Uncategorized

ASX Large Caps: Gold, lithium stocks climb; and a business-class airfare blunder by ANA

Gold miners performed as bullion prices rebounded in the last few hours on the back of a falling USD. Gold … Read More

The post ASX Large Caps: Gold,…

- Local shares closed flat on Wednesday

- Gold and lithium stocks climbed

- The Star Entertainment Group lost 7% after saying a strategic review will be conducted for its Sydney casino

The ASX has ended the day flat, with gains in Mining stocks offset by losses in Discretionary stocks.

Gold miners outperformed as bullion prices rebounded in the last few hours on the back of a falling USD. Gold Road Resources (ASX:GOR) was up 4%, and De Grey Mining lifted 3%.

Lithium miners also gained as investors continue to digest falling spodumene prices. Pilbara Minerals (ASX:PLS) rose 4%, while IGO (ASX:IGO) climbed 4%.

Star Casino operator, The Star Entertainment Group (ASX:SGR), lost 7% after saying a strategic review will be conducted for its Sydney casino, and that 500 people would need to be made redundant.

Star also said it was accelerating debt refinancing plans to improve liquidity, and that the company will “consider any structural alternatives available” for its Sydney casino.

Meanwhile, the Westpac leading index released today showed an 8th consecutive negative print, pointing to below-trend growth in the Australian economy.

While the Leading Index does not yet provide a guide for 2024, Westpac has predicted ongoing sluggish growth of 1.5% with the household sector again accounting for most of the weakness.

Sepearately, a Bloomberg survey revealed that Australia’s recession probability stands at 35%, down from 40% in the last poll in March.

ANA blunder

A report in China said Tesla should be punished after a worker was crushed by equipment and died at its Shanghai factory last month.

The investigation found that Tesla was at fault in its risk-control measures, and should be held responsible, said the Caixin report.

Investigators recommended an “unspecified administrative penalty” for Tesla, Caixin said.

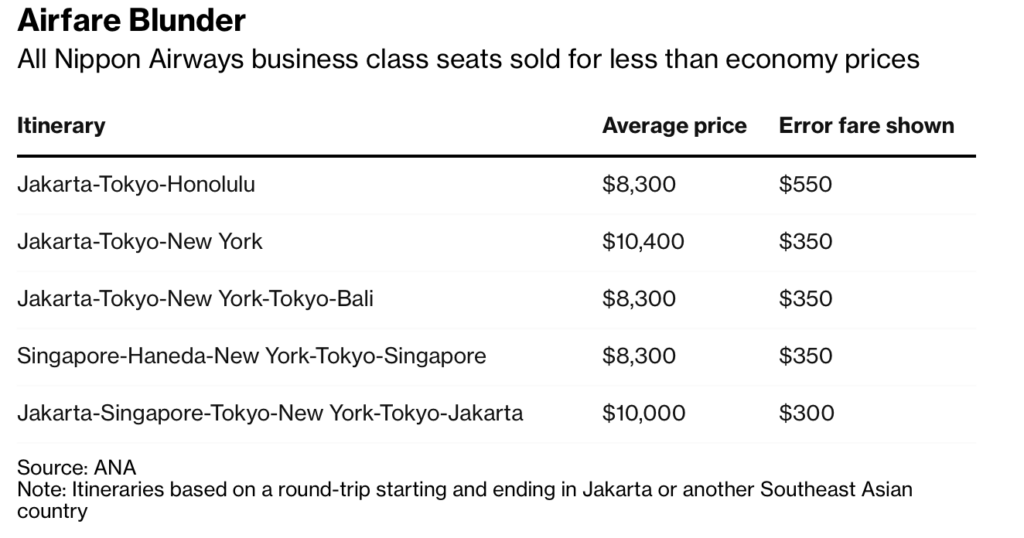

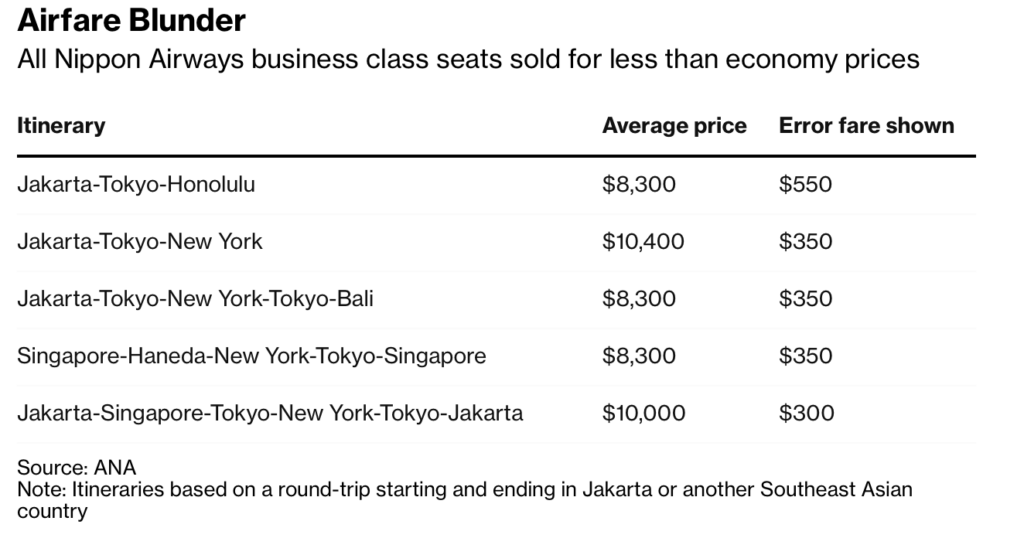

Japan’s ANA airlines fell 2% today after revealing that US$10,000 business-class tickets were sold for just a few hundred dollars after a currency conversion blunder.

Most of the flights were sold from Jakarta and Singapore.

Looking ahead to tonight’s session on Wall Street, the US Federal Reserve Beige Book is due for release.

This report contains information on current economic conditions obtained through interviews with key business contacts, economists, and market experts.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

gold road

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TLX | Telix Pharmaceutical | 9.34 | 5.01 | 2,862,104 | $2,821,879,011 |

| IGO | IGO Limited | 14.50 | 4.28 | 1,824,441 | $10,526,022,601 |

| GOR | Gold Road Res Ltd | 1.86 | 3.92 | 3,052,026 | $1,924,982,183 |

| CXO | Core Lithium | 1.02 | 3.81 | 19,222,801 | $1,827,191,542 |

| DEG | De Grey Mining | 1.64 | 3.47 | 2,075,586 | $2,474,449,560 |

| PLS | Pilbara Min Ltd | 4.10 | 3.41 | 27,533,573 | $11,872,133,535 |

| AMP | AMP Limited | 1.13 | 3.20 | 10,529,802 | $3,246,972,565 |

| VUK | Virgin Money Uk PLC | 2.84 | 2.90 | 441,834 | $1,950,174,175 |

| MIN | Mineral Resources. | 84.45 | 2.85 | 779,271 | $15,840,258,368 |

| BSL | BlueScope Steel Ltd | 20.78 | 2.36 | 2,881,204 | $9,355,779,836 |

| EMR | Emerald Res NL | 1.76 | 2.33 | 2,460,561 | $1,018,368,686 |

| AUB | AUB Group Ltd | 27.19 | 2.22 | 83,070 | $2,700,711,779 |

| ZIM | Zimplats Holding Ltd | 26.71 | 2.14 | 9,189 | $2,814,724,521 |

| AKE | Allkem Limited | 12.31 | 2.07 | 3,875,380 | $7,690,156,517 |

| WAM | WAM Capital Limited | 1.73 | 2.06 | 899,177 | $1,854,489,642 |

| NUF | Nufarm Limited | 5.85 | 2.01 | 559,548 | $2,180,116,192 |

AMP (ASX:AMP) was up 2% after saying that its loan book grew by $200m to $24.2bn in Q1.

The company said it focused on “being disciplined” in its growth in a highly competitive market to maintain strong credit quality and margins. However, UBS has retained its sell rating on AMP with a price target of $1 (versus current price of $1.13).

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SGR | The Star Ent Grp | 1.27 | -6.80 | 36,032,563 | $2,201,405,993 |

| GEM | G8 Education Limited | 1.20 | -3.82 | 1,105,813 | $1,007,835,137 |

| STX | Strike Energy Ltd | 0.44 | -3.80 | 4,376,431 | $1,154,991,790 |

| KLS | Kelsian Group Ltd | 5.64 | -3.75 | 424,728 | $1,573,973,052 |

| DHG | Domain Holdings Aus | 3.29 | -3.67 | 899,638 | $2,153,950,892 |

| KAR | Karoon Energy Ltd | 2.17 | -3.13 | 2,003,317 | $1,260,668,862 |

| ARB | ARB Corporation. | 31.69 | -2.78 | 189,043 | $2,671,458,420 |

| NXT | Nextdc Limited | 11.75 | -2.73 | 1,007,029 | $5,525,751,779 |

| DOW | Downer EDI Limited | 3.41 | -2.71 | 1,244,439 | $2,350,507,877 |

| JHX | James Hardie Indust | 32.92 | -2.66 | 968,685 | $14,950,343,931 |

| BRG | Breville Group Ltd | 20.12 | -2.42 | 145,009 | $2,944,151,746 |

The post ASX Large Caps: Gold, lithium stocks climb; and a business-class airfare blunder by ANA appeared first on Stockhead.