Uncategorized

ASX Small Caps Lunch Wrap: Who else doesn’t feel remotely like working today?

Cooling Aussie inflation and better US jobs data has helped local markets climb more than 1.2% this morning, with RocketDNA … Read More

The post ASX…

The ASX is rising again today, up 1.25% at lunchtime for a variety of reasons, not least of which is a bit of a banger from Wall Street overnight, and some healthy gains among the local big kids in Industrials and Health Care this morning.

There’s also been a welcome announcement on Australia’s inflation rates, which have cooled to 4.9%, which is usually good for a mid-sized kick in the bum to get the market moving higher.

But before it’s time to delve too deeply into the numbers, I’m gonna tug on your coat about the rising trend of cranky old Big Business execs demanding that their workforce ditch the notion of working remotely, because apparently it’s making the C-Suite crowd sad.

Let me preface this by saying that we all knew that this was going to happen. Covid struck and shut down the planet, people had no choice but to work from home, business went on as normally as possible and the world, being what it is, continued its wobbly path around the sun.

The weird side effect of that whole scenario was an uptick in happiness for workers who were able to do their jobs quite happily from home.

And it wasn’t just a little uptick, either. More than a year ago, some fella with a PhD in work stuff wrote this piece for Forbes, which categorically stated that working remotely had driven a 20% jump in worker happiness.

For the life of me, I can’t figure out if that means everyone is 20% better off on a completely intangible ‘How Happy Are Ya?’ scale, or if 20% more people are no longer filled with existential dread by the idea of being able to smell their co-workers.

But whatever it is, 20% is a lot more than a mere statistical blip.

But even back then, CEOs and other balding ne’er-do-wells were starting to make gutteral, harrumphing sounds about how they’d like everyone to start coming back into the office, since it’s been pretty well documented that the more alarming predictions about Covid-19 were a long way past the (still awful) reality.

That includes people like current Amazon CEO Andy Jassy, who – it seems – is on the now-familiar path of trying to stamp his name on the company he now holds the reins to, via the simple expedience of trying to out-arsehole the last guy.

And that is something that was always going to take some doing, because former Amazon boss Jeff Bezos, whose ability to be a prize-winning skidmark on the undies of humanity is well-documented.

Here’s one example, just off the top of my head… Bezos took Captain “William Shatner” Kirk for a ride on his peenie-shaped rocket a while back, giving Shatner the chance to finally have the life-altering trip into space he’d always dreamed of.

Upon their return to earth, Shatner was visibly moved by the experience, and – obviously emotional – did his best to explain to Bezos just what that time in the sky really meant to him.

See if you can spot what Bezos might have done wrong:

… what a dick guy.

Anyway, his successor Andy Jassy is going head to head with Amazon HQ workers in Seattle, because he wants them back in the office, and they want to be able to work in their pyjamas reeking of bong smoke from the comfort of their beanbags, or whatever furniture those Seattle dirtbags are favouring at the moment.

The workforce has made it abundantly clear that they would be much, much happier working remotely, and about 1,000 of them were threatening to walk off the job altogether at one stage.

To which Jassy recently replied with a blatant, not even thinly-veiled or nothin’, threat saying that for employees who defy his edict to return to the office for at least three days a week that “it’s probably not going to work out for you”, per the always-reliable New York Post.

It’s obvious that Amazon’s going to win, should push come to shove – because the writing for remote workers is not so much ‘on the wall’, but could be more accurately be described as “well and truly beaten into the psyche of workers everywhere”.

And that’s because Jassy’s not alone, and even the bosses at workplace communications platform Zoom, which almost single-handedly facilitated the fundamental shift to remote work during the pandemic, are now saying that their workers can’t work remotely anymore.

In the interests of full disclosure, you should be aware that I am writing this from my home, and that my wonderful team here at Stockhead aren’t putting any of that nonsense pressure on me to do my work ‘in person’.

Partly because they’re awesome, and partly because they are very well aware that I’ve gotten quite used to working sans trousers, and not even having to be in the office is going to drive me back into pants any time soon.

TO MARKETS

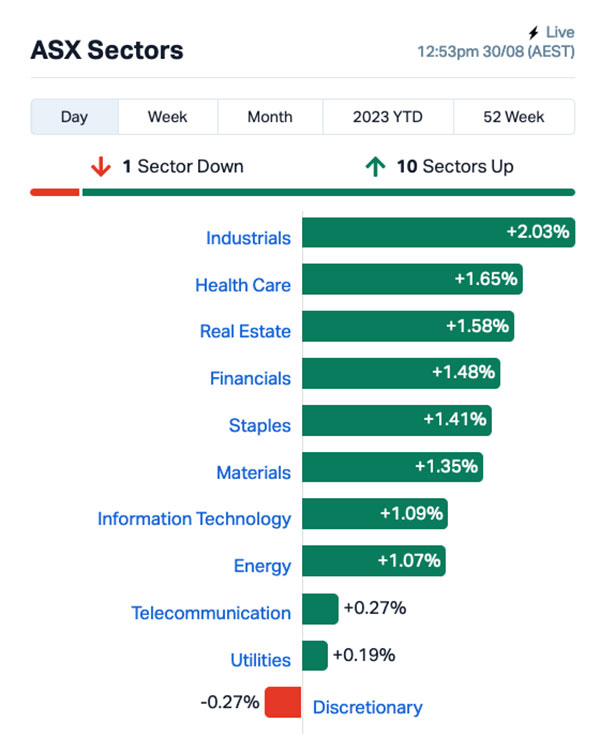

Local markets are higher by 1.25% at lunchtime, thanks to some solid performances across most of the market sectors – with the notable exceptions of Consumer Discretionary and the Telcos, both of which are down by enough to make a visible impact.

InfoTech and Utilities are running at a blistering level of lukewarm so far this morning as well, but it’s Industrials leading the pack (+2.03%) into lunch, with seven other market sectors above the +1.0% mark as well.

The XGD ASX All Ords Gold index is moving best this morning, adding more than 1.57% with the XBK Banks index up 1.45%, the XTX Tech index recovering to reach +1.41% and the XJR Resources index not far behind on 1.32%.

Up the top end of town, Brambles (ASX:BXB) is up just over 6.0% off the back of a decent-looking FY23 results report, as is healthcare radiology support services company Healius (ASX:HLS), which is up 6.8% despite reporting a $368 million loss for the year, which it’s blaming on a $389 million impairment linked to AgileX, which it acquired in 2021.

APM Human Services (ASX:APM) is up 6.1% a couple of days after announcing it’s had a solid year, and McMillan Shakespeare (ASX:MMS) is up 5.0% this morning, bouncing back from a terrifying post-earnings freefall that kicked off on Monday.

NOT THE ASX

Wall Street dropped a bit of a bumper issue last night, after a rally among the tech stocks helped drive the major indices higher, leaving the S&P 500 up +1.45%, blue chips Dow Jones up-ish by +0.85%, and the tech-heavy Nasdaq upperest at +1.74%.

Fresh US jobs data helped soothe the raging minds of US investors, as it showed that the American jobs market is cooling, now that all the really daggy jobs have been filled.

Earlybird Eddy reports that, according to CME Group’s FedWatch tool, interest rate futures are currently signalling an 87% chance the Fed will keep rates steady in September, and a 54% chance it will hold this rate through to November.

In US stock news, Tesla jumped almost 8%, Nvidia by 4%, and other megacap growth stocks all rose as well, including a 2.7% jump for Alphabet, after it unveiled watermark and images identification tools generated with AI, and a fancy new version of its custom-built AI chips, which still have that glorious New Chip smell.

In Japan, the Nikkei is up nearly 1.0% this morning, despite carmaker Toyota being forced to close down its manufacturing facilities nationwide due to a “glitch”.

“We’re not entirely sure what happened, or who is responsible, but we have some ideas,” Toyota CEO Kōji Satō absolutely did not say.

“Without warning, all LandCruiser and HiLux production suddenly switched to completely different make and model of vehicles, and in minutes Toyota workers throughout Japan were drowning in DongFeng E90s,” he also did not say.

“Whether that’s a clue or part of a cunning ruse, we are not sure. But somebody, somewhere, will pay for this outrageous insolence.”

Meanwhile in China, Shanghai markets are up more than 0.4% on claims that several of that nation’s automakers, including DongFeng subsidiaries Mengshi, Voyah and Fengxing have discovered new manufacturing methods that drastically reduce costs, in some cases by nearly 100%.

(Don’t bother writing in.)

In Hong Kong, the Hang Seng is up 1.28% on news that the cost of new Chinese manufactured cars is set to drop below the ~AUD$2,800 annual cost of registering them.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 30 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KEY | KEY Petroleum | 0.0015 | 50% | 6,000 | $1,967,928 |

| RKT | Rocketdna Ltd | 0.0145 | 45% | 125,085,204 | $5,338,926 |

| ICR | Intelicare Holdings | 0.016 | 23% | 294,671 | $2,715,900 |

| TON | Triton Min Ltd | 0.027 | 23% | 1,117,036 | $34,349,823 |

| MTO | Motorcycle Hldg | 2.07 | 21% | 362,093 | $126,356,499 |

| PGM | Platina Resources | 0.028 | 22% | 1,034,158 | $14,333,148 |

| KGD | Kula Gold Limited | 0.017 | 21% | 601,933 | $5,224,967 |

| NAG | Nagambie Resources | 0.034 | 21% | 20,000 | $16,288,337 |

| SOV | Sovereign Cloud Hldg | 0.115 | 21% | 97,503 | $32,243,064 |

| AMD | Arrow Minerals | 0.003 | 20% | 19,715,876 | $7,559,413 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 4,138,066 | $1,787,583 |

| MEL | Metgasco Ltd | 0.013 | 18% | 444,437 | $11,702,754 |

| ZNC | Zenith Minerals Ltd | 0.105 | 18% | 455,920 | $31,361,899 |

| RXH | Rewardle Holding Ltd | 0.027 | 17% | 374,293 | $12,105,394 |

| AOA | Ausmon Resorces | 0.0035 | 17% | 325,000 | $2,907,868 |

| DDT | DataDot Technology | 0.0035 | 17% | 179,999 | $3,632,858 |

| SIT | Site Group Int Ltd | 0.0035 | 17% | 125,000 | $7,807,471 |

| TAS | Tasman Resources Ltd | 0.007 | 17% | 200,492 | $4,276,016 |

| ACM | Aus Critical Mineral | 0.29 | 16% | 1,652,599 | $7,432,813 |

| SBR | Sabre Resources | 0.058 | 16% | 10,853,959 | $14,574,309 |

| FRB | Firebird Metals | 0.15 | 15% | 426,447 | $9,499,750 |

| AFA | ASF Group Limited | 0.076 | 15% | 3,009 | $52,298,237 |

| CLU | Cluey Ltd | 0.115 | 15% | 6,081 | $20,161,357 |

| LCL | LCL Resources Ltd | 0.0355 | 15% | 4,959,760 | $24,623,438 |

| AL8 | Alderan Resource Ltd | 0.008 | 14% | 274,089 | $4,316,863 |

At the top of the winner’s list this morning, it’s RocketDNA (ASX:RKT), which has (don’t say ‘rocketed’… don’t say ‘rocketed’) rocketed (dammit!) up 50% on news that the company has been granted Australian Civil Aviation Safety Authority approval for the use of its “drone-in-a-box” product.

The approvals cover two autonomous drone systems (DJI Dock System and Hextronics Global Drone Station), which includes Beyond Visual Line of Sight (BVLOS) and Remote Operations, making RKT the first company in Australia to receive approval for DJI’s new to market Dock System.

Triton Minerals (ASX:TON) is enjoying a morning in the sun, climbing nearly 23% after revealing that it has been granted a 25-year Mining Concession for the Cobra Plains graphite deposit in Mozambique.

That gives Triton access to an existing, globally significant graphite JORC Compliant Inferred Mineral Resource estimate of 103 Million Tonnes (Mt) at an average grade of 5.2% TGC, containing 5.7Mt of graphitic carbon, expanding the company’s portfolio to world class graphite projects with a diversified mix of flake sizes.

And in third place, it’s Motorcycle Holdings (ASX:MTO), up 22.5% after dropping its earnings report after-hours last night.

MTO says that it’s seen a 25% jump in revenue to $580 million, built gross profit by 17% to $154.6 million and, while its NPAT has stayed steady on $23 million, the company has seen its Net Assets climb 27% to $197.6 million.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 30 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WEL | Winchester Energy | 0.002 | -33% | 27,175 | $3,061,266 |

| ENV | Enova Mining Limited | 0.007 | -30% | 933,082 | $3,909,293 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | 20,000,000 | $4,267,580 |

| CHN | Chalice Mining Ltd | 3.89 | -23% | 10,099,596 | $1,954,119,777 |

| AGD | Austral Gold | 0.02 | -20% | 921,813 | $15,307,784 |

| BPP | Babylon Pump & Power | 0.004 | -20% | 300,000 | $12,288,857 |

| DCX | Discovex Res Ltd | 0.002 | -20% | 80,000 | $8,256,420 |

| M4M | Macro Metals Limited | 0.002 | -20% | 500,000 | $4,967,694 |

| GW1 | Greenwing Resources | 0.145 | -19% | 306,215 | $31,098,754 |

| BMM | Balkan Mining and Minerals | 0.17 | -17% | 554,029 | $12,519,763 |

| HLX | Helix Resources | 0.005 | -17% | 4,122,875 | $13,938,875 |

| NAE | New Age Exploration | 0.005 | -17% | 1,862,729 | $8,615,393 |

| TSL | Titanium Sands Ltd | 0.005 | -17% | 500,000 | $10,270,828 |

| 1MC | Morella Corporation | 0.006 | -14% | 18,796,502 | $42,690,063 |

| CRB | Carbine Resources | 0.006 | -14% | 20,250 | $3,862,164 |

| DOU | Douugh Limited | 0.006 | -14% | 296,598 | $7,398,827 |

| SIS | Simble Solutions | 0.006 | -14% | 1,759,001 | $4,220,655 |

| VMM | Viridis Mining | 0.55 | -14% | 329,734 | $19,973,759 |

| S66 | Star Combo | 0.095 | -14% | 8,959 | $14,859,128 |

| BBX | BBX Minerals Ltd | 0.032 | -14% | 171,197 | $18,953,277 |

| SPA | Spacetalk Ltd | 0.027 | -13% | 281,214 | $9,648,531 |

| BUY | Bounty Oil & Gas NL | 0.007 | -13% | 10,011 | $10,964,008 |

| NES | Nelson Resources. | 0.007 | -13% | 2,000,127 | $4,908,755 |

| KNO | Knosys Limited | 0.035 | -13% | 17,241 | $8,645,548 |

| RCW | Rightcrowd | 0.022 | -12% | 527,474 | $6,579,795 |

The post ASX Small Caps Lunch Wrap: Who else doesn’t feel remotely like working today? appeared first on Stockhead.