Uncategorized

ASX Small Caps Lunch Wrap: Who else feels like we’re running out of space this week?

The ASX has fallen down, Wall Street’s on fire… but Sabre’s cracked the code for how to make gains with … Read More

The post ASX Small Caps Lunch Wrap:…

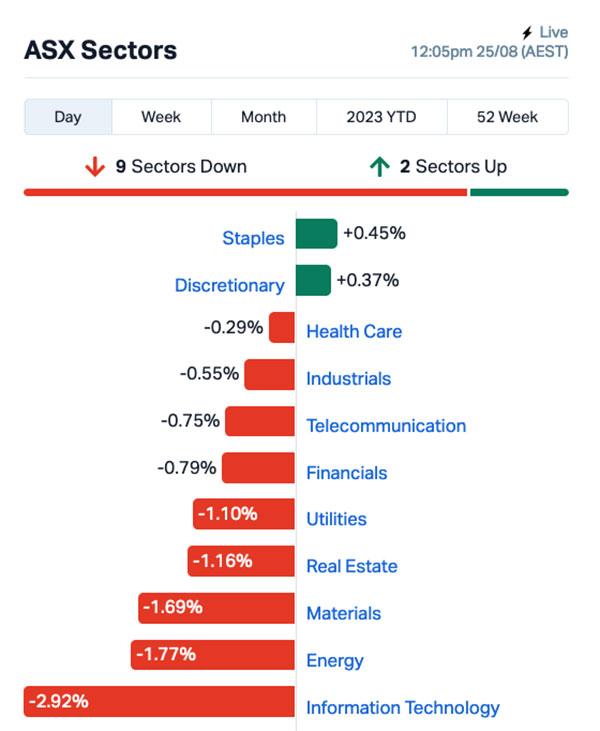

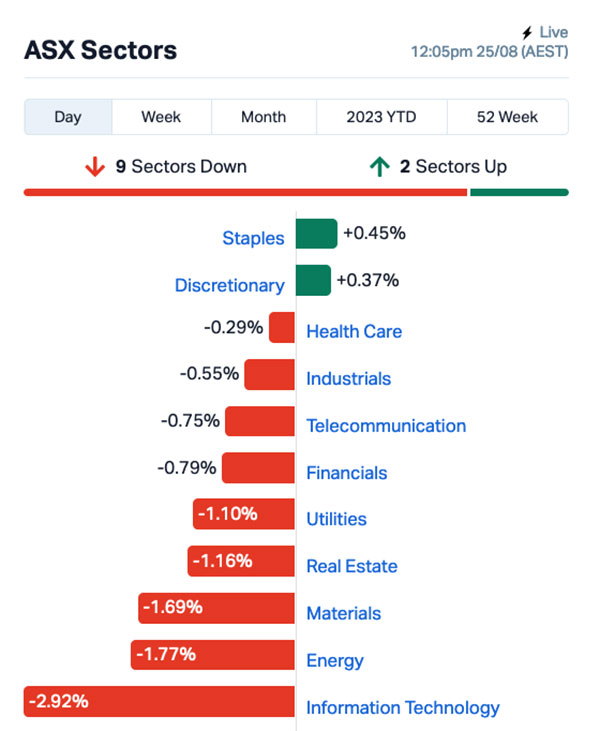

Local markets have fallen this morning, hitting -0.97% around lunchtime, mostly because the InfoTech sector is behaving like a gigantic, hugely expensive toddler this week.

It’s not a uniquely Australian problem, either – the US tech sector is, apparently, steam-powered these days, and that’s a commodity that is visibly in short supply.

I’ll get into more detail on that shortly, but first to a super-quick slice of news from space this morning, after the European Space Agency’s mission to clean up space debris suffered a severe blow.

Called ClearSpace-1, the mission was being developed around the removal of a leftover rocket adaptor that the agency was planning to deal with in 2026.

Sadly, the plan to remove the space debris is now in serious doubt, because the space debris is now surrounded by a cloud of smaller space debris, most likely because the large space debris has been hit by a piece of space debris believed to be smaller than the targeted space debris, and slightly larger than the space debris that now surrounds the big space debris.

So, you can see what the problem is.

In other space news, SpaceX dude Elon Musk recently confirmed that he’s aiming at having more than 42,000 Starlink satellites in space once the project is complete.

Each of those satellites reportedly has a working life of about five years. What could possibly go wrong?

TO MARKETS

This morning, the ASX 200 Futures Index was pointing south and well below any semblance of decency, with the needle at -1.3% because of how awful things are in the US right now.

Proving remarkably prescient, that index was very close to the money, as the benchmark hit -1.24% just 15 minutes after the doors flew open, but things have improved ever-so-slightly since then, to -1.0% or thereabouts.

The big albatross-shaped millstone around the bourse’s neck this morning is the increasingly erratic Tech sector, which has fallen close enough to 3.0% this morning to be declared a write-off for the day.

In fact, the only two sectors that aren’t in the red are the Consumer Twins, with Staples edging out Discretionary – but not by much.

Everything else is on course to bum everyone out, just in time for the weekend. Even the normally “reliable bet when all is looking grim” goldies are down today, with the XGD All Ords Gold index falling 0.7% in just two hours.

That’s not to say that there aren’t some solid performances today, and chief among those is a banger for Large Capper Accent Group (ASX:AX1), which waited until the markets were closed yesterday before dropping a stunner of an earnings report.

The highlights of that include things like “Total sales of $1.57 billion, up 24% on the prior year”, and “EBITDA of $298.2 million, up 39.6% on the prior year”, and the show-stopper: “Net Profit After Tax (NPAT) of $88.7 million”, a very nice lift against last year’s result of $31.5 million.

Accent Group is trading higher by more than 17.6% this morning as a result.

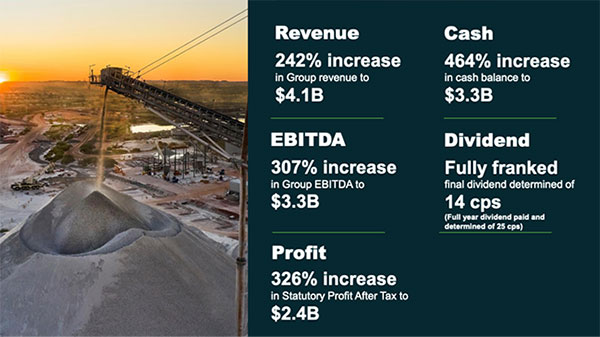

The news was far from great for Pilbara (ASX:PLS) though, despite the lithium giant posting some astonishing results for its past 12 months.

That’s from Pilbara’s results presentation, and those are some outstanding figures worth boasting about.

But, since the market’s a fickle beast, Pilbara’s fallen more than 7.0% this morning, most likely because things will undoubtedly be tougher for PLS over the next 12 months, and because the 620,000t of spodumene concentrate the company shipped in the past year fell short of the 700,000t the market was expecting.

I’m reliably informed that the drop could also be partly attributed to a pocket of investors expressing their sincere displeasure at the unspeakable outrage of a fully-franked $0.14 divvy.

There really is no pleasing some people. But we can probs assume those people aren’t the ones who were paying 14c a share for PLS little more than three years ago.

NOT THE ASX

In the United States of America, Wall Street has fallen because everything is relentlessly getting weirder by the day.

“It appears the market is becoming increasingly nervous about the annual gathering of the world’s top central bankers in Jackson Hole, Wyoming, where Jerome Powell is scheduled to deliver a speech on Friday morning, US time,” Earlybird Eddy wrote this morning, proving conclusively that he is the undisputed champion of understatement.

(For what it’s worth, I would’ve gone with “sh-t’s on fire, yo” and been done with it).

The indices tell the story: The S&P 500 tumbled by -1.3%, blue chips Dow Jones by -1.08%, and tech heavy Nasdaq was sold off heavily by -1.87%.

One small highlight at the dizzy end of town was chipmaker Nvidia briefly touching all time highs, but even the unstoppable growth machine faltered to leave the stock down 0.1% for the day.

For those of you who suffer from a fear of flying, you’ll no doubt be interested to learn that Boeing fell 5% after improperly drilled holes in a component that helps maintain cabin pressure were discovered in the 737 Max jets.

You’re welcome.

And in Gaming news, Sony has acquired privately held Californian headphones maker Audeze, in a bid to advance the sound experience of its PlayStation products to the point where there can be absolutely no mistake about the atrocities every 12-year-old COD enthusiast is planning to perpetrate against your mum.

In Japan, the Nikkei has fallen nearly 2.0% this morning, after those scamps at the state-owned Tokyo Electric Power Company carried out their plan to dump water from the recently-disastered Fukushima nuclear plant into the sea.

China reacted to the news by banning all Japanese seafood from being imported into the country, which on the one hand makes sense, but is still a bit rich coming from a nation with a long and glorious history flogging counterfeit eggs.

Chinese markets have reacted to a sudden drop in tasty seafood by falling 0.32%, while in Hong Kong the Hang Seng has fallen 1.02%, because someone dropped it on its head when it was a baby, and it’s been ‘not quite right’ ever since.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 25 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EMU | EMU NL | 0.002 | 100% | 500,000 | $1,450,021 |

| SBR | Sabre Resources | 0.066 | 47% | 67,389,283 | $13,116,878 |

| AOA | Ausmon Resorces | 0.004 | 33% | 300,000 | $2,907,868 |

| ELE | Elmore Ltd | 0.004 | 33% | 785,054 | $4,198,151 |

| AWJ | Auric Mining | 0.054 | 32% | 141,379 | $5,365,243 |

| BVS | Bravura Solution Ltd | 0.625 | 25% | 2,928,183 | $224,177,001 |

| GDM | Great Divide Mining | 0.25 | 25% | 1,135,465 | ~$2,300,000 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 23,688 | $6,847,219 |

| AUZ | Australian Mines Ltd | 0.019 | 19% | 9,193,685 | $10,461,158 |

| BXN | Bioxyne Ltd | 0.014 | 17% | 144,583 | $22,819,745 |

| CHK | Cohiba Min Ltd | 0.0035 | 17% | 710,126 | $6,639,733 |

| IEC | Intra Energy Corp | 0.007 | 17% | 2,612,557 | $9,724,690 |

| STP | Step One Limited | 0.53 | 16% | 208,086 | $84,329,832 |

| AX1 | Accent Group Ltd | 2.14 | 16% | 3,396,266 | $1,019,288,623 |

| TSO | Tesoro Gold Ltd | 0.022 | 16% | 582,002 | $20,018,639 |

| LLI | Loyal Lithium Ltd | 0.79 | 15% | 2,095,746 | $49,973,799 |

| REC | Recharge Metals | 0.23 | 15% | 265,923 | $21,116,895 |

| LLO | Lion One Metals Ltd | 1.2 | 15% | 58,005 | $14,430,764 |

| RBX | Resource B | 0.195 | 15% | 13,252 | $14,056,362 |

| 1AG | Alterra Limited | 0.008 | 14% | 602,999 | $4,875,868 |

| AJX | Alexium Int Group | 0.016 | 14% | 372,900 | $9,119,457 |

| ARV | Artemis Resources | 0.032 | 14% | 5,075,636 | $43,957,714 |

| ASR | Asra Minerals Ltd | 0.008 | 14% | 432,500 | $10,082,710 |

| MLS | Metals Australia | 0.04 | 14% | 10,720,433 | $21,841,267 |

| ERW | Errawarra Resources | 0.21 | 14% | 3,385,978 | $11,193,240 |

This morning’s Small Caps leader is Sabre Resources (ASX:SBR), which has climbed more than 42% on the back of an announcement that hit the trifecta of Magic Words in the title, but doesn’t amount to much at all.

Sabre told the market this morning that it’s gobbled up a slightly larger slice of the prospective lithium pie near Azure’s barnstomer Andover project, which it plans to explore.

That’s it. That’s the whole announcement.

But it says “lithium”, “Andover” and for some reason “major” in the title, so skyward it’s gone.

Bravura Solutions (ASX:BVS) is up +26% – a gain directly attributable to an earnings report that starts out with “achieved guidance across all metrics with a significant closing cash balance”, before explaining why it’s not all good news by any reasonable measure.

Bravura’s operating expenses rose from $221.3 million to $257.7 million, operating EBITDA declined $53.4m, from $45.3 million in the pcp to a deficit of $8.1 million and an adjusted NPAT of -$23.1 million, which represents a $48.8m decline against the pcp figure of $25.7 million.

“Because of headwinds”, Bravura said, gustily. “We don’t care,” said investors.

In second place, Australian Mines (ASX:AUZ) is up 18.75% on zero news – the last time the market heard from AUZ was when we all got told last week that CEO Michael Holmes is exiting the company to “pursue other interests” at the end of October.

Artemis Resources (ASX:ARV) is up 14.2%, ostensibly on recent news of new gold targets and an updated JORC tables from its Lulu Creek project, and Metals Australia (ASX:MLS) has jumped 17% for no apparent reason.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 25 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -50% | 2,202,652 | $20,529,010 |

| ARN | Aldoro Resources | 0.135 | -34% | 1,203,977 | $27,597,867 |

| ROO | Roots Sustainable | 0.004 | -20% | 583 | $693,611 |

| MKL | Mighty Kingdom Ltd | 0.017 | -19% | 286,175 | $6,850,611 |

| EEL | Energy Elements | 0.005 | -17% | 1,150,000 | $6,059,790 |

| MXC | MGC Pharmaceuticals | 0.0025 | -17% | 752,770 | $11,677,079 |

| ROG | Red Sky Energy | 0.005 | -17% | 265,679 | $31,813,363 |

| AKO | Akora Resources | 0.165 | -15% | 30,000 | $18,521,649 |

| GSR | Greenstone Resources | 0.011 | -15% | 1,000 | $17,432,412 |

| AIV | Activex Limited | 0.017 | -15% | 50,000 | $4,310,052 |

| IRI | Integrated Research | 0.43 | -15% | 613,339 | $87,405,747 |

| PRX | Prodigy Gold NL | 0.006 | -14% | 20,000 | $12,257,755 |

| WGR | Western Gold Resources | 0.037 | -14% | 163,057 | $3,988,160 |

| G50 | Gold50 Limited | 0.13 | -13% | 206,600 | $14,703,750 |

| SOV | Sovereign Cloud Holdings | 0.096 | -13% | 11,850 | $37,334,074 |

| SPX | Spenda Limited | 0.007 | -13% | 288,404 | $29,371,377 |

| VAL | Valor Resources Ltd | 0.0035 | -13% | 314,570 | $15,313,339 |

| NZK | NZK Salmon Ltd | 0.175 | -13% | 2,500 | $108,290,942 |

| POD | Podium Minerals | 0.043 | -12% | 65,033 | $17,852,493 |

| WRK | Wrkr Ltd | 0.024 | -11% | 142,857 | $34,332,904 |

| NTM | Nt Minerals Limited | 0.008 | -11% | 5,200 | $7,206,290 |

| AHC | Austco Healthcare | 0.17 | -11% | 459,700 | $55,250,132 |

| RBL | Redbubble Limited | 0.54 | -10% | 1,427,784 | $166,632,134 |

| BCT | Bluechiip Limited | 0.018 | -10% | 7,530 | $14,273,409 |

| ICG | Inca Minerals Ltd | 0.018 | -10% | 674,706 | $9,700,200 |

The post ASX Small Caps Lunch Wrap: Who else feels like we’re running out of space this week? appeared first on Stockhead.