Uncategorized

ASX Large Caps: Shares up 1pc as lithium stocks lead the way; inflation hits 32-year high

ASX 200 gained 1% on Wednesday Australian CPI came in at 7.3%, up from 6.9% Lithium miners led the proceedings … Read More

The post ASX Large Caps: Shares…

- ASX 200 gained 1% on Wednesday

- Australian CPI came in at 7.3%, up from 6.9%

- Lithium miners led the proceedings today

The ASX 200 surged by around 1% on Wednesday despite higher than expected CPI figures.

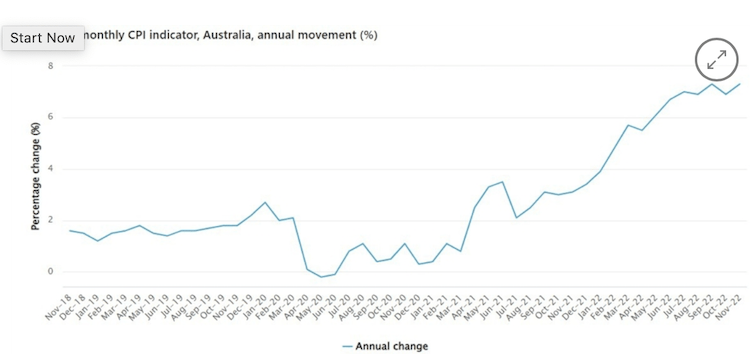

The ABS said that Australia’s inflation rose again in November by 7.3% (year on year) to a 32-year high, up from October’s rise of 6.9%.

The prices of food and non-alcoholic beverages jumped 9%, while fruit and vegetables and travel costs softened. Transportation costs meanwhile rose 16.6% in November from 11.85% in October.

The larger than expected inflation figure (vs forecast of 7%) and strong retail sales (up 1.4%) has dashed hopes the RBA could soften its rate hike stance.

After the data release, money market futures jumped as traders firmed up 25bp RBA hike bets for February.

The US will also publish its CPI data on Thursday (US time).

In November, the US CPI was cooler than expected at 7.1% (expectation was 7.3%), a sign that inflation was moderating from its highest level in decades.

JPMorgan Asset Management’s chief global strategist, David Kelly, says US inflation will continue to fall in 2023.

“News outlets and social media feeds will continue to try to draw an audience by raising the alarm on a wide range of issues,” Kelly said.

“No one will cover any improvement in the economy, any lessening of global tensions or any resolution of the issues that plagued markets in 2022.

“For this reason, investors should resolve to examine the environment for themselves and invest while prices are more reflective of the state of public attitudes than the reality of economic prospects,” he added.

Back to the ASX, Mining and Real Estate were the main gainers today, while Utilities lagged.

Lithium miners led the way with Allkem (ASX:AKE) gaining 6% and Pilbara Minerals (ASX:PLS) by 3.5%.

Gold stocks continued their recent ascent, with De Grey Mining (ASX:DEG) leading the way, up 3.5%.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Security | Description | Last | % | Volume | MktCap |

| 29M | 29Metalslimited | 2.28 | 6.31 | 1,266,181 | $1,030,102,052 |

| AKE | Allkem Limited | 12.50 | 5.40 | 2,550,741 | $7,562,624,900 |

| IGO | IGO Limited | 14.63 | 5.18 | 2,566,972 | $10,533,595,279 |

| ARU | Arafura Rare Earths | 0.53 | 5.00 | 8,695,685 | $1,020,354,724 |

| LTR | Liontown Resources | 1.50 | 4.55 | 5,962,921 | $3,140,902,551 |

| SYR | Syrah Resources | 2.19 | 4.29 | 1,923,444 | $1,408,198,491 |

| BSL | BlueScope Steel Ltd | 18.45 | 4.27 | 968,178 | $8,207,998,207 |

| PNI | Pinnacle Investment | 10.19 | 4.09 | 253,869 | $1,970,375,108 |

| LOV | Lovisa Holdings Ltd | 25.18 | 4.01 | 110,658 | $2,610,609,403 |

| SLR | Silver Lake Resource | 1.46 | 3.91 | 3,853,399 | $1,306,290,788 |

| MIN | Mineral Resources. | 87.97 | 3.80 | 360,734 | $16,083,880,425 |

| DEG | De Grey Mining | 1.51 | 3.79 | 3,430,345 | $2,263,692,027 |

| RWC | Reliance Worldwide | 3.33 | 3.74 | 3,345,541 | $2,536,204,196 |

29Metals (ASX:29M) rose 6% on the back of bullish sentiment on metals.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Security | Description | Last | % | Volume | MktCap |

| MEZ | Meridian Energy | 4.81 | -3.80 | 41,345 | $6,317,572,185 |

| XRO | Xero Ltd | 69 | -3.69 | 739,778 | $10,758,939,617 |

| PNV | Polynovo Limited | 2.43 | -2.80 | 2,952,256 | $1,720,009,508 |

| KAR | Karoon Energy Ltd | 2.1 | -2.78 | 828,608 | $1,215,396,049 |

| CMM | Capricorn Metals | 4.975 | -2.45 | 686,483 | $1,910,884,193 |

| WHC | Whitehaven Coal | 8.87 | -2.21 | 6,892,142 | $8,181,115,157 |

| EBO | Ebos Group Ltd | 42.04 | -2.14 | 10,437 | $8,189,799,673 |

| PSI | Psc Insurance Ltd | 5 | -1.96 | 817 | $1,806,127,291 |

| CRN | Coronado Global Res | 2.02 | -1.46 | 3,073,902 | $3,436,730,147 |

| NUF | Nufarm Limited | 6.06 | -1.46 | 3,275,548 | $2,339,567,643 |

| SPK | Spark New Zealand | 4.81 | -1.43 | 394,749 | $9,141,040,393 |

| LFG | Liberty Fin Group | 3.85 | -1.28 | 16,584 | $1,184,040,000 |

| PXA | Pexagroup | 12.17 | -1.22 | 891,501 | $2,184,653,708 |

| SUN | Suncorp Group Ltd | 11.69 | -1.10 | 2,413,854 | $14,941,373,557 |

Xero (ASX:XRO) fell 4% on no specific news.

The post ASX Large Caps: Shares up 1pc as lithium stocks lead the way; inflation hits 32-year high appeared first on Stockhead.