Uncategorized

ASX Small Caps Lunch Wrap: What’s got us crying out ‘Oh, the Hugh Manatee’ this week?

Local markets are flat at lunchtime today, after a soggy and sodden lead-in from Wall Street was countered by surging … Read More

The post ASX Small…

Local markets are flat at lunchtime today, after a soggy and sodden lead-in from Wall Street was countered by surging Resources and Bank stocks, with a super-gigantic-bumper delivery of very good news for Azure got investors all lithium-crazy again today.

But before I get into the market stuff, I’d like you all to pause briefly for a moment of silence, to mourn the passing of “Hugh”, a large, mostly docile manatee who passed away earlier this year from complications of engaging in a vigorous sexual act with his brother.

While the tragic event occurred in April, it was only quite recently that researchers were able to confirm 38-year-old Hugh’s precise cause of death – a 14.5cm tear in his colon, which is obvisouly a very tricky spot to put on a Band-Aid.

The injury has been blamed on Hugh’s brother, Buffett, as the two were known to enjoy a spot of rough play from time to time.

As have many other manatees both in captivity in the wild, where the males of the seriously endangered species have been observed using their goolies in a game of underwater cat’n’mouse, where the winner gets to doink the other.

Anyone who’s grown up with an older brother, or – heaven help us – is currently trying their darndest to parent multiple sons, will know that what starts as fun and games can, and frequently does, escalate without notice into all-out, mutually assured destruction-level warfare.

And so it is among the manatees, those gentle undersea bovines that look like floating turds with faces, and are believed to be the source of mermaid myths that have captivated lonely, horny sailors and pre-teen girls alike for centuries.

Following Hugh’s passing – he was found dead at the bottom of his enclosure – staff at the facility released a statement, saying in part that the manatees “engaged in natural, yet increased, mating behaviour observed and documented in manatees both in managed care and in the wild.”

Hugh and Buffett “were both observed initiating and mutually seeking interactions from each other throughout the day, and there were no obvious signs of discomfort or distress such as listing, crunching, or active avoidance that would have triggered a need for intervention.”

It’s a wake up call for both the trainers and the manatees alike, but more importantly a lesson to us all about the inherent cruelty of Mother Earth, a cold and callous anthropomorphic idealisation that cares so little for our planet’s wildlife, the she’s prepared to let a little bit of innocent butt stuff between siblings turn deadly.

Oh, the Hugh Manatee indeed.

TO MARKETS

I’ll be honest here – I was kind of hoping that the markets this morning had opened lower, because I had the perfect “… and speaking of butt stuff and bad endings” segue lined up and ready to go.

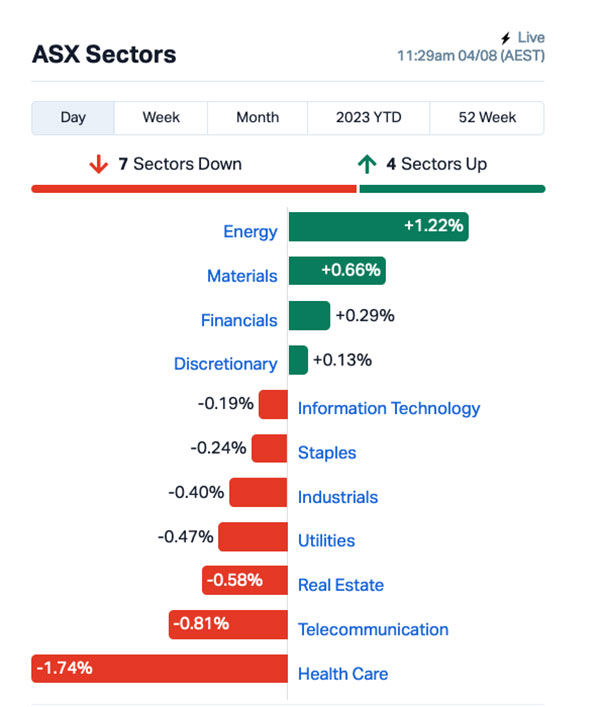

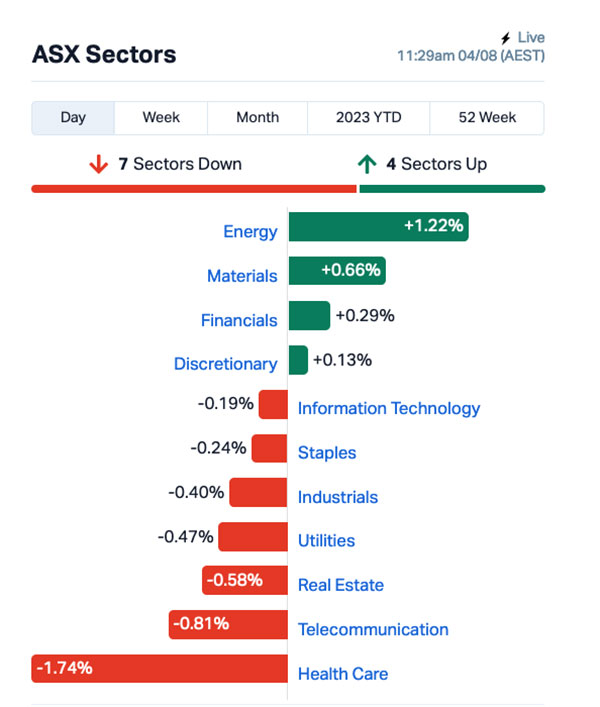

Aggravatingly, though, local markets are “mostly flat”, but unconventionally so – the benchmark is behaving in a fairly volatile manner, but only within a narrow 0.2% band either side of zero.

Resources and the Banks are enjoying themselves, for the most part – the latter because they’re banks and, as such, have untold quantities of money on hand to help prove The Beatles’ 1964 hit Can’t Buy Me Love completely wrong.

Money absolutely can buy you love – either in the form of The World’s Tallest Meerkat who is, bafflingly, still married to Donald Trump, or in a more short-term, by-the-hour ‘no kissing on the lips’ kinda way as well.

And the Resources mob are climbing nicely as well – the Energy sector’s up 1.25% and Materials has added 0.75% – helped along by some of the fattest lithium news that the market’s seen in a while, through Azure Minerals’ (ASX:AZS) announcement this morning.

Azure says drilling at its Andover prospect has found exceptionally thick intercepts, including 126.2m at 1.72% Li2O from 219m and 183.1m intersection at 1.25% Li2O from 170.5m, with several higher grade zones.

The extent of the mineralisation is also turning out to be waaaay larger as well, now extending for more than 1,800m along strike.

It’s huge news for Azure, and lithium in general, pushing AZS up by around 17% so far today.

NOT THE ASX

Things were less than rosy again on Wall Street overnight, leaving the S&P 500 down 0.25%, the Dow 0.19% lower and the Nasdaq falling by 0.1% as traders combed through earnings reports from tech titans.

Earlybird Eddy reports that Apple fell 0.73% after missing slightly on iPhone sales for the quarter, while Block Inc dropped 6% after the bell despite beating analyst expectations on revenue.

There was better news for Amazon, though, when it surged 8% post-market after delivering strong profit for the quarter as ecommerce sales grew strongly.

And Atlassian rocketed higher by 22% after the bell as the software firm far exceeded analysts’ forecasts on cloud-based products sales to small businesses.

In broader economic news, the US jobs market remained resilient, with weekly jobless claims increasing by just 6,000 to 227,000. Productivity also surged at a 3.7% rate in the second quarter.

Over the Atlantic, the Bank of England raised its key interest rate by 25bp to 5.25%, a 15-year high, as protests took place outside the BoE building in London.

In Japan, the Nikkei is up 0.12% this morning, mostly (I think…) because investors have finally come to terms with what many experts are calling the “peak of Japanese music”.

It’s a song called Graduation, by a band called Super Beavers, which serves as the theme song to a recent film release Tokyo Revengers 2: Bloody Halloween – Destiny, a live-action adaptation of a popular manga and featuring the musical stylings of band members Kenta Uesugi on bass, vocalist Ryuta Shibuya, guitarist Ryota Yanagisawa and drummer Hiroaki “34 years old” Fujiwara.

The song is A) an absolute banger, and B) the most Japanese thing I’ve seen in a while – which means a lot because I’ve seen a lot of Japanese things.

(Get your mind out of the gutter).

In China, Shanghai markets are up 0.94% because everyone’s stopped talking about missing former foreign minister Qin Gang, while in Hong Kong the Hang Seng has climbed 1.9% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 04 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.002 | 100% | 100,783 | $5,824,681 |

| KNB | Koonenberry Gold | 0.04 | 29% | 130,000 | $2,348,450 |

| ID8 | Identitii Limited | 0.019 | 27% | 1,930,345 | $3,191,977 |

| IRX | Inhalerx Limited | 0.044 | 26% | 51,426 | $6,641,843 |

| M2M | Mt Malcolm Mines | 0.03 | 25% | 46,000 | $1,914,420 |

| RDN | Raiden Resources Ltd | 0.01 | 25% | 64,086,040 | $16,442,151 |

| CCX | City Chic Collective | 0.595 | 24% | 5,636,960 | $111,321,641 |

| ERW | Errawarra Resources | 0.1 | 23% | 1,238,289 | $4,900,824 |

| EPM | Eclipse Metals | 0.017 | 21% | 1,085,558 | $28,392,837 |

| NAE | New Age Exploration | 0.006 | 20% | 120,000 | $7,179,495 |

| RNX | Renegade Exploration | 0.013 | 18% | 180,909 | $10,484,362 |

| GRE | Greentech Metals | 0.415 | 17% | 1,160,946 | $20,091,422 |

| CPT | Cipherpoint Limited | 0.007 | 17% | 1,070,502 | $6,955,450 |

| EDE | Eden Inv Ltd | 0.0035 | 17% | 429,710 | $8,990,833 |

| RIM | Rimfire Pacific | 0.007 | 17% | 1,279,727 | $12,031,468 |

| AZS | Azure Minerals | 2.53 | 17% | 7,409,585 | $846,812,276 |

| FFT | Future First Tech | 0.011 | 16% | 1,519,431 | $6,790,947 |

| PPG | Pro-Pac Packaging | 0.3 | 15% | 6,679 | $47,238,805 |

| AW1 | American West Metals | 0.265 | 15% | 9,232,048 | $80,333,768 |

| MKL | Mighty Kingdom Ltd | 0.023 | 15% | 80,129 | $6,524,392 |

| AD1 | AD1 Holdings Limited | 0.008 | 14% | 100,000 | $5,757,983 |

| GTR | Gti Energy Ltd | 0.008 | 14% | 22,204,160 | $13,634,279 |

| TAS | Tasman Resources Ltd | 0.008 | 14% | 63,010 | $4,988,685 |

| TKL | Traka Resources | 0.008 | 14% | 500,378 | $6,099,305 |

| EOF | Ecofibre Limited | 0.24 | 14% | 145,590 | $73,335,056 |

Leading the Small Caps today is Errawarra Resources (ASX:ERW), spiking 29.6% on news that the company’s second program of Ground EM surveys underway at Errabiddy graphite project are progressing well… which doesn’t really warrant a huge jump in price.

The more likely reason ERW’s flying today is because it’s also exploring for lithium at its own Andover West project, 10km along strike from the Azure hits reported this morning, which I’ve already mentioned above.

Errawarra is reporting that rock chip analysis results indicate geochemical affinity to LCT pegmatites at Andover West – hence investors are piling on this morning.

Meanwhile, Koonenberry Gold (ASX:KNB) is up 29% this morning as well, after announcing that the NSW Regulator has granted approval to commence drilling at the company’s Bellagio prospect in the state’s northwest.

KNB says that an aircore drilling program is scheduled to commence in August and has been designed to test multiple high grade gold assays from outcropping quartz veins, including the 39.4g/t gold and 22.5g/t gold rock chips previously reported, as well as a “robust” gold in soil anomaly with a maximum result of 33ppb Au.

Tech firm Identitii is up 26.6% on no news, swimming well against the tide of steep losses throughout that sector, while City Chic Collective (ASX:CCX) is up 25% this morning after revealing the sale of its Evans business and EMEA inventory.

The Evans brand (along with its IP and customer base) has been snapped up by AK Retail Holdings, for a cash total (after costs) of around $12 million, and the EMEA business, which I’m assuming for now stands for Europe, Middle East, and Africa, is set to be shuttered completely and treated as a discontinued business.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MSB | Mesoblast Limited | 0.485 | -56% | 44,406,466 | $887,483,259 |

| CCE | Carnegie Clean Energy | 0.001 | -50% | 2,777,865 | $31,285,147 |

| GBE | Globe Metals & Mining | 0.041 | -41% | 3,081,442 | $34,967,040 |

| CLE | Cyclone Metals | 0.001 | -33% | 13,000,000 | $15,396,757 |

| MCT | Metalicity Limited | 0.0015 | -25% | 1,375,041 | $7,472,172 |

| BTE | Botala Energy | 0.1 | -23% | 10,000 | $6,931,167 |

| LRL | Labyrinth Resources | 0.007 | -22% | 3,823,798 | $9,941,029 |

| H2G | Greenhy2 Limited | 0.012 | -20% | 26,030 | $6,281,337 |

| AJQ | Armour Energy Ltd | 0.002 | -20% | 187,375 | $12,303,355 |

| EEL | Energy Elements Ltd | 0.004 | -20% | 13,097,665 | $5,046,171 |

| ENT | Enterprise Metals | 0.004 | -20% | 1,071,232 | $3,747,355 |

| NYM | Narryer Metals | 0.14 | -18% | 418,410 | $5,182,875 |

| AJX | Alexium International | 0.015 | -17% | 27,833 | $11,725,016 |

| PHL | Propell Holdings Ltd | 0.03 | -17% | 100,000 | $4,332,799 |

| M4M | Macro Metals Limited | 0.0025 | -17% | 4,200 | $5,961,233 |

| MXC | MGC Pharmaceuticals | 0.0025 | -17% | 560,021 | $11,677,079 |

| NGS | NGS Ltd | 0.01 | -17% | 606,997 | $2,019,689 |

| PFT | Pure Foods Tas Ltd | 0.097 | -16% | 165,739 | $12,620,090 |

| RRR | Revolver Resources | 0.15 | -14% | 74,323 | $20,361,093 |

| ELE | Elmore Ltd | 0.006 | -14% | 924,653 | $9,795,687 |

| HLX | Helix Resources | 0.006 | -14% | 62,000 | $16,262,021 |

| 8VI | 8Vi Holdings Limited | 0.16 | -14% | 18,246 | $7,753,613 |

| APC | Aust Potash Ltd | 0.007 | -13% | 180,666 | $8,309,432 |

| ASR | Asra Minerals Ltd | 0.007 | -13% | 48,250 | $11,523,097 |

| YPB | YPB Group Ltd | 0.0035 | -13% | 59,288 | $2,973,846 |

The post ASX Small Caps Lunch Wrap: What’s got us crying out ‘Oh, the Hugh Manatee’ this week? appeared first on Stockhead.