Financing News

Macarthur Minerals Third Quarter Update 2022

Third Quarter Update 2022

Canada NewsWire

VANCOUVER, BC, Oct. 24, 2022

/This news release is not for distribution to united states services or for dissemination in the United States/

VANCOUVER, BC, Oct. 24, 2022 /CNW/ – Macarthur Minerals Limited (…

Third Quarter Update 2022

Canada NewsWire

VANCOUVER, BC, Oct. 24, 2022

/This news release is not for distribution to united states services or for dissemination in the United States/

VANCOUVER, BC, Oct. 24, 2022 /CNW/ – Macarthur Minerals Limited (TSXV: MMS) (ASX: MIO) (OTCQB: MMSDF) (the Company or Macarthur) is pleased to update shareholders on a productive third quarter 2022 in which the Company appointed a Strategic Sub-Committee to proceed with the assessment, and implementation of the Company’s plan for the development of the Lake Giles Iron Project and associated infrastructure (power, water treatment and construction). The appointment of the Strategic Sub-Committee follows on from the delivery of the maiden Ore Reserve and completion of the Feasibility Study earlier in the year.

- Strategic Appointments

- Strategic Sub-Committee to oversee the successful assessment, and implementation of the Company’s plan for attracting strategic partners to assist with the development of the Lake Giles Iron Project and associated infrastructure.

- Ryan Welker appointed to the Board of Directors.

- Appointment of consultants to advance logistics contracting strategies for rail and port operations.

- Management conducted a site visit to the Company’s Nevada lithium claims in the US to investigate further exploration or repositioning options for the Company’s 210 lithium brine claims in Nevada.

- Macarthur increased its holding in Infinity Mining (ASX: IMI) through an on-market purchase of 1 million shares to now control 21.56%.

- Management attended the Prospectors and Developers Association of Canada (PDAC) conference in Toronto. This year’s conference held in June was well attended and was the first in-person PDAC event since March 2020, confirming the sector’s thirst for returning to business face to face.

- Management attended the Saudi International Iron & Steel Conference held in Riyadh, Saudi Arabia in September.

Macarthur’s primary areas of focus include the following:

- Strategic Partnerships: Formalising strategic partnerships to commercialise the Lake Giles Iron Project remains a key focus. The Company is in active discussions with a number of global corporates that have the potential to add capital and technical capabilities to the project.

- Producing the Company’s strategic partner action plan, drawing together the individual efforts of the Company’s executives and EAS Advisors’ initiatives in North America.

- A program to engage and solicit support from the Australian Federal Government, project support to deliver this project for the Esperance and Goldfields community.

- Implementation of a plan targeting preferred partners for construction, power, water, communications, and logistics.

Nevada Lithium Assets: The Company continues to examine the potential to reposition or seek strategic partnership(s) that can advance a programme of works to realise an improved value proposition for the Company’s 100% owned 210 lithium brine mining claims, covering an area of 7 square miles (18 km2) located in Railroad Valley, in Nye County, Nevada, USA. The 210 claims are located approximately 180 miles (300 km) North of Las Vegas, Nevada, and 330 miles (531 km) Southeast of Tesla’s new Gigafactory. Driven by the tight supply in the lithium market expected to grow significantly to 2030 and as demand for product remains incredibly strong1, the Nevada lithium assets are positioned to capture value for Macarthur.

|

_____________________________ |

Cameron McCall, Chairman of Macarthur Minerals commented:

“The Project fundamentals of the Company have been greatly enhanced during the first three quarters of 2022. Our key focus is on securing key strategic partners for process facility EPCM construction, turnkey power and water infrastructure, above-rail contracting and mining and crushing service partners. The clear message from recent discussions with major debit providers in New York is that they are not as focused on the equity market as they are on the debt providers.”

Board changes

Mr Ryan Welker was appointed to the Board of Directors effective 1 September 2022. Ryan is Chairman and Co-founder of Vitrinite Pty Ltd a tightly held, private, premium-hard coking coal producer in Queensland’s Bowen Basin. Ryan brings a vast range of skills and experience to the board of Macarthur. Before moving back to Australia in 2019, he was Head of Mining at EAS Advisors in New York, where he advised and raised more than $2bn for dozens of ASX, LSE, TSX and AIM listed companies. Prior to EAS, he held positions at Rio Tinto, Hancock Prospecting, Standard Bank and served as a Non- Executive Director of Mineral Resources Limited. His direct industry experience gives him a blend of capabilities giving him an in -depth understanding of the needs of mining companies of all sizes, but particularly publicly listed junior mining companies.

Mr Joe Phillips retired from the Board of Directors on 31 August 2022. Following his retirement, Joe continues to work with Macarthur and is engaged in an advisory capacity to the Macarthur Strategic Sub-Committee. He also remains the Executive Chair of Macarthur’s spinoff Company, Infinity Mining Limited. The change in role will allow him to concentrate on the development of Infinity’s Pilbara and Central Goldfield tenements in Western Australia.

Share Price

In July 2021, Macarthur market cap hovered around the $75million level and since that time, the Company has significantly de-risked the Lake Giles Magnetite Project with a positive + $800 NPV Feasibility Study and a Maiden Ore Reserve Statement released in Q1 2022. What has changed is the investor sentiment and this is clearly impacting the share price of the company.

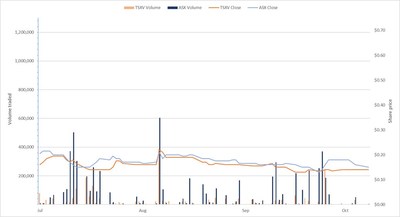

Both ASX and TSXV continue to demonstrate reasonably synchronised share price trading patterns for MIO and MMS. Although Macarthur’s share price has pulled back over the third quarter, this is not an anomaly that is specific to Macarthur, as it reflects the broader patterns and impacts felt across the entire iron ore industry following the pull-back in global prices during Quarter 1 and 2 of 2022. Encouragingly, iron ore prices are still above pre-Covid levels, demonstrating the resilience of a sector that supplies a critical global resource necessary for many facets of human endeavour and advancement.

Macarthur holds 21.56% of the issued equity and is the largest shareholder in Infinity, which is an Australian mining exploration company focused primarily on renewable rare earth minerals in Western Australia.

Macarthur’s spinoff to Infinity Mining, of its non-core renewable energy assets in 2021 has allowed the Company to commit its full focus to its flagship Lake Giles Iron Project in Western Australia.

High-Grade Iron Benefits

On average, approximately two tonnes of carbon dioxide (CO₂) are emitted for every tonne of steel produced. This accounts for roughly 7% of global greenhouse gas emissions. The trend towards higher-grade ores demonstrates a change in demand preferences aimed at factoring in the global shift towards decarbonisation. Macarthur’s strategy to meet and help lead the future growth in demand for high-grade ore is the right strategy moving into the third decade of this century which will be defined by how industries respond to the challenges of meeting net zero targets.

As outlined by Macarthur in its second-quarter update in 2021, the premium for steel products may arguably result in increased direct investment by the rest of the world (excluding China) in new steel production capacity that has the eventual function of replacing older blast furnace steel technology needed by the mid-2030s to meet the strict C02 emissions standards announced in the Paris Accord and by Japan and the USA in 2020.

Completing the journey to net zero emissions in steel production has been demonstrated as technically possible by the use of high-grade magnetite and scrap steel in electric arc furnaces with ‘green hydrogen’ as the reductant. The first green steel production was achieved in Sweden in 2021, with the only output from that process being H2O.

With Macarthur’s high grade 1.3 billion tonne magnetite resource, it aims to take advantage of the coming structural shift in the global iron ore market and help lead Australia’s contribution to a cleaner steel future.

Pursuant to the Company’s Share Compensation Plans (“Plans”), the Board of Directors of the Company has granted an aggregate of 1,300,000 stock options (“Options”) to acquire common shares of the Company pursuant to the Plans, of which 500,000 granted to a director of the Company with an exercise price of A$0.40 and expire three years from the date of issue, 650,000 options granted to employees with an exercise price of A$0.45 and expire two years from the date of issue and the remaining 150,000 options granted to a consultant with an exercise price of A$0.50 and expire 24 months from the date of issue.

The Options are being issued under the terms of the Company’s Share Compensation Plans which were approved by shareholders at the Company’s Annual General Meeting on 31 August 2022.

On behalf of the Board of Directors, Mr Cameron McCall, Executive Chairman and CEO

Macarthur is an iron ore development, and lithium exploration company that is focused on bringing to production its Western Australia iron ore projects. The Lake Giles Iron Project mineral resources include the Ularring hematite resource (approved for development) comprising Indicated resources of 54.5 million tonnes at 47.2% Fe and Inferred resources of 26 million tonnes at 45.4% Fe and the Lake Giles magnetite resource of 53.9 million tonnes (Measured), 218.7 million tonnes (Indicated) and 997 million tonnes (Inferred). The Lake Giles Iron Project also contains Proven Ore Reserves of 51.9 Mt and Probable Ore Reserves of 184.7Mt. Macarthur also holds 24 square kilometre tenement area iron exploration interests in the Pilbara region of Western Australia. In addition, Macarthur has lithium brine Claims in the emerging Railroad Valley region in Nevada, USA.

The Mineral Resource and Ore Reserve estimates presented above have previously been released to the ASX on 21 March 2022, including supporting JORC reporting tables. Unless explicitly stated, no new information is contained in accordance with Table 1 checklist in the JORC Code. The Company confirms that it is not aware of any new information or data that materially affects the information included in the relevant market announcements and, in the case of Mineral Resources and Ore Reserves that all assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed.

Certain of the statements made and information contained in this press release may constitute forward-looking information and forward-looking statements (collectively, “forward-looking statements”) within the meaning of applicable securities laws. All statements herein, other than statements of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future, including but not limited to statements regarding expected completion of the Feasibility Study; conversion of Mineral Resources to Ore Reserves or the eventual mining of the Project, are forward-looking statements. The forward-looking statements in this press release reflect the current expectations, assumptions or beliefs of the Company based upon information currently available to the Company. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and no assurance can be given that these expectations will prove to be correct as actual results or developments may differ materially from those projected in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include but are not limited to: unforeseen technology changes that results in a reduction in iron or magnetite demand or substitution by other metals or materials; the discovery of new large low cost deposits of iron magnetite; the general level of global economic activity; failure to complete the FS; inability to demonstrate economic viability of Mineral Resources; and failure to obtain mining approvals. Readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof. Such statements relate to future events and expectations and, as such, involve known and unknown risks and uncertainties. The forward-looking statements contained in this press release are made as of the date of this press release and except as may otherwise be required pursuant to applicable laws, the Company does not assume any obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

SOURCE Macarthur Minerals Limited

investment stock options tsxv-mms macarthur-minerals-limited macarthur minerals limited press-release

Capella Announces Definitive Agreement for the Sale of is Central Norway Copper-Cobalt Projects to NickelX and Financing Update

Capella Announces Definitive Agreement for the Sale of is Central Norway Copper-Cobalt Projects to NickelX and Financing Update

Canada NewsWire

VANCOUVER, BC, Oct. 17, 2023

VANCOUVER, BC, Oct. 17, 2023 /CNW/ – Capella Minerals Ltd (TSXV: CMIL) (OTC…

Goldgroup Announces Exercise of Cerro Prieto Purchase Option

Vancouver, British Columbia–(Newsfile Corp. – October 17, 2023) – Goldgroup Mining Inc. (TSX: GGA) (OTC PINK: GGAZF) (BMV SIX: GGAN.MX) ("Goldgroup" or…

Colibri Provides Company Update

Dieppe, New Brunswick–(Newsfile Corp. – October 17, 2023) – Colibri Resource Corporation (TSXV: CBI) (OTC Pink: CRUCF) ("Colibri" or the "Company") is…