Energy & Critical Metals

Let’s Give Our Profits Some Momentum!

Last week, I introduced the SPDR Russell 1000 Low Volatility Focus ETF (NYSE: ONEV), a multi-factor smart beta fund that focused largely on low volatility…

Last week, I introduced the SPDR Russell 1000 Low Volatility Focus ETF (NYSE: ONEV), a multi-factor smart beta fund that focused largely on low volatility stocks.

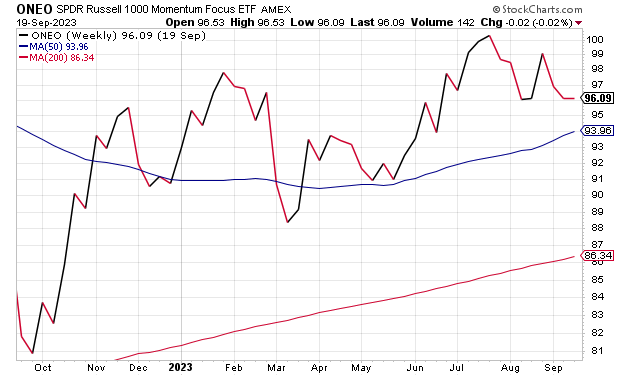

Today, I want to introduce you to one of its cousins, another multi-factor smart beta fund with a different core value set: one focused on momentum. Founded in 2015 by State Street Global Advisors, the SPDR Russell 1000 Momentum Focus ETF (ONEO) tracks the Russell 1000 Momentum Focused Factor Index, whose stocks are selected and weighted by four factors, and are then scaled by market cap.

Despite its name, ONEO doesn’t focus solely on high-momentum stocks. Instead, the fund stands alongside ONEV and ONEY as part of a suite of exchange-traded funds (ETFs) that score the members of the Russell 1000 index on three “core” factors — value, quality and small size — and one “focus” factor, which in ONEO’s case, is momentum. These factor scores are then scaled by market cap to determine their weighting and holdings. Russell 1000 equities with weights below a certain threshold get dropped from the index.

The result is a portfolio that loosely resembles the broad market, but with emphasis on the four factors, including momentum. ONEO’s focus on the Russell 1000 means it holds a significant amount of mid-cap investments. That focus is amplified by the fund’s small size factor tilt.

At present, ONEO has $152.34 million assets under management, and has an expense ratio of 0.20%. Its current top holdings include the Marathon Petroleum Corporation (NYSE: MPC), Cardinal Health, Inc. (NYSE: CAH), the ON Semiconductor Corporation (NASDAQ: ON), the McKesson Corporation (NYSE: MCK) and Reliance Steel & Aluminum Co. (NYSE: RS).

Courtesy of www.stockcharts.com

As of Sept. 19, the fund is up 0.02% in the past month, 0.27% in the past three months and up 5.91% year to date.

While this fund may be focused on high momentum, it is better for investors to slow down and take their time. Remember to always consider your personal financial situation and goals before making any investment. Investors are always encouraged to do their due diligence before adding any stock or exchange-traded fund (ETF) to their portfolios.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You may just see your question answered in a future ETF Talk.

The post Let’s Give Our Profits Some Momentum! appeared first on Stock Investor.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…