Uncategorized

Asra Minerals Mt Stirling project ‘up there with the best quality rare earths deposits’

Special Report: There are several reasons Asra Minerals’ Mt Stirling clay rare earths project stands out from the rest. … Read More

The post Asra Minerals…

There are several reasons Asra Minerals’ Mt Stirling clay rare earths project stands out from the rest.

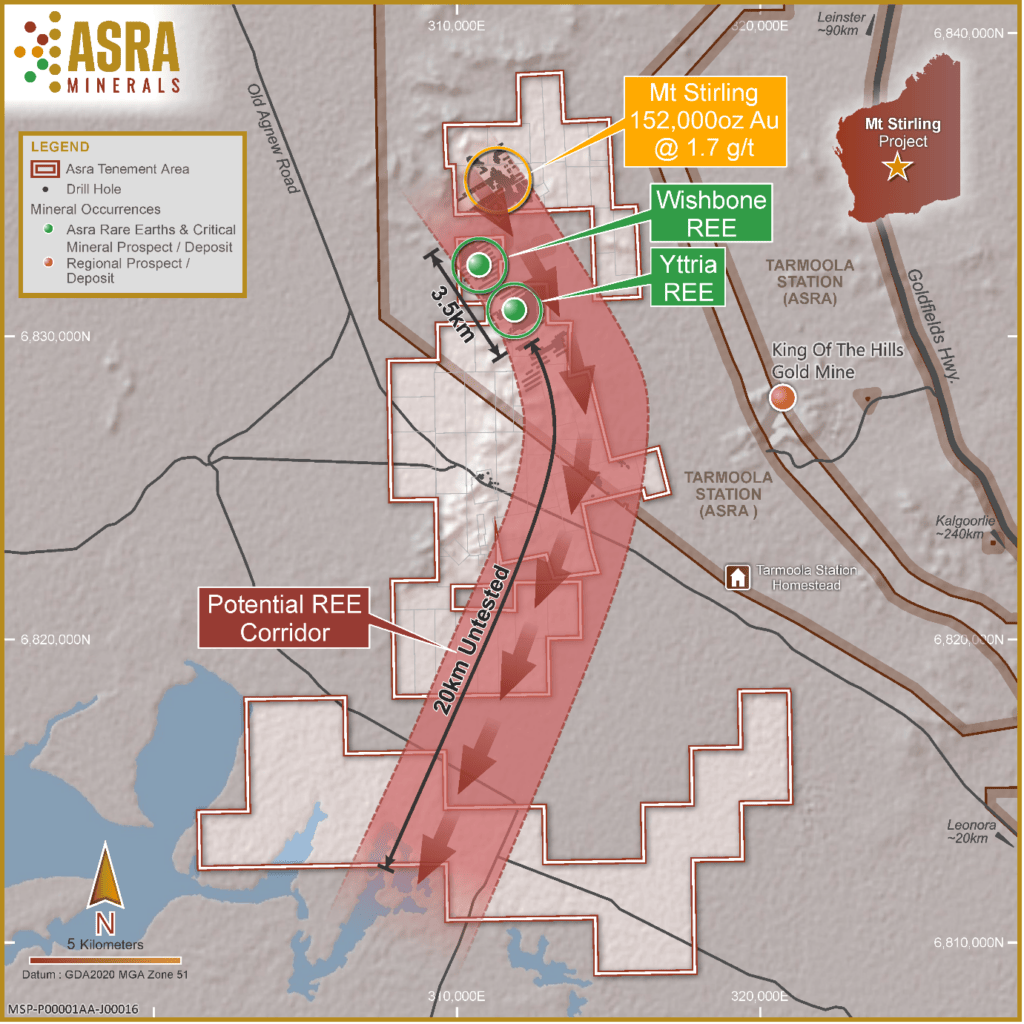

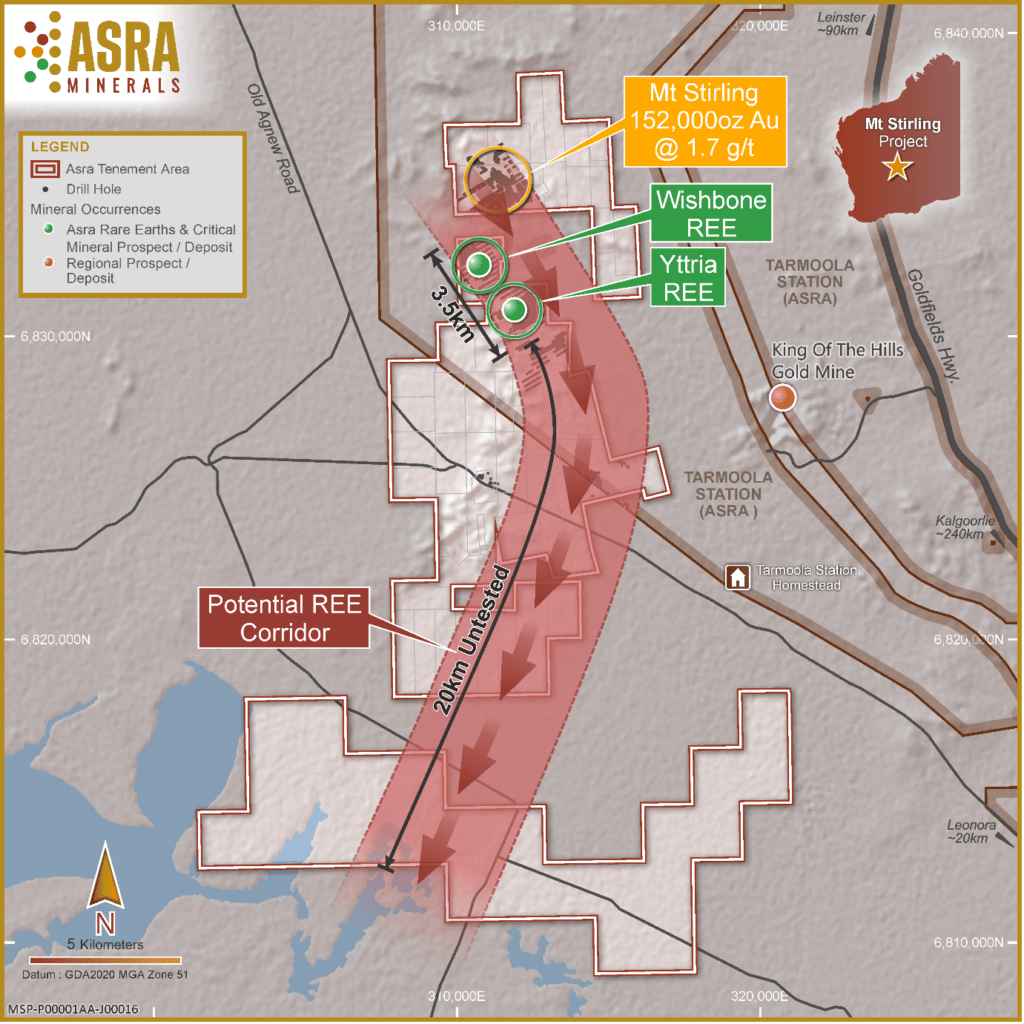

In early 2022, WA focused explorer Asra Minerals (ASX:ASR) uncovered exciting clay rare earths potential at its ‘Mt Stirling’ project in WA’s eastern goldfields.

It now has two shallow deposits, Wishbone and Yttria, which boast grades up to 2714ppm rich in heavy (57% HREO/TREO) and magnet (22%) REEs – crucial for the energy transition.

A lot of clay-hosted RRE deposits around WA run at 20-30% Heavies, so 57% is significant.

“It’s getting up there with the best quality rare earths deposits in clays,” managing director Rob Longley told Stockhead.

There are other things that make Mt Stirling stand out, ASR says.

The project – located on an ASR-owned pastoral station — also contains significant levels of highly valuable scandium as well as substantial cobalt and gold . It is low in deleterious elements, like uranium.

“It’s a clean rare earths deposit,” Longley says.

“We own the land – the Tarmoola pastoral lease – which is a tick already.

“And what some strategic investors are noticing is that we have a large scandium resource around the rare earths – 65-100ppm in the background, which is telling us there is a probably a deep source.

“All our overburden is scandium rich, so we can stockpile it. A bit like Iluka, who had the foresight to stockpile product for years before it was of value.”

Met test work is now being undertaken on the rare earths at Mt Stirling, with results due later this month and into September. “We have intensely drilled a 2km-3km area at Yttria with quality RC drilling, so we are expecting that a lot of the mineral resource will be in the high value measured and indicated categories,” Longley says.

“That, combined with the met test work, will give us an authentic geological assessment of the deposit.

“We are going to get a detailed picture on a small part of what we think is going to be a big project.”

We believe there is a corridor system in WA that runs east west generally from Mt Weld, through us, to Victory’s REE deposit near Cue.

“There could be a deeper meaning to these deposits. We aren’t chasing that at the moment, but who knows.

While REEs are the main focus, ASR won’t ignore the gold prospectivity of the project.

“We are collecting values in soils for arsenic, which is a gold pathfinder. While gold isn’t all that attractive at the moment to investors in the junior end, we are not ignoring the fact we sit on a 150,000oz deposit.

We haven’t done much gold exploration outside of the Mt Stirling area to the north. We are also building up gold targets for when the time is right to attack them.”

A market ready to boom

“Rare earths have dropped off a little at the moment, but it will come back. We are going to prove this thing up to take advantage of the next bull market,” Longley says.

“If you listen to [rare earths expert] George Bauk talk, there’s enough future demand for all these projects.

“There is also a lot of will to get Critical Minerals projects up and running in Australia, projects that aren’t already owned or controlled by China.

It’s a great opportunity for Australia to replicate the lithium success story.”

Lithium had its own Winter a few years ago and yet WA now has massive hard rock lithium production and a very healthy exploration sector.

“There are a whole bunch of companies getting strategic players on board. That is where we hope to be in 12 months once we have done the metallurgy and pushed a resource out.”

What lurks beneath Kookynie West?

Meanwhile, the Kookynie West project 40km south adjoins the Ulysses gold project, owned by acquisitive gold miner Genesis Minerals (ASX:GMD).

This is virtually untouched ground near some of WA’s biggest gold mines.

A proverbial stone’s throw to the west is Delta Lithium’s (ASX:DLI) Mt Ida project, as well as numerous rare earths deposits.

“We think Kookynie West, being on a granite greenstone contact — as well as the lithium and rare earths potential — is a massive gold trap,” Longley says.

“There hasn’t been any work done out there. We are going to start with soil sampling to work out what the structure is there.”

“It’s amazing no one has been out there, to this western side.”

This article was developed in collaboration with Asra Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Asra Minerals Mt Stirling project ‘up there with the best quality rare earths deposits’ appeared first on Stockhead.