Uncategorized

ASX Small Caps Lunch Wrap: Who else is in a flap about bird drones today?

Aussie stocks look like they’re hand-passing back the sick gainz accrued yesterday. That’s despite a decent day on Wall Street. … Read More

The post…

Aussie stonks look like they’re hand-passing back a fair bit of the sick gainz they accrued yesterday. And that’s despite a decent day on Wall Street. What’s doing?

We’ll explore that a little further below. But first, what the guano is happening over in laboratories in New Mexico?

Instead of cooking up inferior batches of bluish crystal meth ever since Walter White carked it, it appears the state’s geniuses are set upon providing scientific ballast to any buffoons who believe that whole “Birds Aren’t Real” nonsense isn’t satire.

As reported by Reuters this week, a bunch of bird-watching boffins at the New Mexico Institute of Mining and Technology in Socorro have been converting dead birds into taxidermied drones – with scientifically developed flapping wings and all.

Scientists in New Mexico are giving dead birds a new life with an unconventional approach to wildlife research — converting them into drones pic.twitter.com/msHbFYF2W7

— Reuters (@Reuters) April 14, 2023

Apparently it’s all in the name of science, to better study flight and help improve the aviation industry. Does this mean we’ll see rapidly flapping bird planes in the near future? Er, no.

“If we learn how these birds manage … energy between themselves, we can apply (that) into the future aviation industry to save more energy and save more fuel,” said Dr. Mostafa Hassanalian, a mechanical engineering professor and the project’s lead.

“We came up with this idea that we can use … dead birds and make them (into) a drone,” said the doc. “Everything is there … we do reverse engineering.”

Reverse engineering, eh? Never mind Gregor’s Great Monkey Uprising, this is very clearly the first step towards developing flocks of all-seeing avian RoboCops for your protection. RoboFlocks, if you will. Probably with little cameras for eyes and anuses that spread government-funded viruses.

In fact, we wouldn’t be surprised to learn the SEC’s Gary “I AM the Law” Gensler is secretly funding this terrifying research. After all, he likes talking about birds. Here’s what he recently said about crypto assets being unregistered securities:

“When I see a bird that walks like a duck and swims like a duck and quacks like a duck, I call that bird a duck.”

TO MARKETS

The Aussie benchmark took a long walk off a short pier this morning, plummeting sharply before recovering somewhat to where it is now, down about 0.33% since this time yesterday.

This wasn’t an entirely unexpected move, according to those who know, and that includes Stockhead’s Eddy Sunarto, who called it well before 105/20 Bridge Street’s doors were even opened this morn in Sydney. He’s good like that.

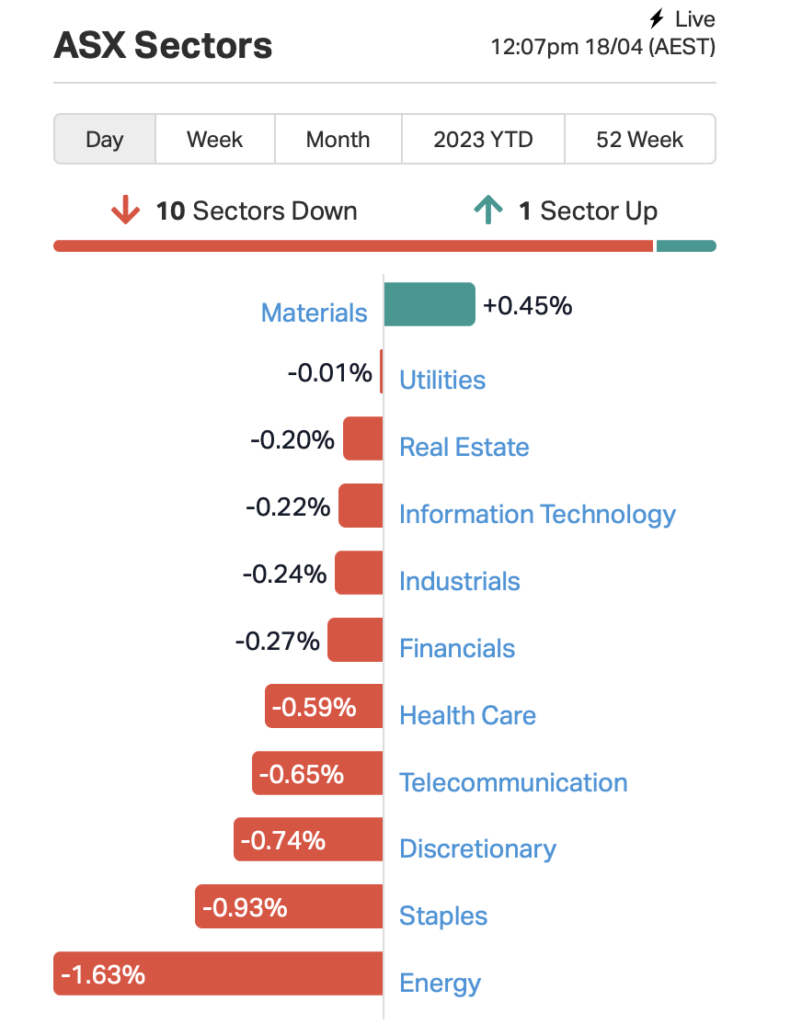

Digging into specifics a little, here’s the sector-based snapshot, per Market Index data:

The chart tells the very bare bones of the plot, with Energy, Staples, Consumer Discretionary stocks, Telecommunications and Healthcare all bleeding out on the whole. Materials… you win the best-in-show in an otherwise messy start to the day.

Making a liar of me, we’re noticing a Healthcare-sector standout today doing pretty damn well, actually…

• TELIX Pharmaceuticals (ASX:TLX); +10%. Can’t see a lot of news to support this today, although the firm did yesterday release a lengthy Q1 business update, with plenty of positive happenings. So maybe investors are only just getting round to reading it today.

Proving the Basic Materials point, however, we have:

• Core Lithium (ASX:CXO); +6%. “Significant increase to Finniss Mineral Resources” – the firm’s 100% lithium operation near Darwin.

• Pilbara Minerals (ASX:PLS); +5%. No fresh news of note today but Josh Chiat’s all over both of those in this AM’s Ground Breakers.

NOT THE ASX

As Eddy noted in his Market Highlights wrap, the US stock markets closed in the green overnight, all rising by about 0.3%.

Will it be a green week on Wall Street? Wouldn’t count on it. Maybe we’re in for a mixed bag of frustrating choppiness.

“The solid start to the US earnings season has continued,” wrote Eddy, “with Charles Schwab and M&T Bancorp reporting strong quarterly earnings beats, but State Street Bank plunged 9% on lower than expected results.”

But with crude oil prices falling and the US dollar suddenly rising again, those who more than fancy a Fed pivot or pause on its tightening might have some re-thinking to do.

Certainly Independent Wealth Solutions’ Paul Meeks is dubious about the pivot narrative and what’s happened with US stocks so far this year.

“Too many people have driven these stocks up based on the Fed pivot narrative,” says Independent Wealth Solutions’ Paul Meeks on tech. “I don’t see a pivot until next year [at the] earliest. I’m super worried about the fact that that drove the Nasdaq up in the first quarter.” pic.twitter.com/xygk4o3LtZ

— Squawk Box (@SquawkCNBC) April 17, 2023

We know that many a Bitcoin and crypto supporter, too, have been hoping for an impending change in US monetary policy. But that’s a market built on hopium, fear and greed. Not that stock markets aren’t, mind.

How is Bitcoin travelling today, incidentally? It’s currently attempting to consolidate and find some strength after dipping quite dramatically below US$30k since about this time yesterday.

Some analysts think the retest down in the mid-low 29ks is a good thing, and all part of a move higher. Others, yeah, not so much. You can read about those differing opinions, and more on the crypto market, including Gary Gensler’s continued terrorising of US crypto firms, over at today’s Mooners and Shakers.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 18 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LRV | Larvotto Resources | 0.24 | 78% | 5,581,117 | $9,079,387 |

| DAF | Discovery Alaska Ltd | 0.046 | 53% | 1,370,809 | $6,727,041 |

| CLZ | Classic Min Ltd | 0.0015 | 50% | 113,484,100 | $3,093,095 |

| VPR | Volt Power Group | 0.0015 | 50% | 353,981 | $10,716,208 |

| OD6 | OD6 Metals | 0.395 | 34% | 5,380,773 | $16,229,571 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | 188,402 | $5,957,756 |

| TIG | Tigers Realm Coal | 0.011 | 22% | 3,557,092 | $117,600,321 |

| IS3 | I Synergy Group Ltd | 0.018 | 20% | 300,000 | $4,336,206 |

| KGD | Kula Gold Limited | 0.018 | 20% | 166,666 | $5,598,179 |

| AMD | Arrow Minerals | 0.006 | 20% | 6,222,777 | $15,118,825 |

| VKA | Viking Mines Ltd | 0.012 | 20% | 5,559,903 | $10,252,584 |

| SRZ | Stellar Resources | 0.0155 | 19% | 11,989,945 | $13,060,202 |

| MBX | My Foodie Box | 0.019 | 19% | 40,000 | $590,692 |

| KNB | Koonenberrygold | 0.071 | 18% | 35,250 | $4,545,387 |

| MTM | Mt Monger Resources | 0.13 | 18% | 1,190,808 | $7,783,627 |

| AVW | Avira Resources Ltd | 0.0035 | 17% | 296,263 | $6,401,370 |

| SVR | Solvar Limited | 2.07 | 15% | 376,648 | $376,645,025 |

| PCL | Pancontinental Energy | 0.0115 | 15% | 24,823,591 | $75,542,228 |

| CZN | Corazon Ltd | 0.016 | 14% | 950,000 | $8,544,628 |

| DOU | Douugh Limited | 0.008 | 14% | 1,248,990 | $6,887,289 |

| TAS | Tasman Resources Ltd | 0.008 | 14% | 900,100 | $4,988,685 |

| 3DP | Pointerra Limited | 0.12 | 14% | 1,059,819 | $71,169,651 |

| RFX | Redflow Limited | 0.21 | 14% | 260,602 | $33,248,082 |

| IRX | Inhalerx Limited | 0.045 | 13% | 494,920 | $7,590,678 |

| ADD | Adavale Resource Ltd | 0.018 | 13% | 685,377 | $8,312,417 |

Standouts…

• Larvotto Resources (ASX:LRV) +78% – The multiple-commodity resources exploration firm, according to a press release, “today announced bonanza grade results of total rare earth element oxide (TREO) results from recent aircore drilling at the company’s Merivale South Prospect (100%) in Western Australia”.

• Discovery Alaska (ASX:DAF) +53% – on no fresh news we’re seeing at this time.

• OD6 Metals (ASX:OD6) +34% – Good results for second-phase drilling at OD6’s Splinter Rock Project, located northeast of Esperance in Western Australia. According to an announcement today, there’s been “bumper assay results and clay thicknesses returned from the second phase, 83-hole drill program, with higher grades and larger thicknesses than those observed in the initial impressive program.”

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for January 18 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PRM | Prominence Energy | 0.001 | -50% | 51,000 | $4,849,218 |

| AR3 | Austrare | 0.63 | -22% | 3,027,714 | $77,113,257 |

| PLG | Pearl Gull Iron | 0.026 | -21% | 1,566,939 | $5,161,736 |

| MTL | Mantle Minerals Ltd | 0.002 | -20% | 12,417,427 | $13,364,013 |

| RDN | Raiden Resources Ltd | 0.004 | -20% | 2,320,000 | $9,272,912 |

| LDX | Lumos Diagnostics | 0.018 | -18% | 428,358 | $6,015,242 |

| TZN | Terramin Australia | 0.018 | -18% | 1,395 | $46,564,380 |

| HHI | Health House Int Ltd | 0.005 | -17% | 7,184 | $847,978 |

| LER | Leaf Res Ltd | 0.018 | -14% | 913,558 | $43,302,816 |

| CXU | Cauldron Energy Ltd | 0.006 | -14% | 1,266,625 | $6,520,981 |

| FAU | First Au Ltd | 0.006 | -14% | 390,000 | $7,663,483 |

| HLF | Halo Food Co. Ltd | 0.012 | -14% | 2,912,177 | $5,610,776 |

| RMX | Red Mount Min Ltd | 0.003 | -14% | 900,600 | $7,951,479 |

| EQN | Equinoxresources | 0.135 | -13% | 287,436 | $6,975,000 |

| REZ | Resourc & En Grp Ltd | 0.014 | -13% | 20,170 | $7,996,893 |

| XTC | Xantippe Res Ltd | 0.0035 | -13% | 3,933,512 | $42,320,399 |

| SRK | Strike Resources | 0.05 | -12% | 756,753 | $16,173,750 |

| MAU | Magnetic Resources | 0.6 | -12% | 10,000 | $156,068,419 |

| APC | Aust Potash Ltd | 0.023 | -12% | 881,776 | $27,005,623 |

| INV | Investsmart Group | 0.195 | -11% | 1,733 | $31,068,224 |

| AGR | Aguia Res Ltd | 0.032 | -11% | 684,314 | $15,618,753 |

| AUK | Aumake Limited | 0.004 | -11% | 53,571 | $4,733,011 |

| AVM | Advance Metals Ltd | 0.008 | -11% | 475,691 | $5,238,397 |

| PKO | Peako Limited | 0.008 | -11% | 4,588,484 | $4,236,583 |

| MKR | Manuka Resources | 0.082 | -11% | 861,080 | $46,257,741 |

The post ASX Small Caps Lunch Wrap: Who else is in a flap about bird drones today? appeared first on Stockhead.