Energy & Critical Metals

Copper Price Forecast

Dr. Copper: Copper Price Forecast as a Key Economic Indicator Apr 18, 2023 A Contrarian View on the Current Economic Situation: The Copper Price Forecast…

Dr. Copper: Copper Price Forecast as a Key Economic Indicator

Apr 18, 2023

A Contrarian View on the Current Economic Situation: The Copper Price Forecast

Amidst widespread concerns about the economic situation, a closer examination of Copper prices, a leading economic indicator, offers a fresh perspective. This piece adopts a contrarian stance, delving into the message conveyed by Copper prices and their forecast in relation to the broader economy.

Rangebound Action and Anticipating a Massive Price Anomaly

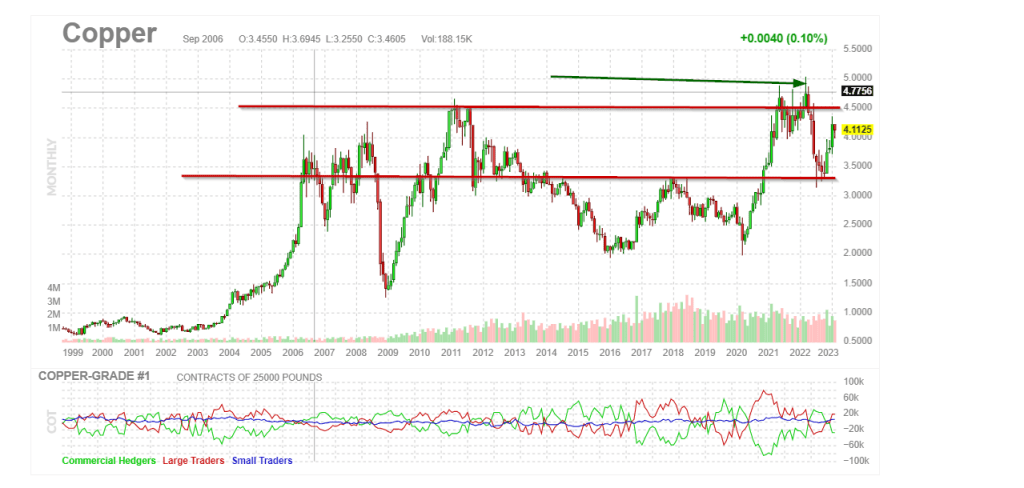

Copper trading has remained rangebound from 2006 to 2023, with occasional brief upticks. This pattern could foreshadow the broader market’s behaviour in the next 18 to 36 months, giving investors insight into potential market trends. As Copper typically leads the stock market, monitoring the copper price forecast is a critical indicator.

The rangebound action was interrupted by a sharp decline in 2008-2009, suggesting that a massive upward spike may be on the horizon. Consequently, Copper could trade within the 9-11 range in the coming years, potentially peaking at 15.00, presenting potential opportunities for savvy investors.

The Copper Price Forecast: The Man-Made Crisis and Economic Decline

Copper prices imply that the current crisis is man-made, and that the U.S. is on a downward economic trajectory. The reckless sanctions imposed by the West have backfired, and their consequences will be felt in the coming years, impacting both the global economy and individual investments. Thus, keeping an eye on the copper price forecast is crucial for investors.

After a sharp pullback in March 2022, Copper found support in the 3.00-3.30 range. It has since challenged the 4.20 range and is now building momentum to test the 4.50+ range. A monthly close at or above 4.50 could lead to a test of the 5.10 to 5.50 range, with a possible overshoot to 6.00, providing valuable insights for investors.

Copper Prices and Their Economic Message

Copper, as a leading economic indicator, conveys a clear message from a macroeconomic standpoint. Future market downturns and crashes should be viewed through a bullish lens, as the current crisis is man-made, and the U.S. is on a path of economic decline. A monthly close at or above 4.50 could lead to a test of the 5.10 to 5.50 range, with a possible overshoot to 6.00. Copper prices, which typically lead the stock market, are crucial to watch, informing investment decisions and providing a glimpse into the global economic climate.

Doctor Copper, as a leading economic indicator, has traditionally been a reliable predictor of economic activity. However, with the advent of quantitative easing, this story has come to an end. Despite this, investors can still consider buying key copper stocks or going long via ETFs, provided they are willing to take on some risk. In 2022, copper prices reached record highs, revealing that issues with inflation and supply were merely symptoms of bad policies.

Copper as a Market Barometer for Global Economic Health: The Copper Price Forecast’s Significance

Doctor Copper, the moniker given to the metal due to its ability to predict economic trends, is currently in a coma. Copper has traditionally been a reliable predictor of economic activity, but with the advent of quantitative easing, this story has come to an end. The Fed’s manipulation of the markets through ultra-low interest rates has created an artificial environment that favours speculators and punishes savers, leading to a disconnection of Dr Copper from the financial markets. Despite this, the masses still cling to Copper as an indicator, resulting in a missed opportunity for many investors.

Articles You’ll Love: Our Top Picks for Curious Minds

Candlesticks: Unconventional Techniques for Reliable Interpretation

Read More

Enhancing AI Dangers Awareness: Understanding the Risks

Read More

AI wars: The battle for Supremacy

Read More

Chart Analysis & the Significance of Mass Psychology

Read More

Copper Price Forecast

Read More

Stock Market Outlook 2023

Read More

2023 stock market outlook

Read More

Zweig Breadth Thrust Indicator: Enigmatic Market Sentiment Tool

Read More

Living below your means

Read More

The Rise of Chinese ChatGpt Rivals

Read More

Time in the Market vs Timing the Market

Read More

AI advancements

Read More

A Deeper Look into Currency Debasement

Read More

Market Cycle: The Best Investment for Kids

Read More

Vulgar Words

Read More

Leading Economic Index

Read More

Why Is Critical Thinking Important

Read More

Volatility of the stock market

Read More

Decoding the Dow Jones Utility Average

Read More

Has the market bottomed: Potential Playbook

Read More

Investing for Success: A Wealth Management Guide

Read More

The post Copper Price Forecast appeared first on Tactical Investor.

inflation

markets

reserve

interest rates

fed

debasement

copper

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…