Economics

Crescat Capital: Gold is About to Break Out and so is Armageddon, but 1600 Small Caps Should Inherit Canada

"The convulsions of a dying macro regime combined with the growing pains of a new one, in our view, have … Read More

The post Crescat Capital: Gold is…

Every now and again I get a terrifying missive from Denver-based Crescat Capital, a global macro asset management firm led by its irresistible founder and CIO Kevin Smith.

The firm’s funds are fascinating and the CIO’s ideas are a pleasure to wrap your head around. Let’s just say Kevin is not a big fan of Wall Street shenanigans and what he often sees as the half-baked decision-making of US policymakers.

Gold is about to break out of its US$2K prison, is one half of the gist of Kevin’s latest monthly newsletter. The other half is a little Armageddonnish, but with the kind of rider we appreciate at Stockhead – the small caps will inherit the Earth.

‘The unholiest of trinities’

Crescat has formed the opinion that US policymakers are putting on a poker face to suggest they’ve got the stability of the global financial system, the US economy, and indeed consumer prices totally under control.

Alas, Kevin says this is not the case.

Instead, it’s The US Fed and the economic czars Stateside, whose rampant deficit spending and debt monetisation post the 2008 GFC has gone and “created a trifecta of macro imbalances.”

1. Historic overvaluation of long-duration financial assets

2. Systemic solvency problems posed by excessive leverage

3. Embedded structural inflation

“This unholy trinity foreshadows both secular stagflation and a near-term hard landing,” Kevin writes.

But the good part of this, is as always, he has a plan.

The Great Rotation

“To capitalise on these imbalances, and not be run over by them, we believe investors will need to rotate out of the still-crowded and expensive securities of the last business cycle and move into the deeply undervalued, high-growth opportunities of the next (one) which include the companies delivering the necessary commodities to meet the world’s basic and aspiring needs.

“We call this reallocation the Great Rotation. In our analysis, the shift is still in the early innings, and there is much more to play out.”

‘Cause you are gold

I’m glad that you’re bound to return

Something I could have learned

You’re indestructible…

Very much in the vein of 80s English new wave band Spandau Ballet, Crescat thinks gold might be both indestructible and the ‘get out of jail with a few dollars to spend’ card.

“Forward-thinking investors should take their cue from global central banks who have been stealth acquirers of gold over the last few years and sellers of US Treasuries.

“If gold is indeed on the verge of a major breakout, as we believe it is, some of the most rewarding value and growth investments to compound real wealth are likely to be found among the metals exploration companies that own the world’s critical new discoveries.”

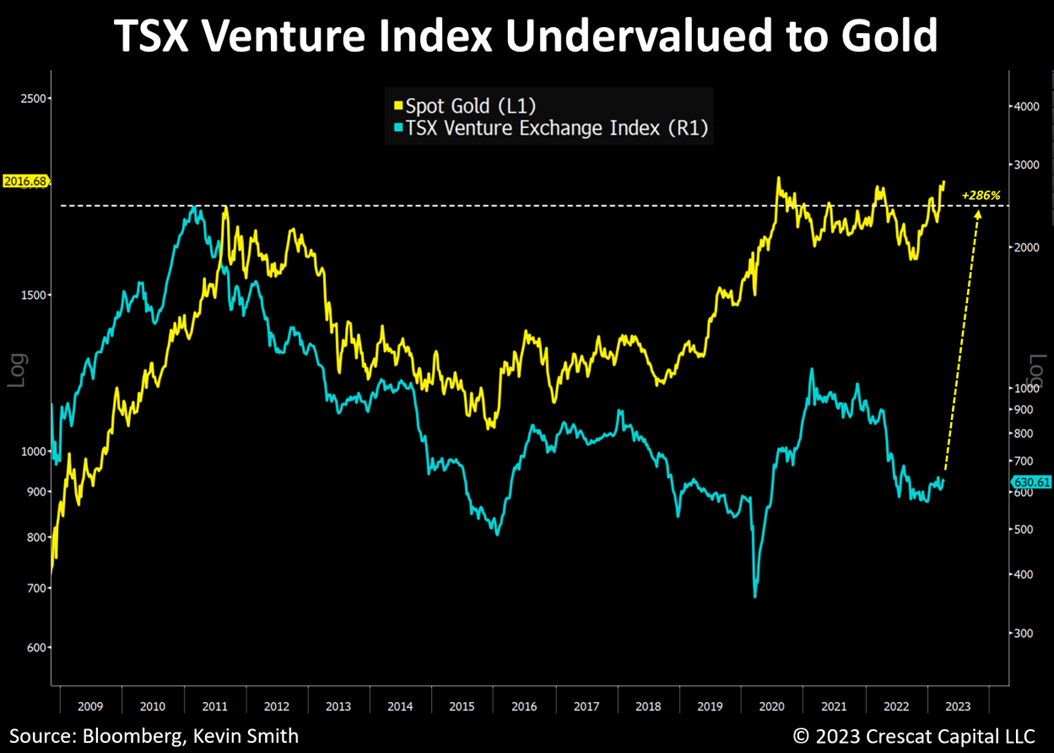

Compare spot gold pronto, to this Canadian exchange not in Toronto

Ahh. The TSX Venture you ask?

Well, that’ll be a stock exchange in Calgary, Alberta, owned and run by the nation of Canada.

It was originally called the Canadian Venture Exchange, but that was obviously too confusing for Canadians who, time has shown, prefer their information oblique.

The TSXV mostly contains small-cap Canadian stocks and there’s a lot of them.

Over 1,600 companies listed as a matter of fact, and in this regard Kevin says it’s dominated by the world’s precious and base metal explorers…

The team at Crescat calculate that for the index to just get back to its 2011 highs along with gold, you’re looking at an almost 300% return opportunity, while in a mad metals bull market, the upside Kevin says is likely to be all sorts of more.

“The bull case is particularly strong because the whole world is dependent on these firms to deliver the resources for the new industries of the energy transition, i.e., to provide the metals for solar, wind, grid infrastructure, EVs, and batteries.”

“The die has been cast, and the trajectory is clear…”

In a slightly end of days assessment of the green machine we’ve been building, Kevin muses we’ve been dancing down a damned road while the big miners wave from the box seats:

“In a joint effort to combat the pressing issue of climate change, both governments and the global citizenry have charted a course toward a greener future through the adoption of renewable energy and electrification. The problem is that the major mining companies have not built the pipeline of metal to deliver what the climate agenda requires.

“Over the last decade, these companies have instead been behind a declining trend in investment in resource exploration and development. The typical lead time coincidentally is an entire decade to make a new discovery, build a mine, and get it into production.

“Given such a major imbalance between the world’s needs and its resources, we believe market participants have been underestimating the risk of a substantial upsurge in commodity prices that will drive another wave of structural inflation and a much-renewed interest in the explorers.

“What an incredible opportunity for the whole mining industry that is likely to get flooded with capital to try to solve the resource shortage problem…

“We think investors at large are still way behind the curve in figuring this out.”

The chart below tracks how the dollar trading volume in exploration-focused companies has been “unusually depressed for the last year while stock prices have shrunk.”

However, Crescat reckons the market could be waking up to it as trading flows in these wee Canadian names appears to be turning.

The theory is that when big money flows into this tiny segment of the market – comprised of small and micro market cap stocks – you can see how it tends to correspond with outsized price appreciation.

“We are confident that there is an enormous value-oriented and macro growth window that is wide open now,” Crescat writes.

“Surprisingly, people are only just starting to wake up to the reality of the resource imbalance.”

As we’ve seen elsewhere over the last little bit, Crescat suggests we’re looking at a clear misallocation of capital and it’s led to big-arse commodity underinvestment over the last decade. And that, my friends, is an “unintended policy error”.

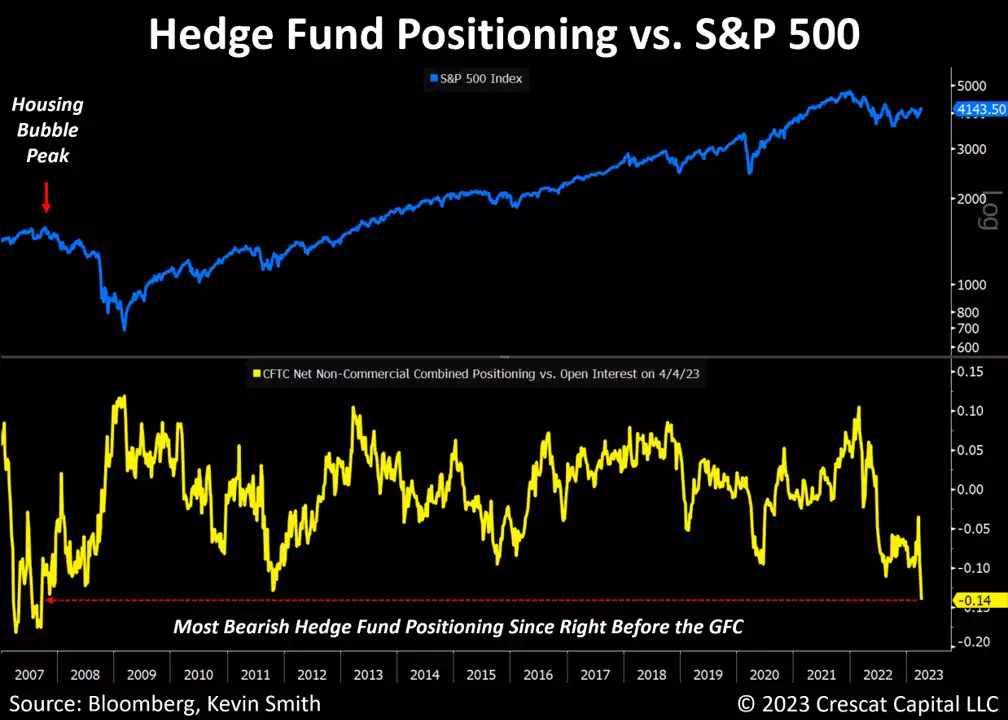

Hedge Fund Positioning

Meantime, switching gears, here’s a chart for embiggenning your sleep loss.

Tracking the behaviour of hedge funds is a hassle but a useful truth serum for the overly optimistic.

Kevin says hedge funds shorting US futures is not what it seems (and it’s also because Wall St is a little evil.).

“Wall Street spin doctors would have you believe that currently high hedge fund short positioning in S&P 500 futures and options is a bullish contrary indicator.

The trick is they have only used data over the long bull market to support their argument…

Going back further to 2007, we can see that hedge funds actually had an even larger short position 16 years ago, right before the top of the market and ahead of the GFC (Global Financial Crisis).

Megacap Tech

And on big tech, Kevin is just not in the mood.

“According to our equity model, growth fundamentals for the biggest tech companies have deteriorated substantially and do not support their valuations which still exceed the peak of the 2000 tech bubble.

“However, these stocks have rallied on the recent bank rescue package which is understandable but extremely shortsighted.”

“The next leg down could unfold viciously just like in the early 2000s tech bust, especially if the overall economy heads into recession on the back of system-wide tightening of lending standards, which is a high probability.

So what do we do?

As yu might know by now, Crescat has an answer for that too.

“We believe the perversions in the financial and commodity markets year to date have set up an excellent entry point for new and existing investors who are not already fully allocated to Crescat’s strategies on the unwarranted pullback.

“The convulsions of a dying macro regime combined with the growing pains of a new one, in our view, have teed up a great opportunity to sell short the still speculatively valued investments of the last cycle on a bear market rally and to buy the undervalued scarce resource companies that are key building blocks of the new economy in the decade ahead.”

There you go. Now just hang on a moment and I’ll grab the disclaimer.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Crescat Capital: Gold is about to break out and so is armageddon, but 1600 small caps should inherit Canada appeared first on Stockhead.

dollar gold inflation stagflation commodities commodity markets policy metals mining fed bubble tsx tsxv tsx venture

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…