Energy & Critical Metals

DevEx is counting on uranium and rare earths to deliver material discoveries

Special Report: Uranium sentiment continues to improve, which is welcome news for DevEx. But uranium isn’t the only pie that … Read More

The post DevEx…

Uranium sentiment continues to improve, which is welcome news for DevEx. But uranium isn’t the only pie that the company has its fingers in.

At first glance, DevEx Resources’ (ASX:DEV) inventory looks downright eclectic with projects covering a range of commodities ranging from uranium to rare earths and also to copper-gold and nickel-copper-PGE across Australia.

However, managing director Brendan Bradley told Stockhead that this is due to the company choosing projects based on the opportunity to make material discoveries, a strategy that also leverages the strong familiarity with a number of mineral styles and commodities possessed by the company’s leadership.

Chairman and major shareholder Tim Goyder is a prominent mining entrepreneur who is known for his success with Chalice Mining (ASX:CHN), which he had previously chaired and is still a major shareholder in, and market darling Liontown Resources (ASX:LTR).

Incidentally, both Chalice and Liontown were spun out from DevEx, which highlights Goyder’s ability to build success stories.

“Tim doesn’t really need much introduction these days. He has built successful companies multiple times, he knows how to go about it and support those companies,” Bradley noted.

“That’s a big attribute and he’s got a lot of very happy shareholders backing him.”

Bradley adds that Goyder – a major shareholder in the company – is an active participant in DevEx’s running and is supported by a good board.

“Bryn Jones is very familiar with uranium and REE. He’s worked at Beverly uranium mine and is a non-executive director of Boss Energy (ASX:BOE) and Australian Rare Earths (ASX:AR3).

“Bryn brings a lot of process capability to the group and offers a lot of insight around how you squeeze these metals out of both uranium and REE.”

Of the other directors, Bradley said executive director Stacey Apostolou and non-executive director Richard Hacker bring their commercial skillsets to the company.

“Stacey is working as our corporate director and both she and Richard offer unique skill sets, which allows us to get on with the business of exploration and we’ve got somewhere in the order of about 7-8 geologists working for us,” he added.

Earlier this year, DevEx also added highly regarded mining executive Andrew Eddowes, previously Business Development and Investor Relations Manager at IGO Limited, to its team as General Manager – Business Development.

Bradley himself is a geologist with over 20 years’ of experience in multiple commodities.

“Tim’s success stories come from the drill bit and discoveries are his business, so that’s what we are focused on,” he explained.

So just what are the projects that DevEx will be maintaining its exploration momentum by drilling?

Last week, the Company unveiled a deal to sell its NSW copper-gold portfolio to ASX-listed Lachlan Star Limited (ASX: LSA) for $7.5 million.

The portfolio includes DevEx’s Junee Project, which is located in the same world-class gold, copper-gold belt as Newcrest Mining’s Cadia-Ridgeway and China Molybdenum’s Northpeakes project.

Bradley says the transaction will streamline DevEx’s portfolio, sharpening its focus on its uranium and rare earths assets while giving it ongoing exposure to the upside at the NSW assets via a 36.46% stake in Lachlan Star and a 2% Net Smelter Royalty.

Uranium powering ahead

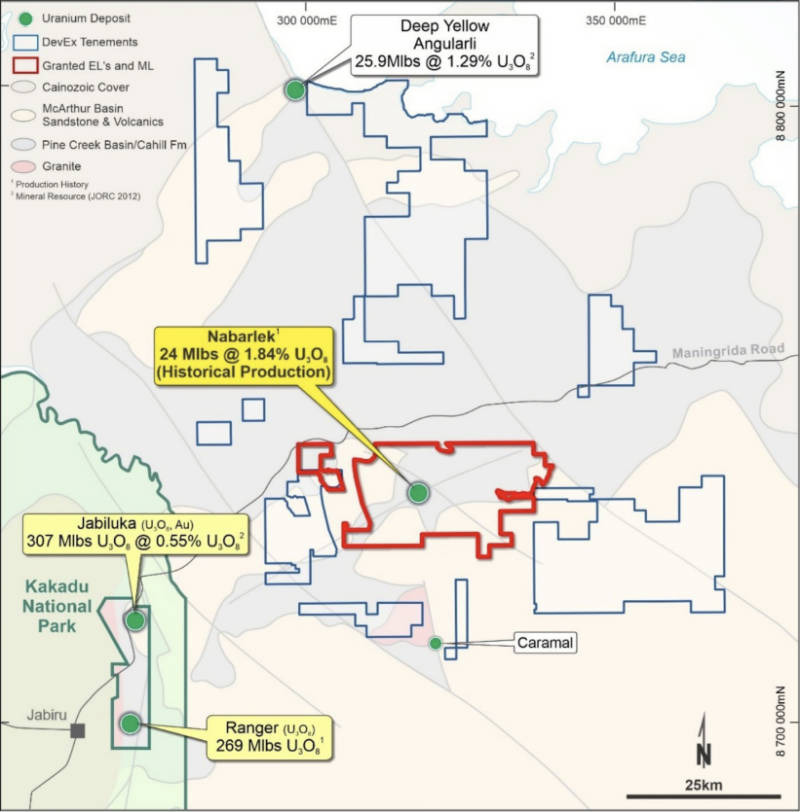

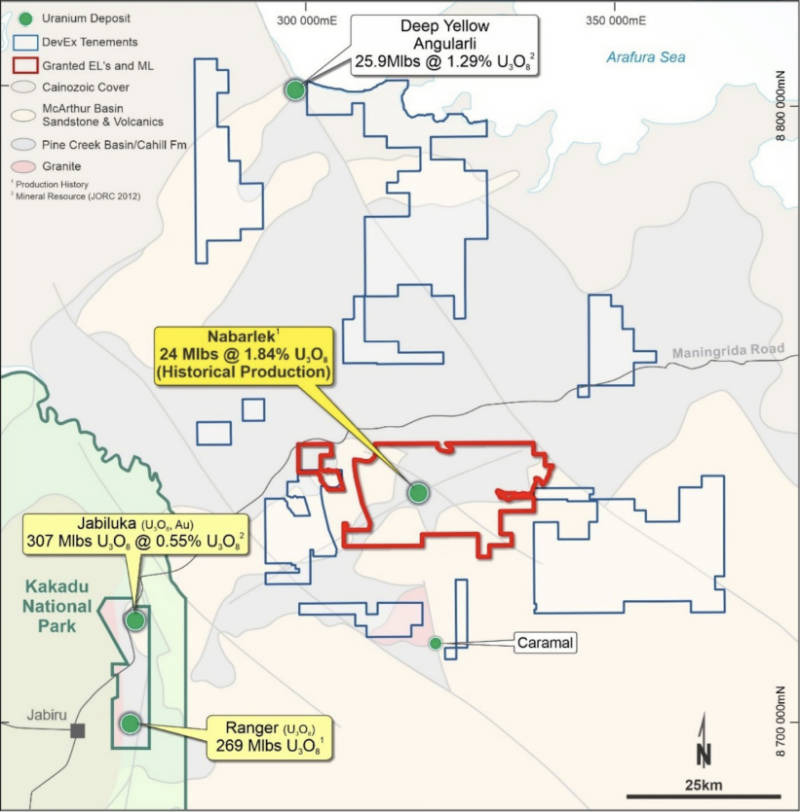

Top of the pops for DevEx is its Nabarlek uranium project within the Northern Territory’s prolific Alligator Rivers Uranium Province, which has an endowment of some 500 million pounds of U3O8 and is a close analogue to uranium deposits in Canada’s Athabasca Basin.

Nabarlek itself is centred around the historical Nabarlek uranium mine, which produced 24Mlb of U3O8 at an average grade of 1.84% U3O8.

It consists of a mining lease and three exploration tenements covering more than 4,700km2 and hosts numerous drill targets recognised in 50 years of exploration data.

But what is particularly intriguing for the company is that the advanced brownfields project possesses high-grade uranium that is unique in Australia.

“You don’t find that style of mineralisation at Nabarlek elsewhere in Australia,” Bradley noted.

“It is unique to that area which we are exploring, the Alligator Rivers uranium province.”

He added that the company understood the mineral systems and controls that form the uranium.

“We’ve got numerous high-grade uranium intercepts that we are following up on all around the historical mining area because it is province-size,” Bradley explained.

“We are focused on four or five immediate prospects that we’re drilling adjacent to previous high grade hits. The idea obviously is to see if these things have legs and if they’re going to grow and obviously lead towards a resource.

“The next step is to define a significant volume or significant occurrences of high grade uranium that can lead to a resource.”

Notable targets for further drilling are: Nabarlek South, where previous drilling of near-surface fracture-hosted uranium mineralisation in dolerite returned assay results such as 10.1m grading 1.1% U3O8 from 124m including 3.3m at 2.65% U3O8, U42 and U40.

U42 is a new high-grade U3O8 intercept seen in broad spaced reconnaissance RC drilling while U40 targets uranium mineralisation open to the south of previous intercepts such as 6m at 7.6% U3O8 from 75m.

Bradley adds that the style of mineralisation found at Nabarlek is a straightforward sort that is easy to mine and leach, making it comparatively easy to move from explorer to developer and then to producer.

“It has already been done at Nabarlek, somebody came in, they dug it up, mined it, produced uranium and sold it to Japanese reactors,” he noted.

“Timeline comes down to exploration success, this is a project that is not going to go away, it’s a project that we’re going to be with for quite some time, so it will come down to the success of the drill bit.”

Angling for ionic clay-hosted rare earths

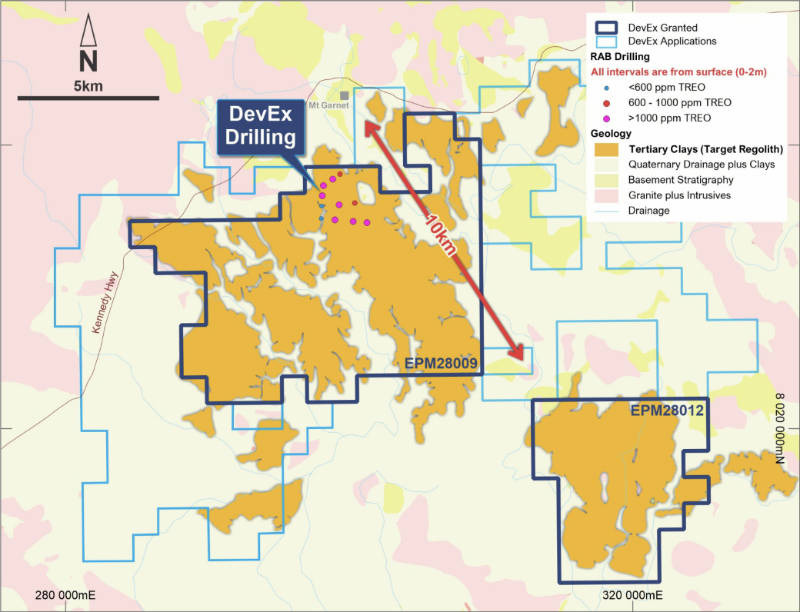

While Nabarlek takes the bulk of the company’s attention and budget due to its advanced nature, the company is also pushing ahead with exploration of its Kennedy rare earths project in Queensland, which Bradley described as a very cheap opportunity to test a target that’s now starting to look quite successful.

Clay-hosted REE projects have been attracting more than their fair share of attention but Kennedy is a much rarer beast that boasts REEs hosted in ionic adsorption clays that are prized for their low processing costs that more than offset their lower grades compared to hard rock REE deposits.

Metallurgical testing has already demonstrated rapid recoveries by desorption of REE in the first 30 minutes using an ammonium sulphate (AMSUL) solution in weak acidic conditions (pH4).

This achieved recoveries of 38% praseodymium, 40% neodymium, 29% dysprosium and 31% terbium, which increased to 49% praseodymium, 51% neodymium, 44% dysprosium and 47% terbium when left for 24 hours.

“Kennedy is a new project that’s emerged in the last four months for us and we’re pretty excited,” Bradley noted.

“It has a sense of scale and continuity, that’s the key driver for what we want to do right now.

“We went in under a proof of concept test and targeted that area specifically for ionic-clay hosted deposits.

“We drilled 11 very broad spaced holes that averaged about a kilometre apart to test an area of 3km by 3km and all 11 holes hit rare earths from surface in the first 2m to 4m.

“We have been able to demonstrate now that they are ionic clay and they leach very quickly with minimal fuss and minimal acid consumption, so that’s great as it puts us in a very unique space.”

DevEx has engaged the Australian Nuclear Science and Technology Organisation (ANSTO) for further leach tests and the company has plans to infill the very broad-spaced drilling completed to date.

Bradley notes that the infill drilling will allow the company to determine the continuity of the REE mineralisation from surface as well as uncover the sweet spots.

The company will then step out from the currently drilled area as the state government had previously mapped these clays, which he said the company liked the look of, over an area of about 20km by 18km.

“So we’ve got an enormous amount of area that we need to be targeting,” he noted.

“If we can demonstrate continuity then that’s a big scale.”

Other projects

But the company’s project inventory doesn’t end there. It also holds the Sovereign project to the north of Chalice’s province-opening Julimar PGE-nickel-copper-cobalt discovery in Western Australia.

Sovereign is a 12km long mafic-ultramafic intrusion that has had no previous nickel-copper-PGE exploration but hosts the same style of rocks as Julimar.

DevEx has started extensive ground electromagnetic surveys with Bradley noting that the company is looking to emulate Chalice’s success story.

More recently, the company reached an earn-in agreement to earn up to 75% of the non-gold mineral rights contained within tenements E29/0966 and E29/0996 (the Highway project) held by Brightstar Resources (ASX:BTR).

Previous broad-spaced aircore drilling has confirmed that the nickel-bearing Highway ultramafic, also host to Future Battery Metals’ Saints nickel deposits immediately to the south and the historical Scotia nickel sulphide mine further to the south, extends under thin clay cover at the project over a strike length of 11km.

It is carrying out a ground electromagnetic survey over the prospective rocks to explore for Kambalda-style massive nickel sulphides.

These and other emerging opportunities are part of an active business development strategy where DevEx actively targets and acquires exploration ground in Tier-1 provinces to constantly replenish its growth pipeline.

Given the runaway successes of both Chalice and Liontown, Bradley believes that it’s time for DevEx to make its mark.

“Nabarlek and Kennedy are good assets. The drilling we are doing now and the drilling we’ve got planned for the coming months is an opportunity to really grow these opportunities.

“We are supported by a strong cash balance of about $13m and we’re very focused on maintaining good strong relationships in the Northern Territory around Nabarlek as we understand the value that those positive relationships bring to building the success story.”

This article was developed in collaboration with DevEx Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post DevEx is counting on uranium and rare earths to deliver material discoveries appeared first on Stockhead.

asx

gold

uranium

rare earths

ree

praseodymium

neodymium

terbium

dysprosium

nickel

copper

molybdenum

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…