Economics

Yields Tumble After European PMIs Signal Stagflation Accelerating

Yields Tumble After European PMIs Signal Stagflation Accelerating

The contraction of private-sector activity in the euro area intensified…

Yields Tumble After European PMIs Signal Stagflation Accelerating

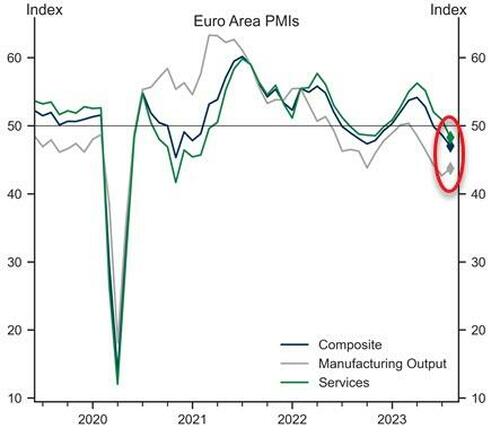

The contraction of private-sector activity in the euro area intensified in August as the composite flash PMI decreased by 1.6pt to 47.0, below consensus expectations (48.5), on the back of a further meaningful decline in services activity (offset only partially by an improvement in the manufacturing output index).

“The service sector of the euro zone is unfortunately showing signs of turning down to match the poor performance of manufacturing,” Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said in a statement.

“Service companies reported shrinking activity for the first time since the end of last year, while output in manufacturing dropped again.”

The composition of the August report showed continued declines in the new orders, employment, and backlogs indices, but a small improvement in new export orders, although these remain in contractionary territory.

Worse still, firms’ future output expectations edged down further, reflecting a more pessimistic outlook in the services sector.

And even more problematic for central banks price pressures, both input and output price components ticked up for the first time since January.

“The PMIs were very weak and highlight the dire outlook for Europe’s largest economy and the risks ahead of the September ECB policy meeting,” said Valentin Marinov, head of G10 FX strategy at Credit Agricole.

Across Euro area regions:

-

France: The French composite flash PMI remained unchanged (on rounding) at 46.6, below consensus expectations. Across sectors, a decline in the services index was offset by an improvement in manufacturing output, although both remain in contractionary territory.

-

Germany: The German composite flash PMI decreased by 3.8pt to 44.7, well below consensus expectations. The decline in the composite index was broad-based across sectors, but skewed largely towards services, where the index fell sharply (by 5.1pt) to 47.3.

-

Periphery: The periphery composite PMI declined by 0.6pt to 49.5, driven by a meaningful decline in services—which is now only slightly above 50—that was offset partially by an improvement in manufacturing output, which remains in contractionary territory.

Separate data for the UK showed private-sector firms suffered their first contraction in seven months.

The UK composite flash PMI decreased by 2.9pt to 47.9, also below consensus expectations.

The decline in the composite index was broad-based across sectors as the services index fell into contractionary territory for the first time since January, while manufacturing output declined further to 43.3.

The press release attributed this weakness to a reluctance to spend among clients in the wake of higher interest rates and stretched disposable household incomes.

The composition of the August report showed broad-based declines across new orders, employment, backlogs, and new export orders indices.

The reaction was swift with bond yields tumbling…

…and stocks too…

Finally, Goldman see three main takeaways from today’s data.

First, Euro area growth momentum appears to be weakening by more than anticipated, due to a sharper deterioration in services activity. Country press releases attributed today’s weak print to a range of factors, including inventory de-stocking, weak foreign demand, and a squeeze on both household and corporate budgets.

Second, despite the weakening in activity, underlying price pressures are turning out to be more persistent. This is particularly true in Germany where the services price components ticked up for the second consecutive month.

Third, growth momentum in the UK also appears to be slowing on the back of weakening in demand, which is being accompanied by a moderation in inflationary pressures.

Rate-hike expectations slipped after the prints: “It strengthens the hands of those arguing for a ‘pause’ in September,” said Dirk Schumacher, an economist at Natixis SA. “The economy is clearly not doing well given these figures.”

Tyler Durden

Wed, 08/23/2023 – 08:17

stagflation

policy

interest rates

inflationary

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…