Economics

With Cushing Hitting “Tank Bottoms” Goldman Hikes Oil Price Target To $100

With Cushing Hitting "Tank Bottoms" Goldman Hikes Oil Price Target To $100

After tagging $96 yesterday, Brent’s torrid rally hit the pause…

With Cushing Hitting “Tank Bottoms” Goldman Hikes Oil Price Target To $100

After tagging $96 yesterday, Brent’s torrid rally hit the pause button overnight, which – as Bloomberg’s Jake Lloyd-Smith writes – makes sense given the extremely stretched RSIs and pre-FOMC caution. Still, the next signal of the fast-tightening physical market may be just around the corner, potentially buttressing the case that any reversal in crude prices will be temporary (a topic we first touched upon yesterday in “Strong Tailwinds Could See Oil Become Even More Overbought“).

As a reminder, Wednesday brings the DOE’s weekly stockpile breakdown, a key window into what’s happening in tank farms across the world’s largest economy. Well, as we noted last night, the latest API estimates suggested that there will be a further drawdown in nationwide crude holdings, including a drop at the vital storage hub in Cushing, Oklahoma.

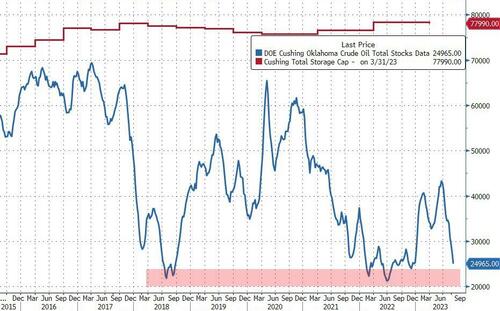

This matters because as Lloyd-Smith notes, crude inventories at that site have collapsed by 42% so far this quarter, putting them on pace for a record decline! They were last down to about 25 million barrels after falling in 10 of the past 11 weeks…

… and a couple more draws could revive talk of so-called “tank bottoms”, or the effective minimum, as they always need to hold some oil for operational reasons (just like the salt caverns that make up the US SPR). According to Bloomberg’s veteran market watcher Javier Blas, “traders talk about tank bottoms when Cushing inventories drop toward the 20-to-25m barrel range.”

It’s not all smooth sailing for oil, however. In addition to the previously discussed potential drop in Chinese demand, which recently hit a 2023 high)…

… overnight Goldman – which after repeatedly slashing its oil price target for much of the past two quarters (despite having turned commodity supercycle two years ago, a flip that probably cost Jeff Currie his job) after being wrong in expecting oil to soar in the first half – realized that it is once again badly behind the curve after oil’s 30% rally in the past three months, and the bank’s commodity strategists hiked the12-month Brent price target from $93 to $100, rejoining the triple digit club as worldwide demand hits unprecedented levels and OPEC+ supply curbs continue to tighten the market.

Of course, any time Goldman turns bullish, prices of the referenced asset mysteriously tumble, although in this particular case the fundamentals may be just too powerful to fade Goldman.

According to Goldman, the key reason for the hike is that significantly lower OPEC supply and higher demand more than offset significantly higher US supply, largely verbatim what we said two weeks ago in “Oil To Hit $107 As Deficit Approaches 3 Million Barrels Per Day.”

As GS commodity strategist Daan Struyven writes, “overall, we believe that OPEC will be able to sustain Brent in an $80-$105 range in 2024 by leveraging robust Asia-centric global demand growth (1.8mb/d) and by exercising its pricing power assertively.“

Extending our oil deficit analysis from two weeks ago, the bank then predicts that the market will have a deficit estimated at 2 million barrels a day this quarter, followed by a shortfall of 1.1 million barrels a day in the final three months of 2023..

… thanks to record global consumption.

Yet at the same time as it is turned bullish (again), Goldman appears to have learned from its recent mistakes and is no longer projecting oil “mooning” but instead believes that “most of the rally is behind us, and that Brent is unlikely to sustainably exceed $105/bbl next year” which of course is the best possible outcome in a world which is already sliding into stagflation. Goldman lists the following 3 factors for why it expects oil to remain rangebound between $80 and $105:

- First, while US supply is more capital disciplined than a decade ago, the upward trend in capex and supply beats over the past three years, and the recent inflection in rigs confirms its dynamism.

- Second, high spare capacity and the return to growth in offshore projects limit the upside to long-dated oil prices.

- Third, OPEC is unlikely to push prices to extreme levels, which would destroy its long-term residual demand.

Below we excerpt some more details from the report (full note available to pro subscribers in the usual place).

We now assume Saudi Arabia unwinds the extra 1mb/d cut gradually starting in 2024Q2, but that the 1.7mb/d cut with 8 other OPEC+ countries remains fully in place next year. The 900kb/d downgrade to our 2024 average OPEC supply forecast reflects three factors. First, Saudi Arabia appears determined to lower inventories. Second, keeping the group cut would likely support Saudi oil revenues in 2024. Third, recent US supply beats on easing supply constraints and efficiency gains lower the call on OPEC.

We believe that most of the rally is behind us, and that Brent is unlikely to sustainably exceed $105/bbl next year. First, while US supply is more capital disciplined than a decade ago, the upward trend in capex and supply beats over the past three years, and the recent inflection in rigs confirms its dynamism. Second, high spare capacity and the return to growth in offshore projects limit the upside to long-dated oil prices. Third, OPEC is unlikely to push prices to extreme levels, which would destroy its long-term residual demand.

We also believe that Brent is unlikely to sustainably drop below $80/bbl next year because of the strong OPEC put. Moreover, Western energy policy now has less room left to fight high prices given declines in the SPR and in Iran spare capacity. Third, we remain on track for a soft landing despite the oil rally.

Fast-forwarding to Goldman’s trade reco, the bank writes that “based on our constructive outlook for oil prices and bearish view on volatility, we conclude by taking profit on two trade recommendations, and launching a new restructured trade.”

We have previously recommended clients position for higher Brent prices and lower volatility via long call spreads and being short a strangle. While this trade had performed well, we now believe that further declines in OECD stocks are needed before OPEC barrels are brought back to market, and we now view OPEC to be optimizing for higher prices than before. As such, we take profit on our original recommendation, closing the trade at $0.65/bbl, for $0.67/bbl profit.

However, we now restructure the trade for a higher range. We now recommend clients go long a $90-95/bbl Brent call spread and short a $80/$100 Brent strangle on the Jun-24 contracts. This strategy raises c.$6/bbl upfront, with a max payoff of $15/bbl, and stands to profit if the contract expires in a $75-110/bbl range. It sells volatility on net to benefit from the recent increase in implied volatility, and exploits the backwardation and contango at the front of the Brent futures curve and Brent volatility surface, respectively. Ample spare capacity and loosening constraints to US shale should both act to bring breakevens back towards their pre-pandemic range, in our view.

Meanwhile, we hold onto our Long Dec-24 Brent trading recommendation (initiated Sep-22; current profit $11.62/bbl) as we still see upside to current forwards. However, we take profit on our short $60/bbl Dec-24 Brent put trade (initiated Dec-22; current profit $5.10/bbl), given limited potential for further gains.

More in the full note available to pro subs.

Tyler Durden Wed, 09/20/2023 – 10:16 stagflation commodity policy

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…

Fed Pivot: A Blend of Confidence and Folly

Fed Pivot: Charting a New Course in Economic Strategy Dec 22, 2023 Introduction In the dynamic world of economics, the Federal Reserve, the central bank…