Financing News

Black Mountain Gold USA Corp. Announces Definitive Agreement for Banio Potash Project

Vancouver, British Columbia–(Newsfile Corp. – November 2, 2022) – Black Mountain Gold USA Corp. (TSXV: BMG) ("BMG" or the "Company") is pleased to announce…

Vancouver, British Columbia–(Newsfile Corp. – November 2, 2022) – Black Mountain Gold USA Corp. (TSXV: BMG) (“BMG” or the “Company”) is pleased to announce that it has entered into a definitive agreement (the “Definitive Agreement”) dated effective October 31,2022 concerning its option to acquire up to a 100% interest in the Banio Potash Project first announced on September 27, 2022.

The Definitive Agreement replaces a binding Memorandum of Understanding (the “MOU”), dated effective September 5,2022, with the shareholders (the “Vendors”) of all of the Equatorial Potash Pty. Ltd (“Equatorial”) shares (the “Equatorial Shares”).

The Definitive Agreement provides for the option (the “Option”) to acquire up to a 100% interest in the Banio Potash Project in Gabon (the “Banio Potash Project”) by the acquisition from the Vendors of all of the issued and outstanding Equatorial Shares. Equatorial is the 100% owner of Mayumba Potasse SARL (“Mayumba”), a Gabonese company holding a 100% interest in Gabonese Exploration Permit No. G2-595 Potasse et Sels Connexes Mayumba renewed February 4, 2022 (the “Banio Permit”).

Further details regarding Mayumba, the Banio Permit and the Banio Potash Project can be found in the Company’s September 27,2022 news release.

The Definitive Agreement and the Option to acquire the Banio Potash Project represent a “Fundamental Acquisition” under the policies of the TSX Venture Exchange (the “Exchange”). Exchange approval of the Definitive Agreement requires submission of a technical report on the Banio Potash Project and other information to the Exchange. It is anticipated that the Company has sufficient working capital to meet its financial obligations under the Definitive Agreement as well as other financial obligations for the next six months.

Terms and conditions of the Banio Potash Project Definitive Agreement

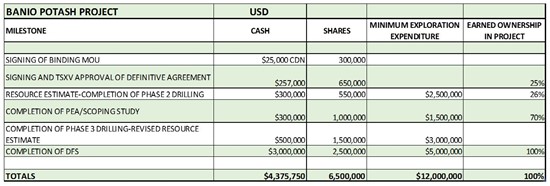

The terms and conditions of the Definitive Agreement remain materially unchanged from those of the MOU and are summarized below:

Table 1 Terms and Conditions of Definitive Agreement

Table 1

To view an enhanced version of Table 1, please visit:

https://images.newsfilecorp.com/files/4674/142640_bmtbl1.jpg.

The amount of USD$257,000 due upon execution and final regulatory approval of the Definitive Agreement is changed slightly from the September 27, 2022 news release (which stated in error that the payment was USD$250,000 less CDN$25,000). In contract to the MOU, the Definitive Agreement earn in for the Option now has four stages with the initial 51% ownership being earned in two stages (of 25% and 26%). In calculating total cash payments in the table, USD$18,750 has been used in place of the $25,000CDN due upon signing of the MOU (which amount has been paid).

BMG has engaged Ercosplan Ingenieugesellschaft Geotechnik und Bergbau mbH (“Ercosplan”) to complete a NI 43-101 compliant technical report (the “Technical Report”) on the Banio. It is anticipated the Technical Report will be completed by Ercosplan and submitted to the Exchange in November 2022.

Name Change

In conjunction with the acquisition of the Banio Potash Project, BMG is planning a name change to “Millennial Potash Corp.”

To find out more about Black Mountain Gold USA Corp. please contact Investor Relations at (604) 662-8184 or email [email protected].

BLACK MOUNTAIN GOLD USA CORP.

“Graham Harris”

CEO, Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “intend”, “may”, “schedule” and similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to future prices of commodities, accuracy of mineral or resource exploration activity, reserves or resources, regulatory or government requirements or approvals including approvals of title and mining rights or licenses and environmental, local community or indigenous community approvals, the reliability of third party information, continued access to mineral properties or infrastructure, changes in laws, rules and regulations in Gabon or any other jurisdiction which may impact upon the Company or its properties or the commercial exploitation of those properties, currency risks including the exchange rate of USD$ for Cdn$ or other currencies, fluctuations in the market for gold/silver and potash or potash related products, changes in exploration costs and government royalties, export policies or taxes in Gabon or any other jurisdiction and other factors or information. The Company’s current plans, expectations and intentions with respect to development of its business and of the Banio Potash Project may be impacted by economic uncertainties arising out of Covid-19 pandemic or by the impact of current financial and other market conditions on its ability to secure further financing or funding of the Banio Potash Project. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political, environmental and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affections such statements and information other than as required by applicable laws, rules and regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/142640

financing

acquisition

tsxv-bmg

black-mountain-gold-usa-corp

black mountain gold usa corp

press-release

Capella Announces Definitive Agreement for the Sale of is Central Norway Copper-Cobalt Projects to NickelX and Financing Update

Capella Announces Definitive Agreement for the Sale of is Central Norway Copper-Cobalt Projects to NickelX and Financing Update

Canada NewsWire

VANCOUVER, BC, Oct. 17, 2023

VANCOUVER, BC, Oct. 17, 2023 /CNW/ – Capella Minerals Ltd (TSXV: CMIL) (OTC…

Goldgroup Announces Exercise of Cerro Prieto Purchase Option

Vancouver, British Columbia–(Newsfile Corp. – October 17, 2023) – Goldgroup Mining Inc. (TSX: GGA) (OTC PINK: GGAZF) (BMV SIX: GGAN.MX) ("Goldgroup" or…

Colibri Provides Company Update

Dieppe, New Brunswick–(Newsfile Corp. – October 17, 2023) – Colibri Resource Corporation (TSXV: CBI) (OTC Pink: CRUCF) ("Colibri" or the "Company") is…