Energy & Critical Metals

How Battery Metals Can Power Energy Independence in America

As the U.S. transitions to clean energy, investing in battery metals like lithium and cobalt can help secure an energy-independent future.

The post How…

How Battery Metals Can Power Energy Independence in America

The U.S. has been historically dependent on foreign sources of energy to meet the needs of domestic consumption.

However, as the country transitions to clean energy and electrified transport, the raw materials behind green technologies offer an opportunity to build an energy-independent future. As clean energy technologies grow, the U.S. can reshore energy production for the future by investing in domestic mineral supply chains, from mine to battery.

This infographic from our sponsor Surge Battery Metals highlights the state of America’s energy transition and explains how battery metals can help in enabling energy independence. This is part three of the Energy Independence Series.

America’s Energy Transition in Numbers

The United States may not be on track to reach its climate goals yet, but the country’s energy transition is well underway.

For example, no new coal-fired power plants have come online since 2013, and the energy sector has retired 30% of its coal-fired capacity since 2010. In turn, the decline in coal-fired generation is being offset by new renewable capacity.

| Energy Source | Net Capacity Additions (2021-2025P, megawatts) |

2021 Total Capacity (megawatts) | Net Capacity Additions as % of Current Capacity |

|---|---|---|---|

| Coal | -33,072.0 | 210,000 | -16% |

| Nuclear | -5,913.8 | 95,000 | -6% |

| Natural Gas | 18,151.8 | 491,000 | 4% |

| Wind | 33,433.9 | 132,400 | 25% |

| Solar | 51,241.7 | 61,000 | 84% |

| U.S. Total | 63,841.6 | 989,400 | 6% |

U.S. solar generation capacity is projected to nearly double, increasing 84% by 2025 relative to 2021 levels. Wind capacity, which is already twice that of solar, is projected to increase by 25% by 2025.

Alongside renewables, the U.S. electric vehicle (EV) market is charging ahead. The Biden Administration is targeting 50% of all new car sales to be zero-emissions by 2030, and this requires a significant uptick in EV adoption. Consequently, the government is pouring billions into supporting EVs through the Inflation Reduction Act, which includes funding for charging infrastructure and EV purchase incentives.

Moreover, battery manufacturers are flocking to North America as the region seeks to reduce reliance on imports from China.

The expansions in clean energy capacity, EV adoption, and battery manufacturing mean that the U.S. will need more battery metals like lithium and nickel. These metals are key to developing energy storage for renewables, and of course, batteries for EVs.

The Need for Battery Metals

The U.S. is projected to sell 17.5 million electric cars in 2030. What does that mean for metal demand?

According to the IEA, the average electric car contains about 8.9kg of lithium and 39.9kg of nickel. Based on these figures, here’s how much of each the U.S. would need for 17.5 million electric cars:

- 155,928 tonnes of lithium in 2030

- 699,048 tonnes of nickel in 2030

Currently, the U.S. produces less than 0.1% and 3% of the lithium and nickel needed in 2030, respectively. While these are approximate figures based on the above projections, they show how current production is lagging relative to future demand.

With a high reliance on imports for both lithium and nickel, the U.S. needs to reshore the production of battery metals. Domestic production of these metals is not only critical for clean energy and EVs but also for an energy-independent future.

>> Surge Battery Metals is focused on exploring North American deposits of lithium and nickel, furthering the potential to develop domestic battery metal sources.

-

Green2 days ago

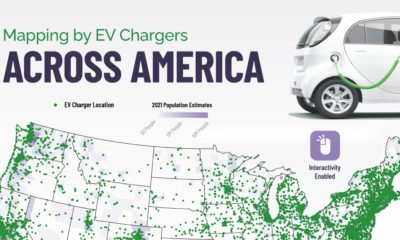

Green2 days agoInteractive: EV Charging Stations Across the U.S. Mapped

Looking for an EV charging station in the states? This interactive map contains every EV charging station in America.

-

Agriculture3 days ago

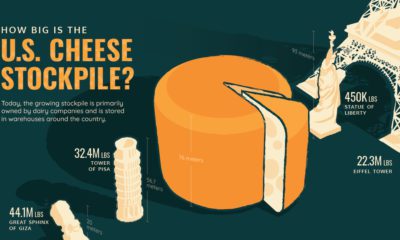

Agriculture3 days agoHow Big is the U.S. Cheese Stockpile?

The U.S. has 1.5 billion pounds of cheese in cold storage across the country—around $3.4 billion worth of cheese.

-

Mining6 days ago

Mining6 days agoAll the Metals We Mined in 2021: Visualized

See all the 2.8 billion tonnes of metals mined in 2021.

-

Datastream6 days ago

Datastream6 days agoUK Prime Ministers with the Shortest Term Length

As Liz Truss becomes the shortest-serving prime minister in UK history, we look at other whirlwind tours of Number 10 Downing Street.

-

Markets1 week ago

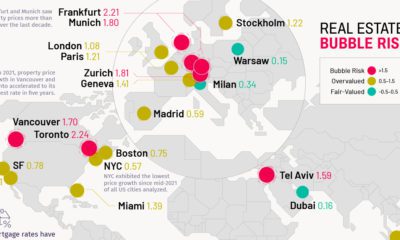

Markets1 week agoThese Global Cities Show the Highest Real Estate Bubble Risk

A global look at which cities have the most overheated real estate markets. Toronto shows the highest bubble risk in 2022.

-

Technology1 week ago

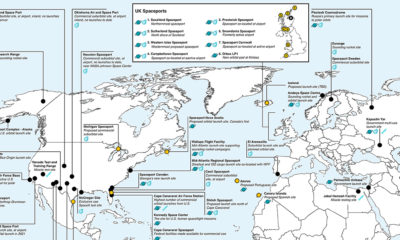

Technology1 week agoAll of the World’s Spaceports on One Map

This map is a comprehensive look at both existing and proposed spaceports and missile launching locations around the world.

The post How Battery Metals Can Power Energy Independence in America appeared first on Visual Capitalist.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…