Financing News

FRONTIER LITHIUM FILES NI 43-101 PRE-FEASBILITY STUDY FOR PAK PROJECT IN NORTHERN ONTARIO

FRONTIER LITHIUM FILES NI 43-101 PRE-FEASBILITY STUDY FOR PAK PROJECT IN NORTHERN ONTARIO

Canada NewsWire

SUDBURY, ON, July 14, 2023

SUDBURY, ON, July 14, 2023 /CNW/ – Frontier Lithium Inc. (TSXV: FL) (FRA: HL2) (OTCQX: LITOF) (“Frontier” or “the C…

FRONTIER LITHIUM FILES NI 43-101 PRE-FEASBILITY STUDY FOR PAK PROJECT IN NORTHERN ONTARIO

Canada NewsWire

SUDBURY, ON, July 14, 2023

SUDBURY, ON, July 14, 2023 /CNW/ – Frontier Lithium Inc. (TSXV: FL) (FRA: HL2) (OTCQX: LITOF) (“Frontier” or “the Company”), Ontario’s leading lithium developer, has filed the “Pre-Feasibility Study for the PAK Project ” technical report (the “Technical Report“). As communicated in a news release dated May 31, 2023, this Technical Report outlines the preliminary feasibility assessment of the 100% owned PAK Project, located north of Red Lake in Ontario, and a proposed hydrometallurgical plant that would convert spodumene concentrate feedstock into lithium chemicals. The Technical Report confirms the vertically integrated project could be North America’s largest and lowest-cost producer of lithium hydroxide, supplying the rapidly growing electric vehicle industry on the continent.

The Technical Report is effective as of the 31st day of May 2023, the summary press release is located at https://us13.campaign-archive.com/?u=4007c765f4181d2d87e755530&id=cf13300efd. The full Technical Report is available on SEDAR (www.sedar.com) and can be located at https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00008434.

Pre-Feasibility Study Highlights: A 24-year total project life, with after-tax pay back of capital expenditures in less than 5 years following commercial production

- Life of Project Cash Flow (unlevered) of US$8.07 billion over 24-year total project life;

- Total initial capital expenditure estimate of US$468 million for the technical grade concentrator and expansion capital of US$576 million for the chemical grade concentrator and chemical plant with a contingency of 20% included.

- Sustaining Capital of US$90 million ;

- Post-tax Net Present Value at an 8% base case discount rate (“NPV 8 “) of US$1,739 million and IRR of 24.1% [see Tables and Figures below];

- Post-tax net “undiscounted” Cash Flow (before initial capital expenditures) of US$5.98 billion ;

- Annual Average EBITDA of US$251.3 million ;

- Chemical plant producing 12,520 tonnes of battery-quality Lithium Hydroxide Monohydrate (LiOH-H 2 O) per year with an average selling price of US$22,000 per tonne and a 7,360 tonnes of battery-quality Lithium Carbonate per year with an average selling price of US$20,500 per tonne;

- PAK and Spark deposits are open along strike and to depth;

- All-in cash costs of US$7,433 per tonne of Lithium Carbonate Equivalent; and

- After-Tax Pay Back of Capital Expenditures is 4.9 years after the start of commercial operations.

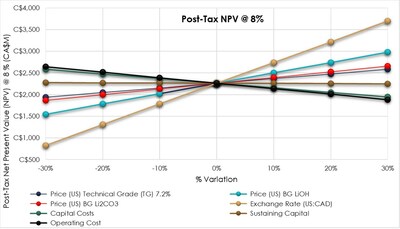

In addition, with regard to this particular release, the Company hereby presents the following sensitivity analysis tables and figures that were hitherto undisclosed. The sensitivity analysis reveals that the USD:CAD exchange rate and battery grade (“BG”) lithium hydroxide price have the most significant influence on both the Net Present Value (“NPV”) and Internal Rate of Return (“IRR”) compared to the other parameters, based on the ranges evaluated. Overall, the NPV and IRR of the Project is positive over the range of values used for the sensitivity analysis when the sensitivities are analyzed individually.

Table 1: Summary of NPV Sensitivity Results

|

Item |

Results |

||||||

|

Discount Rate: |

8 % |

||||||

|

After-Tax Net Present Value (NPV) |

-30 % |

-20 % |

-10 % |

0 % |

10 % |

20 % |

30 % |

|

Chemical Grade |

1,151 |

1,521 |

1,891 |

2,261 |

2,631 |

3,001 |

3,371 |

|

Technical Grade |

1,939 |

2,046 |

2,154 |

2,261 |

2,369 |

3,662 |

3,811 |

|

Metal Price (USD) Chemical Grade (CG) 6% |

2,261 |

2,261 |

2,261 |

2,261 |

2,261 |

2,261 |

2,261 |

|

Metal Price (USD) Technical Grade (TG) 7.2% |

1,939 |

2,046 |

2,154 |

2,261 |

2,369 |

2,476 |

2,583 |

|

Metal Price (USD) BG LiOH |

1,544 |

1,783 |

2,022 |

2,261 |

2,500 |

2,739 |

2,979 |

|

Metal Price (USD) BG Li2CO3 |

1,869 |

2,000 |

2,130 |

2,261 |

2,392 |

2,523 |

2,653 |

|

Exchange Rate (USD: CAD) |

829 |

1,306 |

1,784 |

2,261 |

2,738 |

3,216 |

3,693 |

|

Capital Costs |

2,580 |

2,473 |

2,367 |

2,261 |

2,155 |

2,049 |

1,943 |

|

Sustaining Capital |

2,272 |

2,269 |

2,265 |

2,261 |

2,257 |

2,254 |

2,250 |

|

Operating Cost |

2,640 |

2,514 |

2,387 |

2,261 |

2,135 |

2,008 |

1,882 |

Table 2: Summary of IRR Sensitivity Results

|

Item |

Results |

||||||

|

Discount Rate: |

8 % |

||||||

|

After-Tax Net Present NPV) |

-30 % |

-20 % |

-10 % |

0 % |

10 % |

20 % |

30 % |

|

Chemical Grade |

17.6 % |

20.0 % |

22.1 % |

24.1 % |

25.9 % |

27.6 % |

29.2 % |

|

Technical Grade |

21.6 % |

22.4 % |

23.2 % |

24.1 % |

24.9 % |

25.7 % |

26.6 % |

|

Metal Price (USD) Chemical Grade (CG) 6% |

24.1 % |

24.1 % |

24.1 % |

24.1 % |

24.1 % |

24.1 % |

24.1 % |

|

Metal Price (USD) Technical Grade (TG) 7.2% |

21.6 % |

22.4 % |

23.2 % |

24.1 % |

24.9 % |

25.7 % |

26.6 % |

|

Metal Price (USD) BG LiOH |

20.1 % |

21.5 % |

22.8 % |

24.1 % |

25.3 % |

26.4 % |

27.5 % |

|

Metal Price (USD) BG Li2CO3 |

22.0 % |

22.7 % |

23.4 % |

24.1 % |

24.7 % |

25.4 % |

26.0 % |

|

Exchange Rate (USD:CAD) |

14.8 % |

18.2 % |

21.3 % |

24.1 % |

26.7 % |

29.2 % |

31.5 % |

|

Capital Costs |

31.2 % |

28.4 % |

26.1 % |

24.1 % |

22.4 % |

20.9 % |

19.5 % |

|

Sustaining Capital |

24.2 % |

24.1 % |

24.1 % |

24.1 % |

24.1 % |

24.0 % |

24.0 % |

|

Operating Cost |

26.3 % |

25.5 % |

24.8 % |

24.1 % |

23.3 % |

22.6 % |

21.8 % |

Pre-Feasibility Study Overview

1. LITHIUM CHEMICALS FOR THE NORTH AMERICAN ELECTRIC VEHICLE MARKET

- The PAK Project has the ability to produce 7,360 metric tonnes of lithium carbonate and 12,520 m.t. of lithium hydroxide annually. This production tonnage meets the specific requirements of original equipment manufacturers (OEMs), such as automotive companies operating in the North American electric vehicle market. As the electric vehicle market continues to evolve and expand, the ability to adapt and meet changing customer demands becomes crucial. The lithium chemicals to be produced by Frontier Lithium will be tailored to the needs of the industry, supporting the growth of electric vehicles manufacturing in the region and building in optionality for the future demand profiles through adjustments in production capacity and product mix to align with future market trends and customer preferences.

2. A PHASED APPROACH

- The development of the PAK project and hydromet chemical plant will be completed in phases to allow for efficient resource allocation, to minimize upfront capital expenditure, and de-risk project execution. The first phase will focus on the production of spodumene concentrate to generate revenue and support the concurrent development of necessary infrastructure to build the proposed mine-to-lithium hydroxide chemical plant facility. Implementing a phased approach also enables a more streamlined and controlled project development process, enabling a thorough understanding of the resource base and an optimization of the refining process in advance of chemical plant construction. This approach ensures that the subsequent refinery build-up is well-informed, efficient, and aligned with market demand.

3. GROWING REGIONAL DEMAND

- The North American electric vehicle market is experiencing significant growth, with strong commitments of over CAD$25 billion to build Ontario battery capacity by 2030. This strong regional growth provides a favorable market environment for the lithium project. The project can capitalize on its strategic North American location, the growing demand for electric vehicles and the need for lithium chemicals to support battery production.

- The commitments to build Ontario battery manufacturing capacity indicate a long-term future in sustainable transportation and the development of the electric vehicle ecosystem. By supplying locally produced lithium chemicals, the project can contribute to the regional supply chain, reduce dependence on imports, and strengthen the overall resilience and competitiveness of the North American electric vehicle market.

4. OPPORTUNITIES FOR FURTHER UPSIDE

- The project offers opportunities for further upside through the potential conversion of additional mineral resource to mineral reserves. The PFS reserve calculation includes only one-third of the identified resources. None of the 32.4 million tonne of inferred mineral resources were included in the PFS mineral reserves. This indicates significant exploration potential and the possibility of scaling the project.

- Frontier has a strong track record in resource exploration and development, and the continued exploration efforts within the PAK Lithium Project could uncover additional mineral resources. The potential to tap into additional resources ensures the project will be responsive to future market demands and supports long-term sustainability.

All scientific and technical information in this release has been reviewed and approved by Todd McCracken , P.Geo., Director – Mining & Geology – Central Canada , BBA E&C Inc., the qualified person (QP) and Garth Drever , P.Geo., VP Exploration for Frontier Lithium Inc. the qualified person (QP) under the definitions established by National Instrument 43-101. Under Frontier’s QA/QC procedures, all drilling was completed by Chenier Drilling Ltd. of Val Caron, ON using thin-walled BTW drill rods (4.2 cm core diameter) and a Reflex ACT III oriented core system. Using the Reflex system, the drill core was oriented and marked as it was retrieved at the drill. The core was boxed and delivered to the Frontier core shack where it was examined, geologically logged and marked for sampling. The core was photographed prior to sampling. Using a rock saw, the marked sample intervals were halved with one halve bagged for analysis. Sample blanks along with lithium, rubidium and cesium certified reference material was routinely inserted into the sample stream in accordance with industry recommended practices. Field duplicate samples were also taken in accordance with industry recommended practices. The samples were placed in poly sample bags and transported to Red Lake by Frontier employees and then shipped to AGAT Laboratories Ltd. (AGAT) in Mississauga, ON for quantitative multi-element analysis. AGAT is an ISO accredited laboratory. The core is stored on site at the Pakeagama Lake exploration camp.

Frontier Lithium is a preproduction business with an objective to become a strategic domestic supplier of spodumene concentrates for industrial users as well as battery-grade lithium hydroxide and other chemicals to the growing electric vehicle and energy storage markets in North America. The Company maintains the largest land position and resource in a premium lithium mineral district located in Ontario’s Great Lakes region.

The PAK lithium project contains North America’s highest-grade lithium resource and is the second largest in North America by size. The project encompasses close to 27,000 hectares and remains largely unexplored; however, since 2013, the company has delineated two premium spodumene-bearing lithium deposits (PAK and Spark), located 2.3 kilometres apart. Exploration is continuing on the project through two other spodumene- bearing discoveries: the Bolt pegmatite (located between the PAK and Spark deposits), as well as the Pennock pegmatite (25 kilometres northwest of PAK deposit within the project claims). A 2023 Pre-Feasbility Study “National Instrument 43-101 Technical Report PFS PAK Lithium Project” by BBA E&C Inc., delivered post-tax NPV(8) of US$1.74 billion and IRR of 24.1% as per the press release disseminated on May 31, 2023, and was filed on Sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical fact constitute forward-looking statements. Forward looking statements contained in this news release include, but are not limited to, statements with respect to: estimated mineral resources, estimated capital costs to construct mine facilities, estimated operating costs, the duration of payback periods, estimated amounts of future production, estimated cash flows, net present value (NPV) , and statements that address future production, reserve potential, exploration drilling, exploitation activities and events or developments that the Company expects.

Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those expressed in the forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties. Risk factors that could cause actual results to differ materially from those in forward looking statements include: market prices for commodities, increases in capital or operating costs, construction risks, availability of infrastructure including roads, regulatory and permitting risks, exploitation and exploration successes, continued availability of capital and financing, financing costs, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and those actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, Investors should review the Company’s registered filings available at sedar.com.

SOURCE Frontier Lithium Inc.

drilling

tsxv-fl

frontier-lithium-inc

frontier lithium inc

financing

press-release

Capella Announces Definitive Agreement for the Sale of is Central Norway Copper-Cobalt Projects to NickelX and Financing Update

Capella Announces Definitive Agreement for the Sale of is Central Norway Copper-Cobalt Projects to NickelX and Financing Update

Canada NewsWire

VANCOUVER, BC, Oct. 17, 2023

VANCOUVER, BC, Oct. 17, 2023 /CNW/ – Capella Minerals Ltd (TSXV: CMIL) (OTC…

Goldgroup Announces Exercise of Cerro Prieto Purchase Option

Vancouver, British Columbia–(Newsfile Corp. – October 17, 2023) – Goldgroup Mining Inc. (TSX: GGA) (OTC PINK: GGAZF) (BMV SIX: GGAN.MX) ("Goldgroup" or…

Colibri Provides Company Update

Dieppe, New Brunswick–(Newsfile Corp. – October 17, 2023) – Colibri Resource Corporation (TSXV: CBI) (OTC Pink: CRUCF) ("Colibri" or the "Company") is…