Energy & Critical Metals

Is VinFast Really the New Telsa

In the realm of electric vehicles (EVs), few names stand out as prominently as Tesla, Inc. (NASDAQ: TSLA). A pioneer in the sector, the company has established…

In the realm of electric vehicles (EVs), few names stand out as prominently as Tesla, Inc. (NASDAQ: TSLA). A pioneer in the sector, the company has established a reputation for innovation and market dominance.

Yet, as the industry evolves, emerging players like VinFast Auto Ltd. (NASDAQ: VFS) are stepping onto the global stage, bringing with them unique strategies and ambitions.

Although VinFast came charging out of the gate last month, the downward pressure on the stock continues, with it falling another 11.5% yesterday.

Overview of Tesla – the American EV Darling

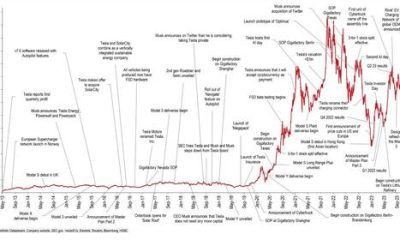

Tesla is an American company that specializes in electric vehicles, solar panels, and battery energy storage systems. Tesla went public in June 2010 at $17 per share and closed the day at $23.89, up over 40% from its IPO price.

The company’s stock price has increased more than tenfold since 2019, reaching a record high of $1,200 per share in December 2022. Today, it is one of the world’s most valuable companies and the most valuable automaker as of 2023.

Tesla’s product portfolio includes the Model S, Model 3, Model X, Model Y, Cybertruck, Semi, and Roadster vehicles, as well as the Powerwall, Powerpack, Megapack, and Solar Roof products. The company also operates a network of Superchargers and Destination Chargers for its vehicles and offers leasing, financing, insurance, and maintenance services.

The company has a global presence with factories in the US, China, and Germany. The company also has research and development centers in various locations. Tesla is known for its innovation and leadership in battery technology, software, and autonomous driving.

Overview of VinFast – the Vietnamese Upstart

VinFast is a company that designs and manufactures EVs, electric scooters, and electric buses. The company operates in Vietnam, the United States, and Europe, and aims to create an e-mobility ecosystem based on customers, community, and connectivity.

VinFast is a subsidiary of Vingroup Joint Stock Company (HOSE: VIC), a large conglomerate in Vietnam. VinFast started trading in the US market on August 15, 2023, after merging with a Special Purpose Acquisition Company (SPAC) and opened at $22, more than double the $10 SPAC price.

VinFast’s stock price ended the trading day at $37.06, valuing the company at $85 billion, more than both Ford’s (NYSE: F) and General Motors’ (NYSE: GM) market capitalization at $48 billion and $46 billion, respectively but still well below Telsa’s market capitalization at $775 billion.

VinFast began manufacturing electric scooters in 2018, followed by cars in 2019, and electric buses in 2020. By September 2022, they had distributed almost 88,000 vehicles and more than 145,000 electric scooters. Their first electric SUV series entered production in late 2021. Throughout 2022, they transitioned away from traditional combustion engines to concentrate solely on EVs.

VinFast still has not posted a profit.

Tesla’s Latest Financials – Billion Dollar Revenue and Profits

Tesla’s revenue for 2022 was $81.5 billion, up 28% from 2021. The company’s net income for 2022 was $12.6 billion, up 57% from 2021. The company’s total assets as of December 31, 2022, were $82.4 billion, and its total equity was $44.7 billion.

Tesla reported its financial results for the second quarter of 2023 on July 19, 2023. The company posted revenues of $24.93 billion, beating the analysts’ consensus estimate of $24.32 billion. This represents a 47% year-over-year growth, driven by strong demand for its EVs and energy products. The company also delivered a net income of $2.61 billion, or $0.85 per share, surpassing the analysts’ expectation of $0.80 per share. This marks the ninth consecutive quarter of profitability for Tesla.

The company’s gross profit was $4.53 billion, up 7% year-over-year, resulting in a gross margin of 18.2%, down from 25.0% in the same period last year. The company attributed the lower gross margin to lower vehicle average selling price, underutilization of new factories, and lower regulatory credit revenue.

Tesla produced 479,700 vehicles in the second quarter of 2023, including 460,211 Model 3 and Model Y vehicles, and 19,489 Model S and Model X vehicles. The company delivered 466,140 vehicles in the same period, including 446,915 Model 3 and Model Y vehicles, and 19,225 Model S and Model X vehicles.

The company ended the quarter with $23.08 billion in cash and cash equivalents, up from $22.40 billion at the end of the first quarter of 2023. The increase in cash was mainly due to cash flow from operations exceeding capital expenditures.

The company reaffirmed its guidance of achieving 50% average annual growth in vehicle deliveries over a multi-year horizon. The company also expects operating margins to continue to grow over time, reaching industry-leading levels with capacity expansion and localization plans underway.

VinFast’s Latest Financials – Million Dollar Revenue and Losses

VinFast’s revenue from vehicle sales fell by over 50% to $84 million in the first quarter of 2023, compared to $169.5 million in the first quarter of 2022. VinFast reported a net loss of $600.7 million in the first quarter of 2023, up from a loss of $421.7 million in the same period of 2022. The company attributed the increased loss to higher operating expenses, research and development costs, and depreciation and amortization charges related to its EV production and expansion plans.

VinFast’s cost of goods sold (COGS) was $246.4 million in the first quarter of 2023, resulting in a negative gross profit of $162.4 million. VinFast’s COGS exceeded its revenue due to low production volumes, high fixed costs, and limited economies of scale.

The company sold 18,700 vehicles in total from 2021 to June 2023, with 740 of these delivered to U.S. customers. The majority of its sales were in Vietnam, where it faces competition from other Asian automakers. VinFast’s revenue also includes income from its e-scooter and bus segments, which are not disclosed separately.

VinFast plans to invest $2 billion to build a new factory in North Carolina, where it expects to start production in 2025. VinFast aims to sell 15,000 vehicles in the U.S. market in 2024 and 45,000 vehicles in 2025.

Final Thoughts

Tesla’s longstanding dominance in the EV market is undeniable, with impressive financial figures and consistent innovation.

However, the rise of VinFast offers a fascinating glimpse into the evolving dynamics of this sector. As VinFast strives to carve out its niche, particularly in markets outside its home base of Vietnam, it will be intriguing to observe how these two companies navigate the challenges and opportunities ahead.

The EV industry remains ripe for growth and disruption, but time will tell if VinFast can play a pivotal role in its future.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…