Financing News

ATHA ENERGY SHARES TO COMMENCE TRADING ON THE CSE UNDER THE SYMBOL “SASK” ON TUESDAY, APRIL 11, 2023

ATHA ENERGY SHARES TO COMMENCE TRADING ON THE CSE UNDER THE SYMBOL “SASK” ON TUESDAY, APRIL 11, 2023

Canada NewsWire

VANCOUVER, BC, April 10, 2023

/NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED…

ATHA ENERGY SHARES TO COMMENCE TRADING ON THE CSE UNDER THE SYMBOL “SASK” ON TUESDAY, APRIL 11, 2023

Canada NewsWire

VANCOUVER, BC, April 10, 2023

/NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/

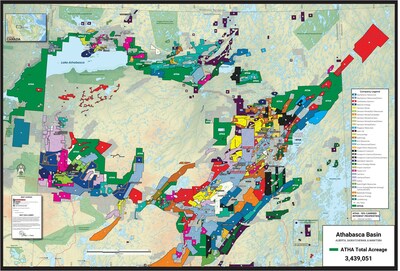

ATHA holds the largest reported cumulative exploration package in the Athabasca Basin – the world’s most prominent basin for uranium discoveries.

VANCOUVER, BC, April 10, 2023 /CNW/ – ATHA Energy Corp. (CSE: SASK)(“ATHA” or the “Company“) is pleased to announce that its common shares have been approved for listing on the Canadian Securities Exchange (“CSE“) under the trading symbol “SASK” and are to commence trading on Tuesday, April 11, 2023.

Michael Castanho, Chief Executive Officer and Director of ATHA commented, “As the world moves toward cleaner energy sources in the battle against climate change, nuclear power has gained increasing support and popularity, which has now driven uranium prices to 12-year highs. With global uranium production deficits expected to continue for the foreseeable future, ATHA was established with a vision of creating a best-in-class uranium exploration company to meet the growing demand for reliable North American uranium supply.”

Mr. Castanho added, “Successfully completing a listing of ATHA’s common shares on the CSE is a significant milestone we have been working towards over the past six months. During that time, we have completed an extremely exciting acquisition of 3.4 million acres in the Athabasca basin in Saskatchewan and Alberta, which we believe are highly prospective for uranium deposits, along with a 10% carried interest portfolio of claims operated by NexGen Energy Ltd. (TSX: NXE) and IsoEnergy Ltd. (TSX-V: ISO). The level of interest and support for our private rounds of financing is a strong testament to our management team and board’s track record of success and the quality of the world-class land position we have assembled in a highly desirable uranium jurisdiction. With current cash holdings of approximately $37 million, we are confident in our team’s ability to execute on our exploration strategy to unlock the prospective potential of our core holdings and build value for shareholders. Our team is also excited at the prospect of leveraging our expansive portfolio of exploration assets to secure high-value partnerships within the Athabasca basin. We are proud of the Company we’ve built and are excited about our prospects for the future. We are also very appreciative of our current and future shareholders’ support on the path to discovery.”

Key Investment Highlights of ATHA

- Largest Footprint in World’s Best Basin for Uranium: ATHA holds the largest reported exploration land package in the highest-grade uranium district in the world, with over 3.4 million acres held in Saskatchewan and Alberta’s Athabasca basin (see map below)1,2;

- Athabasca Basin Assets Staked by Renowned Team with a History of Value Creation: ATHA’s exploration assets have been aggregated over a period of 10 years in the depths of the previous uranium bear market by the same group that staked the foundational assets of NexGen Energy Ltd. (TSX: NXE), as well as the assets leading to Hathor Exploration’s Roughrider deposit, (C$650 million sale in 2012);

- Strong Balance Sheet to Execute on Growth Strategy: ATHA maintains one of the strongest balance sheets in the Athabasca basin among public uranium exploration peers, with $37 million in cash and zero debt2;

- ATHA Holds Desirable Carried Interest with Industry Leaders: ATHA assets include a 10% carried interest on key exploration blocks owned and operated by two of the most successful development teams in the Athabasca basin – NexGen Energy Ltd. (TSX: NXE) and IsoEnergy Ltd. (TSX-V: ISO);

- Exploration Acreage in “Great Neighbourhoods”: ATHA’s exploration portfolio includes sizeable prospective assets near major operating mines and infrastructure in the southeast basin, high-grade development projects of the southwest basin, and historical operating mines in the north and west rims of the basin (see map below);

- Well Balanced and Supportive Investor Base: ATHA’s shareholder base maintains strong alignment between uranium focused institutional support at 26% and management, board, and insiders with over 34% of shares outstanding; and

- Nimble Company with Growth Focus: ATHA intends to leverage its extensive exploration portfolio, cash position, clean capital structure, and strong balance sheet for its own exploration program in addition to the aggressive pursuit of joint ventures, farm-ins, and accretive acquisition opportunities.

Corporate Presentation

For further information, please download ATHA’s Corporate Presentation (link) or visit the Company’s website at www.athaenergy.com. Investors may also seek additional information by reviewing the Company’s public disclosure record, including its Final Prospectus dated March 23, 2023 which is available on the SEDAR website (www.sedar.com).

|

Notes: |

|

[1] World Nuclear Association |

|

[2] Company Filings |

ATHA is a mineral exploration company focused on the acquisition, exploration and development of mineral resource properties. The Company has an option to acquire a 100% interest and title to the Golden Rose Property located in Northeastern Ontario and has acquired 3.4 million acres in the Athabasca basin in Saskatchewan and Alberta along with a 10% carried interest portfolio of claims operated by NexGen Energy Ltd. (TSX: NXE) and IsoEnergy Ltd. (TSX-V: ISO).

Certain information in this news release constitutes forward-looking information. In some cases, but not necessarily in all cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans,” “targets,” “expects” or “does not expect,” “is expected,” “an opportunity exists,” “is positioned,” “estimates,” “intends,” “assumes,” “anticipates” or “does not anticipate” or “believes,” or variations of such words and phrases or state that certain actions, events or results “may,” “could,” “would,” “might,” “will” or “will be taken,” “occur” or “be achieved.” In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events.

Forward-looking information is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by ATHA as of the date of this news release, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to the factors described in greater detail in the “Risk Factors” section of ATHA’s final prospectus dated March 23, 2023 available at www.sedar.com. These factors are not intended to represent a complete list of the factors that could affect ATHA; however, these factors should be considered carefully. There can be no assurance that such estimates and assumptions will prove to be correct. The forward-looking statements contained in this news release are made as of the date of this news release, and ATHA expressly disclaims any obligation to update or alter statements containing any forward-looking information, or the factors or assumptions underlying them, whether as a result of new information, future events or otherwise, except as required by law.

Neither the CSE nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this release.

SOURCE ATHA Energy Corp.

financing

investment

acquisition

tsx-nxe

nexgen-energy-ltd

nexgen energy ltd

tsxv-iso

isoenergy-ltd

isoenergy ltd

press-release

Capella Announces Definitive Agreement for the Sale of is Central Norway Copper-Cobalt Projects to NickelX and Financing Update

Capella Announces Definitive Agreement for the Sale of is Central Norway Copper-Cobalt Projects to NickelX and Financing Update

Canada NewsWire

VANCOUVER, BC, Oct. 17, 2023

VANCOUVER, BC, Oct. 17, 2023 /CNW/ – Capella Minerals Ltd (TSXV: CMIL) (OTC…

Goldgroup Announces Exercise of Cerro Prieto Purchase Option

Vancouver, British Columbia–(Newsfile Corp. – October 17, 2023) – Goldgroup Mining Inc. (TSX: GGA) (OTC PINK: GGAZF) (BMV SIX: GGAN.MX) ("Goldgroup" or…

Colibri Provides Company Update

Dieppe, New Brunswick–(Newsfile Corp. – October 17, 2023) – Colibri Resource Corporation (TSXV: CBI) (OTC Pink: CRUCF) ("Colibri" or the "Company") is…