Energy & Critical Metals

It Took 5 Years for EV Sales to Reach 1M in 2015. By 2026, 26M Will be Sold Annually

EV sales in 2022 were 10.5 million; by 2026, annual sales are projected to be 26.6 million PNN has returned … Read More

The post Eye on Lithium: It took…

- EV sales in 2022 were 10.5 million; by 2026, annual sales are projected to be 26.6 million

- PNN has returned strong lithium grades from brine at its Salta lithium project

- LEL has posted a 3.3Mt maiden resource estimate at its Solaroz lithium brine project in Argentina

All your lithium news, Thursday June 29.

Researchers at Bloomberg New Energy Finance (BNEF) have released their Electric Vehicle Outlook 2023 report, showing that electrification is now spreading rapidly into almost all segments of road transport – from passenger cars to commercial vehicles, buses and two and three-wheelers.

It took five years for EV sales to reach 1 million in 2015. It took another four years to sell the 5 millionth EV in March 2019.

BNEF’s latest data shows sales have gone from a relative snails-pace to a canter, with plenty of growth still to come.

EV sales in 2022 alone were 10.5 million. Over 2.3 million EVs were sold in the first quarter of 2023, ~25% more than in Q1 2022.

By 2026, annual sales are projected to be 26.6 million; predominantly in China, followed by Europe and the US markets respectively.

National policies and incentives – such as China’s recent US$72.3 billion four-year extension and increase of tax breaks on new electric vehicle sales – are helping fuel uptake.

By 2040, EV passenger vehicle sales are expected to reach 75%. Despite this, by that time they will only make up just under 50% of the global passenger vehicle fleet.

Bloomberg says much faster progress is needed to achieve net-zero road transport emissions by 2050.

“A stronger push is still needed. Heavy trucks in particular are far behind the net-zero trajectory and should be a priority focus for policymakers,” BNEF says.

“Grid investments, grid connections and permitting processes also need to be streamlined to support the large number of charging points needed for the transition.”

The economic opportunities are enormous. The cumulative value of EV sales across all segments will hit US$8.8 trillion by 2030 and 10X to a mind-boggling US$88 trillion in just two decades to 2050, BNEF says.

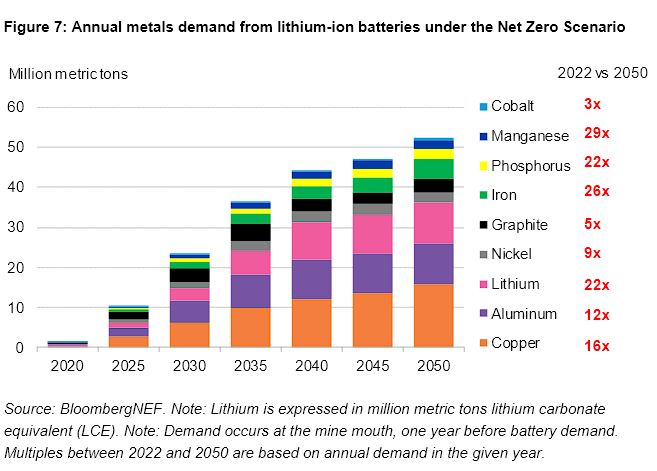

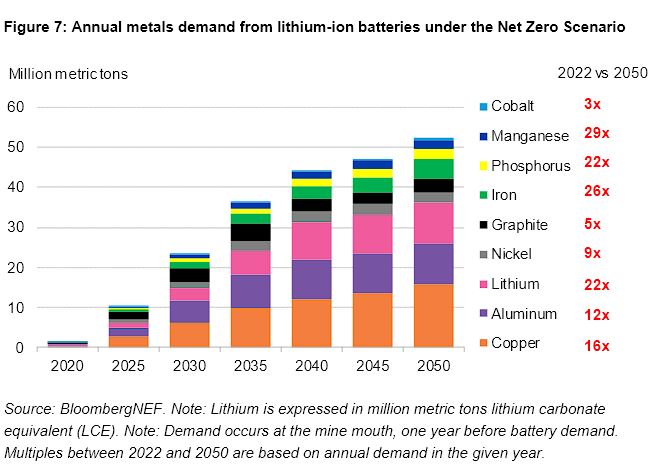

To reach net-zero car emissions, large investments are necessary in all areas of the battery supply chain, especially raw materials such as lithium.

Here’s how Aussie lithium stocks are tracking:

| Code | Company | Price | % Today | Market Cap |

|---|---|---|---|---|

| DAL | Dalaroo Metals | 0.088 | 17% | $3,249,375 |

| EVR | Ev Resources Ltd | 0.014 | 17% | $11,231,809 |

| REC | Recharge Metals | 0.335 | 16% | $30,619,497 |

| LSR | Lodestar Minerals | 0.0045 | 13% | $7,373,589 |

| GW1 | Greenwing Resources | 0.225 | 13% | $29,981,955 |

| NVA | Nova Minerals Ltd | 0.265 | 10% | $50,613,590 |

| IR1 | Irismetals | 1.61 | 10% | $116,804,450 |

| MAN | Mandrake Res Ltd | 0.045 | 10% | $24,549,157 |

| KTA | Krakatoa Resources | 0.023 | 10% | $7,630,908 |

| PL3 | Patagonia Lithium | 0.185 | 9% | $8,330,595 |

| ADV | Ardiden Ltd | 0.0065 | 8% | $16,130,012 |

| IMI | Infinity Mining | 0.13 | 8% | $9,177,398 |

| BMM | Balkan Mining and Minerals | 0.2 | 8% | $8,837,823 |

| LPM | Lithium Plus | 0.28 | 8% | $17,156,932 |

| NWM | Norwest Minerals | 0.045 | 7% | $11,660,649 |

| EPM | Eclipse Metals | 0.015 | 7% | $28,392,837 |

| G88 | Golden Mile Res Ltd | 0.049 | 7% | $15,151,917 |

| AM7 | Arcadia Minerals | 0.105 | 6% | $8,464,510 |

| QXR | Qx Resources Limited | 0.02 | 5% | $17,040,384 |

| TKM | Trek Metals Ltd | 0.085 | 5% | $35,554,552 |

| STM | Sunstone Metals Ltd | 0.022 | 5% | $64,721,682 |

| OCN | Oceana Lithium | 0.34 | 5% | $12,732,363 |

| VSR | Voltaic Strategic | 0.095 | 4% | $33,620,655 |

| TMB | Tambourah Metals | 0.099 | 4% | $3,913,297 |

| WML | Woomera Mining Ltd | 0.013 | 4% | $11,952,015 |

| IPT | Impact Minerals | 0.0135 | 4% | $36,981,151 |

| SCN | Scorpion Minerals | 0.082 | 4% | $27,310,789 |

| LRV | Larvotto Resources | 0.14 | 4% | $9,079,387 |

| LPI | Lithium Pwr Int Ltd | 0.3 | 3% | $182,478,892 |

| PSC | Prospect Res Ltd | 0.15 | 3% | $67,027,622 |

| LRS | Latin Resources Ltd | 0.3 | 3% | $747,471,593 |

| KOB | Koba Resources | 0.15 | 3% | $15,285,417 |

| NIS | Nickelsearch | 0.062 | 3% | $4,023,599 |

| SYA | Sayona Mining Ltd | 0.175 | 3% | $1,706,653,464 |

| CMD | Cassius Mining Ltd | 0.036 | 3% | $17,385,487 |

| AGY | Argosy Minerals Ltd | 0.39 | 3% | $533,674,849 |

| CHR | Charger Metals | 0.435 | 2% | $20,809,856 |

| GSM | Golden State Mining | 0.046 | 2% | $6,491,889 |

| DRE | Dreadnought Resources | 0.053 | 2% | $173,041,867 |

| PNN | Power Minerals Ltd | 0.38 | 1% | $27,125,356 |

| ESS | Essential Metals Ltd | 0.415 | 1% | $109,702,345 |

| DLI | Delta Lithium | 0.865 | 1% | $445,090,336 |

| A11 | Atlantic Lithium | 0.605 | 1% | $365,544,996 |

| LEL | Lithenergy | 0.815 | 1% | $76,958,100 |

| PLL | Piedmont Lithium Inc | 0.87 | 1% | $331,167,413 |

| MIN | Mineral Resources | 70.97 | 0% | $13,778,953,627 |

| ASN | Anson Resources Ltd | 0.155 | 0% | $193,234,016 |

| AVZ | AVZ Minerals Ltd | 0.78 | 0% | $2,752,409,203 |

| EUR | European Lithium Ltd | 0.1 | 0% | $149,423,918 |

| GLN | Galan Lithium Ltd | 0.87 | 0% | $293,116,402 |

| LIT | Lithium Australia | 0.029 | 0% | $35,414,558 |

| LPD | Lepidico Ltd | 0.01 | 0% | $76,383,057 |

| RLC | Reedy Lagoon Corp | 0.006 | 0% | $3,400,318 |

| TKL | Traka Resources | 0.006 | 0% | $5,227,976 |

| TON | Triton Min Ltd | 0.032 | 0% | $49,963,379 |

| ARN | Aldoro Resources | 0.105 | 0% | $14,114,493 |

| AX8 | Accelerate Resources | 0.019 | 0% | $7,212,433 |

| AS2 | Askari Metals | 0.28 | 0% | $19,115,727 |

| MMC | Mitre Mining | 0.3 | 0% | $11,470,530 |

| CTN | Catalina Resources | 0.003 | 0% | $3,715,461 |

| TEM | Tempest Minerals | 0.014 | 0% | $7,095,503 |

| WCN | White Cliff Min Ltd | 0.007 | 0% | $7,369,963 |

| AZI | Altamin Limited | 0.077 | 0% | $30,162,190 |

| ENT | Enterprise Metals | 0.004 | 0% | $2,917,884 |

| KAI | Kairos Minerals Ltd | 0.017 | 0% | $33,389,589 |

| AVW | Avira Resources Ltd | 0.002 | 0% | $4,267,580 |

| A8G | Australasian Metals | 0.115 | 0% | $5,993,857 |

| EFE | Eastern Resources | 0.01 | 0% | $12,419,465 |

| SRZ | Stellar Resources | 0.013 | 0% | $13,077,535 |

| AOA | Ausmon Resorces | 0.004 | 0% | $3,877,157 |

| VKA | Viking Mines Ltd | 0.011 | 0% | $11,277,843 |

| SRI | Sipa Resources Ltd | 0.02 | 0% | $4,563,163 |

| VMC | Venus Metals Cor Ltd | 0.19 | 0% | $34,433,450 |

| WC8 | Wildcat Resources | 0.115 | 0% | $76,534,148 |

| THR | Thor Energy PLC | 0.004 | 0% | $5,840,051 |

| LLI | Loyal Lithium Ltd | 0.32 | 0% | $19,036,800 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | $74,238,031 |

| ALY | Alchemy Resource Ltd | 0.015 | 0% | $17,671,144 |

| DAF | Discovery Alaska Ltd | 0.028 | 0% | $6,558,572 |

| FTL | Firetail Resources | 0.11 | 0% | $8,470,000 |

| TUL | Tulla Resources | 0.35 | 0% | $118,262,971 |

| RMX | Red Mount Min Ltd | 0.004 | 0% | $9,087,404 |

| LM1 | Leeuwin Metals Ltd | 0.4 | 0% | $17,914,000 |

| ENT | Enterprise Metals | 0.004 | 0% | $2,917,884 |

| FBM | Future Battery | 0.115 | 0% | $49,202,190 |

| XTC | Xantippe Res Ltd | 0.002 | 0% | $22,960,199 |

| IEC | Intra Energy Corp | 0.005 | 0% | $3,528,908 |

| WES | Wesfarmers Limited | 49.045 | 0% | $55,622,328,642 |

| GL1 | Globallith | 1.495 | 0% | $388,577,300 |

| LTR | Liontown Resources | 2.85 | 0% | $6,293,374,116 |

| RIO | Rio Tinto Limited | 115.155 | -1% | $42,983,125,419 |

| GT1 | Greentechnology | 0.68 | -1% | $145,889,603 |

| VUL | Vulcan Energy | 4.07 | -1% | $686,074,734 |

| IGO | IGO Limited | 14.96 | -1% | $11,419,598,620 |

| LKE | Lake Resources | 0.3025 | -1% | $433,845,636 |

| AKE | Allkem Limited | 15.97 | -1% | $10,279,048,346 |

| ZNC | Zenith Minerals Ltd | 0.09 | -1% | $32,066,660 |

| EMH | European Metals Hldg | 0.86 | -1% | $109,480,121 |

| AAJ | Aruma Resources Ltd | 0.041 | -1% | $8,142,377 |

| CRR | Critical Resources | 0.0385 | -1% | $62,195,440 |

| PLS | Pilbara Min Ltd | 4.76 | -1% | $14,481,245,533 |

| EG1 | Evergreenlithium | 0.335 | -1% | $19,118,200 |

| LLL | Leo Lithium | 0.985 | -2% | $986,728,033 |

| INR | Ioneer Ltd | 0.325 | -2% | $692,451,628 |

| AZL | Arizona Lithium Ltd | 0.0325 | -2% | $90,739,331 |

| INF | Infinity Lithium | 0.0925 | -2% | $43,483,657 |

| CXO | Core Lithium | 0.9 | -2% | $1,700,542,867 |

| PAT | Patriot Lithium | 0.27 | -2% | $16,881,563 |

| QPM | Queensland Pacific | 0.098 | -2% | $174,634,792 |

| MQR | Marquee Resource Ltd | 0.046 | -2% | $15,543,253 |

| ZEO | Zeotech Limited | 0.045 | -2% | $75,472,461 |

| LRD | Lordresourceslimited | 0.081 | -2% | $3,081,966 |

| SGQ | St George Min Ltd | 0.04 | -2% | $34,460,933 |

| DTM | Dart Mining NL | 0.04 | -2% | $7,063,776 |

| MM1 | Midas Minerals | 0.37 | -3% | $27,910,777 |

| MLS | Metals Australia | 0.034 | -3% | $21,841,267 |

| NMT | Neometals Ltd | 0.51 | -3% | $290,189,117 |

| CAI | Calidus Resources | 0.17 | -3% | $106,331,778 |

| RAS | Ragusa Minerals Ltd | 0.063 | -3% | $9,268,921 |

| FIN | FIN Resources Ltd | 0.015 | -3% | $9,587,298 |

| BNR | Bulletin Res Ltd | 0.059 | -3% | $17,909,057 |

| AUN | Aurumin | 0.029 | -3% | $8,225,084 |

| LNR | Lanthanein Resources | 0.0145 | -3% | $16,823,634 |

| JRL | Jindalee Resources | 1.77 | -4% | $105,290,403 |

| KZR | Kalamazoo Resources | 0.125 | -4% | $19,982,391 |

| LIS | Lisenergylimited | 0.25 | -4% | $43,137,689 |

| RAG | Ragnar Metals Ltd | 0.024 | -4% | $9,479,622 |

| CY5 | Cygnus Metals Ltd | 0.235 | -4% | $52,464,474 |

| PAM | Pan Asia Metals | 0.21 | -5% | $34,158,587 |

| MTM | MTM Critical Metals | 0.1 | -5% | $9,277,543 |

| BUR | Burley Minerals | 0.2 | -5% | $15,670,159 |

| KGD | Kula Gold Limited | 0.018 | -5% | $7,091,026 |

| TYX | Tyranna Res Ltd | 0.018 | -5% | $59,022,081 |

| WR1 | Winsome Resources | 1.625 | -6% | $279,464,769 |

| FRS | Forrestania Resources | 0.099 | -6% | $8,926,421 |

| BYH | Bryah Resources Ltd | 0.016 | -6% | $5,807,616 |

| MRR | Minrex Resources Ltd | 0.015 | -6% | $17,357,880 |

| YAR | Yari Minerals Ltd | 0.014 | -7% | $7,235,367 |

| M2R | Miramar | 0.04 | -7% | $3,456,415 |

| LLO | Lion One Metals Ltd | 0.8 | -7% | $11,337,246 |

| RGL | Riversgold | 0.013 | -7% | $13,317,660 |

| EMS | Eastern Metals | 0.05 | -7% | $2,486,760 |

| MNS | Magnis Energy Tech | 0.1325 | -9% | $161,723,065 |

| MXR | Maximus Resources | 0.03 | -9% | $10,528,840 |

| AML | Aeon Metals Ltd. | 0.014 | -13% | $17,542,410 |

| PGD | Peregrine Gold | 0.275 | -13% | $17,672,322 |

| FG1 | Flynngold | 0.052 | -13% | $8,153,744 |

| 1MC | Morella Corporation | 0.006 | -14% | $42,690,063 |

| EMC | Everest Metals Corp | 0.17 | -19% | $27,180,953 |

45 lithium stocks were up today and 44 remained flat. 58 took a tumble.

WHO’S GOT NEWS OUT?

POWER MINERALS (ASX:PNN)

Argentina-focused PNN has returned strong lithium grades from brine at its Salta lithium project.

A first diamond hole at the Rincon salar drilled down to 345m and assays showed grades of up to 331mg/l of lithium suggesting strong aquifer thickness for brine.

It’s early stages at the moment, but this first hole result of a total three holes across 1,000m bodes well for the rest of the initial campaign at the deposit.

Last month, PNN announced a maiden resource estimate at its Incahuasi salar, with 249,308t LCE @ 198mg/l concentration.

The whole Salta project currently has a total resource of 488,308t LCE.

LITHIUM ENERGY (ASX:LEL)

LEL has posted a 3.3Mt maiden resource estimate at its Solaroz lithium brine project in Argentina.

Solaroz, next door to Allkem’s (ASX:AKE) lithium facility in the Salar de Olaroz Basin, is expected to grow further as LEL continues to spin the drill bit. Five holes remain to be drilled of the 10-hole campaign.

Within that 3.3Mt lithium carbonate equivalent (LCE) resource is a high-grade core of 1.34Mt of LCE with an average concentration of 405mg/l lithium (at a 350mg/l lithium cut-off grade).

Lithium Energy plans to build a 20,000-40,000tpa LCE pond evaporation plant at Solaroz and is currently advancing plans for the construction of an initial 3,000tpa LCE production plant with Xi’an Lanshen New Material Technology, to be located at the Mario Angel concession within the project area.

“This maiden resource estimate of 3.3Mt of LCE confirms the potential for Solaroz to be a world-class lithium project, with reported lithium grades, brine volumes, Mg/Li ratios, and specific yields all being positive indicators for the potential economic future brine extraction at Solaroz,” LEL chair William Johnson said.

“With the establishment of this significant maiden resource, the company will now focus on fast-tracking the development of Solaroz.”

At Stockhead, we tell it like it is. While Lithium Energy is a Stockhead advertiser, they did not sponsor this article.

The post Eye on Lithium: It took five years for EV sales to reach 1m in 2015. By 2026, 26m will be sold every year appeared first on Stockhead.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…