Uncategorized

ASX Small Cap and IPO Weekly Wrap: Appears we can still learn from European class

ASX 200 ends the week 0.42% lower, snapping three straight weeks of gains EU benchmark makes it 5 weeks of … Read More

The post ASX Small Cap and IPO…

- ASX 200 ends the week 0.42% lower, snapping three straight weeks of gains

- EU benchmark makes it 5 weeks of straight gains, hits 14 month high

- Chinese economy shows signs of life; global inflation shows signs of easing

US markets fell a bit in the last week, muddled by softer US economic data and weaker earnings numbers.

The 3 big indices are headed to close the week in the red with the tech-heavy Nasdaq the guiltiest, down around -0.36%.

But who can spare the time or the pity when European equity markets are smashing it. They largely closed higher on Friday making it week 5 of straight, phat gains.

The benchmark Stoxx 600 added 0.33%, to end at a lofty height not seen since February last year.

And Japanese shares jumped, aided by a timely show of love from the Oracle of Osaka, Warren Buffett. They’ve walked off 8-month highs, but still, the Topix added 0.84% this week adding meat to the bones of a second straight weekly rise.

Chinese shares did very little, despite the economic recovery playing out just as the Emperor has foreseen.

According to the National Bureau of Chinese Communist Party Statistics, economic growth rebounded more than expected (by 2.2% QoQ and 4.5% YoY) with property market activity much stronger and the domestic retail action at +10.6% YoY really killing it.

The jobless rate fell to 5.3%, more people are on the metro and with services PMIs (in particular) showing genuine oomph, FY 2023 GDP could well be around 6%. That’s very good news for them and for us.

At home. Local markets fell around 0.4% with a retreat in resources offset by gains among the banks, the industrial stocks and property shares.

The S&P/ASX 200 fell 0.45% to close at 7,330 on Friday.

The blue chip finance and mining names did the damage the former on soft commodity prices, the latter following US leads.

BHP Group (ASX:BHP) lost 2.3%, Rio Tinto (ASX:RIO) -2.8% and Fortescue Metals (ASX:FMG) looked shot at -4.2%.

The four major banks – sans ANZ (ASX:ANZ) down-0.5%, shed between 1.2% and 1.1%. The benchmark index ended the week 0.42% lower, snapping three straight weeks of gains.

Bond yields rose, as did the Aussie dollar, disregarding a similar spirit from its nemesis the greenback.

The week that was

News-wise, this week lived and died by the central bank sword, as per the last 18 months.

Interestingly, some changes are afoot for the way the RBA goes about its business following the independent review.

For those few and peculiar (like me) who take an active (wait for it) interest in such things, here’s what a few million bucks of indy review get you nowadays:

-

Affirmation of the flexible 2-3% inflation target which “has generally worked well”, although it recommended the RBA’s objectives should be more clearly and equally defined around price stability and full employment

-

Removal of the “on average, over time” reference to the achievement of the inflation target, which should be replaced with the RBA explaining “how it is using its flexibility”

-

Affirmation of RBA independence and that it be strengthened with removal of the power of the Treasurer to overrule it

-

Installation of a dedicated Monetary Policy Board from 1 July next year compromised of the Governor as chair, Deputy Governor and Treasury Secretary with 6 external members with expertise in macroeconomics, the financial system, labour markets and the supply side of the economy to set monetary policy. (The Board would have formal votes with the 6 external members having the potential to override RBA official recommendations. Eek…)

-

A move to 8 meetings a year (not 11) to allow for more thought, less talk.

-

Pressers after each meeting with the aim to increase the flow of information;

-

And an external Monetary Policy Board members publicly discussing decisions. I hope to get a seat on that one.

The actual inflation news

But it won’t change the business of the bank, its key mandate, focus or most especially what happens to interest rates, says Dr Shane Oliver at AMP Capital, who BTW, reckons inflation pressures are continuing to recede is the official word.

US inflation dipped a little in March, although the core data looks a little suspect to most other observers.

Elsewhere inflation data in Canada, across the ditch and even in London eased according to new data released for March.

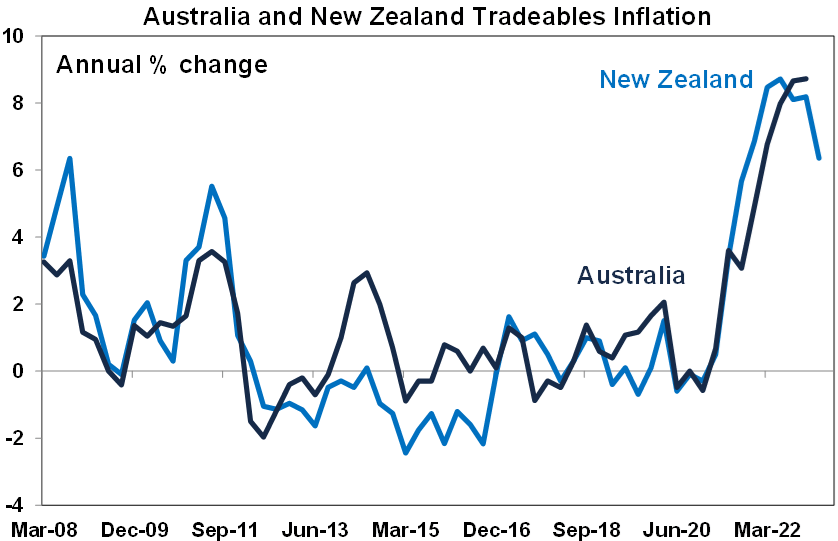

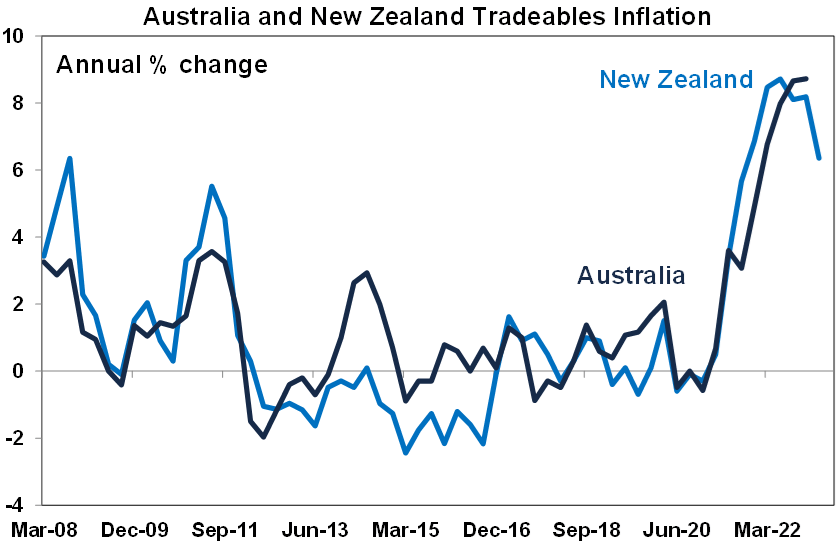

“Inflation also fell more than expected in Malaysia and the Indonesian central bank left rates on hold, while the plunge in tradeable inflation (goods and services that are imported or in competition with imports) in New Zealand suggests reasonable prospects for a similar fall in Australia,” says the good doctor.

ASX recap

We need to talk about Western Mining Group (ASX:WMG).

The WA explorer hit a new all-time-high this week.

According to Reubs, it’s now up some +430% since announcing a cumulative 693.5m at 0.28% nickel, 128ppm cobalt, 61ppm copper, plus palladium and platinum in one drill hole at its “extensive” Mulga Tank system early April.

A follow up hole (MTD025) intersected “~446m of high MgO adcumulate dunite with multiple occurrences of visible nickel sulphide mineralisation”, the company said April 17.

A near 100% gain in early trade on Thursday for wee explorer Moho Resources (ASX:MOH) is a decent reflection of where we are on rare earths thiss week too.

MOH hit clay hosted REE grades up to 1890ppm Total Rare Earth Oxides (TREO) in maiden drilling at the Peak Charles project in southern WA.

MD Ralph Winter says the identified target zone is circa 15 x 12km thus far… “with further room for growth across the tenement package, puts the company in a positive position in the REE market in Australia.”

The XEC ASX Emerging Companies index is down around 0.9% this week.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks from 17-21 April:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| RGI | Roto-Gro Intl Ltd | 0.22 | 1900% | $4,333,920 |

| 8IH | 8I Holdings Ltd | 0.066 | 214% | $14,294,240 |

| KEY | KEY Petroleum | 0.002 | 100% | $1,967,928 |

| OLL | Openlearning | 0.027 | 93% | $5,625,251 |

| POL | Polymetals Resources | 0.325 | 81% | $14,232,548 |

| WOA | Wide Open Agricultur | 0.325 | 81% | $42,016,576 |

| HHI | Health House Int Ltd | 0.009 | 80% | $1,488,038 |

| DAF | Discovery Alaska Ltd | 0.05 | 67% | $11,435,970 |

| LRV | Larvottoresources | 0.21 | 56% | $11,769,576 |

| WMG | Western Mines | 0.575 | 53% | $19,285,275 |

| AQX | Alice Queen Ltd | 0.0015 | 50% | $2,530,288 |

| MEB | Medibio Limited | 0.0015 | 50% | $6,225,891 |

| MOH | Moho Resources | 0.024 | 50% | $5,606,880 |

| IPD | Impedimed Limited | 0.145 | 49% | $214,454,248 |

| TMB | Tambourahmetals | 0.13 | 49% | $4,737,149 |

| BMG | BMG Resources Ltd | 0.016 | 45% | $6,175,867 |

| OM1 | Omnia Metals Group | 0.32 | 45% | $7,559,554 |

| NYM | Narryermetalslimited | 0.125 | 44% | $3,506,063 |

| KNM | Kneomedia Limited | 0.01 | 43% | $15,047,853 |

| ROG | Red Sky Energy. | 0.005 | 43% | $21,208,909 |

| LIN | Lindian Resources | 0.365 | 40% | $379,670,297 |

| KOR | Korab Resources | 0.025 | 39% | $9,910,350 |

| IPB | IPB Petroleum Ltd | 0.011 | 38% | $5,651,224 |

| DCG | Decmil Group Limited | 0.21 | 35% | $36,554,771 |

| MCM | Mc Mining Ltd | 0.21 | 35% | $65,944,758 |

| KOB | Kobaresourceslimited | 0.175 | 35% | $13,217,500 |

| SLA | Silk Laser Australia | 3.01 | 34% | $159,363,531 |

| CDX | Cardiex Limited | 0.335 | 34% | $44,474,312 |

| AGR | Aguia Res Ltd | 0.036 | 33% | $15,618,753 |

| ICN | Icon Energy Limited | 0.008 | 33% | $6,144,109 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | $7,943,675 |

| TSK | Task Group Holdings | 0.37 | 32% | $131,298,061 |

| MEI | Meteoric Resources | 0.145 | 32% | $242,778,492 |

| SHN | Sunshine Gold Ltd | 0.021 | 31% | $16,933,900 |

| FYI | FYI Resources Ltd | 0.105 | 31% | $38,463,347 |

| GRL | Godolphin Resources | 0.085 | 31% | $9,706,295 |

| ID8 | Identitii Limited | 0.039 | 30% | $8,496,149 |

| RAD | Radiopharm | 0.195 | 30% | $43,010,575 |

| RNX | Renegade Exploration | 0.022 | 29% | $20,638,723 |

| RXH | Rewardle Holding Ltd | 0.022 | 29% | $10,000,108 |

| TAR | Taruga Minerals | 0.018 | 29% | $12,708,482 |

| TYM | Tymlez Group | 0.009 | 29% | $10,921,953 |

| W2V | Way2Vatltd | 0.011 | 28% | $2,421,671 |

| EML | EML Payments Ltd | 0.75 | 28% | $276,748,255 |

| BRX | Belararoxlimited | 0.32 | 28% | $12,874,057 |

| VMS | Venture Minerals | 0.023 | 28% | $38,928,067 |

| OD6 | Od6Metalsltd | 0.37 | 28% | $17,054,804 |

| HPR | High Peak Royalties | 0.07 | 27% | $16,716,512 |

| SLM | Solismineralsltd | 0.14 | 27% | $5,130,947 |

| LAU | Lindsay Australia | 1.335 | 27% | $406,562,547 |

The advanced WA kaolin project developer Pinnacle Minerals (ASX:PIM), had a great week after stumbling across rare earths at the Disruptor prospect.

A hole drilled to test historical elevated nickel geochemical results returned elevated REEs in the bottom 40m, including a maximum value of 626.3ppm TREO.

And in the ag-tech space Aussie small cap Wide Open Agriculture (ASX:WOA) jumped following a positive business update for Q3 FY23 including that it has has completed the majority of investment required to produce Buntine Protein at pilot scale in a variety of food applications at its R&D production facility in Kewdale, WA.

WOA said it’s in advanced confidential negotiations with a strategic production partner for access and production services at an existing brownfield site with the potential to produce commercial quantities of Buntine Protein. The site already has more than 75% of the equipment and services required to produce Buntine Protein at scale and is expected to expedite time to market.

ASX SMALL CAP LAGGARDS

Here are the least-best performing ASX small cap stocks from 17-21 April:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| CCO | The Calmer Co Int | 0.003 | -50% | $1,200,266 |

| ROO | Roots Sustainable | 0.0075 | -46% | $606,212 |

| HVM | Happy Valley | 0.027 | -44% | $7,908,409 |

| BAT | Battery Minerals Ltd | 0.003 | -40% | $11,797,769 |

| PRS | Prospech Limited | 0.029 | -36% | $3,554,018 |

| AMA | AMA Group Limited | 0.165 | -35% | $171,691,235 |

| G1A | Galena Mining | 0.15 | -35% | $92,885,303 |

| IS3 | I Synergy Group Ltd | 0.01 | -33% | $2,890,804 |

| OAU | Ora Gold Limited | 0.002 | -33% | $11,810,775 |

| ODE | Odessa Minerals Ltd | 0.006 | -33% | $5,187,418 |

| OPA | Optima Technology | 0.018 | -31% | $4,472,565 |

| PHL | Propell Holdings Ltd | 0.028 | -30% | $3,731,021 |

| BTC | BTC Health Ltd | 0.018 | -28% | $5,073,234 |

| PVS | Pivotal Systems | 0.0085 | -27% | $2,000,113 |

| CG1 | Carbonxt Group | 0.05 | -25% | $13,764,944 |

| CLE | Cyclone Metals | 0.0015 | -25% | $18,165,296 |

| PLG | Pearlgullironlimited | 0.03 | -25% | $4,692,487 |

| PRM | Prominence Energy | 0.0015 | -25% | $3,636,913 |

| MAU | Magnetic Resources | 0.51 | -25% | $113,608,629 |

| VML | Vital Metals Limited | 0.012 | -25% | $63,673,797 |

| MGA | Metalsgrovemining | 0.11 | -24% | $3,780,053 |

| FFT | Future First Tech | 0.016 | -24% | $9,937,712 |

| FG1 | Flynngold | 0.072 | -23% | $7,304,021 |

| CRB | Carbine Resources | 0.01 | -23% | $3,152,755 |

| TIG | Tigers Realm Coal | 0.01 | -23% | $130,667,024 |

| ERA | Energy Resources | 0.044 | -23% | $180,877,777 |

| WEC | White Energy Company | 0.085 | -23% | $3,448,390 |

| EG1 | Evergreenlithium | 0.38 | -22% | $22,492,000 |

| HAR | Harangaresources | 0.11 | -21% | $5,589,542 |

| HLF | Halo Food Co. Ltd | 0.011 | -21% | $4,408,467 |

| CT1 | Constellation Tech | 0.004 | -20% | $5,884,801 |

| MXC | Mgc Pharmaceuticals | 0.008 | -20% | $21,325,171 |

| PUA | Peak Minerals Ltd | 0.004 | -20% | $5,206,883 |

| AUT | Auteco Minerals | 0.04 | -20% | $101,764,797 |

| BBX | BBX Minerals Ltd | 0.08 | -20% | $40,963,439 |

| CSX | Cleanspace Holdings | 0.33 | -20% | $26,186,638 |

| LME | Limeade Inc. | 0.165 | -20% | $38,503,987 |

| SIO | Simonds Grp Ltd | 0.105 | -19% | $37,790,177 |

| NNG | Nexion Group | 0.017 | -19% | $2,589,234 |

| ANR | Anatara Ls Ltd | 0.026 | -19% | $3,118,024 |

| HCD | Hydrocarbon Dynamic | 0.013 | -19% | $6,457,666 |

| ANP | Antisense Therapeut. | 0.075 | -18% | $52,206,534 |

| CAG | Caperangeltd | 0.09 | -18% | $9,490,830 |

| PR1 | Pureresourceslimited | 0.18 | -18% | $5,130,002 |

| CAI | Calidus Resources | 0.225 | -18% | $116,480,973 |

| EGY | Energy Tech Ltd | 0.05 | -18% | $16,882,992 |

| G88 | Golden Mile Res Ltd | 0.019 | -17% | $5,268,645 |

| LDX | Lumos Diagnostics | 0.019 | -17% | $5,468,402 |

| MFB | My Food Bag Grp Ltd | 0.19 | -17% | $52,124,068 |

| TIE | Tietto Minerals | 0.605 | -17% | $690,579,956 |

ASX IPOs

Another quiet week for IPOs on the ASX, but it’s worth revisiting the blockbuster Evergreen Lithium (ASX:EG1) listing which went live last Tuesday after a $7 million IPO that had shares priced at an ambitious $0.30 a pop.

As Eddy Sunarto noted in his latest stellar wrap of global listings, EG1 ended at $0.36 on Day 1 for a 20% return, but has since surged to three times that.

Evergreen’s flagship Bynoe Project is adjacent to, and on trend with, Core Lithium’s producing Finniss Project.

But chief technical advisor Jason Ward says the flagship Bynoe project is more than just about being next door to a big deposit.

“It’s not simply a nearology play, they’re contiguous geochemical samples to their mine,” Ward told Stockhead.

Apart from Evergreen, Leeuwin Metals (ASX:LM1) has also performed well – returning 44% for the IPO bagholders to date.

Leeuwin has projects in Canada and Western Australia which are prospective for nickel, copper, PGE and lithium.

The post ASX Small Cap and IPO Weekly Wrap: Appears we can still learn from European class appeared first on Stockhead.

aim

nasdaq

asx

gold

lithium

rare earths

ree

rare earth oxides

nickel

copper