345 | 25% | 1,744,357 | 11,624,031 |

| DDT | DataDot Technology | 0.005 | 25% | 297,057 | 4,843,811 |

| ERL | Empire Resources | 0.005 | 25% | 500,000 | 4,451,740 |

| ICN | Icon Energy Limited | 0.005 | 25% | 328,539 | 3,072,055 |

| MXC | MGC Pharmaceuticals | 0.0025 | 25% | 3,214,756 | 7,784,719 |

| PET | Phoslock Env Tec Ltd | 0.02 | 25% | 4,433,730 | 9,990,248 |

| ABE | Australian Bond Exchange | 0.18 | 24% | 74,850 | 5,619,200 |

| GTE | Great Western Exploration | 0.055 | 22% | 627,172 | 11,371,415 |

| SDR | Siteminder | 4.28 | 21% | 1,936,481 | 970,983,354 |

| AHN | Athena Resources | 0.006 | 20% | 4,980,334 | 5,352,338 |

| ZNO | Zoono Group Ltd | 0.055 | 20% | 24,750 | 8,736,673 |

| RMI | Resource Mining Corp | 0.056 | 19% | 454,979 | 24,708,250 |

| ATH | Alterity Therap Ltd | 0.007 | 17% | 100,000 | 14,639,386 |

| SIT | Site Group Int Ltd | 0.0035 | 17% | 125,000 | 7,807,471 |

| B4P | Beforepay Group | 0.555 | 16% | 6,985 | 16,726,473 |

| GCM | Green Critical Minerals | 0.016 | 14% | 320,682 | 13,810,701 |

| RNT | Rent.Com.Au Limited | 0.024 | 14% | 109,600 | 10,786,738 |

In Small Caps this morning, all eyes have been on SaaS company Pointerra (ASX:3DP), after two announcements lit a fire under its share price, sending it soaring 68.5%.

The announcements included a healthy quarterly report, but – in arguably more interesting news – existing Pointerra customer Entergy, a Fortune 500 company, has selected Pointerra’s US EPC partners for its 10-year, US$15 billion grid resilience CAPEX program.

That deal will see Pointerra’s AI-driven analytics platform used to identify and prioritise grid assets requiring remediation or replacement across the 10-year term of the program.

Meanwhile, Tambourah Metals’ (ASX:TMB) rise since revealing it has identified lithium bearing pegmatites at its at Russian Jack project has continued, with the company piling on another 25.5% this morning.

That might change quickly, as TMB has its quarterly due out at any moment today, which Rob “I write about other stuff now” Badman will probably tell you about in Closing Bell later today.

And finally, “open hotel” ecommerce platform SiteMinder (ASX:SDR) has a positive Q4FY23 Activities Report it’s spruiking today, along with a good cash-flow report to boot. Highlight: underlying free cash flow improvement (to 12.5)% of revenues from (28)% at the start of FY23.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for July 28 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTM | MTM Critical Metals | 0.066 | -28% | 5,835,809 | $8,928,299 |

| JAL | Jameson Resources | 0.051 | -28% | 25,288 | $27,797,288 |

| ADS | Adslot Ltd. | 0.003 | -25% | 3,162 | $13,066,468 |

| CCE | Carnegie Clean Energy | 0.0015 | -25% | 2,720,662 | $31,285,147 |

| GED | Golden Deeps | 0.008 | -20% | 22,447,581 | $11,552,267 |

| GFN | Gefen Int | 0.004 | -20% | 55,889 | $641,399 |

| ERW | Errawarra Resources | 0.105 | -19% | 81,547 | $7,865,520 |

| 1AG | Alterra Limited | 0.009 | -18% | 6,373,549 | $7,662,078 |

| NME | Nex Metals Explorations | 0.014 | -18% | 701 | $5,993,053 |

| RML | Resolution Minerals | 0.005 | -17% | 4,563,029 | $7,543,751 |

| AQX | Alice Queen Ltd | 0.016 | -16% | 50,000 | $2,403,782 |

| PEB | Pacific Edge | 0.135 | -16% | 225,119 | $129,658,435 |

| ARN | Aldoro Resources | 0.15 | -14% | 1,300 | $23,559,155 |

| DOU | Douugh Limited | 0.006 | -14% | 895,660 | $6,887,289 |

| HAR | Harangaresources | 0.12 | -14% | 60,588 | $7,113,963 |

| INP | Incentiapay Ltd | 0.006 | -14% | 144,001 | $8,855,445 |

| NMR | Native Mineral Resources | 0.03 | -14% | 160,636 | $5,143,770 |

| PRX | Prodigy Gold NL | 0.006 | -14% | 3,621,068 | $12,257,755 |

| CCA | Change Financial Ltd | 0.049 | -14% | 306,886 | $35,776,699 |

| APS | Allup Silica Ltd | 0.061 | -13% | 24,702 | $2,693,397 |

| C1X | Cosmos Exploration | 0.375 | -13% | 253,332 | $19,124,250 |

| CNJ | Conico Ltd | 0.007 | -13% | 206,077 | $12,560,760 |

| PIL | Peppermint Inv Ltd | 0.007 | -13% | 81,081 | $16,302,855 |

| RLG | Roolife Group Ltd | 0.007 | -13% | 100,000 | $5,756,465 |

| LPE | Locality Planning | 0.05 | -12% | 465,597 | $10,154,908 |

The post ASX Small Caps Lunch Wrap: Who else reckons we should have just finished the working week yesterday? appeared first on Stockhead.